Understanding Stock Market Valuations: BofA's Case For Investor Confidence

Table of Contents

BofA's Key Arguments for Positive Stock Market Valuation

BofA's positive outlook on stock market valuations rests on several pillars. Their analysis suggests that despite near-term challenges, underlying fundamentals support a relatively optimistic view of equity markets.

Earnings Growth as a Valuation Driver

BofA emphasizes the significant role of robust corporate earnings in justifying current valuations. Their analysis points to continued, albeit potentially slowing, earnings growth as a key driver of future market performance.

- BofA's Projected Earnings Growth: BofA projects moderate earnings growth for the next year and beyond, forecasting a range that is contingent on various macroeconomic factors. This projection considers factors like continued consumer spending, although at a reduced rate compared to previous years, and corporate cost-cutting measures.

- P/E Ratios in Context: While current Price-to-Earnings (P/E) ratios might appear high compared to historical averages, BofA argues that this needs to be considered in the context of projected earnings growth. A higher P/E ratio can be justified if future earnings are expected to significantly increase, leading to a lower forward P/E ratio.

- Sector-Specific Growth: BofA's analysis highlights specific sectors expected to demonstrate strong earnings growth, such as technology and healthcare. The performance of these sectors significantly impacts the overall market valuation.

- Examples of Exceeding Expectations: BofA cites several examples of companies exceeding earnings expectations, demonstrating the resilience and adaptability of certain sectors within the current economic climate. These examples bolster their argument for continued earnings growth.

Interest Rate Impact on Valuation

The Federal Reserve's interest rate hikes are a significant factor influencing market valuations. BofA's assessment of the interest rate environment is crucial to understanding their overall valuation thesis.

- BofA's Interest Rate Outlook: BofA anticipates a potential pause or slowdown in interest rate increases, suggesting that the most aggressive phase of tightening may be over. This outlook is based on evolving economic data and projections for inflation.

- Discount Rates and Valuation Models: Changes in interest rates directly influence discount rates used in various valuation models. Higher interest rates typically lead to lower valuations, as future cash flows are discounted more heavily. BofA's analysis incorporates this dynamic, acknowledging the impact but suggesting that the effect might be less pronounced than some fear.

- Impact on Asset Classes: BofA's analysis contrasts the effects on different asset classes. While rising rates might negatively impact bond valuations, they argue that the effect on equities is mitigated by the strength of earnings growth.

- Corporate Adaptation: BofA notes that companies are adapting to the higher interest rate environment through various strategies, including cost optimization and efficient capital allocation, thereby mitigating the negative impact.

Macroeconomic Factors Supporting BofA's View

BofA's positive valuation outlook considers several crucial macroeconomic factors. Their assessment of these factors is key to understanding the broader context of their analysis.

- Key Macroeconomic Indicators: BofA's analysis references key indicators such as inflation (showing signs of cooling), employment (remaining relatively strong), and GDP growth (experiencing a slowdown but remaining positive).

- Economic Resilience: BofA highlights the resilience of the economy despite facing multiple challenges, suggesting that the economic downturn might be less severe than initially anticipated.

- Addressing Potential Risks: BofA acknowledges potential risks, including persistent inflation, geopolitical instability, and supply chain disruptions. Their analysis incorporates these risks but concludes that the positive factors outweigh the negative ones.

- Geopolitical Considerations: BofA assesses the potential impact of geopolitical events, emphasizing their ongoing monitoring of the situation and incorporating these uncertainties into their valuations.

