Understanding Tribal Loans: Direct Lenders And Bad Credit Applications

Table of Contents

What are Tribal Loans?

Tribal loans are short-term loans offered by lenders associated with Native American tribes. These loans derive their unique characteristics from the legal standing of Native American tribes, which allows them to operate, in some cases, outside of certain state usury laws that regulate interest rates. This means they may offer loans with higher interest rates than traditional lenders. It's important to understand this distinction as it significantly impacts the overall cost of borrowing.

- Loans offered by lenders associated with Native American tribes. The lending institution often has a connection to a Native American tribe, giving them a degree of regulatory independence.

- Often operate outside of state usury laws. This aspect is crucial; it's why interest rates can sometimes be higher than those offered by banks or credit unions. However, it's also essential to note that not all tribal loans operate outside of all regulations.

- Can offer higher interest rates than traditional loans. This is a major consideration. Always compare the Annual Percentage Rate (APR) to other loan options.

- May have less stringent credit requirements. This is one of the main attractions for borrowers with bad credit, but it doesn't mean approval is guaranteed.

Finding Reputable Tribal Loan Direct Lenders

Navigating the world of tribal loans requires caution. The ease of access to these loans also unfortunately attracts predatory lenders who may exploit vulnerable borrowers. Thorough research is paramount to avoid falling victim to these practices.

- Check online reviews and ratings. Websites like the Better Business Bureau (BBB) and independent review sites can offer valuable insights into a lender's reputation and customer experiences. Look for consistent positive feedback and a lack of significant complaints.

- Verify the lender's tribal affiliation and licensing. Legitimate tribal lenders will readily provide information about their tribal affiliation and any relevant licenses or permits. Be wary of lenders who are evasive or unwilling to provide this information.

- Be wary of lenders promising guaranteed approval. No reputable lender can guarantee approval for a loan. Offers that sound too good to be true usually are.

- Compare interest rates and fees from multiple lenders. Don't settle for the first lender you find. Shopping around will help you secure the most favorable terms.

Tribal Loans for Bad Credit Applicants

One of the primary reasons people consider tribal loans is their potential accessibility to those with bad credit. While they often have less stringent credit score requirements than traditional banks, it doesn't mean that approval is automatic.

- Often less stringent credit score requirements. While a high credit score is always beneficial, these lenders may focus more on your income and employment stability.

- May consider factors beyond credit score (income, employment). Your ability to repay the loan is a critical factor. Lenders will likely review your income, employment history, and debt-to-income ratio.

- Still require a thorough application process. Expect to provide documentation such as proof of income, identification, and bank statements.

- May involve higher interest rates due to risk. Because these loans are often offered to higher-risk borrowers, the interest rates reflect that increased risk.

Understanding Interest Rates and Fees

Interest rates for tribal loans can vary significantly. They are determined by various factors, including your creditworthiness, the loan amount, and the lender's policies. Understanding all associated fees is critical.

- Interest rates can be significantly higher than traditional loans. This is a significant drawback and should be a primary consideration. Always compare APRs across different lenders.

- Fees can add to the overall cost of the loan. Be aware of origination fees, late fees, and any other charges. These fees can significantly increase the total cost of borrowing.

- Transparency is key - understand all costs upfront. Don't hesitate to ask questions and ensure you fully understand the terms and conditions before signing any agreement.

- Compare APR (Annual Percentage Rate) across different lenders. The APR reflects the total cost of the loan, including interest and fees, allowing for a more accurate comparison.

Advantages and Disadvantages of Tribal Loans

Like any financial product, tribal loans have both advantages and disadvantages. It's vital to weigh these carefully before applying.

Advantages:

- Access to credit for those with bad credit. This is a major benefit for those who have been denied loans by traditional lenders.

- Faster approval process compared to some traditional loans. The application and approval process can often be quicker than with traditional institutions.

- Potentially flexible repayment options. Some lenders might offer flexible repayment schedules, though this isn't always the case.

Disadvantages:

- Higher interest rates and fees than traditional loans. This is a significant drawback that can lead to a substantial increase in the overall cost of borrowing.

- Potential for predatory lending practices. It’s essential to research lenders thoroughly to avoid predatory lenders who may take advantage of vulnerable borrowers.

- May not be suitable for all borrowers. If you can secure a loan with a lower interest rate from a traditional lender, it's generally advisable to do so.

Conclusion

This article provided an overview of tribal loans, focusing on direct lenders and their suitability for bad credit applicants. While tribal loans can offer a solution for those facing financial emergencies and struggling to obtain credit through traditional channels, it's crucial to proceed with caution. Thoroughly research lenders, compare interest rates and fees, and carefully review the loan agreement before committing. Remember, responsible borrowing is key. If you're considering a tribal loan, take the time to fully understand the terms and conditions to ensure it's the right financial choice for your situation. Start your research today for suitable tribal loans and find the best option for your needs.

