Understanding The Recent Volatility Of The Canadian Dollar

Table of Contents

Impact of Global Economic Uncertainty on the Canadian Dollar

Several global factors significantly influence the Canadian dollar's value. These external pressures often contribute to periods of heightened Canadian dollar volatility.

Geopolitical Events and Their Effect on CAD Exchange Rates

Geopolitical instability creates uncertainty in global markets, directly impacting currency values. Recent events have profoundly influenced the CAD:

- The War in Ukraine: The conflict disrupted global supply chains, impacting commodity prices (crucial for the Canadian economy) and increasing global inflation, leading to CAD fluctuations.

- US-China Relations: The ongoing trade tensions between these economic giants create uncertainty that ripples through global markets, influencing the value of the CAD, often tied to the US dollar.

- Other Global Conflicts: Emerging conflicts in various parts of the world contribute to a risk-off sentiment, pushing investors towards safer haven currencies and away from riskier assets like the CAD.

Inflationary Pressures and Their Impact on the Canadian Dollar

Global inflation significantly impacts interest rates and currency values. When inflation rises in major economies, central banks often raise interest rates to curb price increases. This can lead to:

- Increased Interest Rate Differentials: Higher interest rates in one country compared to another can attract foreign investment, strengthening its currency (and potentially weakening the CAD).

- Capital Flows: Investors move their money to countries offering higher returns, influencing the supply and demand for various currencies, including the CAD.

- Reduced Consumer Spending: High inflation reduces consumer spending, potentially slowing economic growth in Canada and weakening the CAD.

Shifting Global Demand and Its Correlation with CAD Strength

Global demand for Canadian goods, particularly commodities like oil and lumber, directly impacts the CAD's value.

- Oil Price Fluctuations: As a major oil exporter, Canada's economy is sensitive to oil price changes. Higher oil prices generally strengthen the CAD, while lower prices weaken it.

- Demand for Canadian Resources: Changes in global demand for other Canadian resources, such as lumber and minerals, can also influence the CAD's value. Increased demand tends to strengthen the currency.

Global economic uncertainty, as exemplified by these factors, significantly influences Canadian dollar volatility.

Domestic Economic Factors Contributing to Canadian Dollar Volatility

Internal economic factors also play a vital role in shaping Canadian dollar volatility.

Interest Rate Changes by the Bank of Canada

The Bank of Canada's monetary policy decisions directly impact the CAD. Interest rate hikes generally attract foreign investment, strengthening the CAD, while interest rate cuts can weaken it. Recent actions by the Bank of Canada, such as [insert example of recent interest rate changes and their market impact], illustrate this effect.

Canadian Economic Growth and Performance

Strong economic growth in Canada usually leads to a stronger CAD due to increased investor confidence and higher demand for Canadian goods and services. Conversely, slower economic growth or recessionary fears can weaken the currency. Tracking key economic indicators like GDP growth and employment figures is essential for understanding CAD movements. [Insert relevant GDP data and forecasts].

Domestic Political Landscape

Political stability and clear policy direction are crucial for maintaining investor confidence. Uncertainty caused by political instability or major policy shifts can lead to increased Canadian dollar volatility. [Insert example of political events impacting investor confidence].

The interplay of these domestic economic factors significantly contributes to fluctuations in the CAD's value.

Understanding the Interplay of Supply and Demand in the Forex Market

The foreign exchange (forex or FX) market operates on the principles of supply and demand. The value of the Canadian dollar is determined by the interplay of these forces.

- Currency Pairs: The CAD is traded against other major currencies in pairs, such as USD/CAD (US dollar/Canadian dollar) and EUR/CAD (euro/Canadian dollar). The exchange rate reflects the relative supply and demand for each currency within the pair.

- Speculation: Speculators in the forex market bet on future price movements. Their actions, driven by anticipation of economic events or policy changes, can significantly impact short-term Canadian dollar volatility.

- Currency Appreciation/Depreciation: When demand for the CAD increases relative to another currency, the CAD appreciates (its value increases). Conversely, when demand decreases, it depreciates (its value falls).

Understanding these basic mechanics of the forex market is crucial for interpreting fluctuations in the CAD.

Forecasting Future Canadian Dollar Volatility

Predicting future movements in the CAD is inherently challenging due to the complex interplay of global and domestic factors. While no one can definitively predict future exchange rates, analyzing several key areas can provide insights:

- Economic Indicators: Monitoring key economic indicators such as inflation rates, GDP growth, and employment figures can offer clues about potential future CAD movements.

- Geopolitical Events: Keeping abreast of major geopolitical events and their potential impact on global markets is crucial for assessing potential risks.

- Market Sentiment: Gauging overall market sentiment – whether it's optimistic or pessimistic – can provide hints about future currency movements.

Various forecasting methods are used by economists and analysts, but it's vital to remember that all forecasts carry inherent uncertainty.

