Understanding The Current GPU Market: High Prices Explained

Table of Contents

The Impact of the Global Chip Shortage

The current GPU market is significantly impacted by the ongoing global chip shortage. This widespread scarcity of semiconductors has created a ripple effect across various industries, and the GPU market is no exception.

Semiconductor Manufacturing Bottlenecks

The production of GPUs relies heavily on intricate semiconductor manufacturing processes. Recent years have seen significant bottlenecks in this process, leading to decreased output and increased prices.

- Limited Wafer Capacity: Foundries, the facilities that manufacture semiconductor wafers, are operating at near maximum capacity. The demand for chips far outstrips the current production capabilities.

- Logistical Challenges: The global supply chain has been severely disrupted, leading to delays in the transportation of raw materials and finished products. This includes everything from the shipping of silicon to the distribution of completed GPUs.

- Raw Material Shortages: The production of semiconductors requires a variety of raw materials, some of which have experienced shortages, further restricting production.

According to industry reports, wafer production capacity increased by only 7% in 2022 while demand surged by over 20%, highlighting the severity of the bottleneck.

Increased Demand for GPUs

The demand for GPUs has skyrocketed in recent years, exacerbating the impact of the chip shortage. Several factors have contributed to this surge:

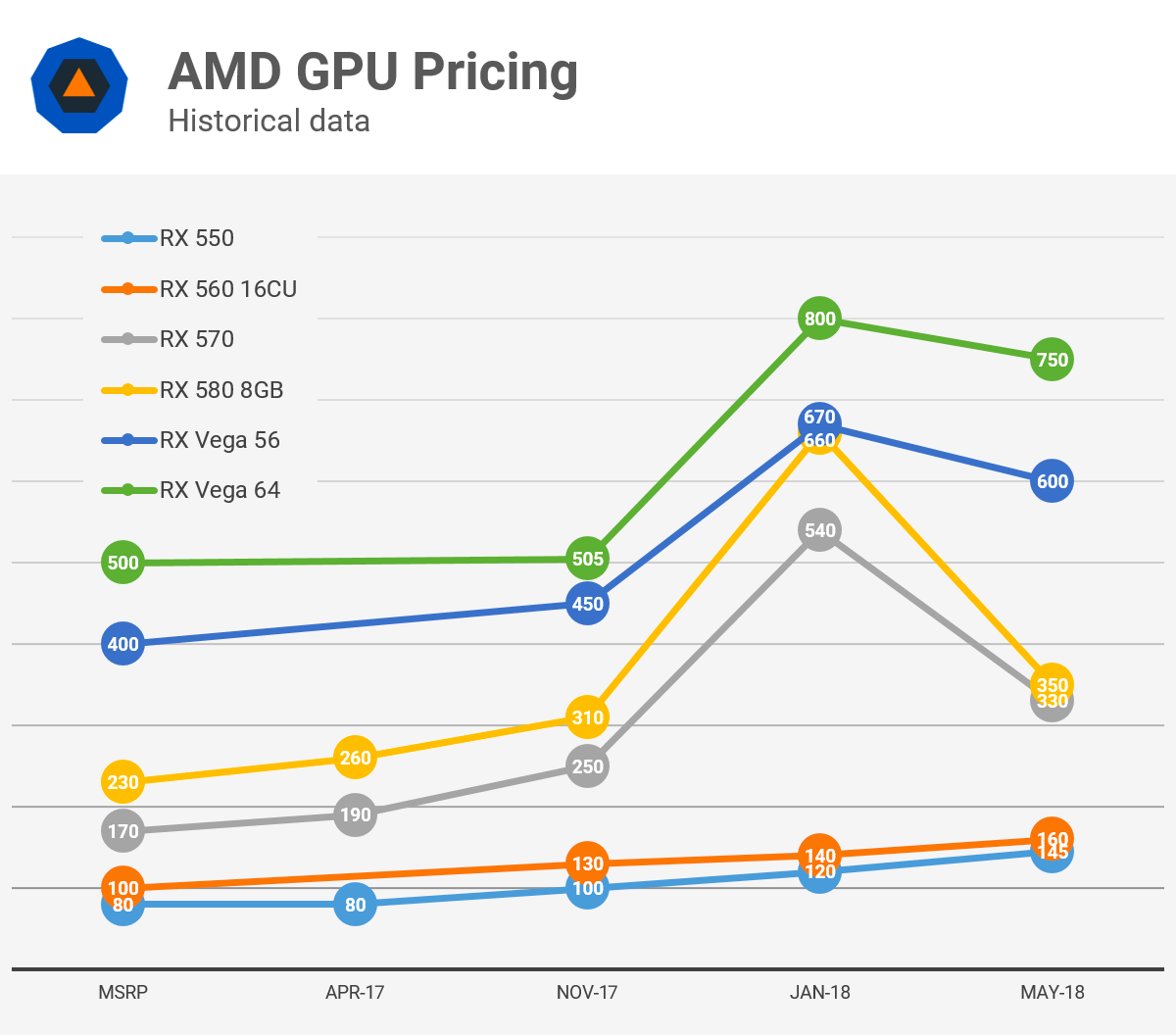

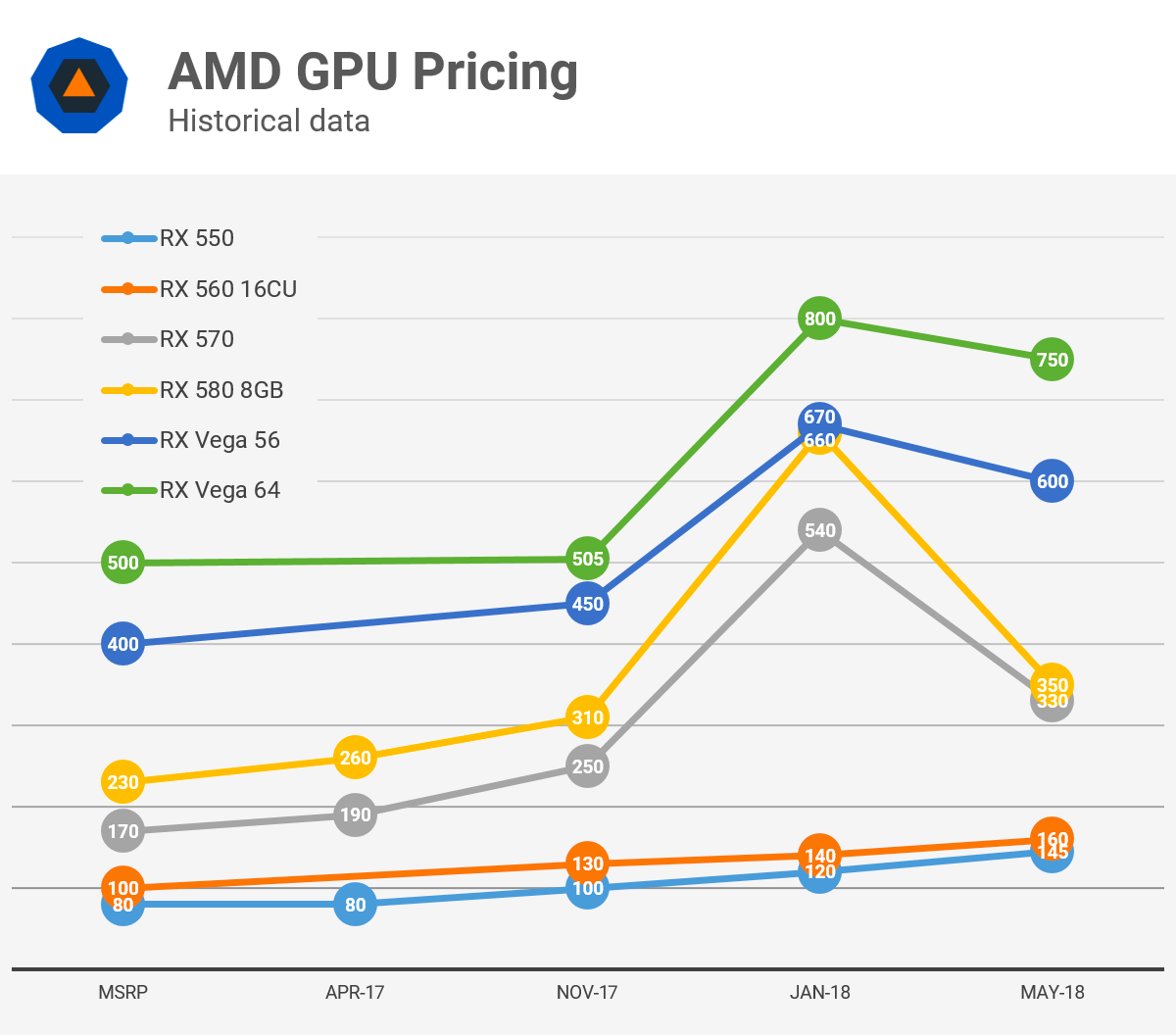

