Understanding Stock Market Valuations: BofA's Insights For Investors

Table of Contents

Key Valuation Metrics Explained

Understanding stock market valuation involves analyzing several key metrics. Let's examine three crucial tools: the Price-to-Earnings Ratio (P/E), the Price-to-Book Ratio (P/B), and the Price-to-Sales Ratio (P/S).

Price-to-Earnings Ratio (P/E)

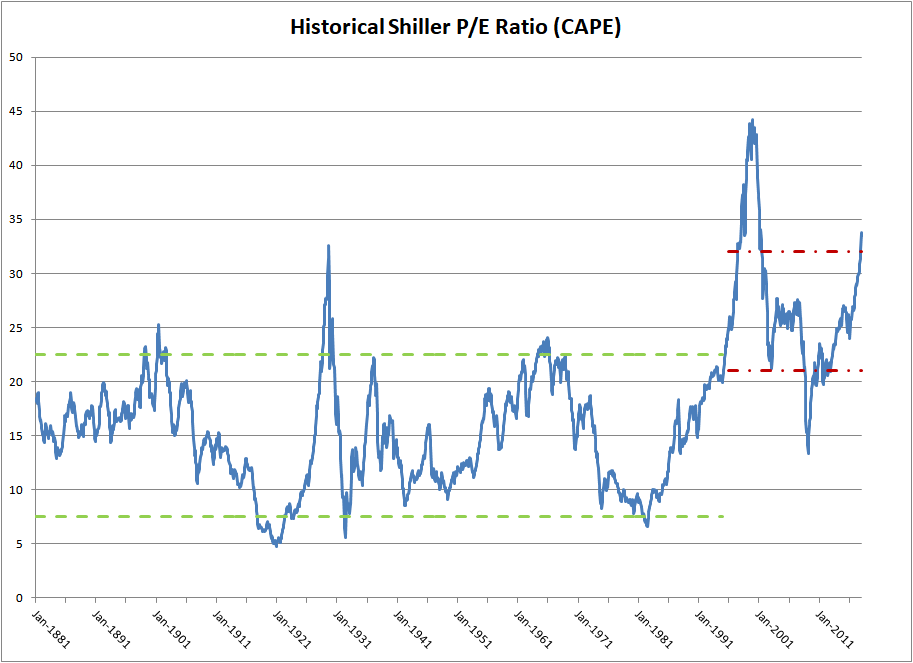

The P/E ratio is a fundamental valuation metric that compares a company's stock price to its earnings per share (EPS). It's calculated by dividing the market price per share by the earnings per share. A high P/E ratio suggests investors are willing to pay a premium for each dollar of earnings, potentially indicating high growth expectations or market optimism. Conversely, a low P/E ratio might signal undervaluation or concerns about future earnings.

- Examples: A high P/E stock (e.g., a technology company with strong growth potential) might have a P/E ratio of 30 or higher, while a low P/E stock (e.g., a utility company with stable, but slower growth) might have a P/E ratio of 10 or lower.

- Industry Comparisons: It's crucial to compare P/E ratios within the same industry, as different sectors have varying growth rates and profitability levels. A high P/E in a slow-growth industry might be a red flag, whereas a high P/E in a fast-growing tech sector may be justified.

- Impact of Earnings Growth: Rapid earnings growth can justify a higher P/E ratio. Investors are willing to pay more for companies expected to generate significantly higher future earnings.

Price-to-Book Ratio (P/B)

The Price-to-Book ratio (P/B) compares a company's market capitalization to its book value of equity. Book value represents the net asset value of a company, calculated as total assets minus total liabilities. The P/B ratio is particularly useful for valuing asset-heavy companies, such as those in the manufacturing or real estate sectors. A low P/B ratio could indicate undervaluation, while a high P/B ratio might suggest overvaluation.

- Analyzing Asset-Heavy vs. Intangible Asset Companies: The P/B ratio is more meaningful for companies with significant tangible assets. Companies with primarily intangible assets (e.g., technology companies) may have less relevant P/B ratios.

- Industry Comparisons: Comparing P/B ratios across industries is essential for meaningful interpretation. Different industries have different asset bases and accounting practices.

Price-to-Sales Ratio (P/S)

The Price-to-Sales ratio (P/S) compares a company's market capitalization to its revenue. It's frequently used to value companies with negative earnings or those in early stages of development, where revenue growth is a primary indicator of future success.

- Advantages and Disadvantages: A significant advantage of the P/S ratio is its applicability to loss-making companies. However, it doesn't directly account for profitability or expenses.

