Understanding The Surge In The Venture Capital Secondary Market

Table of Contents

Increased Liquidity Demands

Many Limited Partners (LPs) are seeking greater liquidity in their venture capital portfolios, significantly driving activity in the secondary market. This demand stems from several key factors:

LP Portfolio Diversification

LPs are actively diversifying their portfolios to mitigate risk and improve overall returns. Secondary transactions offer a powerful tool for achieving this diversification without the lengthy wait for an IPO or acquisition.

- Need for capital for other investment opportunities: LPs may need capital to invest in other promising ventures or sectors. The secondary market provides a mechanism to free up capital without forcing a premature exit from existing investments.

- Meeting redemption requests from investors: Some LPs face pressure to meet redemption requests from their own investors, necessitating the sale of assets in their VC portfolios. Secondary sales offer a more controlled and potentially more profitable exit strategy than waiting for an exit event.

- Rebalancing portfolio allocations: As market conditions change, LPs often need to rebalance their portfolios. Selling some assets through secondary transactions allows them to reallocate capital to areas deemed more promising or align with revised risk tolerance levels.

Shortened Investment Horizons

LPs increasingly favor shorter investment cycles, leading to a higher volume of secondary sales. This trend reflects a shift in the broader investment landscape.

- Pressure from institutional investors focused on shorter-term returns: Institutional investors, such as pension funds and endowments, often face pressure to deliver shorter-term returns to their beneficiaries. This pressure translates into a desire for more frequent liquidity events from their VC investments.

- Increased competition for attractive investments: The competitive landscape for venture capital investments is fierce. LPs may prioritize quicker deployment of capital to secure promising deals, leading them to realize returns earlier through secondary sales.

- Desire for quicker capital deployment: LPs may choose to sell some assets to free up capital for new investments in emerging sectors or promising startups. Secondary sales offer a faster route to capital deployment than waiting for an exit event in the primary market.

Growth of Specialized Secondary Market Funds

The emergence of dedicated secondary market funds has exponentially fueled this growth by providing a readily available pool of capital. These funds bring significant expertise and resources to the table.

Sophisticated Due Diligence

These funds possess the expertise and resources for comprehensive due diligence on complex venture capital portfolio companies. Their involvement significantly enhances the efficiency and reliability of secondary transactions.

- Access to extensive data and networks within the VC ecosystem: These funds leverage their extensive networks and access to proprietary data to thoroughly assess the value and potential of target assets.

- Ability to assess the long-term value and potential of assets: They possess the analytical capabilities to evaluate the long-term prospects of companies, going beyond simple short-term metrics.

- Negotiation power, leading to more favorable transaction terms: Their considerable capital and experience provide them with substantial negotiation power, leading to more advantageous terms for both buyers and sellers.

Strategic Investments

Secondary market funds often make strategic investments, providing additional support and expertise to portfolio companies. This added value enhances the appeal of secondary transactions for both LPs and GPs.

- Providing operational guidance and strategic advice: They can offer valuable operational guidance and strategic advice, helping portfolio companies to enhance their growth trajectory.

- Facilitating mergers and acquisitions: These funds can leverage their network and expertise to facilitate mergers and acquisitions, creating value for the portfolio company.

- Investing additional capital for growth initiatives: They can provide further capital injections to fuel growth initiatives, accelerating the company's development and enhancing its future prospects.

Attractive Valuation Opportunities

The secondary market can offer attractive valuations for both buyers and sellers, particularly in a volatile market. The flexibility and negotiation inherent in these transactions contribute to their appeal.

Negotiated Pricing

Transactions are often negotiated, leading to more favorable pricing compared to public markets. This negotiated aspect differentiates the secondary market from more standardized public exchanges.

- Flexibility in structuring deals: The secondary market allows for greater flexibility in structuring deals to accommodate the specific needs and objectives of both buyers and sellers.

- Ability to consider various factors beyond pure market valuation: The valuation process in the secondary market can take into account a broader range of factors beyond pure market metrics, reflecting the unique characteristics of each company.

- Potential for significant upside: Secondary market transactions can offer substantial upside potential, especially for undervalued assets with strong growth prospects.

Access to Undervalued Assets

The secondary market can provide opportunities to acquire undervalued assets that may not be readily available through primary investments. This access is a key attraction for sophisticated investors.

- Identifying undervalued companies overlooked by primary investors: Secondary market investors can identify companies overlooked by primary investors, allowing them to capitalize on opportunities in the market.

- Acquiring stakes in high-growth companies with future potential: This market offers the chance to acquire stakes in high-growth companies that may not be accessible through traditional primary investment routes.

- Benefitting from a discount relative to the prevailing market valuation: Secondary market transactions can offer a discount relative to prevailing market valuations, providing an attractive entry point for investors.

