Unlocking Profitable Dividends: A Simple Approach

Table of Contents

Understanding Dividend Investing Fundamentals

What are Dividends?

Dividends represent a share of a company's profits distributed to its shareholders. When a company performs well and generates excess cash, it may choose to return a portion of that profit to its investors as dividends. This is a key component of many successful long-term investment strategies focused on profitable dividends.

- Cash Dividends: The most common type, where shareholders receive a direct cash payment.

- Stock Dividends: Instead of cash, shareholders receive additional shares of the company's stock.

The dividend payout ratio is a crucial metric. It indicates the percentage of a company's earnings paid out as dividends. A healthy payout ratio usually suggests a company's financial stability and its commitment to returning value to shareholders, crucial factors when aiming for profitable dividends.

Identifying Dividend-Paying Stocks

Finding strong dividend-paying stocks requires careful research and strategy. You can utilize several resources and tools to assist in your search for high-yield, profitable dividends.

- Financial Websites: Sites like Yahoo Finance, Google Finance, and others offer stock screeners allowing you to filter by dividend yield, payout ratio, and other key metrics.

- Brokerage Platforms: Most brokerage accounts provide tools to screen for dividend-paying stocks, often with more advanced filtering options.

When searching for stocks, focus on:

- Dividend Yield: The annual dividend payment relative to the stock price (higher yield, potentially higher return, but also potentially higher risk).

- Payout Ratio: The percentage of earnings paid out as dividends (a sustainable payout ratio is key for consistent profitable dividends).

- Company Stability: Look for established companies with a history of consistent dividend payments and strong financial performance.

Sectors known for high dividend yields include:

- REITs (Real Estate Investment Trusts): These companies own and operate income-producing real estate.

- Utilities: Companies providing essential services like electricity and water often offer attractive dividend yields.

Building a Profitable Dividend Portfolio

Diversification Strategies

Diversification is key to mitigating risk in any investment strategy, including dividend investing. Don't put all your eggs in one basket! Spread your investments across various sectors and companies to reduce the impact of any single stock's underperformance.

- Value Investing: Focus on undervalued companies with the potential for future growth and high dividend payouts.

- Growth Investing: Focus on companies experiencing rapid growth, although dividends may be lower initially as the company prioritizes reinvestment.

Reinvesting Dividends for Growth

The power of compounding is undeniable when it comes to profitable dividends. Reinvesting your dividends allows you to purchase more shares, leading to greater dividend income over time.

- Dividend Reinvestment Plans (DRIPs): Many companies offer DRIPs, automatically reinvesting your dividends to buy more shares, often at a discounted price. This accelerates the growth of your portfolio and maximizes your returns from profitable dividends.

The long-term effects of reinvestment are substantial. Even small, consistent reinvestment can significantly impact your portfolio's growth over time.

Managing Your Dividend Portfolio

Regularly reviewing and adjusting your portfolio is vital. Market conditions and individual company performance change.

- Regular Review: Assess your portfolio's performance at least annually, making adjustments based on changes in the market and your investment goals.

