Understanding The Investment Case For Uber Technologies (UBER)

Table of Contents

Uber's Diversified Business Model: A Key Strength

Uber's success isn't solely reliant on its original ridesharing service. Its diversified business model is a key strength, offering multiple avenues for growth and mitigating risk.

Ridesharing Dominance and Growth Potential

Uber's core ridesharing business remains a significant revenue driver, although its global market share fluctuates based on local regulations and competitive pressures from companies like Lyft and Bolt.

- Analysis of Uber's market share in key regions (North America, Europe, Asia): While Uber maintains a strong presence in North America, its market share varies considerably across other regions. Intense competition and varying regulatory environments influence its dominance in specific geographic areas. Understanding these regional nuances is crucial for assessing the long-term growth potential of this segment.

- Discussion of pricing strategies and their impact on profitability and customer acquisition: Uber's dynamic pricing model, while controversial, allows it to adjust fares based on demand, impacting both profitability and customer satisfaction. This strategy requires careful management to balance rider affordability with driver earnings and overall platform profitability.

- Exploration of potential for further ridesharing expansion in untapped markets: Untapped markets in developing economies present significant opportunities for expansion. However, entry into these markets often involves navigating complex regulatory hurdles and adapting its services to local needs and preferences.

Uber Eats: A Thriving Food Delivery Arm

Uber Eats has rapidly become a major player in the competitive online food delivery market, contributing substantially to Uber's overall revenue. This segment demonstrates the company’s adaptability and strategic expansion beyond its initial offering.

- Comparison of Uber Eats' market share with competitors like DoorDash and Grubhub: Uber Eats faces stiff competition from established players like DoorDash and Grubhub, particularly in the North American market. Understanding its competitive positioning within this fiercely contested landscape is vital for investors.

- Analysis of the profitability and growth potential of the food delivery segment: While the food delivery sector can be lucrative, it is also characterized by thin margins and intense price wars. Analyzing Uber Eats' profitability relative to its competitors helps determine the long-term sustainability of this segment.

- Discussion of strategic partnerships and expansion opportunities in the food delivery sector: Strategic partnerships with restaurants and grocery stores, as well as expansion into new geographic markets and service offerings (e.g., grocery delivery), contribute to Uber Eats’ growth potential.

Freight and Other Emerging Businesses

Uber Freight and other emerging businesses like Uber Health and its micromobility initiatives represent further diversification, reducing the company’s reliance on the core ridesharing and food delivery segments.

- Overview of Uber Freight's operations and its potential for scaling: Uber Freight aims to revolutionize the logistics industry, connecting shippers with truckers. Its success hinges on efficient logistics, driver acquisition, and scalability within a complex regulatory environment.

- Discussion of other emerging businesses and their contribution to Uber's overall strategy: Uber's forays into areas like healthcare transportation and micromobility demonstrate a commitment to innovation and expansion into adjacent markets.

- Analysis of the risks and rewards associated with investing in these less established segments: While these ventures hold potential, they also carry higher risk due to their relative infancy. Investors need to weigh the potential for high growth against the possibility of limited returns or even failure.

Financial Performance and Key Metrics

Analyzing Uber's financial performance is crucial for understanding its investment potential. Key metrics provide insights into its growth trajectory and financial health.

Revenue Growth and Profitability

Uber's path toward profitability is a key factor for investors. Examining revenue growth and operating margins reveals its financial strength and sustainability.

- Analysis of Uber's revenue growth over the past few years: Consistent revenue growth demonstrates market traction and overall business health. Analyzing the rate of growth and its drivers offers insight into the company's future prospects.

- Examination of its operating margins and profitability trends: Operating margins highlight the efficiency of Uber's operations. An increasing trend indicates improved cost management and operational efficiency.

- Discussion of factors influencing its profitability, including driver costs and operational expenses: Driver costs and operational expenses are significant factors influencing profitability. Strategies to manage these costs directly impact Uber's bottom line.

Cash Flow and Debt

Evaluating Uber's cash flow and debt levels provides a comprehensive view of its financial health and long-term sustainability.

- Analysis of Uber's free cash flow and its implications for future investments: Positive free cash flow indicates the company's ability to generate cash from operations, crucial for funding future growth initiatives and reducing debt.

- Examination of its debt-to-equity ratio and its overall debt burden: A high debt-to-equity ratio may signal higher financial risk. Analyzing Uber's debt burden helps assess its financial stability and ability to withstand economic downturns.

- Discussion of the potential impact of interest rate changes on Uber's financial position: Interest rate fluctuations impact the cost of borrowing for Uber, potentially affecting its profitability and financial flexibility.

Competitive Landscape and Risks

The competitive landscape and regulatory challenges present significant risks for Uber. Understanding these factors is crucial for a comprehensive investment assessment.

Intense Competition in Ridesharing and Food Delivery

Both ridesharing and food delivery are highly competitive markets, posing challenges for Uber’s dominance.

- Analysis of Uber's main competitors in each segment: Identifying key competitors, their strengths, and their market strategies helps evaluate Uber's competitive position.