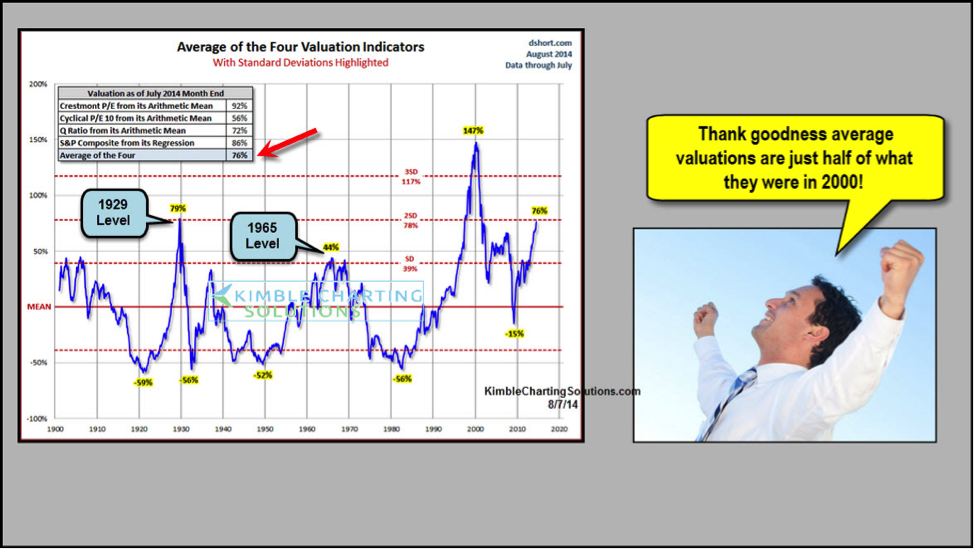

Analyzing Different Valuation Metrics

BofA's positive outlook is supported by an analysis of various valuation metrics. However, it's crucial to consider multiple metrics for a comprehensive understanding of stock market valuations.

Price-to-Earnings Ratio (P/E)

The P/E ratio is a widely used valuation metric. BofA's analysis considers its implications within the current market context.

- Understanding P/E Ratio: The P/E ratio shows the price investors are willing to pay for each dollar of a company's earnings. A higher P/E ratio suggests that investors are paying a premium for future growth.

- Historical and Benchmark Comparisons: BofA compares current P/E ratios to historical averages and industry benchmarks to determine whether current valuations are justified considering earnings growth projections.

- Limitations of P/E Ratio: BofA acknowledges the limitations of relying solely on the P/E ratio, highlighting the importance of considering other relevant metrics for a more holistic evaluation.

Price-to-Book Ratio (P/B)

The Price-to-Book (P/B) ratio offers another perspective on valuation.

- Understanding P/B Ratio: The P/B ratio compares a company's market capitalization to its book value (assets minus liabilities). A higher P/B ratio might indicate that the market anticipates future growth.

- Historical and Benchmark Comparisons: Similar to the P/E ratio, BofA's analysis compares current P/B ratios to historical averages and industry benchmarks.

- Relationship to Company Performance: BofA analyzes the relationship between P/B ratios and actual company performance, assessing the consistency of the metric in reflecting financial health.

Other Relevant Metrics

Beyond P/E and P/B ratios, BofA likely considers other relevant valuation metrics, such as the Price/Earnings to Growth (PEG) ratio and dividend yield, offering a more comprehensive picture of market valuation. These metrics add further layers to their analysis.

Conclusion

BofA's analysis offers a nuanced perspective on current stock market valuations. By considering earnings growth, interest rate dynamics, and macroeconomic factors, they present a compelling case for investor confidence, albeit with an acknowledgment of inherent risks. While challenges remain, their arguments suggest a more resilient market than some might anticipate. Understanding these stock market valuations is crucial for informed investment decisions. By carefully analyzing the factors influencing market valuations, investors can create a robust investment strategy aligned with their risk tolerance and financial goals. Continue to learn about stock market valuations and enhance your investment strategies.

Featured Posts

-

Is Jacob Alons Fairy In A Bottle The New Top Tune

May 31, 2025

Is Jacob Alons Fairy In A Bottle The New Top Tune

May 31, 2025 -

Isabelle Autissier Un Appel A La Solidarite Pour L Environnement

May 31, 2025

Isabelle Autissier Un Appel A La Solidarite Pour L Environnement

May 31, 2025 -

Glastonbury Festival Ticket Resale Official Sales Data And Analysis

May 31, 2025

Glastonbury Festival Ticket Resale Official Sales Data And Analysis

May 31, 2025 -

Exploring Tomorrow Is A New Day With Author Molly Jong Fast A Pw Interview

May 31, 2025

Exploring Tomorrow Is A New Day With Author Molly Jong Fast A Pw Interview

May 31, 2025 -

Embrace Minimalism A 30 Day Plan For A Simpler Life

May 31, 2025

Embrace Minimalism A 30 Day Plan For A Simpler Life

May 31, 2025