Unveiling China's Economic Vulnerability: The Trade War's Impact On Beijing

Table of Contents

Weakening Export Sector & Global Supply Chains

China's economic model has long relied heavily on exports, making it particularly susceptible to disruptions in global trade. The trade war significantly hampered this cornerstone of its economy. The imposition of tariffs on various Chinese goods, impacting sectors from technology to agriculture, led to a decline in export revenue. This export vulnerability was further exacerbated by the disruption of global supply chains.

- Tariff impact on specific export sectors: Tariffs on tech products, such as smartphones and computers, significantly affected Chinese manufacturers. Similarly, tariffs on agricultural goods, like soybeans, impacted farmers and exporters, highlighting the diverse nature of China's export vulnerability.

- Disruption of global supply chains due to trade restrictions: The trade war caused significant uncertainty, forcing businesses to rethink their supply chains and seek alternative sources of goods and components, thus impacting China's role as a key manufacturing hub.

- Loss of market share to competitors: As Chinese exports became more expensive, competitors in other countries gained market share, further weakening the position of Chinese businesses in the global marketplace. This underscores the increasing need for China to diversify its economy and reduce its reliance on exports.

- Impact on Chinese businesses and employment: Many businesses, particularly small and medium-sized enterprises (SMEs), struggled to adapt to the changing trade landscape, leading to job losses and economic hardship. This had a knock-on effect on domestic consumption and overall economic growth, revealing a crucial link between China's export vulnerability and internal economic stability. This supply chain disruption in China further illustrates the interconnectedness of the global economy.

Domestic Consumption Slowdown

While China's export sector suffered, the trade war also negatively impacted domestic consumption. The economic uncertainty created by the trade conflict dampened consumer confidence, leading to reduced spending.

- Reduced consumer confidence due to economic uncertainty: The ongoing trade tensions and the resulting economic uncertainty made consumers hesitant to spend, leading to a slowdown in domestic demand.

- Impact of tariffs on import prices, affecting consumer goods: Tariffs on imported goods increased their prices, affecting consumer purchasing power and further slowing down domestic consumption. This internal economic vulnerability was compounded by the external pressures of the trade war.

- Decreased investment in domestic industries: Businesses delayed or reduced investment due to the uncertain economic outlook, compounding the impact on domestic growth. This internal economic vulnerability further contributed to the overall slowdown.

- Government response and stimulus measures: The Chinese government responded with various stimulus measures to boost domestic consumption and investment, but their effectiveness was limited by the persistent uncertainty surrounding the trade conflict.

Technological Dependence & Innovation Challenges

The trade war highlighted China's significant reliance on foreign technology and intellectual property. Restrictions imposed during the trade conflict exposed the technological vulnerability of China.

- Restrictions on access to foreign technology and intellectual property: The trade war brought to light China's dependence on foreign technology in several key sectors, hindering its technological advancements.

- Increased focus on domestic technological development: In response to these restrictions, China accelerated its efforts to develop domestic technologies and reduce its reliance on foreign sources. This resulted in significant investment in research and development.

- Challenges faced in achieving technological self-reliance: However, achieving technological self-reliance presents significant challenges for China, including the need to cultivate a robust innovation ecosystem and overcome technological gaps. This technological vulnerability remains a significant concern for China’s long-term economic prospects.

- Long-term implications for technological innovation in China: The trade war served as a catalyst for China to invest more heavily in domestic technology development. However, the long-term success of these efforts remains uncertain and constitutes a key area of China’s economic vulnerability.

Financial Market Volatility & Capital Outflows

The trade war also significantly impacted China's financial markets, leading to increased volatility and the potential for capital flight.

- Increased market volatility due to trade uncertainty: The ongoing trade tensions and the resulting uncertainty created volatility in China's stock and bond markets, impacting investor confidence.

- Potential capital flight and currency fluctuations: Concerns about the long-term economic consequences of the trade war led to the potential for capital flight, putting pressure on the Chinese currency (Renminbi). This financial vulnerability underlines the risks associated with trade disputes.

- Government intervention to stabilize the financial markets: The Chinese government intervened to stabilize its financial markets through various measures, including currency interventions and monetary policy adjustments.

- Long-term implications for financial stability in China: The long-term impact of the trade war on China's financial stability remains uncertain, and the potential for future volatility remains a significant concern. This financial vulnerability in China could have significant global implications.

Conclusion

The US-China trade war exposed significant weaknesses in China's economic structure, highlighting China's economic vulnerability in several key areas. From its reliance on exports and global supply chains to its dependence on foreign technology and the volatility in its financial markets, the trade conflict served as a wake-up call. The slowdown in domestic consumption further emphasized the interconnectedness of these vulnerabilities. Understanding China's economic vulnerability is crucial for navigating the complexities of the global economy. Continue your research into the long-term effects of the trade war on Beijing and the future of Sino-American relations to gain a complete understanding of China’s evolving economic landscape and its ongoing challenges.