- Comparing Across Different Sectors: Like P/E and P/B, comparing P/S ratios within the same industry provides the most insightful context.

BofA's Current Market Outlook and Valuation Insights

BofA regularly publishes market outlooks and valuation analyses. (Note: Specific BofA reports and forecasts should be referenced here, if publicly available, with appropriate links). Their current assessment (insert BofA's current assessment here – e.g., whether the market is overvalued, undervalued, or fairly valued) is driven by several key factors:

- Interest Rates: Rising interest rates typically impact valuations by increasing borrowing costs for companies and potentially reducing investor appetite for riskier assets.

- Inflation: High inflation erodes purchasing power and can affect corporate profits, influencing stock valuations.

- Economic Growth: Strong economic growth generally supports higher valuations, while slowing growth often leads to lower valuations.

- Specific Sectors: BofA often highlights specific sectors or industries that are particularly attractive or concerning from a valuation perspective (insert BofA's specific sector analysis here if available).

Applying BofA's Insights to Your Investment Strategy

Investors can leverage BofA's insights to refine their investment strategies in several ways:

- Stock Selection: Use BofA's valuation analysis and sector insights to identify undervalued or attractively priced stocks within specific sectors.

- Portfolio Diversification: Align your portfolio's diversification strategy with BofA's market outlook. For example, if BofA suggests a certain sector is overvalued, you might reduce your exposure to that sector.

- Risk Management: Understand BofA's assessment of market risks and adjust your investment strategy accordingly. This might involve reducing overall risk exposure or shifting to more defensive investments.

Understanding the Limitations of Valuation Metrics

It's crucial to remember that valuation metrics are not perfect predictors of future performance. They have limitations:

- Accounting Practices: Different accounting methods can affect a company's reported earnings and book value, impacting the accuracy of valuation metrics.

- Industry-Specific Factors: Certain industries have unique characteristics that might make standard valuation metrics less reliable.

- Qualitative Factors: Valuation metrics don't capture qualitative factors such as management quality, competitive landscape, or technological disruption, all of which can significantly impact a company's future prospects.

Conclusion: Making Informed Decisions with Stock Market Valuation Knowledge

Understanding stock market valuation is crucial for successful investing. We've explored key metrics—the P/E ratio, P/B ratio, and P/S ratio—and their significance in analyzing stock prices. By incorporating BofA's market outlook and valuation insights, along with an awareness of the limitations of these tools, investors can make more informed decisions. Remember to use multiple valuation tools, consider qualitative factors, and conduct thorough due diligence before making any investment. Utilize BofA's research (or similar reputable sources) to enhance your stock market valuation understanding and build effective investment strategies. Further research into financial statement analysis and qualitative factors will significantly boost your investment skills.

Featured Posts

-

Lizzos Transformation Before And After Photos From The Oscars

May 05, 2025

Lizzos Transformation Before And After Photos From The Oscars

May 05, 2025 -

Heatwave Alert In West Bengal Four Districts On High Alert

May 05, 2025

Heatwave Alert In West Bengal Four Districts On High Alert

May 05, 2025 -

Bob Bafferts Return To The Kentucky Derby An Identity Crisis In Racing

May 05, 2025

Bob Bafferts Return To The Kentucky Derby An Identity Crisis In Racing

May 05, 2025 -

Lizzo Drops A Scorching New Single

May 05, 2025

Lizzo Drops A Scorching New Single

May 05, 2025 -

Pitch Perfects Dynamic Duo How Anna Kendrick And Rebel Wilson Became Friends

May 05, 2025

Pitch Perfects Dynamic Duo How Anna Kendrick And Rebel Wilson Became Friends

May 05, 2025

Latest Posts

-

Ufc 314 Main Card And Prelims Complete Fight Order Announced

May 05, 2025

Ufc 314 Main Card And Prelims Complete Fight Order Announced

May 05, 2025 -

Temperature Plummets In West Bengal Latest Weather Update

May 05, 2025

Temperature Plummets In West Bengal Latest Weather Update

May 05, 2025 -

Ufc 314 Full Bout Order Announced For Main Card And Prelims

May 05, 2025

Ufc 314 Full Bout Order Announced For Main Card And Prelims

May 05, 2025 -

North Bengal To Expect Rain A Detailed Wb Weather Report

May 05, 2025

North Bengal To Expect Rain A Detailed Wb Weather Report

May 05, 2025 -

West Bengal Braces For Cold Snap Temperature Plunge Forecast

May 05, 2025

West Bengal Braces For Cold Snap Temperature Plunge Forecast

May 05, 2025