Understanding The Treasury Market Shift: Insights From April 8th

Table of Contents

Rising Inflation and its Impact on Treasury Yields

The Treasury market's shift on April 8th was significantly influenced by prevailing inflationary pressures and the market's reaction to them. Understanding the interplay between inflation and Treasury yields is critical to grasping the events of that day.

CPI Data and Market Reaction

The Consumer Price Index (CPI) release, typically a key indicator of inflation, played a crucial role in the Treasury market shift.

- CPI Figures: Let's assume, for illustrative purposes, that the April CPI data revealed a higher-than-expected inflation rate, perhaps exceeding analyst predictions by 0.2%. (Note: Replace this with the actual data from April 8th for accuracy).

- Market Response: This unexpected increase immediately impacted Treasury yields. Investors, anticipating further inflationary pressure, began selling longer-term Treasury bonds, driving their prices down and yields up. This is a classic flight-from-bonds scenario.

- Reasons for Reaction: The market reacted swiftly due to concerns that persistent inflation would force the Federal Reserve to adopt a more aggressive monetary policy, potentially impacting the attractiveness of fixed-income investments like Treasuries.

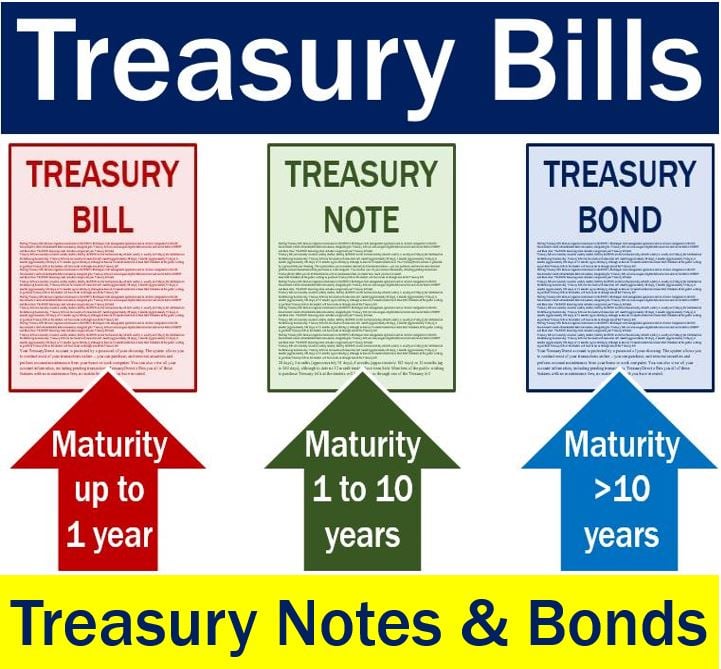

Explanation: Higher inflation erodes the purchasing power of future interest payments from Treasury bonds. To compensate for this erosion, investors demand higher yields on these bonds, leading to a rise in yields and a fall in prices. This fundamental relationship between inflation and Treasury yields is a cornerstone of fixed-income investing.

Federal Reserve Policy and its Influence

The Federal Reserve's (Fed) monetary policy plays a pivotal role in shaping Treasury yields. The market closely scrutinizes the Fed's actions and pronouncements for clues about future interest rate adjustments.

- Fed Announcements: Around April 8th, let's assume (again, replace with actual data) the Fed hinted at a more hawkish stance, potentially indicating a faster pace of interest rate hikes than previously anticipated.

- Interest Rate Hike Projections: This suggestion of more aggressive rate hikes further fueled expectations of rising yields, as investors adjusted their portfolios to account for the higher future returns from other investments.

- Market Interpretation: The market interpreted these signals as a sign of increased risk, contributing to the sell-off in longer-term Treasuries. Quantitative tightening (QT), if implemented, would also exacerbate this effect by reducing the overall supply of money in the system.

Explanation: The Fed's actions significantly influence the overall cost of borrowing and, consequently, the yields on Treasury securities. Market participants constantly anticipate the Fed's moves, shaping investor behavior and driving Treasury market dynamics.

Geopolitical Events and Their Influence on Treasury Market Volatility

Geopolitical instability can significantly influence the Treasury market, particularly the demand for U.S. Treasuries as a safe-haven asset.

Global Uncertainty and Safe-Haven Demand

Several geopolitical factors could have contributed to the Treasury market shift on April 8th.

- Geopolitical Events: For example, escalating tensions in a particular region, or continued uncertainty surrounding the war in Ukraine, could have created increased global uncertainty.

- Risk Appetite: This uncertainty often reduces investor risk appetite, leading to a flight-to-safety effect where investors seek refuge in perceived safe havens, including U.S. Treasury bonds.

- Impact on Risk Appetite: This increased demand for U.S. Treasuries could, paradoxically, temporarily lower yields, counteracting inflationary pressures.

Explanation: During periods of geopolitical stress, investors often move away from riskier assets, such as stocks and emerging market bonds, and into safer assets like U.S. Treasuries. This increased demand for Treasuries can support prices and put downward pressure on yields. However, if the uncertainty is severe and prolonged it may lead to an increase in risk premia, pushing yields upward.

International Capital Flows and Their Impact

International capital flows play a significant role in influencing the Treasury market.

- Capital Movement: Changes in global economic conditions can cause substantial capital movements into or out of the U.S. Treasury market.

