Understanding The Dragons' Investment Criteria: A Comprehensive Guide

Table of Contents

2.1. The Team: Assessing the Entrepreneurs Behind the Pitch

The most crucial aspect of any successful investment is the team. Dragons' Den-style investors prioritize the entrepreneurs behind the pitch, recognizing that a strong team is the foundation of a thriving business. They are not just investing in an idea; they are investing in people.

-

Why investors prioritize the founding team: Investors assess experience, skills, passion, and unwavering commitment. A passionate and capable team inspires confidence and significantly increases the likelihood of success.

-

Essential qualities investors look for:

- Proven track record (or potential): Demonstrate past successes, even if small, or showcase potential through compelling evidence of skills and experience.

- Strong leadership and execution: Investors want to see evidence of the team's ability to lead, manage, and successfully execute plans.

- Passionate belief in the idea: Genuine enthusiasm is infectious and signals a commitment to overcoming challenges.

- Adaptability and resilience: The ability to navigate unexpected obstacles and adapt to market changes is critical.

- Cohesive team dynamics: A team that works well together, complements each other's skills, and shares a common vision is highly desirable.

-

The importance of a compelling pitch: Your pitch needs to highlight the team's expertise and capabilities, showcasing how your combined skills and experience will drive the business forward.

2.2. Market Analysis: Validation and Opportunity

A compelling market analysis is non-negotiable for securing investment. Dragons are looking for businesses that tap into real market needs and demonstrate significant growth potential.

-

Understanding your target market: Clearly define your target audience, including demographics, needs, buying behavior, and market size. Conduct thorough market research to support your claims.

-

Market research and validation: Provide concrete evidence of market demand. Surveys, customer interviews, and pilot programs can demonstrate the viability of your product or service.

-

Competitive landscape analysis: Identify your main competitors, analyze their strengths and weaknesses, and clearly articulate your competitive advantage – your unique selling proposition (USP).

-

Market size and scalability: Demonstrate the potential for substantial revenue generation and the ability to scale your operations to meet growing demand. Show projections for market share growth.

-

Addressing market risks: Acknowledge potential challenges and present well-defined mitigation strategies. Transparency is key; investors want to see that you've considered potential downsides.

2.3. Financial Projections: Demonstrating Viability and Return on Investment (ROI)

Realistic and well-supported financial projections are crucial for demonstrating the viability of your business and the potential return on investment for the Dragons.

-

Realistic financial forecasts: Develop detailed revenue projections, cost analyses, and profit margin forecasts. Use conservative estimations and clearly explain your assumptions.

-

Key financial metrics: Focus on metrics like customer acquisition cost (CAC), customer lifetime value (CLTV), burn rate, and profitability. These metrics demonstrate the financial health and growth potential of your business.

-

Funding requirements and use of funds: Clearly state your funding needs and provide a detailed breakdown of how the investment will be used. Transparency is paramount.

-

Exit strategy: Outline a clear plan for investor return, such as acquisition by a larger company or an Initial Public Offering (IPO).

-

Clear presentation: Present your financial models clearly and concisely, using easy-to-understand charts and graphs.

2.4. The Business Model: Innovation and Scalability

Dragons' Den investors are drawn to innovative business models with significant scalability potential. Your business model must demonstrate a clear path to sustainable growth and profitability.

-

Uniqueness and value proposition: What makes your business unique? What problem are you solving, and what is your competitive advantage? Clearly articulate your value proposition.

-

Revenue model: How will your business generate income? Is your revenue model sustainable and scalable?

-

Scalability and growth potential: Demonstrate how your business can expand operations and increase revenue efficiently. Consider factors like technology, distribution channels, and team capacity.

-

Intellectual property protection: If applicable, highlight any patents, trademarks, or copyrights that protect your intellectual property.

-

Operational efficiency: Show that you have a lean and efficient business model that minimizes costs and maximizes profitability.

2.5. The Ask: Presenting a Compelling Investment Opportunity

The "ask" is the culmination of your efforts. It requires careful consideration of equity offered, valuation, and negotiation.

-

Equity offered vs. valuation: Determine the percentage of equity you are willing to offer in exchange for investment and justify your valuation. Thorough market research and comparable company analysis are crucial here.

