Understanding The CoreWeave (CRWV) Stock Surge: Analysis Of Today's Performance

Table of Contents

CoreWeave's Business Model and Recent Developments

CoreWeave's success is intrinsically linked to its strategic positioning within the rapidly expanding cloud computing and AI sectors.

Focus on AI and Cloud Computing

CoreWeave specializes in providing high-performance cloud computing solutions, particularly catering to the burgeoning demands of AI workloads. The company's focus on providing powerful, scalable data centers equipped with cutting-edge GPU technology is a key driver of its growth. This strategic focus positions CoreWeave to capitalize on the increasing need for sophisticated infrastructure to support AI development and deployment.

- Partnership with leading AI research institutions: Collaborations with these institutions provide CoreWeave with valuable insights and early access to groundbreaking AI technologies.

- Successful deployment of new GPU-powered infrastructure: Continuous investment in and deployment of state-of-the-art GPU infrastructure ensures CoreWeave stays at the forefront of providing the computing power needed for large-scale AI training and inference.

- Securing major cloud contracts with Fortune 500 companies: These significant contracts demonstrate market validation and underscore the demand for CoreWeave's specialized services.

Competitive Advantage and Market Position

CoreWeave differentiates itself from competitors through several key strategies. Its competitive advantages include:

- Superior cost-effectiveness: CoreWeave's efficient infrastructure and operational model allows them to offer competitive pricing, attracting cost-conscious clients.

- Leading-edge sustainable data center practices: A focus on sustainability resonates with environmentally conscious organizations and investors, a growing consideration in the tech sector.

- Exclusive access to cutting-edge GPU technology: Securing access to advanced hardware provides CoreWeave with a technological edge, enabling it to offer superior performance to clients.

External Factors Influencing CRWV Stock Price

The surge in CRWV stock price isn't solely attributable to CoreWeave's internal performance. Several external factors have played a crucial role.

Overall Market Sentiment and Investor Confidence

Positive market sentiment towards technology stocks, particularly those in the AI sector, significantly impacts CRWV's performance.

- Positive investor sentiment towards the AI sector: The ongoing excitement surrounding generative AI and its potential applications fuels investment in companies like CoreWeave.

- Strong performance of the NASDAQ: The overall strength of the tech-heavy NASDAQ index often correlates with the performance of individual tech stocks, including CRWV.

- Easing inflation concerns: Reduced inflation concerns generally lead to increased investor risk appetite, benefiting growth stocks like CoreWeave.

Industry Trends and Technological Advancements

Several industry trends are propelling CoreWeave's growth and influencing investor perception.

- Exponential growth in AI applications: The rapid expansion of AI across various industries creates a massive demand for the type of high-performance computing resources CoreWeave provides.

- Increased demand for specialized AI infrastructure: The increasing complexity of AI models necessitates specialized infrastructure, precisely what CoreWeave offers.

- Advancements in GPU technology and their adoption by CoreWeave: CoreWeave's rapid adoption of the latest GPU technology allows it to maintain a competitive edge and meet the evolving needs of its clients.

Analyzing the CRWV Stock Surge: Potential Drivers

The recent CRWV stock surge is likely the result of a confluence of factors, including company-specific news and broader market dynamics.

News and Announcements

Positive news and announcements often trigger significant stock price movements.

- Positive earnings report exceeding analyst expectations: Strong financial results demonstrate the company's robust growth trajectory, boosting investor confidence.

- Announcement of a major strategic partnership: Strategic partnerships can expand market reach and enhance the company's overall value proposition.

- Launch of a new, highly demanded product: Introducing innovative products that address market needs can significantly impact a company's valuation.

Speculation and Short Squeeze

Speculation and short squeezes can also contribute to dramatic price fluctuations.

- Significant short interest prior to the surge: A high level of short interest makes the stock susceptible to a short squeeze, where short sellers are forced to buy back shares, driving up the price.

- Potential short squeeze contributing to price increase: The rapid price increase may partly be attributed to a short squeeze, amplifying the effects of other positive factors.

Conclusion

The CoreWeave (CRWV) stock surge is a complex phenomenon resulting from the interplay of the company's strong business model focused on high-growth AI cloud computing, positive market sentiment, and potentially a short squeeze. CoreWeave's competitive advantages, coupled with the booming AI industry and favorable market conditions, have created an environment conducive to significant stock price appreciation. However, investors should remember that market volatility is inherent.

Understanding the CoreWeave (CRWV) stock requires ongoing monitoring of its performance and market conditions. Conduct thorough research and consult with a financial advisor before investing in CRWV stock or any other stock. Remember to always perform your own due diligence before making any investment decisions.