- Cryptocurrency Mining: The popularity of cryptocurrencies like Bitcoin and Ethereum has led to a massive increase in demand for GPUs, as they are crucial for mining operations. This demand often outcompetes consumers seeking GPUs for gaming or professional use.

- Gaming Console Shortages: The ongoing shortage of gaming consoles like the PlayStation 5 and Xbox Series X has driven gamers towards building or upgrading their PCs, increasing the demand for high-performance GPUs.

- Increased Remote Work/Online Learning: The shift towards remote work and online learning has also contributed to increased demand for powerful GPUs for tasks such as video conferencing, video editing, and data processing.

A recent analysis showed a 35% year-over-year increase in GPU demand in 2022, while supply remained relatively stagnant. This imbalance significantly impacted graphics card prices.

Increased Manufacturing Costs & Tariffs

Beyond the chip shortage, the cost of producing GPUs has also increased significantly, further contributing to high prices in the GPU market.

Rising Raw Material Prices

The raw materials required for GPU manufacturing, such as silicon, precious metals (used in chip packaging), and specialized chemicals, have experienced considerable price increases in recent years.

- Silicon Prices: The price of silicon, a key component in semiconductor manufacturing, has fluctuated significantly, influenced by global market dynamics and energy costs.

- Precious Metal Costs: The use of precious metals in GPU packaging adds to the overall cost. Fluctuations in the price of gold, platinum, and other metals directly impact the final cost of the product.

