Understanding The Risks And Potential Of Investing In XRP (Ripple)

Table of Contents

The Potential of XRP

XRP's potential stems from its unique technology and its growing adoption in the global financial landscape. Let's explore these factors in detail.

Ripple's Technology and Use Cases

RippleNet, Ripple's payment network, is designed to facilitate fast and cost-effective cross-border transactions. It utilizes XRP to enable near-instantaneous settlements, significantly reducing the time and expense associated with traditional banking systems. This technology has the potential to revolutionize international payments.

- Faster Transactions: XRP transactions are significantly faster than traditional bank transfers, often completing in a matter of seconds.

- Lower Costs: The cost of using XRP for cross-border payments is considerably lower than traditional methods, making it more accessible to businesses and individuals.

- Global Reach: RippleNet boasts a wide network of financial institutions, expanding its global reach and increasing the potential for widespread adoption. Examples include:

- Santander

- American Express

- MoneyGram

- Beyond Payments: While primarily known for payments, XRP's potential extends to other areas, including microtransactions, decentralized finance (DeFi) applications, and potentially even supply chain management.

XRP's Price Volatility and Potential for Growth

XRP's price has historically been highly volatile, experiencing significant fluctuations. However, this volatility also presents the potential for substantial gains.

- Historical Price Trends: Analyzing XRP's past performance reveals periods of both explosive growth and sharp declines. Understanding these trends is key to assessing future potential.

- Market Capitalization: XRP's market capitalization places it among the top cryptocurrencies, though its ranking fluctuates. A rise in market capitalization often signals increased investor confidence.

- Catalysts for Growth: Several factors could trigger future price increases, including:

- Increased adoption by financial institutions.

- Positive legal outcomes in the ongoing SEC lawsuit.

- Integration into new DeFi applications and platforms.

[Insert chart or graph illustrating XRP price fluctuations here]

The Risks of Investing in XRP

Despite its potential, investing in XRP carries substantial risks that should not be overlooked. Let's examine these crucial factors.

Regulatory Uncertainty and Legal Battles

The ongoing SEC lawsuit against Ripple Labs presents significant regulatory uncertainty. The outcome of this case could dramatically impact XRP's price and future prospects.

- SEC Lawsuit Implications: The SEC's claim that XRP is an unregistered security carries considerable legal implications for XRP holders.

- Jurisdictional Differences: Different countries have varying regulatory approaches to cryptocurrencies, adding to the complexity and uncertainty surrounding XRP's legal status.

- Key Events: Keeping abreast of developments in the SEC lawsuit is crucial for understanding the evolving risk profile of XRP.

Market Volatility and Price Fluctuations

The cryptocurrency market is inherently volatile, and XRP is no exception. Price fluctuations can be dramatic and unpredictable.

- Market Sentiment: News events, regulatory announcements, and overall market sentiment can significantly influence XRP's price.

- Risk Management: Diversification and careful risk management strategies are essential for mitigating the potential losses associated with XRP investment.

- Past Price Crashes: Analyzing past price crashes and their causes can help investors better understand and manage risk.

Technological Risks and Competition

Technological advancements and competition pose risks to XRP's long-term viability.

- Competitive Landscape: Other cryptocurrencies and payment solutions compete with Ripple and XRP, potentially limiting its market share.

- Technological Obsolescence: The rapid pace of technological innovation in the blockchain space creates a risk that XRP could become obsolete.

- Security Risks: Holding digital assets carries inherent security risks, such as hacking and exchange failures.

Conclusion

Investing in XRP presents both exciting potential and considerable risk. The potential for significant returns through its use in cross-border payments and integration into emerging financial technologies is undeniable. However, the ongoing legal battles and the inherent volatility of the cryptocurrency market pose significant challenges. Before making any investment decisions regarding XRP or Ripple, carefully weigh the information presented and consult with a qualified financial advisor to determine if it aligns with your risk profile and investment goals. Thorough research and a clear understanding of the risks associated with XRP investment are paramount before committing your capital. Remember, understanding the potential and risks of XRP is key to making informed investment decisions.

Featured Posts

-

Simone Biles South African Honeymoon Photos Revealed

May 07, 2025

Simone Biles South African Honeymoon Photos Revealed

May 07, 2025 -

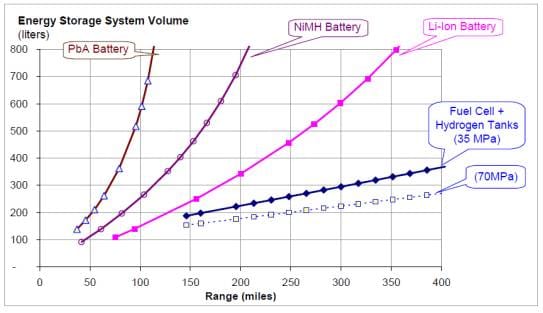

Hydrogen Vs Battery Buses A Real World Look At European Deployment

May 07, 2025

Hydrogen Vs Battery Buses A Real World Look At European Deployment

May 07, 2025 -

Lotto And Lotto Plus Results Saturday April 12 2025

May 07, 2025

Lotto And Lotto Plus Results Saturday April 12 2025

May 07, 2025 -

I Don T Know Where You Are The Urgent Need To Modernize Air Traffic Control

May 07, 2025

I Don T Know Where You Are The Urgent Need To Modernize Air Traffic Control

May 07, 2025 -

Zendayas Parents And Siblings Dispelling Rumors And Exploring Family Dynamics

May 07, 2025

Zendayas Parents And Siblings Dispelling Rumors And Exploring Family Dynamics

May 07, 2025

Latest Posts

-

Kripto Lider Gelecegin Kripto Para Projesi Mi Analiz Ve Degerlendirme

May 08, 2025

Kripto Lider Gelecegin Kripto Para Projesi Mi Analiz Ve Degerlendirme

May 08, 2025 -

Kripto Lider Nedir Ve Neden Herkes Bundan Bahsediyor

May 08, 2025

Kripto Lider Nedir Ve Neden Herkes Bundan Bahsediyor

May 08, 2025 -

Kripto Para Piyasasinda Kripto Lider In Hizli Yuekselisi Detayli Inceleme

May 08, 2025

Kripto Para Piyasasinda Kripto Lider In Hizli Yuekselisi Detayli Inceleme

May 08, 2025 -

Rusya Merkez Bankasi Nin Kripto Para Hakkindaki Son Uyarisi Ve Oenerileri

May 08, 2025

Rusya Merkez Bankasi Nin Kripto Para Hakkindaki Son Uyarisi Ve Oenerileri

May 08, 2025 -

Kripto Lider Kripto Para Duenyasinin Yeni Yuekselen Yildizi Neden Bu Kadar Popueler

May 08, 2025

Kripto Lider Kripto Para Duenyasinin Yeni Yuekselen Yildizi Neden Bu Kadar Popueler

May 08, 2025