Mastering the Challenges of Canadian Dollar Volatility

The recent Canadian dollar volatility is a result of a complex interplay of global economic uncertainty, domestic economic conditions, and the dynamics of the forex market. Understanding these factors is essential for businesses involved in international trade, investors managing portfolios, and individuals making international transactions.

To effectively navigate the challenges of Canadian dollar volatility, stay informed about global and domestic economic developments. Monitor key economic indicators, follow geopolitical events closely, and utilize reliable resources for tracking CAD exchange rates and economic news. By proactively managing the risks associated with these fluctuations, you can better position yourself for success in today's dynamic economic environment.

Featured Posts

-

571 Millions De Dollars Et Une Suite Le Film Fantastique De 2024 Accueille Une Star De Stranger Things

Apr 25, 2025

571 Millions De Dollars Et Une Suite Le Film Fantastique De 2024 Accueille Une Star De Stranger Things

Apr 25, 2025 -

Montreal Guitar Maker Shares Experiences With Confusing Tariffs

Apr 25, 2025

Montreal Guitar Maker Shares Experiences With Confusing Tariffs

Apr 25, 2025 -

Hyundai Profit Surges Past Forecasts Strong N American And Hybrid Vehicle Sales

Apr 25, 2025

Hyundai Profit Surges Past Forecasts Strong N American And Hybrid Vehicle Sales

Apr 25, 2025 -

Pope Francis Legacy Crucial Steps On Abuse And The Future Of Church Reform

Apr 25, 2025

Pope Francis Legacy Crucial Steps On Abuse And The Future Of Church Reform

Apr 25, 2025 -

The Trump Effect How The Former President Influences Canadian Politics

Apr 25, 2025

The Trump Effect How The Former President Influences Canadian Politics

Apr 25, 2025

Latest Posts

-

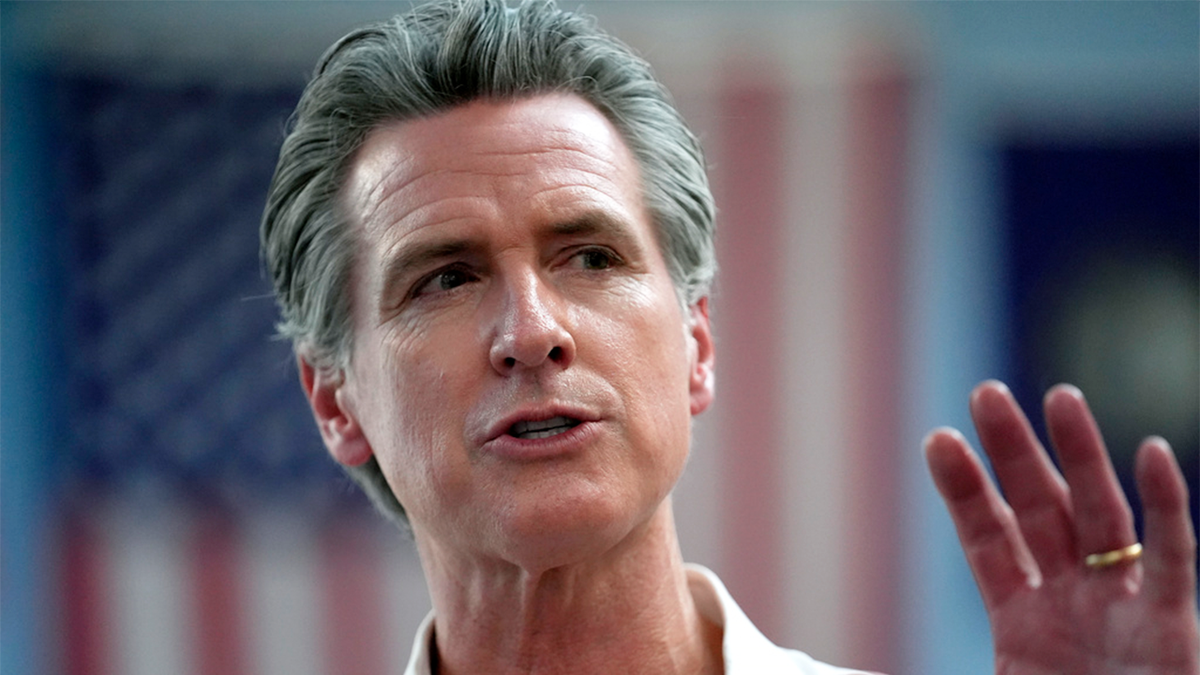

Newsom Faces Criticism For Toxic Democrats Comment

Apr 26, 2025

Newsom Faces Criticism For Toxic Democrats Comment

Apr 26, 2025 -

Gavin Newsoms Toxic Democrat Remark A Political Backlash

Apr 26, 2025

Gavin Newsoms Toxic Democrat Remark A Political Backlash

Apr 26, 2025