Understanding The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

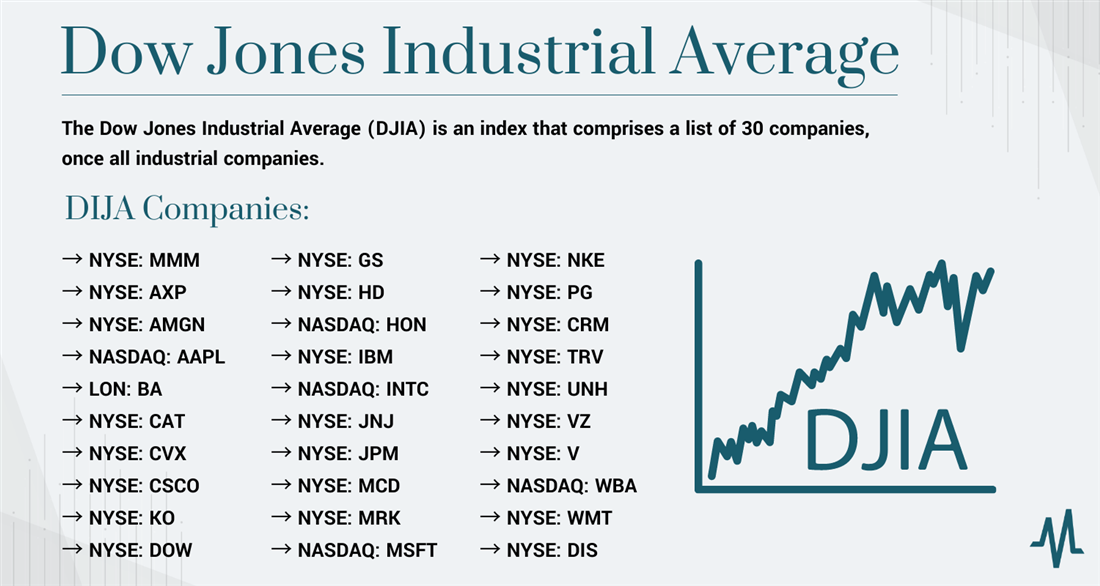

Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, per share. It's essentially the net worth of the ETF on a per-share basis. For the Amundi Dow Jones Industrial Average UCITS ETF (Distributing), the NAV reflects the total market value of its holdings in the 30 companies that make up the Dow Jones Industrial Average, less any expenses or liabilities. The "Distributing" aspect means the ETF pays out dividends and capital gains distributions to shareholders, which directly impacts the NAV.

Understanding the NAV calculation is key:

- Total Assets: This includes the market value of all the stocks held within the ETF, reflecting the current market prices of each component of the Dow Jones Industrial Average.

- Total Liabilities: This includes expenses such as the total expense ratio (TER), management fees, and any other outstanding obligations of the ETF.

- NAV Calculation: NAV per share = (Total Assets - Total Liabilities) / Number of Outstanding Shares

How Distributions Affect NAV:

The distributing nature of this ETF means that it periodically distributes a portion of its profits to shareholders as dividends. These distributions, whether from dividends or capital gains, directly reduce the ETF's assets and therefore lower its NAV. This is important to remember when tracking your investment.

- Step-by-step breakdown: The NAV is calculated daily, reflecting the closing prices of the underlying assets. The calculation takes into account all transactions throughout the trading day.

- Impact of Dividends and Capital Gains: Dividends paid out decrease the NAV, reflecting the distribution of assets. Similarly, capital gains distributions also reduce the NAV.

- Daily Calculation: The NAV is usually calculated at the end of each trading day, offering an up-to-date reflection of the ETF's value.

The Importance of NAV for the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) is essential for several reasons:

- Reflects Underlying Asset Performance: The NAV directly reflects the performance of the Dow Jones Industrial Average. If the index rises, the NAV generally rises (although tracking error can cause slight deviations).

- Tracking Investment Growth: By comparing the NAV over time, you can effectively track the growth (or decline) of your investment in the ETF. This provides a clear picture of your returns.

- Relationship Between NAV and Share Price: While the ETF share price should closely track the NAV, there can be minor discrepancies due to market forces. This difference is known as tracking error.

Key Considerations:

- Finding Daily NAV: You can typically find the daily NAV on the Amundi website, financial news websites, or through your brokerage account.

- Dow Jones Impact: Movements in the Dow Jones Industrial Average directly impact the ETF's NAV. A rising Dow usually leads to a rising NAV, and vice versa.