Featured Posts

-

Sukses Persemian Gerakan Bali Bersih Sampah Dampak Positif Bagi Lingkungan Dan Pariwisata

May 28, 2025

Sukses Persemian Gerakan Bali Bersih Sampah Dampak Positif Bagi Lingkungan Dan Pariwisata

May 28, 2025 -

Hasselbaink Ronaldo Nun Emekli Olmasi Gerektigini Soeyledi 2026 Duenya Kupasi Degerlendirmesi

May 28, 2025

Hasselbaink Ronaldo Nun Emekli Olmasi Gerektigini Soeyledi 2026 Duenya Kupasi Degerlendirmesi

May 28, 2025 -

Will Jennifer Lopez Host The 2025 American Music Awards A Look At The Possibilities

May 28, 2025

Will Jennifer Lopez Host The 2025 American Music Awards A Look At The Possibilities

May 28, 2025 -

Metro Detroit Weather Clearing Skies And Warmer Temperatures Ahead

May 28, 2025

Metro Detroit Weather Clearing Skies And Warmer Temperatures Ahead

May 28, 2025 -

Hot Ones Hailee Steinfelds Unexpected Chiefs Shout Out

May 28, 2025

Hot Ones Hailee Steinfelds Unexpected Chiefs Shout Out

May 28, 2025

Latest Posts

-

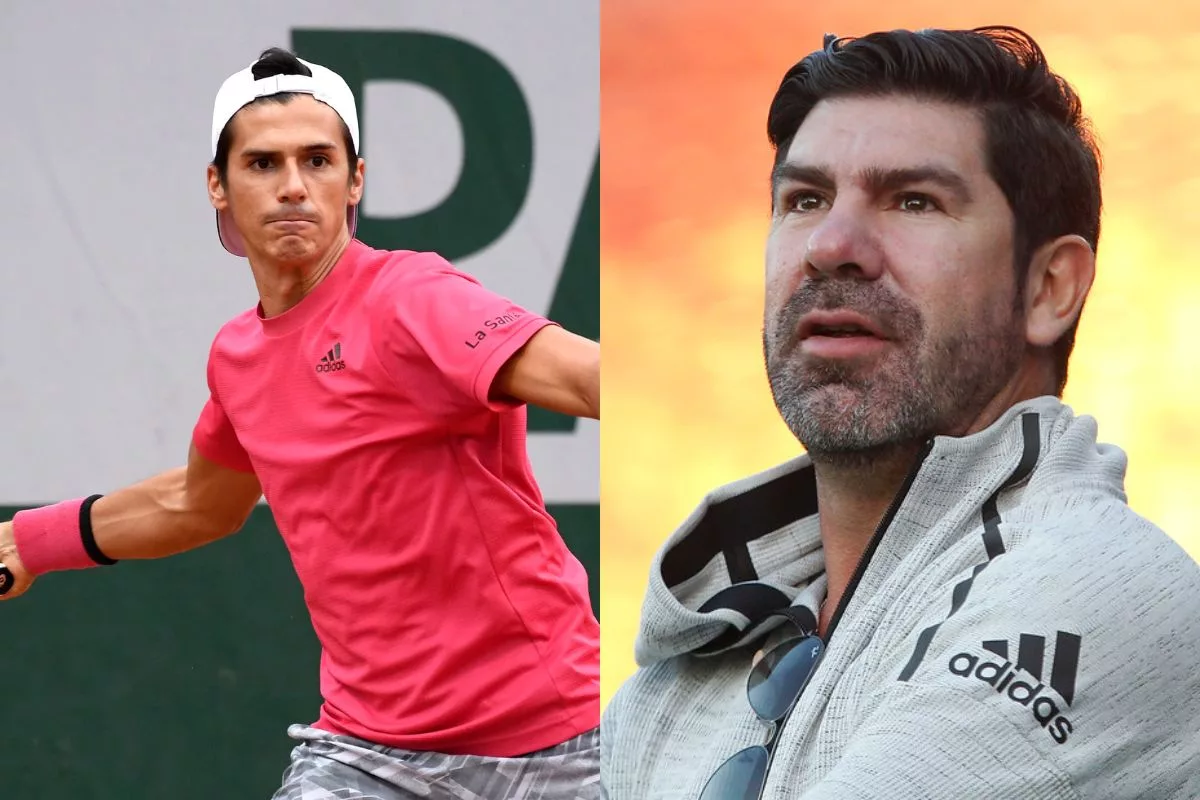

Un Tenista Argentino Revela Su Admiracion Por El Dios Del Tenis Marcelo Rios

May 30, 2025

Un Tenista Argentino Revela Su Admiracion Por El Dios Del Tenis Marcelo Rios

May 30, 2025 -

Marcelo Rios La Opinion De Un Tenista Argentino Que Lo Odiaba

May 30, 2025

Marcelo Rios La Opinion De Un Tenista Argentino Que Lo Odiaba

May 30, 2025 -

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025 -

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025 -

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025