Featured Posts

-

Play Station Beta Program Check Eligibility And Sign Up Now

May 03, 2025

Play Station Beta Program Check Eligibility And Sign Up Now

May 03, 2025 -

Decoding Ap Decision Notes The Minnesota Special State House Election Explained

May 03, 2025

Decoding Ap Decision Notes The Minnesota Special State House Election Explained

May 03, 2025 -

Fortnite Cowboy Bebop Bundle Faye Valentine And Spike Spiegel Skin Prices

May 03, 2025

Fortnite Cowboy Bebop Bundle Faye Valentine And Spike Spiegel Skin Prices

May 03, 2025 -

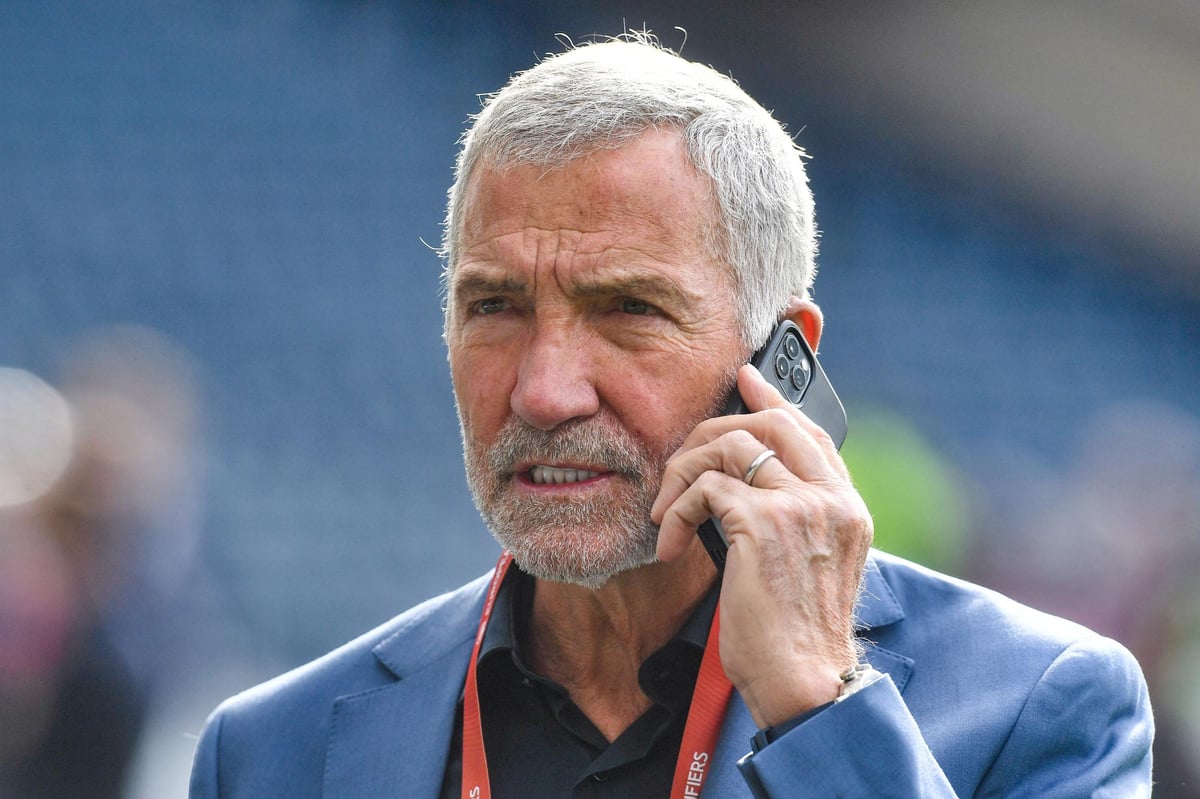

Expert Analysis Souness On Manchester Uniteds Transfer Failure

May 03, 2025

Expert Analysis Souness On Manchester Uniteds Transfer Failure

May 03, 2025 -

Lotto Jackpot Numbers Saturday April 12th Results

May 03, 2025

Lotto Jackpot Numbers Saturday April 12th Results

May 03, 2025

Latest Posts

-

Nebraskas Successful Voter Id Campaign A National Model

May 03, 2025

Nebraskas Successful Voter Id Campaign A National Model

May 03, 2025 -

Excellence In Voter Id Programs Nebraskas Award Winning Campaign

May 03, 2025

Excellence In Voter Id Programs Nebraskas Award Winning Campaign

May 03, 2025 -

Analyzing The Ap Decision Notes Implications Of The Minnesota Special House Election

May 03, 2025

Analyzing The Ap Decision Notes Implications Of The Minnesota Special House Election

May 03, 2025 -

National Award Honors Nebraskas Voter Id Campaign

May 03, 2025

National Award Honors Nebraskas Voter Id Campaign

May 03, 2025 -

Minnesota Special House Election Key Takeaways From Ap Decision Notes

May 03, 2025

Minnesota Special House Election Key Takeaways From Ap Decision Notes

May 03, 2025