Understanding The D-Wave Quantum (QBTS) Stock Crash On Monday

Table of Contents

Market Sentiment and the Broader Tech Sell-Off

Monday's QBTS stock crash didn't happen in isolation. The broader tech sector experienced a significant downturn, impacting numerous companies across the industry. This negative market sentiment played a considerable role in QBTS's performance.

-

Significant Market Events: Several factors contributed to the overall tech sell-off. Rising interest rates, persistent inflation concerns, and ongoing geopolitical instability created a climate of uncertainty, prompting investors to move away from riskier assets, including many technology stocks. This risk aversion directly impacted QBTS, a company operating in a still-developing sector.

-

Correlation with Other Tech Stocks: The decline in QBTS mirrored the downward trend observed across numerous other technology companies. This suggests that the QBTS stock crash was largely driven by broader market forces rather than company-specific issues alone. The correlation between QBTS performance and the Nasdaq Composite, for example, would be a key metric to analyze during this period. [Link to relevant market analysis report showing correlation]

-

Investor Sentiment and Risk Factors: The prevailing negative investor sentiment amplified the impact of any negative news related to D-Wave Quantum. Investors, already cautious due to the broader market conditions, were more likely to react negatively to even minor setbacks for QBTS. The perceived risk associated with investing in quantum computing, a relatively nascent field, also played a role. This volatility highlights the inherent risk factors associated with early-stage technology investments.

D-Wave Quantum's Recent Announcements and Financial Performance

While the broader market downturn significantly influenced the QBTS stock price, D-Wave Quantum's recent performance and announcements likely exacerbated the decline. Analyzing these factors is crucial for a complete understanding of the crash.