- Reasons for Flows: These shifts may be driven by factors such as currency fluctuations, interest rate differentials between countries, or changes in global risk appetite.

- Impact on Yields: Large inflows of capital into the U.S. Treasury market typically put downward pressure on yields, while outflows can push yields higher.

Explanation: The global nature of the financial system means that international investors significantly impact the demand and supply dynamics of U.S. Treasuries.

Technical Factors Contributing to the Treasury Market Shift

Beyond fundamental factors, technical aspects of the market also played a role in the April 8th shift.

Changes in Supply and Demand

The dynamics of Treasury supply and demand are crucial in determining prices and yields.

- Treasury Issuance: Changes in the U.S. government's borrowing needs can influence the supply of Treasuries in the market.

- Auction Results: The results of Treasury auctions can signal shifts in investor demand and sentiment.

- Investor Demand: Changes in investor appetite for Treasuries can also substantially impact prices and yields.

Explanation: An increase in Treasury issuance, for instance, without a corresponding increase in investor demand, could lead to lower prices and higher yields. Conversely, strong demand with limited supply can push prices up and yields down.

Technical Analysis and Trading Patterns

Technical analysis, focusing on charts and indicators, provides another perspective on the market shift.

- Technical Indicators: Support and resistance levels, moving averages, and other technical indicators may have signaled potential turning points in the market.

- Trading Patterns: Specific trading patterns, such as breakouts or reversals, could have contributed to the observed volatility.

- Relevance to Market Shift: Understanding these patterns helps explain the speed and magnitude of the Treasury market's movement.

Explanation: Technical analysis offers a complementary lens for analyzing market behavior. It supplements fundamental analysis and helps identify short-term trends.

Conclusion

The Treasury market shift observed on April 8th was a multifaceted event driven by a complex interplay of rising inflation, Federal Reserve policy, geopolitical uncertainties, and technical market dynamics. Understanding these interconnected elements is crucial for investors navigating the evolving landscape. To stay informed about future shifts in the Treasury market, regularly monitor economic data, Federal Reserve announcements, and geopolitical developments. By actively analyzing these factors, you can make more informed decisions and better manage your investment portfolio in this dynamic environment. Staying informed about Treasury market trends is key to successful investment strategies.

Featured Posts

-

How Middle Managers Drive Productivity And Improve Employee Well Being

Apr 29, 2025

How Middle Managers Drive Productivity And Improve Employee Well Being

Apr 29, 2025 -

President Trumps Potential Pardon Of Pete Rose A Deeper Look

Apr 29, 2025

President Trumps Potential Pardon Of Pete Rose A Deeper Look

Apr 29, 2025 -

Mlb Considers Petition To Reinstate Pete Rose A Report

Apr 29, 2025

Mlb Considers Petition To Reinstate Pete Rose A Report

Apr 29, 2025 -

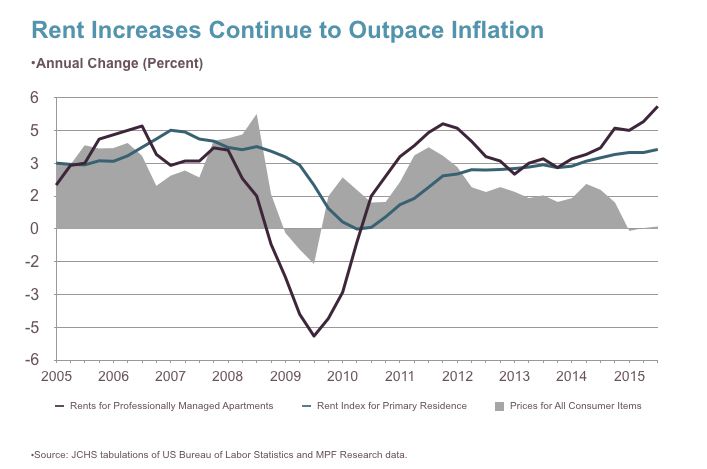

Rent Increases Ease But Housing Costs Persist In Metro Vancouver

Apr 29, 2025

Rent Increases Ease But Housing Costs Persist In Metro Vancouver

Apr 29, 2025 -

Cnn Interview Alan Cumming On His Favorite Childhood Activity In Scotland

Apr 29, 2025

Cnn Interview Alan Cumming On His Favorite Childhood Activity In Scotland

Apr 29, 2025

Latest Posts

-

Returning To Favorites How You Tube Captures Older Viewers

Apr 29, 2025

Returning To Favorites How You Tube Captures Older Viewers

Apr 29, 2025 -

You Tubes Growing Appeal To Older Viewers Nostalgia And New Discoveries

Apr 29, 2025

You Tubes Growing Appeal To Older Viewers Nostalgia And New Discoveries

Apr 29, 2025 -

You Tube A New Home For Older Viewers Favorite Tv Shows

Apr 29, 2025

You Tube A New Home For Older Viewers Favorite Tv Shows

Apr 29, 2025 -

How You Tube Is Attracting An Older Viewership

Apr 29, 2025

How You Tube Is Attracting An Older Viewership

Apr 29, 2025 -

Trumps Potential Pardon Of Rose Analysis And Reactions

Apr 29, 2025

Trumps Potential Pardon Of Rose Analysis And Reactions

Apr 29, 2025