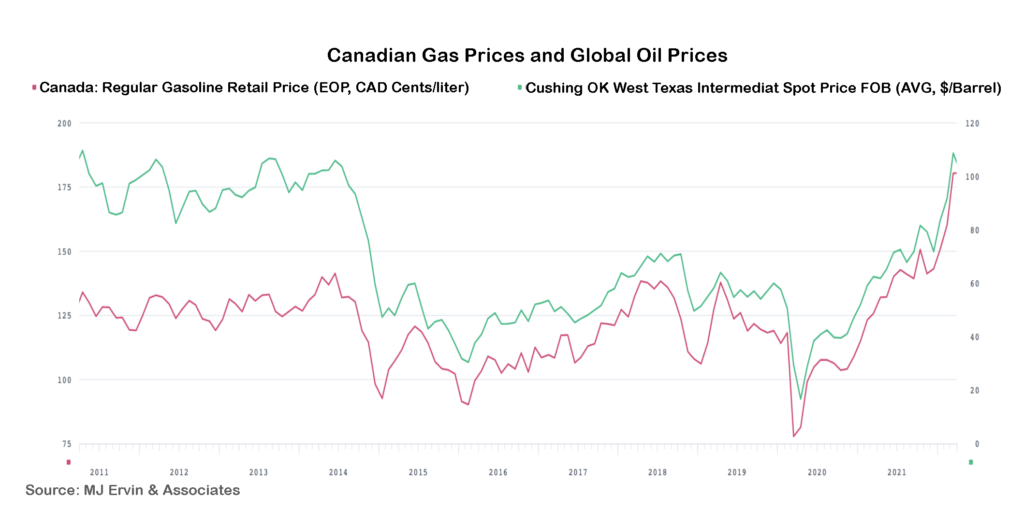

Understanding The 20-Cent Increase In Average Gas Prices

Table of Contents

Global Oil Supply and Demand Imbalance

The foundation of the rising gas prices lies in the global oil market's delicate balance between supply and demand. A significant factor contributing to the 20-cent gas price increase is the ongoing imbalance, with demand outpacing supply. Several key elements contribute to this:

Keywords: Crude oil prices, OPEC+, oil production, global oil demand, supply chain disruptions, geopolitical instability

-

Decreased Oil Production by OPEC+ Countries: OPEC+ (the Organization of the Petroleum Exporting Countries and its allies) has implemented production cuts, limiting the global supply of crude oil. This strategic move, while aiming for price stability, has inadvertently contributed to higher prices.

-

Increased Global Demand Post-Pandemic: As the global economy recovers from the pandemic, the demand for oil has surged. This increased consumption, particularly in developing nations experiencing economic growth, puts further pressure on already strained oil supplies.

-

Sanctions on Russian Oil Impacting Supply: Geopolitical instability, particularly the ongoing conflict in Ukraine and subsequent sanctions on Russian oil, has significantly disrupted global oil supplies. Russia is a major oil producer, and the sanctions have created a supply gap, pushing prices upward.

-

Disruptions to Oil Refining Capacity: Unexpected refinery closures due to maintenance or unforeseen circumstances can significantly reduce the capacity to process crude oil into gasoline, further exacerbating the supply shortage and driving up prices.

-

Speculative Trading Influencing Future Contracts: The oil market is also susceptible to speculative trading. Concerns about future supply shortages can lead to increased trading activity, pushing up future oil contract prices, which in turn influence current gas prices.

The Impact of Refining Capacity and Distribution Costs

Beyond global oil supply, the journey from crude oil to your gas tank involves several steps, each contributing to the final cost. Issues within the refining and distribution processes significantly impact the price at the pump. This is another crucial factor in the 20-cent gas price increase.

Keywords: Refinery capacity, fuel distribution, transportation costs, logistics, refinery maintenance, pipeline issues

-

Planned and Unplanned Refinery Maintenance: Regular maintenance at refineries is essential, but planned and unplanned shutdowns inevitably reduce gasoline production. These periods of reduced output contribute directly to price increases.

-

Increased Costs for Transporting Gasoline: Getting gasoline from refineries to gas stations is a costly process involving pipelines, trucks, and rail. Increased transportation costs due to higher fuel prices, driver shortages, and inflation directly translate to higher prices at the pump.

-

Driver Shortages Impacting Fuel Delivery: The ongoing shortage of truck drivers has created bottlenecks in the fuel distribution system. Delays in delivering gasoline to gas stations exacerbate the supply constraints and push prices higher.