- Implications of NAV Changes: A rising NAV indicates positive performance, while a falling NAV suggests a decline in the value of your investment.

Understanding Distributions and their Impact on NAV

The Amundi Dow Jones Industrial Average UCITS ETF (Distributing) operates under a distribution policy, meaning it regularly distributes a portion of its income to shareholders.

- Distribution Policy: This ETF distributes its accumulated dividends and capital gains to investors at regular intervals.

- Dividend Calculation: Dividends are typically calculated as a percentage of the NAV, based on the ETF's performance.

- Distribution Impact: When distributions are paid, the NAV of the ETF is reduced by the amount distributed per share.

Important Details:

- Ex-Dividend Date: This is the date before which you must own the ETF shares to be eligible to receive the distribution.

- Interpreting Distribution Information: Always check the official ETF documentation and issuer communications to understand the timing and amount of distributions.

- Tax Implications: Remember that distributions are often taxable income, so factor these into your overall financial planning.

Conclusion: Mastering the Net Asset Value (NAV) of Your Amundi Dow Jones Industrial Average UCITS ETF (Distributing) Investment

Understanding the Net Asset Value (NAV) is paramount for successfully managing your investment in the Amundi Dow Jones Industrial Average UCITS ETF (Distributing). Regularly monitoring the NAV allows you to track your investment's performance against the Dow Jones Industrial Average and understand the impact of distributions. By actively monitoring your investment and considering factors like tracking error and the impact of distributions on NAV, you can make more informed decisions. To further enhance your understanding, research the ETF's prospectus, consult financial advisors, and utilize online resources to stay informed about the NAV and other key investment metrics. Mastering the NAV of your Amundi Dow Jones Industrial Average UCITS ETF (Distributing) investment is key to achieving your financial goals. Start monitoring your NAV today and make informed investment decisions.