- Discussion of the competitive strategies employed by these competitors: Analyzing competitors' strategies – pricing, marketing, service offerings – allows for a better understanding of Uber's competitive response and its ability to maintain market share.

- Evaluation of Uber's competitive advantages and disadvantages: Uber's brand recognition, global reach, and diversified offerings are advantages, but it also faces challenges regarding driver relations, regulatory compliance, and profitability.

Regulatory Hurdles and Legal Challenges

Navigating complex regulations and legal challenges poses considerable risk to Uber's operations and financial performance.

- Discussion of key regulatory challenges faced by Uber in different regions: Regulations concerning driver classification, data privacy, and pricing vary widely across regions, posing ongoing challenges for Uber.

- Analysis of ongoing or potential legal disputes and their potential impact on Uber's financial performance: Legal disputes and investigations can lead to significant financial liabilities and reputational damage.

- Evaluation of the potential for future regulatory changes and their impact on Uber's business model: Future regulatory changes could significantly alter Uber's business model and operations, requiring strategic adaptation.

Conclusion

Understanding the investment case for Uber Technologies (UBER) requires a careful evaluation of its diversified business model, financial performance, and the competitive landscape. While Uber's global reach and diverse offerings present significant growth potential, investors must also consider the intense competition, regulatory challenges, and inherent risks associated with the company. Ultimately, a well-informed investment decision requires a thorough assessment of these factors. Before investing in UBER, conduct your own thorough due diligence and consider consulting with a financial advisor. Do your research and assess the ongoing investment case for Uber Technologies (UBER) to make the best decision for your portfolio.