-

Negotiating terms and conditions: Understand the implications of different investment structures (e.g., convertible notes, preferred stock). Seek legal counsel to ensure favorable terms.

-

Clear and concise pitch: Practice your pitch extensively to ensure it is clear, concise, and compelling.

-

Preparation for questions: Anticipate potential questions from investors and prepare thorough answers.

-

Understanding investor types: Research the Dragons' investment history and tailor your pitch to their specific interests and investment strategies.

3. Conclusion: Mastering the Dragons' Investment Criteria

Mastering the Dragons' investment criteria is pivotal for securing funding and achieving entrepreneurial success. By focusing on a strong team, validated market research, realistic financials, a scalable business model, and a compelling investment opportunity, entrepreneurs significantly improve their chances of securing investment. Remember, thorough preparation, a well-structured pitch, and a deep understanding of your business are crucial for success. Start refining your pitch and understanding the intricacies of the Dragons' investment criteria today—your entrepreneurial journey depends on it!

Featured Posts

-

Duurzaam Schoolgebouw Kampen Rechtszaak Tegen Enexis Om Stroomaansluiting

May 01, 2025

Duurzaam Schoolgebouw Kampen Rechtszaak Tegen Enexis Om Stroomaansluiting

May 01, 2025 -

England Triumphs Over France Dalys Late Show Decides Six Nations Clash

May 01, 2025

England Triumphs Over France Dalys Late Show Decides Six Nations Clash

May 01, 2025 -

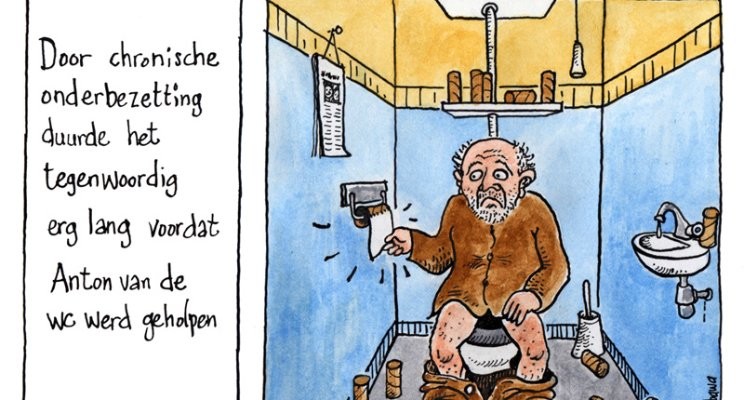

Overvolle Tbs Klinieken De Gevolgen Van Jarenlange Onderbezetting

May 01, 2025

Overvolle Tbs Klinieken De Gevolgen Van Jarenlange Onderbezetting

May 01, 2025 -

Pasifika Sipoti Quick Look At April 4th

May 01, 2025

Pasifika Sipoti Quick Look At April 4th

May 01, 2025 -

Voyage De 8000 Km Le Recit De Trois Jeunes Du Bocage Ornais Sans Stress

May 01, 2025

Voyage De 8000 Km Le Recit De Trois Jeunes Du Bocage Ornais Sans Stress

May 01, 2025

Latest Posts

-

Stroomproblemen Nieuw Schoolgebouw Kampen Spoedprocedure Gestart

May 01, 2025

Stroomproblemen Nieuw Schoolgebouw Kampen Spoedprocedure Gestart

May 01, 2025 -

Duurzaam Schoolgebouw Kampen Kort Geding Tegen Stroomleverancier

May 01, 2025

Duurzaam Schoolgebouw Kampen Kort Geding Tegen Stroomleverancier

May 01, 2025 -

Trump Effect On Ripple Presidential Post Spurs Xrp Price Rally

May 01, 2025

Trump Effect On Ripple Presidential Post Spurs Xrp Price Rally

May 01, 2025 -

Rechtszaak Kampen Nieuwe School Kan Niet Op Stroomnet Worden Aangesloten

May 01, 2025

Rechtszaak Kampen Nieuwe School Kan Niet Op Stroomnet Worden Aangesloten

May 01, 2025 -

Xrp Jumps Presidents Statement Linking Trump And Ripple Drives Market Surge

May 01, 2025

Xrp Jumps Presidents Statement Linking Trump And Ripple Drives Market Surge

May 01, 2025