Understanding The GOP's Proposed Student Loan Overhaul

Table of Contents

Key Proposals within the GOP Student Loan Overhaul Plan

The GOP's student loan overhaul isn't a single, monolithic plan, but rather a collection of proposed changes aimed at reforming the federal student loan system. These proposals often focus on shifting responsibility away from the government and towards market-based solutions. Let's examine some key areas:

Income-Driven Repayment (IDR) Reform

The GOP has indicated a desire to reform Income-Driven Repayment (IDR) plans. This could significantly affect borrowers' monthly payments and loan forgiveness prospects. Proposed changes may include:

- Higher Minimum Payments: Requiring borrowers to pay a larger percentage of their income each month, even if it extends the repayment period.

- Stricter Income Verification: Implementing more rigorous processes to verify borrowers' income, potentially leading to disputes and delays.

- Reduced Forgiveness Thresholds: Lowering the amount of debt eligible for forgiveness under IDR plans, making it harder for borrowers to achieve complete loan cancellation.

The effect of these changes would be a longer repayment period and higher overall interest paid for many borrowers. Those relying on loan forgiveness as a key part of their repayment strategy would face considerable challenges. This reform is a central component of the GOP student loan overhaul and deserves careful consideration.

Changes to Federal Student Loan Programs

The GOP's overhaul may also involve altering existing federal student loan programs, such as Direct Subsidized and Unsubsidized Loans. Potential changes could include:

- Reduced Loan Amounts: Lowering the maximum amount students can borrow, potentially limiting access to higher education for some.

- Stricter Eligibility Requirements: Increasing the requirements for borrowers to qualify for federal student loans, making it harder for some students to access the funds they need.

These changes would likely impact future borrowers, potentially making college more expensive and less accessible for those from low-income backgrounds or those pursuing higher education in more expensive fields. The potential consequences of limiting access to federal student aid under this GOP student loan overhaul are far-reaching.

Focus on Market-Based Solutions

A core tenet of the GOP's approach is a greater reliance on market-based solutions for student loans. This involves:

- Increased Role of Private Lenders: Encouraging the involvement of private lenders in the student loan market, potentially leading to higher interest rates and less borrower protection.

- Promoting Income Share Agreements (ISAs): Shifting towards ISAs, where borrowers pay a percentage of their future income rather than fixed monthly payments. This presents both opportunities and risks, as repayment obligations are tied to future earnings.

While proponents argue that market-based solutions increase efficiency and competition, critics raise concerns about potential exploitation of borrowers and a lack of consumer protection. The shift away from government-backed loans towards private lenders is a key point of contention within the GOP student loan overhaul debate.

Potential Impact on Student Loan Forgiveness Programs

The GOP's proposed overhaul likely has significant implications for existing and future student loan forgiveness programs, potentially including:

- Limitations or Elimination of PSLF: Restricting or eliminating programs like Public Service Loan Forgiveness (PSLF), which forgives loans for borrowers working in public service.

- Reduced Scope of Future Forgiveness Initiatives: Making it harder to implement or expand future loan forgiveness programs.

The political and social ramifications of these changes could be significant. Many borrowers have made career and financial decisions based on the expectation of future loan forgiveness. The GOP's student loan overhaul, with its potential impact on forgiveness, threatens to upend those plans.

Analyzing the Economic Impact of the GOP Student Loan Overhaul

The proposed changes would have wide-ranging economic consequences, affecting borrowers, the federal budget, and the higher education system itself.

Impact on Borrowers

The impact on borrowers will vary significantly depending on their individual circumstances.

- Increased Monthly Payments for Some: For many, the proposed changes in IDR plans could mean significantly higher monthly payments.

- Reduced Overall Debt for Others: For some, the emphasis on market-based solutions could lead to lower overall debt burdens.

Analyzing the diverse impact on low-income borrowers, graduate students, and others requires a careful examination of the specifics of the GOP student loan overhaul proposal. Data and statistical analysis are needed to fully understand its potential consequences.

Impact on the Federal Budget

The GOP argues that its overhaul will reduce the federal budget deficit by decreasing government spending on student loans. However, this is contested, with some arguing that the changes could lead to increased costs in the long run, due to factors like a possible increase in loan defaults if borrowers face higher monthly payments.

- Potential Cost Savings: The elimination of forgiveness programs could lead to significant short-term cost savings.

- Potential Increased Spending: However, increased defaults and increased administrative costs could negate these savings over time.

Impact on the Higher Education System

The proposed changes could significantly impact the higher education landscape.

- Changes to College Affordability and Access: Limited loan amounts and stricter eligibility requirements could make college less accessible and more expensive, potentially discouraging enrollment.

- Increased Pressure on Universities to Control Costs: The changes could put pressure on universities to better manage their costs and improve affordability.

The long-term implications for access to higher education, particularly for low-income students, are a crucial area of concern within the GOP student loan overhaul debate.

