Understanding Stock Market Valuations: BofA's Argument For Investor Calm

Table of Contents

BofA's Valuation Metrics and Their Significance

BofA employs several key valuation metrics to assess the overall health and potential of the stock market. These metrics provide a comprehensive picture, helping to gauge whether current prices accurately reflect underlying company performance and future prospects. Let's examine some of the most significant ones:

-

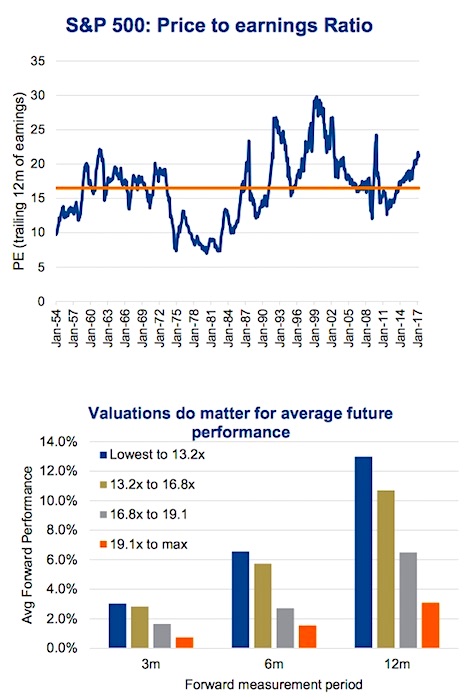

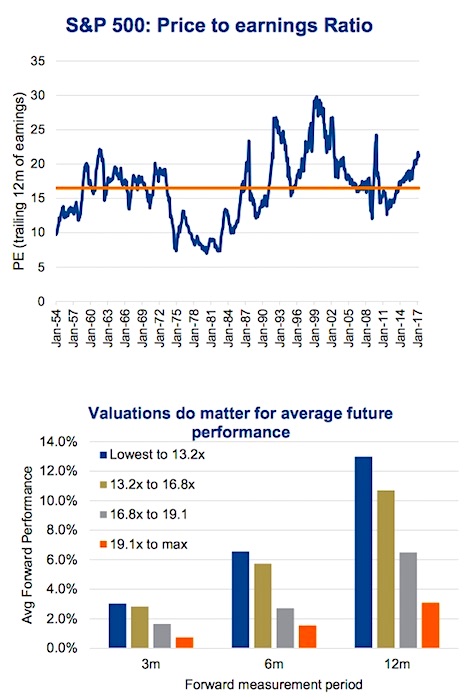

Price-to-Earnings Ratio (P/E): This classic metric compares a company's stock price to its earnings per share (EPS). A higher P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations or overvaluation.

-

Shiller P/E (Cyclically Adjusted Price-to-Earnings Ratio or CAPE): This metric smooths out short-term earnings fluctuations by averaging earnings over a ten-year period. It offers a longer-term perspective on valuation, reducing the impact of cyclical economic variations.

-

Price-to-Sales Ratio (P/S): This ratio compares a company's stock price to its revenue per share. It's particularly useful for evaluating companies with negative earnings, offering a different lens through which to analyze valuation.

BofA's findings on these metrics provide a nuanced perspective:

-

BofA's analysis shows the current P/E ratio is historically high, but not excessively so compared to periods of similar economic uncertainty. This suggests that while valuations are elevated, they are not necessarily at bubble levels.

-

The Shiller P/E, while elevated, suggests less overvaluation than previous market peaks, offering some reassurance to long-term investors.

-

BofA's assessment of P/S ratios across various sectors highlights specific areas of potential overvaluation and undervaluation, guiding investors towards more strategic portfolio allocations.

These findings, taken together, suggest that while the market is not cheap, it's not necessarily wildly overpriced either. This contrasts with the prevailing anxiety in some market segments.

Addressing Concerns about Inflation and Interest Rates

Inflation and interest rate hikes significantly impact stock valuations. Higher inflation erodes purchasing power and can squeeze corporate profit margins, while rising interest rates increase borrowing costs for businesses and reduce the present value of future earnings. BofA addresses these concerns by:

-

Projecting a moderation in inflation: BofA's analysis anticipates a gradual easing of inflationary pressures, alleviating some concerns about corporate profitability.