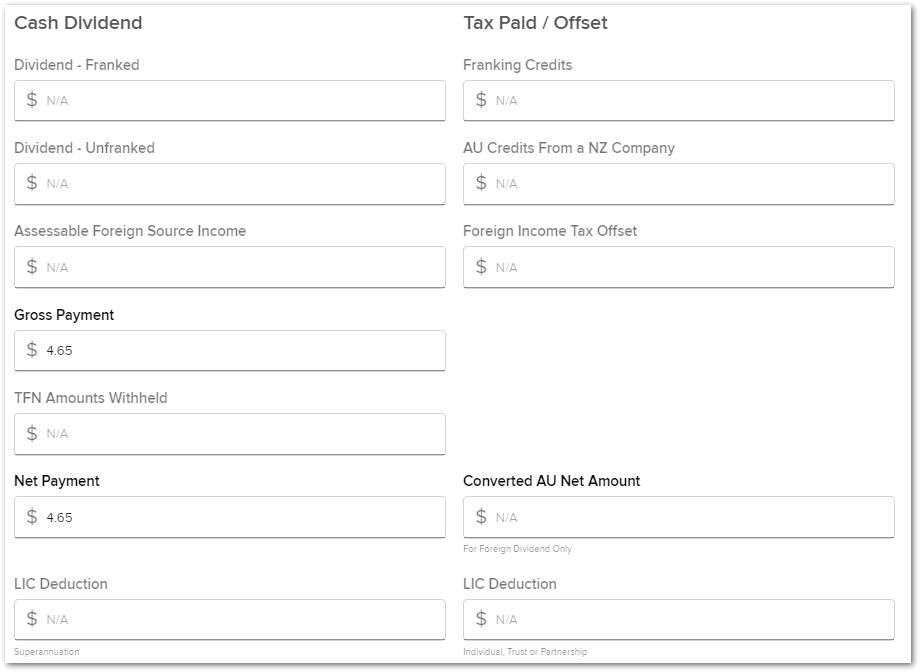

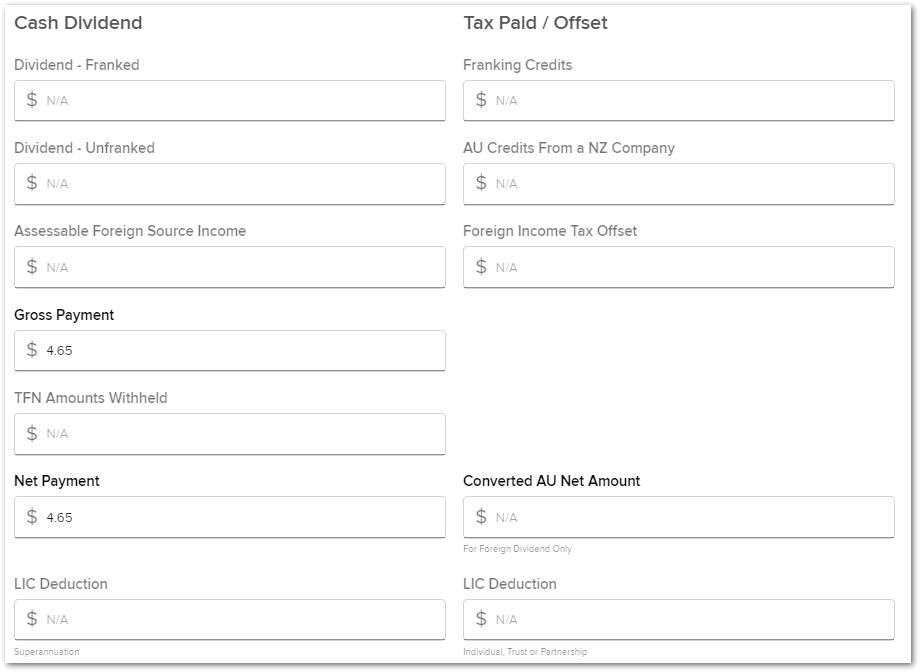

- Tax Implications: Understand the tax implications of dividend income. Dividends are generally taxed as ordinary income.

Minimizing Risk in Dividend Investing

Due Diligence and Research

Thorough research is paramount. Before investing in any dividend-paying stock, analyze the company's financial health and prospects for future growth.

- Financial Statement Analysis: Examine the company's balance sheet, income statement, and cash flow statement to assess its financial stability.

- Business Model and Competition: Understand the company's business model, its competitive advantages, and the overall industry landscape.

Risk Tolerance and Investment Goals

Align your investment strategy with your risk tolerance and financial goals.

- Diversified Portfolio: A well-diversified portfolio helps mitigate risk by spreading your investments across various asset classes and sectors.

- Realistic Expectations: Set realistic expectations for returns. While profitable dividends offer the potential for significant growth, they are not a guaranteed path to riches.

Securing Your Financial Future with Profitable Dividends

This article has outlined a simple yet effective approach to unlocking profitable dividends. By understanding dividend investing fundamentals, building a diversified portfolio, and managing your investments wisely, you can create a stream of passive income and build long-term wealth. Remember, maximizing your dividend income requires diligent research and a well-defined strategy. Start your journey towards building a profitable dividend stream today by researching dividend-paying stocks and building a well-diversified portfolio. Learn more about effective dividend investing strategies [link to relevant resource].

Featured Posts

-

From Flight Attendant To Pilot An Ex Sia Employees Path To Success

May 11, 2025

From Flight Attendant To Pilot An Ex Sia Employees Path To Success

May 11, 2025 -

Mlb Injury News Yankees Vs Diamondbacks April 1 3 Series

May 11, 2025

Mlb Injury News Yankees Vs Diamondbacks April 1 3 Series

May 11, 2025 -

Lily Collins A Glimpse Into Motherhood

May 11, 2025

Lily Collins A Glimpse Into Motherhood

May 11, 2025 -

Planning Your Next Flight Fun Awaits

May 11, 2025

Planning Your Next Flight Fun Awaits

May 11, 2025 -

New Calvin Klein Campaign Featuring Lily Collins A Look At The Images

May 11, 2025

New Calvin Klein Campaign Featuring Lily Collins A Look At The Images

May 11, 2025