Featured Posts

-

Orlandos Culinary Scene How Public Funding Cultivated A Foodie Paradise

May 19, 2025

Orlandos Culinary Scene How Public Funding Cultivated A Foodie Paradise

May 19, 2025 -

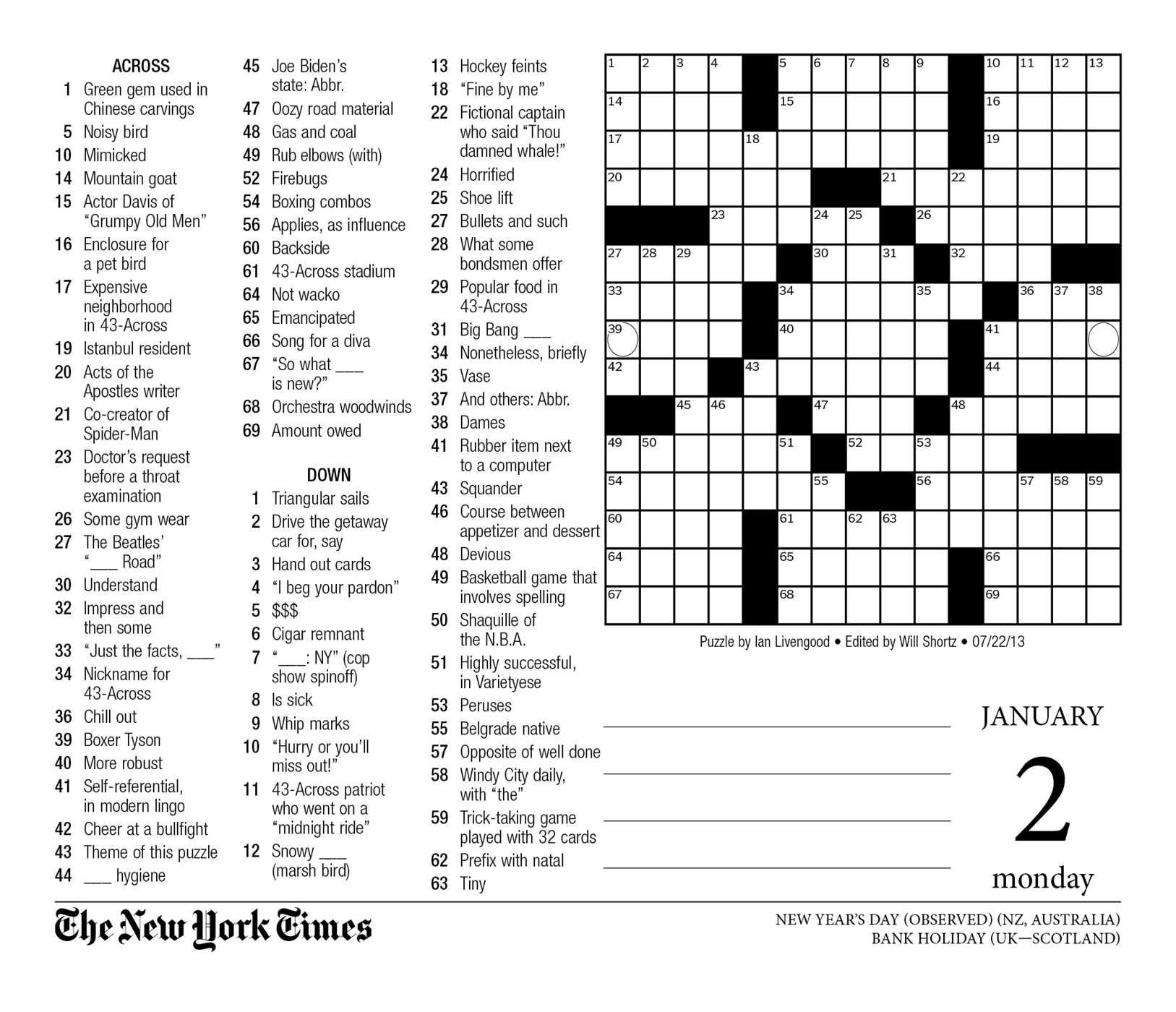

Nyt Mini Crossword Help Answers For March 16 2025

May 19, 2025

Nyt Mini Crossword Help Answers For March 16 2025

May 19, 2025 -

Sea Worlds Expedition Odyssey Your Journey To The Arctic Begins

May 19, 2025

Sea Worlds Expedition Odyssey Your Journey To The Arctic Begins

May 19, 2025 -

Nyt Mini Crossword April 18 2025 Solutions And Clues

May 19, 2025

Nyt Mini Crossword April 18 2025 Solutions And Clues

May 19, 2025 -

Solve The Nyt Mini Crossword April 18 2025 Answers And Clues Provided

May 19, 2025

Solve The Nyt Mini Crossword April 18 2025 Answers And Clues Provided

May 19, 2025

Latest Posts

-

The Fsu Tragedy Exploring The Background Of A Deceased Employees Family

May 19, 2025

The Fsu Tragedy Exploring The Background Of A Deceased Employees Family

May 19, 2025 -

Florida State University Shooting A Victims Family History And The Cold War

May 19, 2025

Florida State University Shooting A Victims Family History And The Cold War

May 19, 2025 -

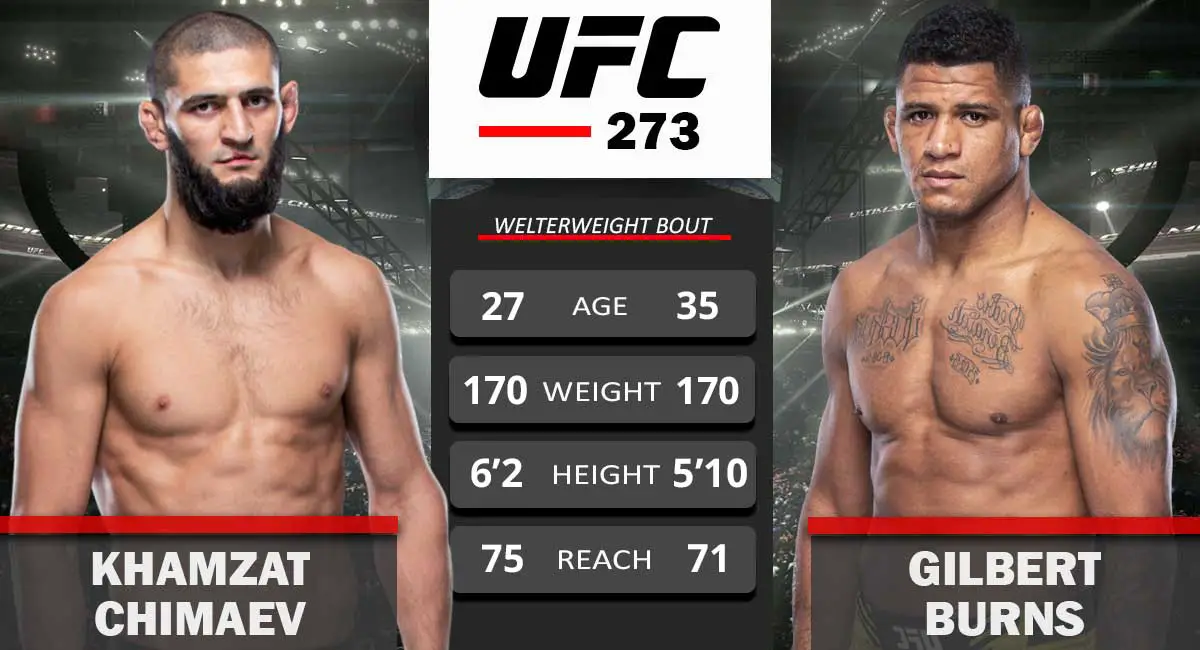

The Morales Knockout Ufc Fighters React To Vegas 106 Headliner

May 19, 2025

The Morales Knockout Ufc Fighters React To Vegas 106 Headliner

May 19, 2025 -

Analyzing Michael Morales Performance At Ufc Vegas 106

May 19, 2025

Analyzing Michael Morales Performance At Ufc Vegas 106

May 19, 2025 -

Ufc Fight Night 222 Burns Vs Morales Full Event Details

May 19, 2025

Ufc Fight Night 222 Burns Vs Morales Full Event Details

May 19, 2025