Understanding The Amundi MSCI World II UCITS ETF USD Hedged Dist Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the market value of an ETF's underlying assets per share. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, this calculation considers the value of the diverse holdings that track the MSCI World Index, a broad benchmark of global equities. However, the "USD Hedged" aspect introduces an additional layer of complexity. The ETF employs currency hedging strategies to minimize the impact of fluctuations between the USD and other currencies represented in the underlying index. This hedging impacts the final NAV calculation, offering investors a degree of protection against exchange rate volatility.

- NAV reflects the ETF's underlying assets' market value. This means the NAV is directly tied to the performance of the companies within the MSCI World Index.

- Calculated daily, usually at the close of market hours. The NAV is recalculated each day to reflect the changes in the market value of the underlying assets.

- Difference between NAV and market price. While ideally, the NAV and market price should be very close, minor discrepancies can arise due to trading volume and market liquidity.

- Impact of currency hedging on NAV fluctuations. The hedging strategy implemented by Amundi aims to reduce the impact of currency fluctuations on the NAV, providing more stability for investors.

Factors Affecting the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Several factors influence the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV. Understanding these factors is key to interpreting NAV movements and making informed investment decisions.

-

Market performance of underlying assets (MSCI World Index). The primary driver of NAV changes is the overall performance of the MSCI World Index. Positive market performance generally leads to increased NAV, while negative performance results in a decreased NAV.

-

Role of currency fluctuations and the impact of hedging. While the USD hedged strategy mitigates currency risk, residual fluctuations can still impact the NAV. Significant movements in exchange rates can affect the value of the underlying assets held in different currencies.

-

Effect of dividends and distribution on NAV. Dividend payments from the underlying companies are typically distributed to ETF shareholders, resulting in a slight decrease in the NAV after the distribution date. This reflects the reduction in the ETF's assets as dividends are paid out.

-

Global economic conditions and their influence. Macroeconomic factors like global growth, inflation, interest rates, and geopolitical events significantly influence the MSCI World Index and, consequently, the ETF's NAV.

-

Performance of specific sectors within the MSCI World Index. The performance of individual sectors within the index (e.g., technology, energy, healthcare) will impact the overall NAV, depending on their weighting within the index.

-

Impact of the US dollar relative to other currencies. Even with hedging, significant USD movements against other major currencies can subtly affect the NAV.

-

Frequency and amount of dividend distributions. The frequency and amount of dividend distributions from the underlying companies affect the NAV, decreasing it on ex-dividend dates.

Understanding the "USD Hedged" aspect

The "USD Hedged" designation in the ETF's name signifies that Amundi employs strategies to minimize the impact of currency exchange rate fluctuations on the NAV. This hedging reduces the risk for investors whose base currency is the US dollar.

- Protection against currency fluctuations. The hedging aims to protect investors from losses resulting from unfavorable currency movements. If the Euro (or another currency) depreciates against the USD, the hedged ETF's NAV would be less affected than an unhedged version.

- Potential impact on NAV compared to an unhedged version. An unhedged ETF would experience larger NAV fluctuations due to currency exchange rate changes. The hedged version aims for greater stability.

- Hedging strategies employed by Amundi. Amundi likely uses various financial instruments, such as forward contracts or currency swaps, to achieve its hedging objectives. The precise strategies may not be publicly disclosed.

Accessing the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Investors can access real-time and historical NAV data for the Amundi MSCI World II UCITS ETF USD Hedged Dist through various sources:

- Amundi's official website. Amundi, the ETF provider, usually publishes NAV information on its investor relations section.

- Major financial data providers (e.g., Bloomberg, Refinitiv). These platforms provide comprehensive financial data, including real-time and historical NAVs for various ETFs.

- Investor's brokerage account. Most brokerage platforms display the current NAV of ETFs held in an investor's portfolio.

Using NAV for Investment Decisions

The NAV is a critical tool for assessing the Amundi MSCI World II UCITS ETF USD Hedged Dist's performance and making informed investment decisions.

- Monitoring NAV changes over time. Tracking NAV fluctuations over time helps to assess the ETF's overall performance.

- Evaluating investment returns based on NAV fluctuations. Comparing the purchase price with the current NAV indicates the investment's gain or loss.