-

Assessing the impact on corporate earnings: While acknowledging the impact of interest rate hikes on borrowing costs, BofA's analysis suggests that many companies are well-positioned to weather the increase, possessing strong balance sheets and pricing power.

Counterarguments and BofA's Response: Some argue that persistent inflation will lead to a significant market correction. BofA acknowledges this possibility but highlights that their analysis incorporates various scenarios, including persistent inflation, and suggests the market is pricing in a significant portion of this risk.

Sector-Specific Valuations and Outlook

BofA's analysis offers a granular view, examining valuations across various sectors. This sector-specific approach provides crucial insights for portfolio diversification and strategic asset allocation.

-

Technology: BofA suggests caution in the technology sector, citing higher valuations compared to other sectors and highlighting the potential impact of rising interest rates on growth stocks.

-

Energy: The energy sector, according to BofA, presents opportunities given its relative undervaluation and strong earnings, driven by global energy demand.

-

Healthcare: BofA’s analysis indicates that the healthcare sector displays a mixed valuation picture, with certain segments showing robust growth prospects while others are facing pricing pressures.

This sector-specific breakdown empowers investors to make more informed decisions, tailoring their portfolios to reflect both overall market conditions and the unique characteristics of individual sectors.

The Long-Term Perspective on Stock Market Valuations

Short-term market fluctuations are a normal part of the investment cycle. Focusing solely on daily or weekly market movements can be detrimental to long-term investment success.

-

Historical trends suggest long-term growth: BofA emphasizes that historical market trends suggest long-term growth despite short-term volatility. This reinforces the importance of staying the course and maintaining a long-term investment horizon.

-

Consistent investment is key: Consistent investment, especially through periods of uncertainty, is key to achieving long-term financial goals. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, is particularly useful during times of market volatility.

Risk Management Strategies for Investors

Even with a positive outlook, risk management remains crucial. BofA’s insights can inform effective risk mitigation strategies:

-

Diversification: Diversifying your portfolio across multiple asset classes (stocks, bonds, real estate, etc.) can reduce overall risk and improve resilience to market downturns.

-

Dollar-cost averaging: Implementing a dollar-cost averaging strategy minimizes the impact of market timing, allowing investors to systematically accumulate assets regardless of short-term price fluctuations.

-

Understanding your risk tolerance: Investors should carefully assess their individual risk tolerance and tailor their investment strategies accordingly. BofA's analysis helps to frame the level of risk currently present in the market.

Conclusion: Maintaining Calm in the Face of Stock Market Valuations

BofA's analysis of stock market valuations presents a cautiously optimistic view. While acknowledging elevated valuations in certain sectors and the impact of inflation and interest rate hikes, their findings suggest that current market conditions do not necessarily signal an imminent crash. The emphasis on long-term investment strategies, sector-specific analysis, and robust risk management techniques reinforces a message of calm amidst market volatility. Understanding stock market valuations is crucial for navigating market uncertainty. Use BofA’s insights to inform your investment strategy and maintain a calm approach to your portfolio. Conduct your own thorough research and consult with a qualified financial advisor to make informed decisions tailored to your individual financial goals and risk tolerance.

Featured Posts

-

Projets Viticoles Dijon Plantation De 2500 M Aux Valendons

May 09, 2025

Projets Viticoles Dijon Plantation De 2500 M Aux Valendons

May 09, 2025 -

Hoe Brekelmans India Zo Dicht Mogelijk Bij Zich Wil Houden

May 09, 2025

Hoe Brekelmans India Zo Dicht Mogelijk Bij Zich Wil Houden

May 09, 2025 -

Tonights Nhl Game Oilers Vs Sharks Odds Prediction And Expert Picks

May 09, 2025

Tonights Nhl Game Oilers Vs Sharks Odds Prediction And Expert Picks

May 09, 2025 -

Chief Justice Roberts Mistaken Identity And Political Misunderstandings

May 09, 2025

Chief Justice Roberts Mistaken Identity And Political Misunderstandings

May 09, 2025 -

Kucherovs Performance Propels Lightning To 4 1 Win Over Oilers

May 09, 2025

Kucherovs Performance Propels Lightning To 4 1 Win Over Oilers

May 09, 2025