- Chemical Costs: Specialized chemicals play a critical role in the manufacturing process, and their prices have also risen, contributing to the overall increase in GPU production costs.

Industry data indicates that the cost of raw materials used in GPU manufacturing increased by an average of 15% in 2022, directly impacting the final retail price.

Tariffs and Trade Restrictions

International trade policies, including tariffs and trade restrictions, can also impact the price of GPUs. Tariffs increase import costs, which are often passed on to consumers.

- Import Duties: Tariffs on imported components used in GPU manufacturing increase the production costs, influencing the final price.

- Trade Wars: Geopolitical tensions and trade disputes can disrupt global supply chains and lead to higher prices for imported goods.

Scalpers and Market Speculation

The GPU market has been significantly impacted by scalpers and market speculation, further contributing to the high prices.

The Role of Resellers

Resellers and scalpers use automated bots and other methods to purchase large quantities of GPUs at retail prices, then resell them at significantly inflated prices to consumers desperate for a graphics card.

- Automated Purchasing: Sophisticated bots allow scalpers to bypass typical purchase limits, acquiring large quantities of GPUs.

- Price Gouging: Scalpers often charge exorbitant prices, taking advantage of the high demand and limited supply.

Market Volatility and Investment

The cryptocurrency market's volatility also influences GPU prices. When cryptocurrency prices rise, the demand for GPUs used in mining increases, driving up prices. Conversely, when cryptocurrency prices fall, demand decreases, but prices often remain elevated due to existing scarcity.

