Understanding The New HMRC Rules For Side Hustle Income And Tax Compliance

Table of Contents

What Constitutes a "Side Hustle" for HMRC Purposes?

Defining the precise boundaries of a "side hustle" for HMRC purposes is crucial for tax compliance. It's not simply about earning extra cash; HMRC considers several factors to determine whether your activity constitutes a genuine business venture requiring tax reporting. The distinction lies between a hobby, casual work, and a bona fide side business generating regular income.

Examples of common side hustles falling under HMRC's purview include: freelancing (writing, graphic design, web development), gig economy work (Uber, Deliveroo, TaskRabbit), selling goods online (Etsy, eBay, Amazon), renting out property (Airbnb), and providing tutoring or consultancy services.

Key factors considered by HMRC include:

-

Regularity of income: Consistent income generation, even on a small scale, is a strong indicator of a business activity. Occasional earnings are less likely to trigger HMRC's attention.

-

Profit motive: The primary intention behind your activity should be to generate profit, not merely for personal enjoyment or to cover expenses.

-

Scale of operations: While small-scale operations are common for side hustles, significant revenue or operational complexity may necessitate more formal business structures and accounting practices.

-

Consistent income generation is a key indicator. Sporadic earnings are less likely to be classified as a side hustle for tax purposes.

-

Advertising your services indicates a business intention. Creating a website, using social media marketing, or actively seeking clients demonstrates a commercial purpose.

-

Keeping detailed records is crucial for demonstrating legitimacy. This will be essential when submitting your tax return and helps protect against potential audits.

New HMRC Reporting Requirements for Side Hustle Income

HMRC provides various reporting options for side hustle income, depending on the level of earnings. Understanding your obligations is vital to avoid penalties.

Simplified reporting options: For lower income levels, using the simplified online services might suffice. However, if your earnings exceed a certain threshold (generally £1,000), you'll likely need to file a Self Assessment tax return.

Self Assessment Tax Returns: These are mandatory for most individuals earning over £1,000 from a side hustle. Understanding the filing deadlines (typically January 31st following the tax year) is crucial; late submissions attract penalties.

Using HMRC's online services: Registering for a Self Assessment online is straightforward. HMRC provides user-friendly online portals and guidance on completing and submitting your tax return digitally. This significantly streamlines the process and allows for prompt submission.

- Income above £1,000 generally requires reporting. This threshold can vary based on other income streams.

- Missing deadlines can result in significant financial penalties. These penalties increase with the length of the delay.

- HMRC offers support and resources to assist with online filing. Utilizing these resources can simplify the process and ensure accuracy.

Allowable Expenses and Deductions for Side Hustle Income

One of the most important aspects of side hustle tax compliance is understanding what expenses you can legitimately deduct from your income to reduce your tax liability. Accurate record-keeping is essential.

Claiming legitimate business expenses: You can deduct expenses directly related to generating your side hustle income. However, you'll need evidence (receipts, invoices, bank statements) to support your claims.

Examples of allowable deductions: These include office supplies, travel costs (directly related to work), marketing expenses (advertising, website fees), professional subscriptions (relevant software, memberships), and training courses.

Understanding the difference between allowable and non-allowable expenses: Expenses of a purely personal nature are not deductible. For instance, general household bills or entertainment expenses are typically not allowed.

- Keep detailed receipts for all expenses claimed. This is crucial for HMRC audits.

- Maintain a separate bank account for business transactions. This makes it easier to track income and expenses.

- Seek professional advice if unsure about allowable expenses. Accountants specializing in side hustle tax can provide guidance.

Tax Rates and Calculating Your Side Hustle Tax Liability

Your side hustle income is added to your other income sources to determine your overall tax liability. Understanding the different tax bands and rates is essential for accurate calculation.

Understanding the different tax bands and rates: The UK has a progressive tax system, meaning higher earners pay a higher percentage of tax. Your side hustle income will be taxed according to the applicable tax band for your total income.

Calculating your tax liability based on your total income: This includes both your main employment income and your side hustle income. HMRC provides various tools and resources to assist with this calculation.

Considering the impact of National Insurance contributions: These apply to most side hustles. The rates and thresholds are subject to change, so staying informed about the latest regulations is vital.

- Tax rates vary depending on your total income. Consult the HMRC website for the current tax bands and rates.

- National Insurance contributions apply to most side hustles. This is an additional levy on earnings.

- Using tax calculators and HMRC resources to estimate liability. This helps avoid surprises at tax return filing time.

Penalties for Non-Compliance with HMRC Side Hustle Tax Rules

Failing to accurately report your side hustle income carries serious consequences.

Consequences of failing to report side hustle income accurately: This can range from additional tax assessments to substantial penalties.

Potential penalties including fines and interest charges: Penalties can significantly outweigh the initial tax owed.

HMRC investigation procedures and what to expect: HMRC conducts regular investigations into suspected non-compliance. Cooperation during an investigation is important.

- Accurate reporting is vital to avoid penalties. Honest and timely filing minimizes risk.

- HMRC can conduct investigations into non-compliance. These can be triggered by inconsistencies or suspicious activity.

- Seeking professional advice can help mitigate risks. Tax professionals can ensure compliance and help manage potential audits.