Featured Posts

-

Box Truck Accident Shuts Down Portion Of Route 581

May 22, 2025

Box Truck Accident Shuts Down Portion Of Route 581

May 22, 2025 -

Trans Australia Run A World Record Under Threat

May 22, 2025

Trans Australia Run A World Record Under Threat

May 22, 2025 -

Dexter Resurrections Villain Beloved Or Just Popular

May 22, 2025

Dexter Resurrections Villain Beloved Or Just Popular

May 22, 2025 -

Abn Amro Storing Oplossingen Voor Online Betalingsproblemen

May 22, 2025

Abn Amro Storing Oplossingen Voor Online Betalingsproblemen

May 22, 2025 -

Sumergete En El Misterio 5 Podcasts De Terror Y Suspenso Imprescindibles

May 22, 2025

Sumergete En El Misterio 5 Podcasts De Terror Y Suspenso Imprescindibles

May 22, 2025

Latest Posts

-

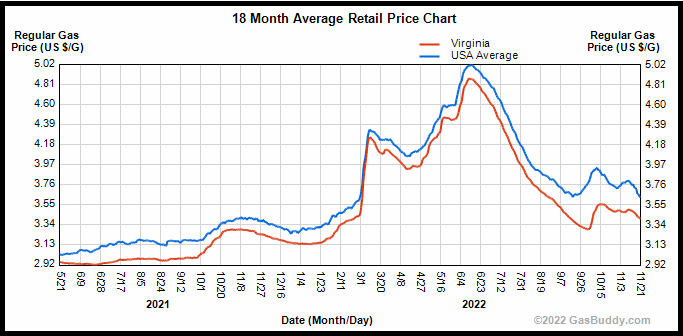

Significant Drop In Virginia Gas Prices 50 Cents Less Per Gallon

May 22, 2025

Significant Drop In Virginia Gas Prices 50 Cents Less Per Gallon

May 22, 2025 -

Analysis Gas Prices Soar By Almost 20 Cents

May 22, 2025

Analysis Gas Prices Soar By Almost 20 Cents

May 22, 2025 -

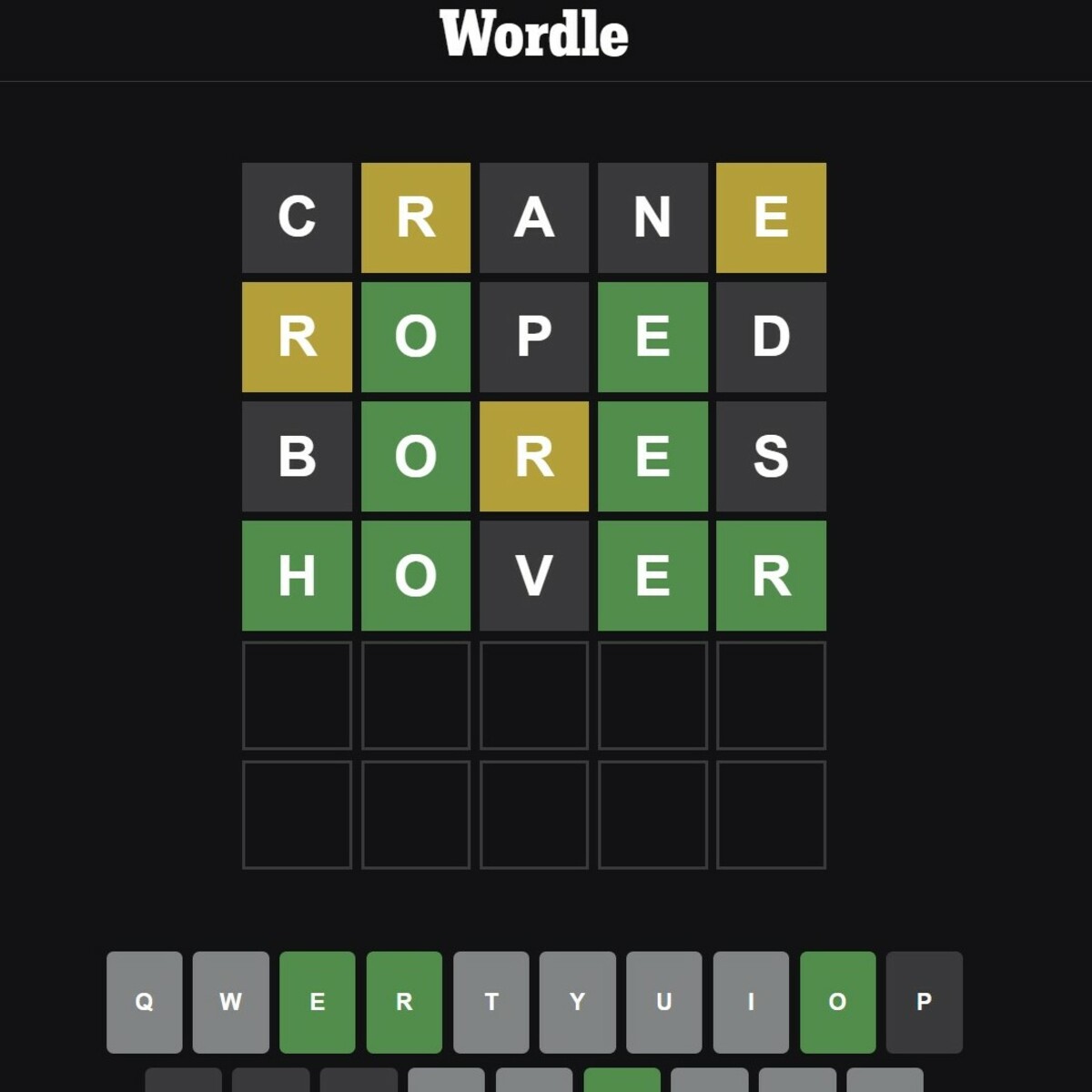

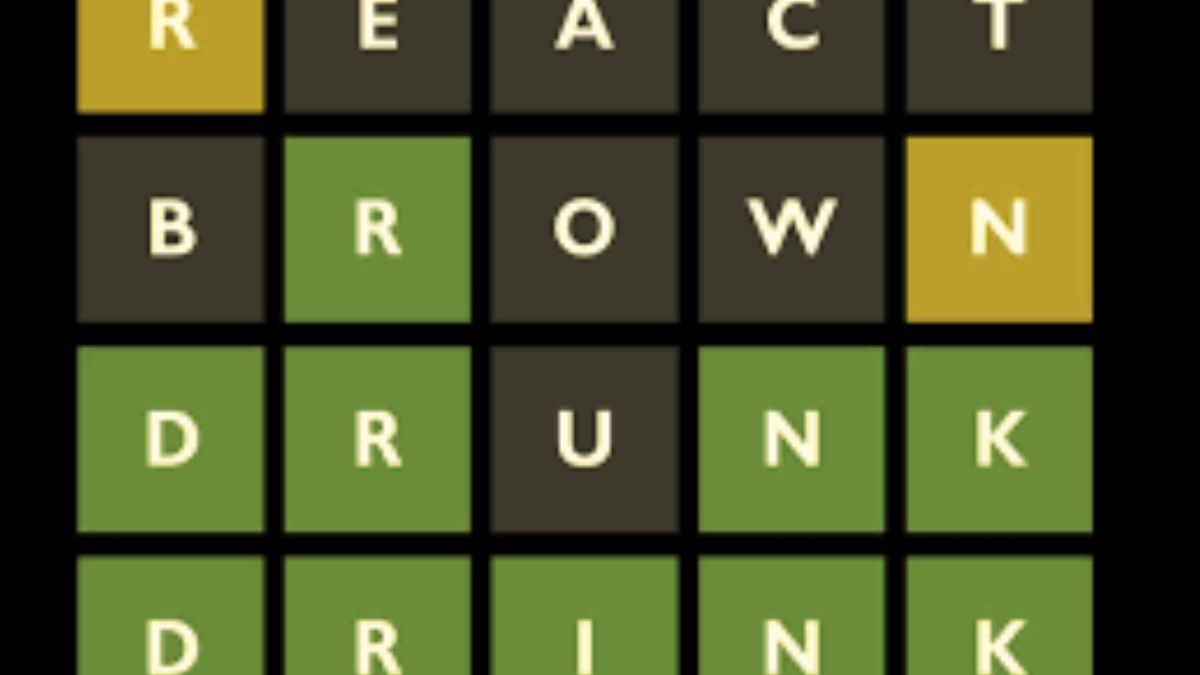

Wordle Help Hints And Answer For April 8th 1389

May 22, 2025

Wordle Help Hints And Answer For April 8th 1389

May 22, 2025 -

Wordle 367 March 17 Clues And Solution

May 22, 2025

Wordle 367 March 17 Clues And Solution

May 22, 2025 -

Significant Increase In Gas Prices Nearly 20 Cents Per Gallon

May 22, 2025

Significant Increase In Gas Prices Nearly 20 Cents Per Gallon

May 22, 2025