-

Infrastructure Limitations Affecting Efficient Distribution: Outdated or insufficient infrastructure, such as pipelines and storage facilities, can hinder efficient fuel distribution, leading to higher costs and price increases.

Inflation and its Influence on Gas Prices

The current inflationary environment plays a crucial role in the rising cost of gasoline. Inflation affects various aspects of the fuel supply chain, ultimately impacting the price at the pump and contributing to the 20-cent gas price increase.

Keywords: Inflation rate, consumer price index, economic inflation, energy inflation, cost-push inflation

-

Rising Costs of Labor and Raw Materials: Inflation increases the cost of labor and raw materials used in refinery operations. These higher input costs directly increase the production cost of gasoline, leading to higher prices.

-

Increased Transportation Costs Due to Inflation: As mentioned earlier, transportation is a significant cost component. Inflation impacts trucking costs, fuel costs for transportation, and other logistics expenses, ultimately increasing the price at the pump.

-

Impact of General Inflation on Consumer Spending and Fuel Demand: General inflation affects consumer spending. Even with higher gas prices, increased demand due to overall economic activity can contribute to the price surge.

Government Regulations and Taxes

Government policies and taxes also influence gas prices. While not the primary driver of the recent 20-cent increase, these factors play a role in the final price consumers pay.

Keywords: Fuel taxes, government regulation, environmental policies, carbon tax, energy policy

-

Federal and State Gasoline Taxes: Governments impose various taxes on gasoline at both the federal and state levels. These taxes contribute to the overall price at the pump.

-

Environmental Regulations Impacting Refinery Operations: Environmental regulations, while aimed at protecting the environment, can impact refinery operations and increase costs, which may be passed onto consumers.

-

Potential Future Impacts of Carbon Pricing Policies: Some regions are exploring or implementing carbon pricing policies, such as carbon taxes, which would further increase the cost of gasoline.

Conclusion

The 20-cent increase in average gas prices is a multifaceted issue. The interplay of global oil market dynamics, refining and distribution challenges, inflationary pressures, and government regulations all contribute to this significant price hike. Understanding these interconnected elements is crucial for consumers and policymakers alike. By grasping the complexities behind these price fluctuations, we can better navigate the volatile fuel market and make informed decisions about our energy consumption. Stay informed about the factors affecting average gas prices. Continue to monitor news and updates regarding the ongoing 20-cent gas price increase and its implications.

Featured Posts

-

Hon 200 Nguoi Chay Bo Kham Pha Dak Lak And Phu Yen

May 22, 2025

Hon 200 Nguoi Chay Bo Kham Pha Dak Lak And Phu Yen

May 22, 2025 -

Service De Navette Gratuit Experimente La Haye Fouassiere Haute Goulaine

May 22, 2025

Service De Navette Gratuit Experimente La Haye Fouassiere Haute Goulaine

May 22, 2025 -

Leaked Texts Fuel Blake Lively Taylor Swift Feud Allegations Of Blackmail Emerge

May 22, 2025

Leaked Texts Fuel Blake Lively Taylor Swift Feud Allegations Of Blackmail Emerge

May 22, 2025 -

Ea Fc 24 Fut Birthday Player Ratings And Tier List Analysis

May 22, 2025

Ea Fc 24 Fut Birthday Player Ratings And Tier List Analysis

May 22, 2025 -

Klopps Future Agent Responds To Real Madrid Rumours

May 22, 2025

Klopps Future Agent Responds To Real Madrid Rumours

May 22, 2025

Latest Posts

-

Siren Trailer Julianne Moore Clarifies Character Portrayal

May 22, 2025

Siren Trailer Julianne Moore Clarifies Character Portrayal

May 22, 2025 -

Un Nou Serial Netflix Cu O Distributie Care Impresioneaza

May 22, 2025

Un Nou Serial Netflix Cu O Distributie Care Impresioneaza

May 22, 2025 -

White Lotus Star And Oscar Winner Headline Netflixs New Darkly Funny Drama

May 22, 2025

White Lotus Star And Oscar Winner Headline Netflixs New Darkly Funny Drama

May 22, 2025 -

New Siren Trailer Julianne Moore Addresses Monster Rumors

May 22, 2025

New Siren Trailer Julianne Moore Addresses Monster Rumors

May 22, 2025 -

New Netflix Drama Sexy Darkly Funny Series Starring White Lotus And Oscar Winner

May 22, 2025

New Netflix Drama Sexy Darkly Funny Series Starring White Lotus And Oscar Winner

May 22, 2025