- Crypto Price Fluctuations: The direct correlation between cryptocurrency prices and GPU demand creates price instability in the GPU market.

- Investment in Mining Operations: The large-scale investment in cryptocurrency mining operations further drives up demand and contributes to inflated GPU prices.

Potential Future Trends and Predictions

While the current GPU market situation is challenging, there are some potential positive trends on the horizon.

Increased Production Capacity

Several factors could lead to an increase in GPU production capacity in the coming years:

- New Manufacturing Plants: Companies are investing heavily in expanding their semiconductor manufacturing facilities.

- Technological Advancements: Improvements in chip manufacturing technology could lead to increased efficiency and output.

- Alternative Chip Designs: The exploration of alternative chip designs and manufacturing processes could help to alleviate some of the current bottlenecks.

Long-Term GPU Market Outlook

Predicting the future of the GPU market is complex, but several factors suggest that prices may eventually stabilize. Increased production capacity, a potential decrease in cryptocurrency mining demand (due to market fluctuations or changes in mining algorithms), and a more balanced supply and demand equilibrium could all contribute to a normalization of GPU prices. However, these are long-term predictions, and significant price drops are not expected in the immediate future. Supply chain issues and geopolitical factors remain wildcard elements influencing GPU pricing.

Conclusion

The high prices in the current GPU market are a result of a complex interplay of factors. The global chip shortage, increased demand (driven by cryptocurrency mining, gaming console shortages, and remote work), rising manufacturing costs, and the actions of scalpers have all contributed to the current situation. Understanding the dynamics of the GPU market is key to navigating its complexities. Stay informed about the latest trends and developments to make smart decisions regarding your next GPU purchase. Carefully evaluate your needs and budget before making a purchase to avoid overpaying for a graphics card in this challenging market.

