Understanding The BigBear.ai (BBAI) Stock Drop: Revenue & Leadership Issues

Table of Contents

Declining Revenue and Missed Projections

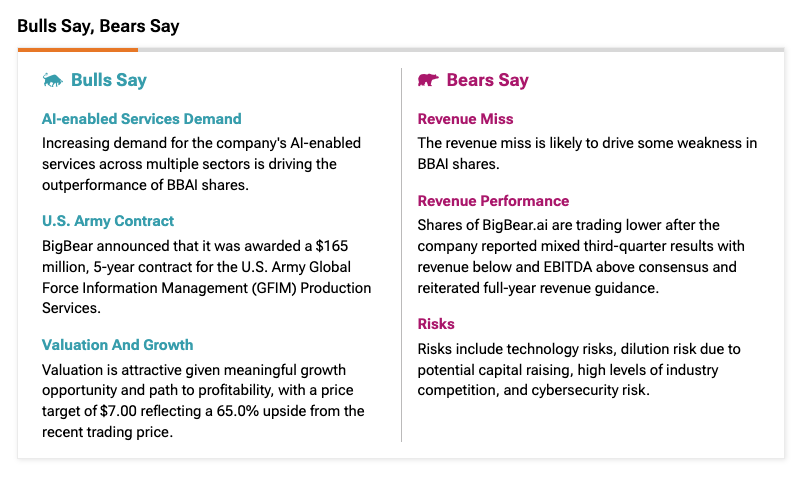

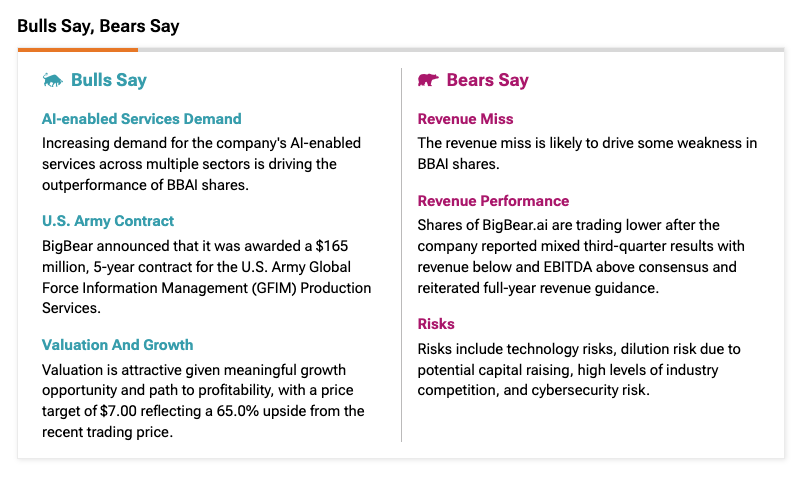

The primary driver behind the BBAI stock drop appears to be the company's consistent failure to meet revenue projections. This underperformance has significantly eroded investor confidence and resulted in a sharp decline in the stock price.

Revenue Shortfalls Below Analyst Expectations

- Q2 2023: BBAI reported revenue significantly below analyst expectations, missing the mark by approximately 15%. This followed a similar trend in Q1 2023, indicating a persistent pattern of underperformance.

- Q3 2023 (Projected): Early indicators suggest another potential revenue shortfall in Q3 2023, further fueling concerns about the company's financial health and its ability to meet future targets. The percentage difference compared to projected revenue remains to be seen.

- Full Year 2023 Projections: The cumulative effect of these missed targets is likely to result in a substantial shortfall in the company's full-year revenue projections for 2023.

The reasons behind these revenue shortfalls are multifaceted. Decreased government contract awards, coupled with slower-than-expected adoption of their new AI solutions, have significantly hampered revenue growth. Intense competition within the burgeoning AI market has also played a crucial role. BBAI's financial performance, as reflected in its BBAI revenue reports, paints a concerning picture for investors concerned about the BBAI stock price decline.

Impact of Contract Delays and Competition

Contract delays with government agencies have significantly impacted BBAI's revenue streams. Securing large-scale government contracts is vital for BBAI's business model, and any delays or setbacks directly translate into reduced revenue.