Conclusion

The GOP's proposed student loan overhaul represents a significant shift in how the government approaches student loan debt. The key proposals – IDR reform, changes to federal loan programs, a focus on market-based solutions, and potential impacts on loan forgiveness – could lead to both positive and negative consequences for borrowers, the federal budget, and the higher education system. While proponents argue the overhaul promotes fiscal responsibility and market efficiency, critics express concerns about increased costs for borrowers, reduced access to higher education, and a potential increase in inequality.

Further research into the specifics of the GOP student loan overhaul is recommended to form a comprehensive understanding of its potential implications. Stay informed about the ongoing debate and contact your elected officials to voice your opinions. Active participation in the discussion surrounding the GOP student loan overhaul is essential to shaping the future of student loan policy.

Featured Posts

-

Understanding Florida School Shooter Lockdown Procedures For A Safer Generation

May 17, 2025

Understanding Florida School Shooter Lockdown Procedures For A Safer Generation

May 17, 2025 -

Ralph Lauren Fall 2025 The Riser Collection Unveiled

May 17, 2025

Ralph Lauren Fall 2025 The Riser Collection Unveiled

May 17, 2025 -

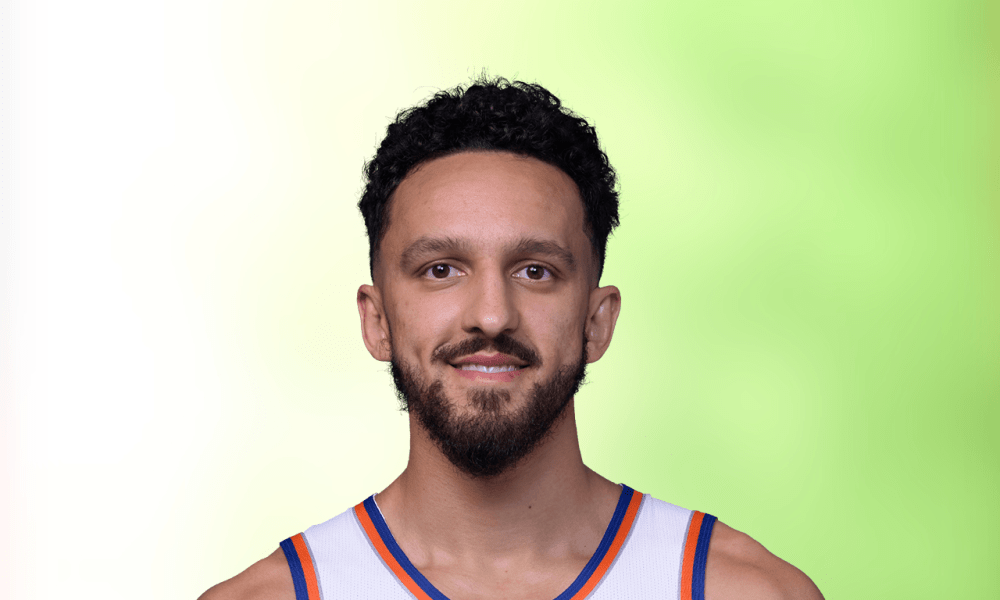

Knicks Face A Difficult Decision What To Do With Landry Shamet

May 17, 2025

Knicks Face A Difficult Decision What To Do With Landry Shamet

May 17, 2025 -

Your Guide To Moto Racing Gncc Mx Sx Flat Track And Enduro News

May 17, 2025

Your Guide To Moto Racing Gncc Mx Sx Flat Track And Enduro News

May 17, 2025 -

Todays Mlb Game Yankees Vs Mariners Prediction Betting Odds And Picks

May 17, 2025

Todays Mlb Game Yankees Vs Mariners Prediction Betting Odds And Picks

May 17, 2025

Latest Posts

-

Tuerkiyes Subat Ayi Uluslararasi Yatirim Pozisyonu Verileri Detayli Analiz

May 17, 2025

Tuerkiyes Subat Ayi Uluslararasi Yatirim Pozisyonu Verileri Detayli Analiz

May 17, 2025 -

Analyzing Warner Bros Pictures Cinema Con 2025 Presentation

May 17, 2025

Analyzing Warner Bros Pictures Cinema Con 2025 Presentation

May 17, 2025 -

Warner Bros At Cinema Con 2025 Upcoming Movie Releases

May 17, 2025

Warner Bros At Cinema Con 2025 Upcoming Movie Releases

May 17, 2025 -

El Colapso De Koriun Inversiones El Impacto De Su Esquema Ponzi

May 17, 2025

El Colapso De Koriun Inversiones El Impacto De Su Esquema Ponzi

May 17, 2025 -

2025 Cinema Con Warner Bros Pictures Film Announcements

May 17, 2025

2025 Cinema Con Warner Bros Pictures Film Announcements

May 17, 2025