Featured Posts

-

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

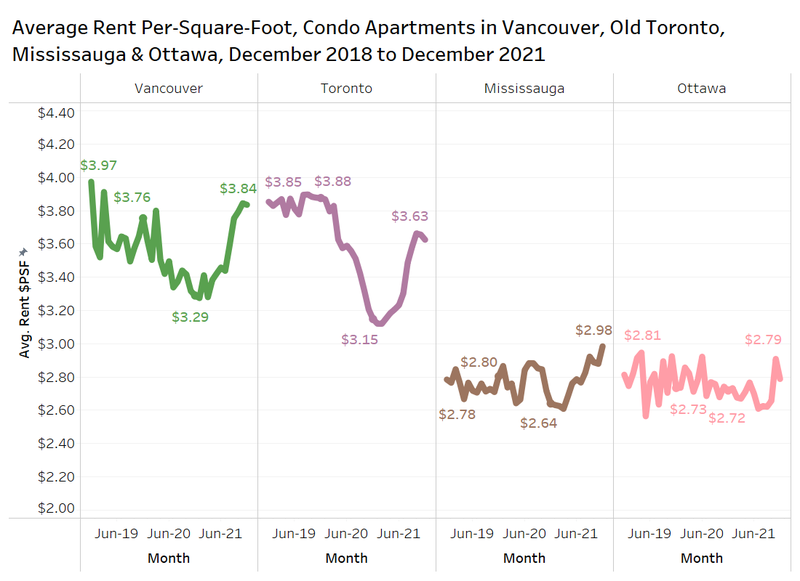

Rent Growth Cools In Metro Vancouver But Housing Remains Expensive

Apr 28, 2025

Rent Growth Cools In Metro Vancouver But Housing Remains Expensive

Apr 28, 2025 -

Bof As View Addressing Investor Concerns About Stretched Stock Market Valuations

Apr 28, 2025

Bof As View Addressing Investor Concerns About Stretched Stock Market Valuations

Apr 28, 2025 -

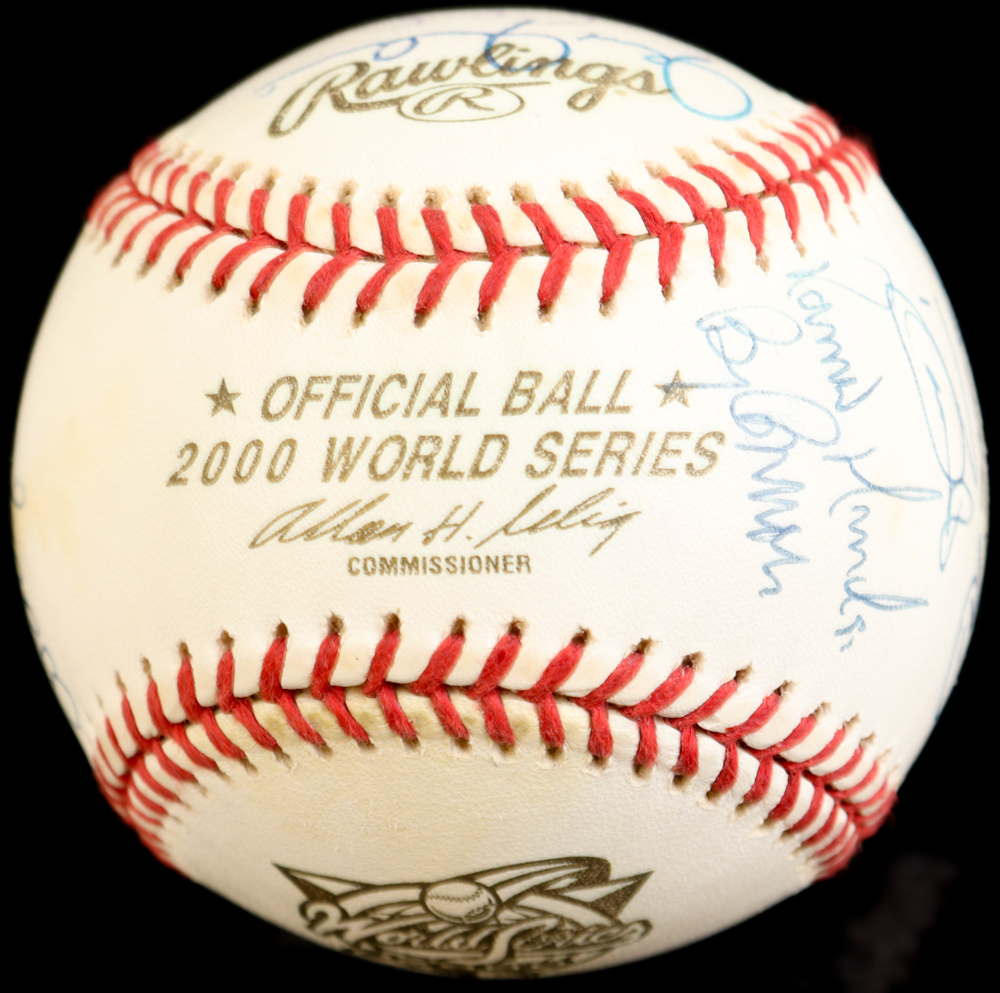

Remembering 2000 Yankees Success With Torre And Pettittes Crucial Win

Apr 28, 2025

Remembering 2000 Yankees Success With Torre And Pettittes Crucial Win

Apr 28, 2025 -

Is Your Marriage Ending Quietly Spotting The Symptoms Of A Silent Divorce

Apr 28, 2025

Is Your Marriage Ending Quietly Spotting The Symptoms Of A Silent Divorce

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Coras Subtle Red Sox Lineup Changes For Doubleheader

Apr 28, 2025

Coras Subtle Red Sox Lineup Changes For Doubleheader

Apr 28, 2025 -

Could Espns Red Sox Outfield Prediction For 2025 Come True

Apr 28, 2025

Could Espns Red Sox Outfield Prediction For 2025 Come True

Apr 28, 2025 -

Slight Lineup Shift For Red Sox Doubleheader Game 1

Apr 28, 2025

Slight Lineup Shift For Red Sox Doubleheader Game 1

Apr 28, 2025