Conclusion

Successfully managing your side hustle income and complying with HMRC rules requires understanding the latest regulations and proactively managing your tax obligations. This guide has highlighted key aspects of the new HMRC rules for side hustle income, including reporting requirements, allowable expenses, and the consequences of non-compliance. By accurately reporting your income and keeping thorough records, you can avoid penalties and ensure you're fulfilling your tax responsibilities. Don't delay – take control of your side hustle finances today and learn more about the latest HMRC side hustle tax rules. Visit the official HMRC website for further details and resources.

Featured Posts

-

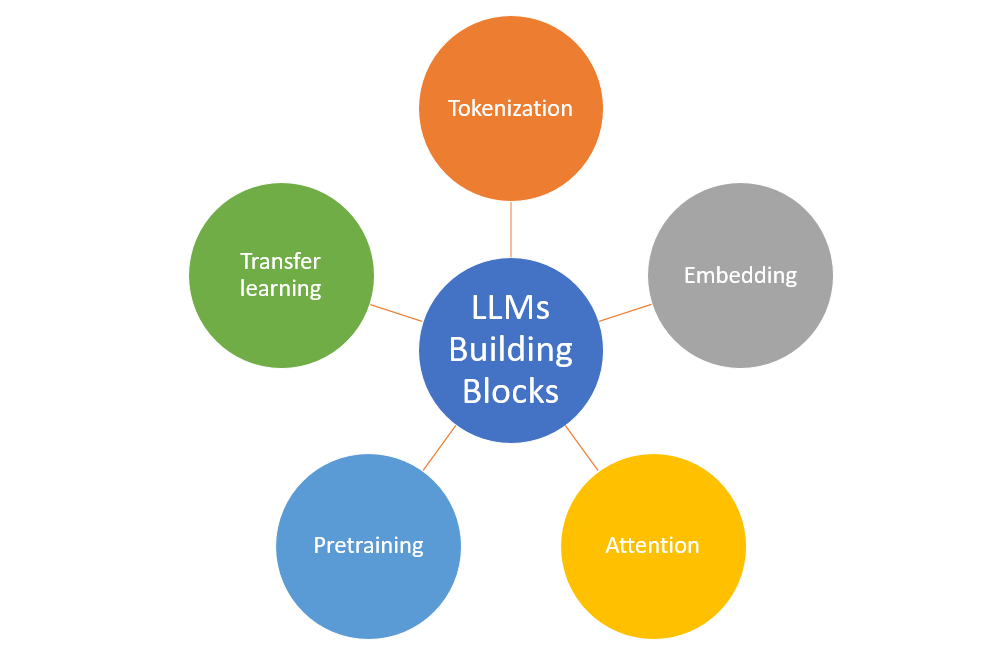

Improving Siri Apples Focus On Large Language Models

May 20, 2025

Improving Siri Apples Focus On Large Language Models

May 20, 2025 -

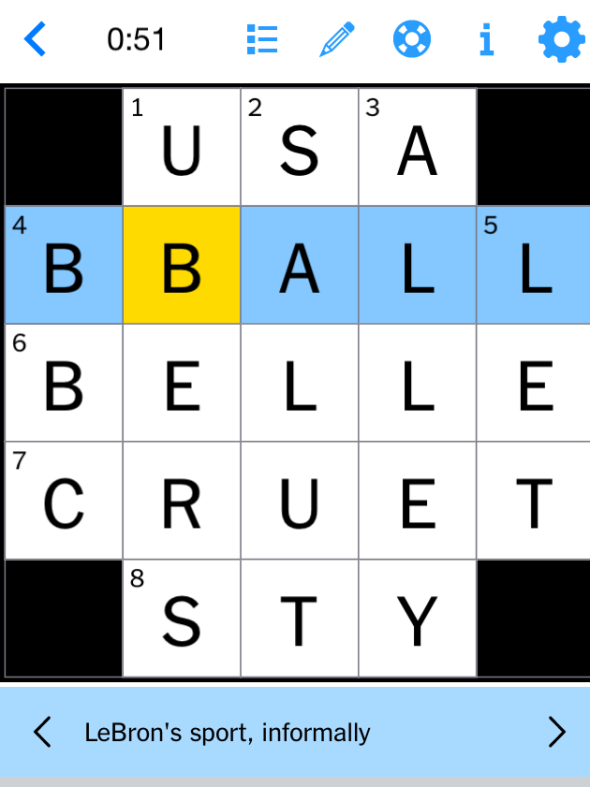

March 24 2025 Nyt Mini Crossword Complete Answers And Clues

May 20, 2025

March 24 2025 Nyt Mini Crossword Complete Answers And Clues

May 20, 2025 -

Gunners Transfer Pursuit 17m Rated Premier League Players Release Clause Explained

May 20, 2025

Gunners Transfer Pursuit 17m Rated Premier League Players Release Clause Explained

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Surge Reasons Behind The Recent Price Jump

May 20, 2025

D Wave Quantum Inc Qbts Stock Surge Reasons Behind The Recent Price Jump

May 20, 2025 -

Kaellmanin Nousu Maalivireestae Huuhkajiin

May 20, 2025

Kaellmanin Nousu Maalivireestae Huuhkajiin

May 20, 2025