-

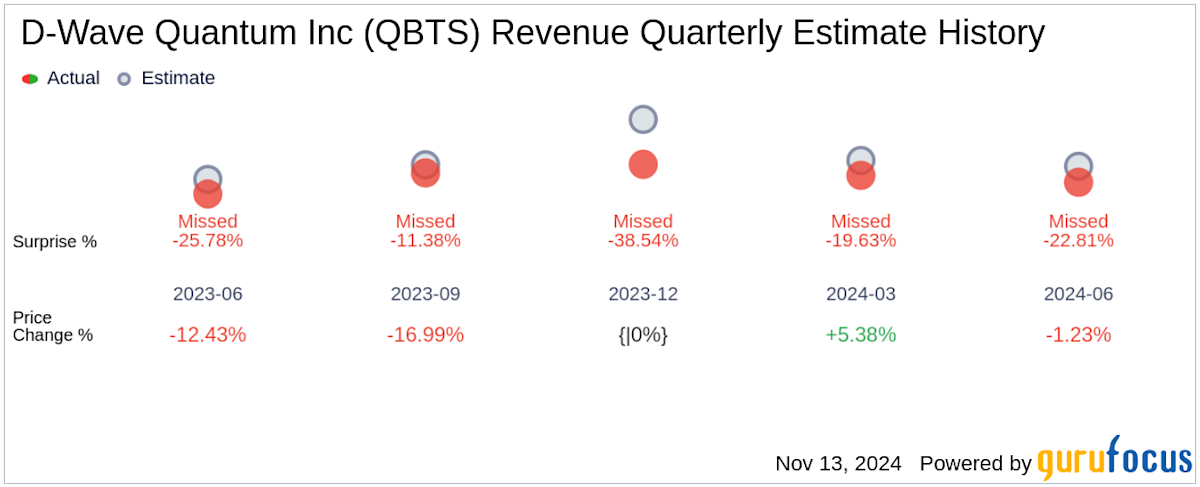

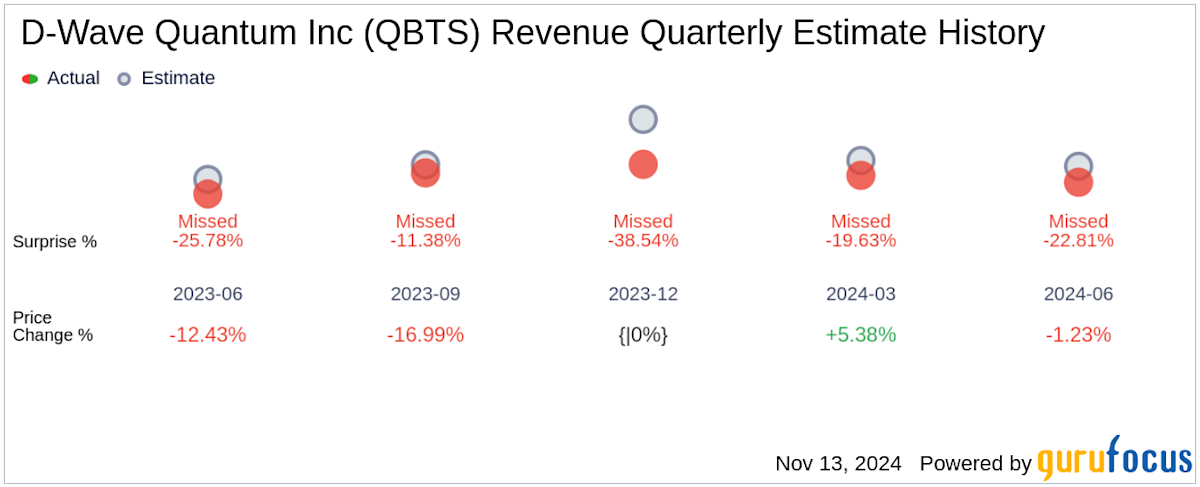

Recent Earnings Reports and Partnerships: [Insert details of any recent D-Wave Quantum earnings reports, highlighting key figures like revenue, profits, and growth rates]. Any missed earnings expectations or weaker-than-anticipated performance could have negatively impacted investor confidence. Additionally, the success or failure of recent partnerships or collaborations could have played a role. [Mention specific partnerships and their impact].

-

Product Launches and Development: Delays in product development or less-than-stellar market reception for new quantum computing solutions could also contribute to a stock decline. [Insert details on any recent product launches and their market impact, mentioning any potential disappointments]. The quantum computing market is highly competitive, and failing to meet expectations can have significant consequences.

-

Financial Health and Stock Price Impact: The overall financial health of D-Wave Quantum, including its cash reserves, debt levels, and future projections, directly influences investor confidence. Any concerns about the company's long-term financial sustainability likely contributed to the stock's decline. [Include relevant data or links to financial reports].

Speculation and Analyst Reactions

Market speculation and analyst opinions played a role in the QBTS stock crash. Understanding these perspectives is key to gaining a holistic view of the situation.

-

Analyst Reports and Commentary: [Summarize key analyst reports and commentary following the stock drop, including any changes in rating or target price]. Were there any significant downgrades from analysts that contributed to the sell-off?

-

Theories and Explanations: Various theories emerged to explain the price drop, ranging from concerns about competition in the quantum computing space to broader anxieties about the future of the technology itself. [Discuss the different theories and assess their plausibility].

-

Short Selling and Speculative Activities: The involvement of short sellers, who profit from a stock's decline, cannot be ruled out. [Discuss the potential role of short selling and other speculative activities in amplifying the downturn]. Increased short interest could exacerbate a downward trend.

Long-Term Implications for QBTS and the Quantum Computing Sector

The QBTS stock crash raises questions about the long-term prospects of both D-Wave Quantum and the broader quantum computing sector.

-

Temporary Setback or Significant Challenge?: Was this a temporary market correction, or does it signal deeper, more persistent challenges for D-Wave Quantum and the field as a whole? [Discuss both possibilities and provide reasoning].

-

Impact on Investor Confidence: The crash undoubtedly impacted investor confidence in quantum computing. This could make it more challenging for quantum computing companies to secure funding and attract further investment. [Discuss how this could affect the sector's future growth].

-

Future Growth Prospects: Despite the setback, the long-term potential of quantum computing remains significant. The crash, while painful, may offer opportunities for long-term investors to enter the market at a lower price point. [Discuss the future growth potential of the sector and how it might impact QBTS].

Conclusion

The D-Wave Quantum (QBTS) stock crash on Monday resulted from a confluence of factors, including a broader tech sell-off driven by macroeconomic concerns, D-Wave Quantum's recent performance, market speculation, and analyst reactions. Understanding these factors is crucial before investing in any volatile stock, particularly in emerging technology sectors like quantum computing. The QBTS situation highlights the inherent risks associated with early-stage investments. Stay informed about the evolving situation surrounding D-Wave Quantum (QBTS) and other quantum computing stocks by following reputable financial news sources and conducting thorough due diligence before making any investment decisions. Understanding the risks associated with investing in QBTS and the broader quantum computing market is crucial for successful long-term investment strategies.

Featured Posts

-

Diskvalifikatsiya Leklera I Khemiltona Analiz Gonochnogo Intsidenta Ferrari

May 20, 2025

Diskvalifikatsiya Leklera I Khemiltona Analiz Gonochnogo Intsidenta Ferrari

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon Family Finance And Future

May 20, 2025

Understanding The Billionaire Boy Phenomenon Family Finance And Future

May 20, 2025 -

Experience Culinaire Restaurant Rooftop Galeries Lafayette Biarritz Avant Pau

May 20, 2025

Experience Culinaire Restaurant Rooftop Galeries Lafayette Biarritz Avant Pau

May 20, 2025 -

Jennifer Lawrence Majka Drugoj Djeci

May 20, 2025

Jennifer Lawrence Majka Drugoj Djeci

May 20, 2025 -

Robert Pattinsons Accent Performance In Mickey 17 A Signature Trait

May 20, 2025

Robert Pattinsons Accent Performance In Mickey 17 A Signature Trait

May 20, 2025