Featured Posts

-

Former French Premier Challenges Macrons Governing Decisions

May 25, 2025

Former French Premier Challenges Macrons Governing Decisions

May 25, 2025 -

Cac 40 Index End Of Week Report March 7 2025

May 25, 2025

Cac 40 Index End Of Week Report March 7 2025

May 25, 2025 -

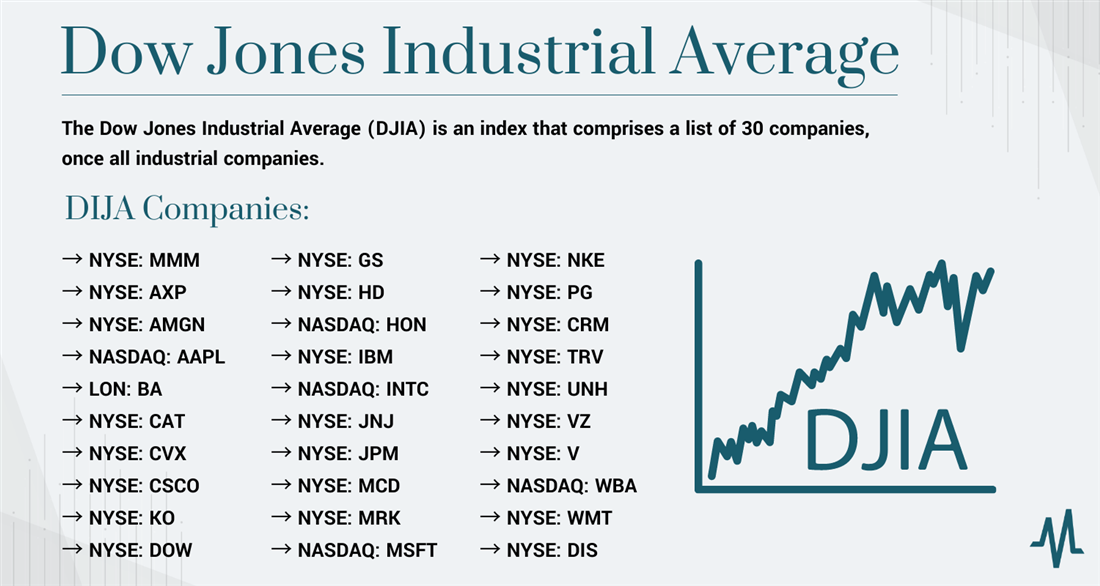

Yevrobachennya 2025 Prognoz Konchiti Vurst Na Chotirokh Peremozhtsiv

May 25, 2025

Yevrobachennya 2025 Prognoz Konchiti Vurst Na Chotirokh Peremozhtsiv

May 25, 2025 -

Major Road Closed After Serious Accident Person Hospitalized

May 25, 2025

Major Road Closed After Serious Accident Person Hospitalized

May 25, 2025 -

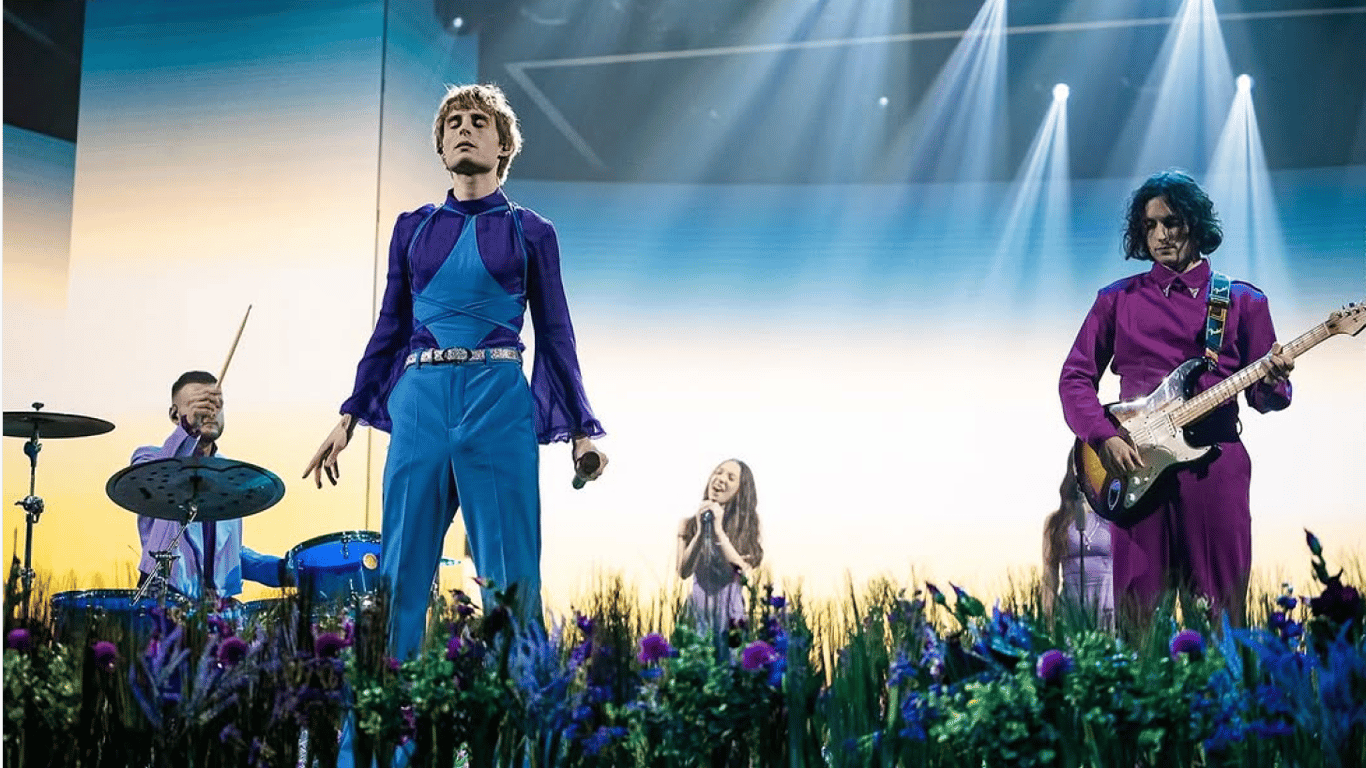

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025

Latest Posts

-

A Deep Dive Into Demnas Gucci Collections

May 25, 2025

A Deep Dive Into Demnas Gucci Collections

May 25, 2025 -

Demna Reshaping Guccis Brand Identity

May 25, 2025

Demna Reshaping Guccis Brand Identity

May 25, 2025 -

The Future Of Gucci Under Demnas Leadership

May 25, 2025

The Future Of Gucci Under Demnas Leadership

May 25, 2025 -

Analyzing Demnas Design Direction At Gucci

May 25, 2025

Analyzing Demnas Design Direction At Gucci

May 25, 2025 -

Demna Gvasalias Gucci Debut What To Expect

May 25, 2025

Demna Gvasalias Gucci Debut What To Expect

May 25, 2025