- Key Competitors: Companies like Palantir Technologies and other established players in the government AI and data analytics space pose significant competitive threats to BBAI, potentially eating into their market share.

- Market Saturation: The increasingly competitive landscape of the AI market makes it harder for BBAI to secure new contracts and maintain existing ones. The pressure to offer competitive pricing and innovative solutions adds further complexity.

Leadership Changes and Instability

Leadership instability at BigBear.ai has exacerbated the negative impact of declining revenue, further contributing to the BBAI stock drop.

CEO Turnover and its Implications

- Recent CEO Changes: The recent turnover in the CEO position, coupled with [mention any other significant leadership changes, dates, and reasons if publicly available], has created uncertainty within the company and amongst its investors.

- Investor Confidence: Frequent changes at the top can signal underlying organizational issues and a lack of strategic direction, which in turn erodes investor confidence. The volatility associated with leadership changes can make it challenging for BBAI to attract and retain both customers and investors.

Impact of Leadership on Strategic Decisions

Leadership transitions often lead to shifts in strategic direction. These shifts, particularly during times of financial difficulty, can be detrimental to a company's long-term success.

- Strategic Shifts: Any recent changes in the company’s strategic focus, brought about by leadership shifts, need to be critically evaluated for their potential impact on revenue generation.

- Market Adaptation: The ability of BBAI's leadership to adapt its strategy to the evolving dynamics of the AI technology market is crucial for its future. Failure to do so might further exacerbate the challenges they're currently facing.

Conclusion

The significant drop in BigBear.ai (BBAI) stock price can be attributed to a combination of disappointing revenue performance, consistently falling short of projections, and challenges related to leadership changes and strategic direction. Addressing these fundamental issues is critical for BBAI's future success. Understanding the complexities of the BBAI stock drop requires a careful analysis of the company's financial performance alongside its organizational structure and strategic path. Investors should continue to monitor BBAI's progress closely, paying attention to future revenue reports and leadership announcements to make informed decisions regarding their investments. Staying informed about the BBAI stock and its performance is key to navigating this dynamic market. Careful monitoring of BBAI revenue and leadership developments is crucial for informed investment decisions.

Featured Posts

-

Echo Valley Images A First Look At The Sydney Sweeney And Julianne Moore Thriller

May 21, 2025

Echo Valley Images A First Look At The Sydney Sweeney And Julianne Moore Thriller

May 21, 2025 -

Kcrg Tv 9 To Air 10 Minnesota Twins Games

May 21, 2025

Kcrg Tv 9 To Air 10 Minnesota Twins Games

May 21, 2025 -

Understanding The D Wave Quantum Qbts Stock Drop In 2025

May 21, 2025

Understanding The D Wave Quantum Qbts Stock Drop In 2025

May 21, 2025 -

Trans Australia Run Will The Record Fall This Year

May 21, 2025

Trans Australia Run Will The Record Fall This Year

May 21, 2025 -

Spectacles Engages Au Festival Du Collectif Le Bouillon Clisson

May 21, 2025

Spectacles Engages Au Festival Du Collectif Le Bouillon Clisson

May 21, 2025

Latest Posts

-

The Goldbergs Behind The Scenes Look At Production And Cast

May 22, 2025

The Goldbergs Behind The Scenes Look At Production And Cast

May 22, 2025 -

From Prison To Studio Vybz Kartels Exclusive Update On Life And Music

May 22, 2025

From Prison To Studio Vybz Kartels Exclusive Update On Life And Music

May 22, 2025 -

Vybz Kartels Exclusive Interview Life In Prison Family And Future Plans

May 22, 2025

Vybz Kartels Exclusive Interview Life In Prison Family And Future Plans

May 22, 2025 -

Exclusive Vybz Kartel On Prison Freedom And New Music

May 22, 2025

Exclusive Vybz Kartel On Prison Freedom And New Music

May 22, 2025 -

Bp Executive Compensation A 31 Reduction

May 22, 2025

Bp Executive Compensation A 31 Reduction

May 22, 2025