Conclusion

The surge in the venture capital secondary market is a complex phenomenon driven by a confluence of factors, including increased liquidity demands, the rise of specialized funds, and attractive valuation opportunities. Understanding these dynamics is crucial for both Limited Partners seeking to manage their portfolios effectively and General Partners navigating this evolving landscape. To stay informed on the latest trends and opportunities in the venture capital secondary market, continue researching and engage with industry experts. Learning about the intricacies of secondary market transactions is essential for anyone involved in the venture capital ecosystem. The secondary market's growth offers exciting potential for strategic investment and portfolio optimization.

Featured Posts

-

The Future Of Blaugrana Ramiro Helmeyers Role

Apr 29, 2025

The Future Of Blaugrana Ramiro Helmeyers Role

Apr 29, 2025 -

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025 -

Louisville Restaurants Struggle Amid River Road Construction

Apr 29, 2025

Louisville Restaurants Struggle Amid River Road Construction

Apr 29, 2025 -

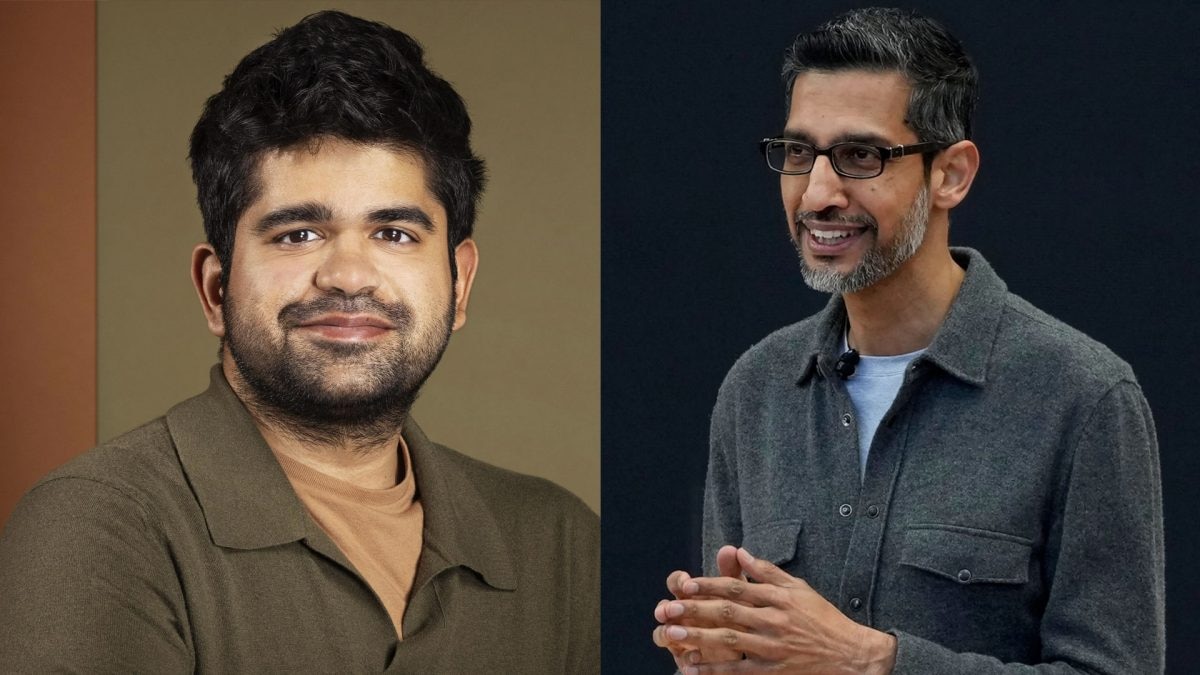

Perplexity Ceo The Fight For Ai Browser Dominance Against Google

Apr 29, 2025

Perplexity Ceo The Fight For Ai Browser Dominance Against Google

Apr 29, 2025 -

Pete Rose Ban Trump Promises Posthumous Pardon Criticizes Mlb

Apr 29, 2025

Pete Rose Ban Trump Promises Posthumous Pardon Criticizes Mlb

Apr 29, 2025

Latest Posts

-

Amanda Owen Addresses Recent Conflict With Ex Husband Clive

Apr 30, 2025

Amanda Owen Addresses Recent Conflict With Ex Husband Clive

Apr 30, 2025 -

Raw And Real Amanda Owen Shares Photos Of Her 9 Childrens Lives

Apr 30, 2025

Raw And Real Amanda Owen Shares Photos Of Her 9 Childrens Lives

Apr 30, 2025 -

Amanda Owens Tearful Response To Clive Owens Latest Move

Apr 30, 2025

Amanda Owens Tearful Response To Clive Owens Latest Move

Apr 30, 2025 -

Amanda Owen Unfiltered Photos Of Her 9 Childrens Busy Lives

Apr 30, 2025

Amanda Owen Unfiltered Photos Of Her 9 Childrens Busy Lives

Apr 30, 2025 -

9 Kids 9 Times The Chaos Amanda Owens Family Album

Apr 30, 2025

9 Kids 9 Times The Chaos Amanda Owens Family Album

Apr 30, 2025