Understanding Stock Market Valuations: BofA's Reassurance For Investors

Table of Contents

BofA's Key Arguments for Current Market Valuations

Bank of America's recent market outlook provides a reasoned argument for current stock valuations. Their analysis incorporates a multifaceted approach, considering various macroeconomic factors and corporate performance indicators. This isn't a simple "buy everything" recommendation; instead, it's a nuanced perspective grounded in data and thorough analysis.

-

Summary of BofA's key findings: BofA's analysts generally suggest that while valuations aren't historically cheap, they are not excessively overvalued either, given the current economic environment and projected corporate earnings growth. They highlight the resilience of certain sectors and the potential for continued, albeit moderated, growth.

-

Specific data points and evidence: BofA's analysis often cites factors such as projected interest rate trajectories, inflation expectations, and robust corporate earnings reports from key sectors. They often compare current valuations to historical averages, adjusting for inflation and economic cycles. Specific data points will vary based on the most recent reports, but generally involve detailed examination of Price-to-Earnings ratios (P/E) across various market sectors.

-

BofA's methodology: BofA employs a sophisticated blend of quantitative and qualitative analysis. Their valuation models incorporate various financial metrics, economic forecasts, and assessments of geopolitical risks. This multi-pronged approach aims to provide a more comprehensive and robust evaluation than relying on single metrics alone.

-

Potential risks and caveats: BofA always acknowledges potential risks, such as unexpected inflationary pressures, geopolitical instability, or a sharper-than-expected economic slowdown. Their reports typically include scenarios outlining potential downside risks and how these could impact market valuations.

Understanding Key Valuation Metrics

Understanding key valuation metrics is crucial for assessing the intrinsic worth of stocks and the overall market. While no single metric provides a complete picture, using a combination offers a more informed perspective.

-

Price-to-Earnings Ratio (P/E): This ratio compares a company's stock price to its earnings per share (EPS). A high P/E ratio suggests investors expect higher future growth, while a low P/E might indicate undervaluation or lower growth expectations. It's important to compare the P/E ratio to industry averages and historical trends.

-

Price-to-Sales Ratio (P/S): The P/S ratio relates a company's stock price to its revenue per share. It's particularly useful for valuing companies with negative earnings, as it focuses on revenue generation. A lower P/S ratio generally indicates a potentially better value.

-

Price-to-Book Ratio (P/B): The P/B ratio compares a company's market capitalization to its book value (assets minus liabilities). A lower P/B ratio can suggest undervaluation, although this metric is less relevant for companies with significant intangible assets.

-

Dividend Yield: This metric represents the annual dividend payment relative to the stock price. It's a key factor for income-oriented investors, providing a measure of the return on investment from dividends alone. Higher dividend yields are generally seen as attractive.

-

Market Capitalization: This represents the total value of a company's outstanding shares. While not a valuation metric in itself, it provides context when comparing companies of different sizes.

The Importance of Long-Term Investing

Navigating market fluctuations requires a long-term investment strategy. Short-term market noise should be largely ignored, focusing instead on the fundamental strength of your investments and your overall financial goals.

-

Benefits of long-term investing: Long-term investing allows you to ride out market cycles, benefiting from the power of compounding returns. Short-term losses become less significant over extended periods.

-

Risk mitigation strategies: Diversification across different asset classes, sectors, and geographies is crucial for managing risk. Regular rebalancing of your portfolio ensures you maintain your desired asset allocation.

-

Ignoring short-term noise: Focus on the long-term growth potential of your investments rather than reacting to daily market fluctuations. Sticking to a well-defined investment plan reduces emotional decision-making.

Addressing Investor Concerns and Addressing Market Volatility

Market volatility is inherent; however, understanding BofA's analysis can alleviate some investor anxieties.

-

Common investor anxieties: Concerns often include inflation, interest rate hikes, and potential recessions. These factors directly impact stock valuations and investor confidence.

-

BofA's response: BofA's analysis often attempts to address these concerns by providing context, highlighting the long-term growth potential of the economy, and explaining how current valuations account for potential risks.

-

Managing risk tolerance: Investors should assess their own risk tolerance and adjust their investment strategy accordingly. This might involve shifting towards less volatile investments or increasing the diversification of their portfolios.

Conclusion

BofA's analysis offers a reasoned perspective on current stock market valuations, emphasizing the importance of understanding key valuation metrics and adopting a long-term investment strategy. While market volatility is inevitable, a well-informed approach, incorporating the factors discussed above, can help investors navigate uncertainty and achieve their financial goals. Understanding stock market valuations is crucial for informed investment decisions. Continue to research and stay updated on market analysis from reputable sources like BofA to make confident decisions regarding your investments and build a strong, diversified portfolio. Learn more about effective stock market valuation techniques and strategies today!

Featured Posts

-

Hamas Duped Witkoff Envoy Report

May 23, 2025

Hamas Duped Witkoff Envoy Report

May 23, 2025 -

16 Mart Burcu Nedir Oezellikleri Nelerdir

May 23, 2025

16 Mart Burcu Nedir Oezellikleri Nelerdir

May 23, 2025 -

Are Macaulay And Kieran Culkin Helping Their Ailing Mother A Look At The Familys Finances

May 23, 2025

Are Macaulay And Kieran Culkin Helping Their Ailing Mother A Look At The Familys Finances

May 23, 2025 -

Shooting Outside Jewish Museum In Washington Israeli Embassy Casualties

May 23, 2025

Shooting Outside Jewish Museum In Washington Israeli Embassy Casualties

May 23, 2025 -

Aleksandrova Pobezhdaet Samsonovu V Pervom Kruge Turnira V Shtutgarte

May 23, 2025

Aleksandrova Pobezhdaet Samsonovu V Pervom Kruge Turnira V Shtutgarte

May 23, 2025

Latest Posts

-

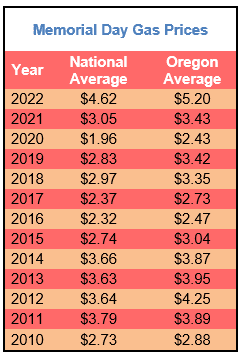

Low Gas Prices Forecast For Memorial Day Weekend

May 23, 2025

Low Gas Prices Forecast For Memorial Day Weekend

May 23, 2025 -

Memorial Day Gas Prices A Decade Low Prediction

May 23, 2025

Memorial Day Gas Prices A Decade Low Prediction

May 23, 2025 -

Memorial Day Gas Prices A Look At The Expected Low Costs

May 23, 2025

Memorial Day Gas Prices A Look At The Expected Low Costs

May 23, 2025 -

Arrows Damien Darhk Would Neal Mc Donough Return To The Dc Universe

May 23, 2025

Arrows Damien Darhk Would Neal Mc Donough Return To The Dc Universe

May 23, 2025 -

Actor Neal Mc Donough Takes On Pro Bull Riding In New Film

May 23, 2025

Actor Neal Mc Donough Takes On Pro Bull Riding In New Film

May 23, 2025