- Comparing performance to benchmarks. Comparing the NAV performance to the MSCI World Index provides insights into the ETF's tracking effectiveness.

Conclusion

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist Net Asset Value is essential for anyone considering investing in this ETF. By grasping the factors that influence its NAV and how to access this crucial data, investors can make more informed decisions and effectively monitor their portfolio's performance. Regularly reviewing the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV, alongside other key metrics, will allow you to optimize your investment strategy within this global market fund. Start monitoring your Amundi MSCI World II UCITS ETF USD Hedged Dist NAV today!

Featured Posts

-

Atfaq Washntn Wbkyn Altjary Ydfe Mwshr Daks Laela Artfae Ila 24 Alf Nqtt

May 24, 2025

Atfaq Washntn Wbkyn Altjary Ydfe Mwshr Daks Laela Artfae Ila 24 Alf Nqtt

May 24, 2025 -

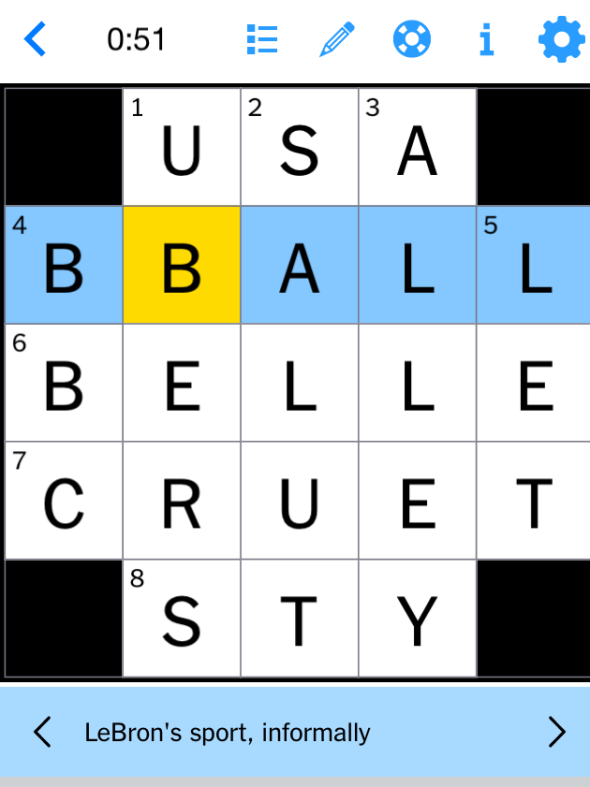

Nyt Mini Crossword March 26 2025 Hints To Help You Solve

May 24, 2025

Nyt Mini Crossword March 26 2025 Hints To Help You Solve

May 24, 2025 -

How To Get Bbc Radio 1s Big Weekend 2025 Sefton Park Tickets

May 24, 2025

How To Get Bbc Radio 1s Big Weekend 2025 Sefton Park Tickets

May 24, 2025 -

West Hams Pursuit Of Kyle Walker Peters A Transfer Update

May 24, 2025

West Hams Pursuit Of Kyle Walker Peters A Transfer Update

May 24, 2025 -

Essen Uniklinikum Beruehrende Ereignisse In Der Naehe

May 24, 2025

Essen Uniklinikum Beruehrende Ereignisse In Der Naehe

May 24, 2025

Latest Posts

-

Allegations Of Poisoning Emerge Annie Kilner Speaks Out

May 24, 2025

Allegations Of Poisoning Emerge Annie Kilner Speaks Out

May 24, 2025 -

The Kyle Walker Annie Kilner Story A Timeline Of Events

May 24, 2025

The Kyle Walker Annie Kilner Story A Timeline Of Events

May 24, 2025 -

Kyle Walker New Details Emerge Following Party Pictures And Annie Kilners Trip Home

May 24, 2025

Kyle Walker New Details Emerge Following Party Pictures And Annie Kilners Trip Home

May 24, 2025 -

Annie Kilners Public Statements After Kyle Walker Incident

May 24, 2025

Annie Kilners Public Statements After Kyle Walker Incident

May 24, 2025 -

The Kyle Walker Controversy Party Pictures And Relationship Implications

May 24, 2025

The Kyle Walker Controversy Party Pictures And Relationship Implications

May 24, 2025