US-China Trade Deal Spurs Bitcoin Investment: Crypto Market Analysis

Table of Contents

Economic Uncertainty and the Flight to Safe Haven Assets

Bitcoin, often touted as "digital gold," is increasingly perceived as a safe haven asset, a non-correlated investment that can protect portfolios during times of economic turmoil. Traditional safe havens like gold and government bonds have seen increased demand during periods of uncertainty, and Bitcoin is now following a similar trajectory.

- Increased volatility in traditional markets due to trade tensions: The prolonged trade war between the US and China created significant uncertainty in global stock markets, prompting investors to seek alternative options.

- Investors seeking diversification and hedging against economic uncertainty: The US-China trade deal, while positive, doesn't eliminate future uncertainties. Investors are actively seeking ways to diversify their portfolios and hedge against potential future economic downturns. Bitcoin, with its decentralized nature, offers a unique opportunity for this.

- Bitcoin's decentralized nature and limited supply as attractive features: Unlike fiat currencies controlled by governments, Bitcoin's limited supply of 21 million coins makes it an attractive hedge against inflation and potential currency devaluation. Its decentralized nature makes it resistant to government manipulation or censorship.

- Historical correlation between geopolitical instability and Bitcoin price increases: Historically, periods of geopolitical instability and economic uncertainty have often been correlated with increases in Bitcoin's price. The current surge is consistent with this observed pattern.

The lingering uncertainties, even after the trade deal, continue to fuel investor interest in Bitcoin as a potential safe haven.

Increased Institutional Interest in Bitcoin

Beyond individual investors, institutional interest in Bitcoin is rapidly growing, adding significant momentum to the price increase. This institutional adoption signals a maturing and legitimizing of the cryptocurrency market.

- Grayscale Bitcoin Trust's increasing assets under management (AUM): Grayscale, a leading investment firm, has seen a massive influx of funds into its Bitcoin Trust, demonstrating substantial institutional confidence.

- Reports of large corporations exploring Bitcoin as a treasury asset: Several major companies are reportedly exploring Bitcoin as a part of their treasury reserves, further validating its potential as a store of value.

- Increased regulatory clarity in some jurisdictions leading to greater institutional confidence: Increased regulatory clarity in certain countries is fostering greater institutional confidence in the cryptocurrency market, paving the way for wider adoption.

- The role of Bitcoin as a potential inflation hedge: With global inflation concerns rising, Bitcoin's limited supply is increasingly viewed as a potential hedge against inflation, attracting institutional investors seeking to preserve their capital.

This institutional interest, fueled by a cautious optimism surrounding the US-China trade deal's long-term impact, further strengthens the upward trajectory of Bitcoin investment.

The Role of Technology and Innovation in Driving Bitcoin Adoption

Technological advancements are playing a crucial role in Bitcoin's increasing appeal and adoption, compounding the effects of the trade deal-driven investment.

- Development of the Lightning Network for faster and cheaper transactions: The Lightning Network significantly improves Bitcoin's transaction speed and reduces fees, making it more practical for everyday use.

- Growing adoption of Bitcoin as a payment method in certain sectors: Several businesses are starting to accept Bitcoin as a form of payment, expanding its use cases and boosting demand.

- Improvements in Bitcoin's scalability and security: Ongoing development efforts are continually improving Bitcoin's scalability and security, making it a more robust and reliable asset.

- The increasing ease of access to Bitcoin through various platforms: The proliferation of user-friendly platforms for buying, selling, and storing Bitcoin makes it increasingly accessible to a wider range of investors.

These technological improvements are working in synergy with the economic uncertainties spurred by the US-China trade situation, further driving Bitcoin investment.

Addressing the Volatility of Bitcoin

It's crucial to acknowledge Bitcoin's inherent price volatility. This volatility stems from several factors:

- Market sentiment: Bitcoin's price is heavily influenced by market sentiment, which can fluctuate dramatically based on news events, regulatory changes, and overall investor confidence.

- Regulatory changes: Regulatory announcements and changes in different jurisdictions can significantly impact Bitcoin's price.

- Technological developments: Major technological advancements or setbacks can also affect the price.

Effective risk management strategies are vital for Bitcoin investors:

- Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio across different asset classes.

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals can help mitigate the impact of price volatility.

- Thorough research and due diligence: Before investing in Bitcoin, conduct thorough research and understand the risks involved.

While volatility remains a factor, the current upward trend in Bitcoin investment is undeniably influenced by the ongoing uncertainties surrounding the US-China trade situation and the perceived safety and potential of Bitcoin as an asset.

Conclusion

The US-China trade deal, while a positive development, hasn't completely eliminated economic uncertainty. This ongoing uncertainty, coupled with growing institutional interest and continuous technological advancements, has fueled a significant surge in Bitcoin investment. Bitcoin's unique properties, particularly its decentralized nature and limited supply, are driving this trend, enhancing its appeal as a safe haven asset and a potential hedge against inflation.

Understanding the intricate interplay between global trade dynamics and the cryptocurrency market is crucial for navigating the evolving financial landscape. Learn more about Bitcoin investment strategies and stay updated on the latest news in the crypto market to capitalize on future opportunities. Continue your research into the impact of the US-China trade deal on Bitcoin investment and the broader cryptocurrency market.

Featured Posts

-

El Psg Se Impone Al Lyon En Un Partido Clave

May 08, 2025

El Psg Se Impone Al Lyon En Un Partido Clave

May 08, 2025 -

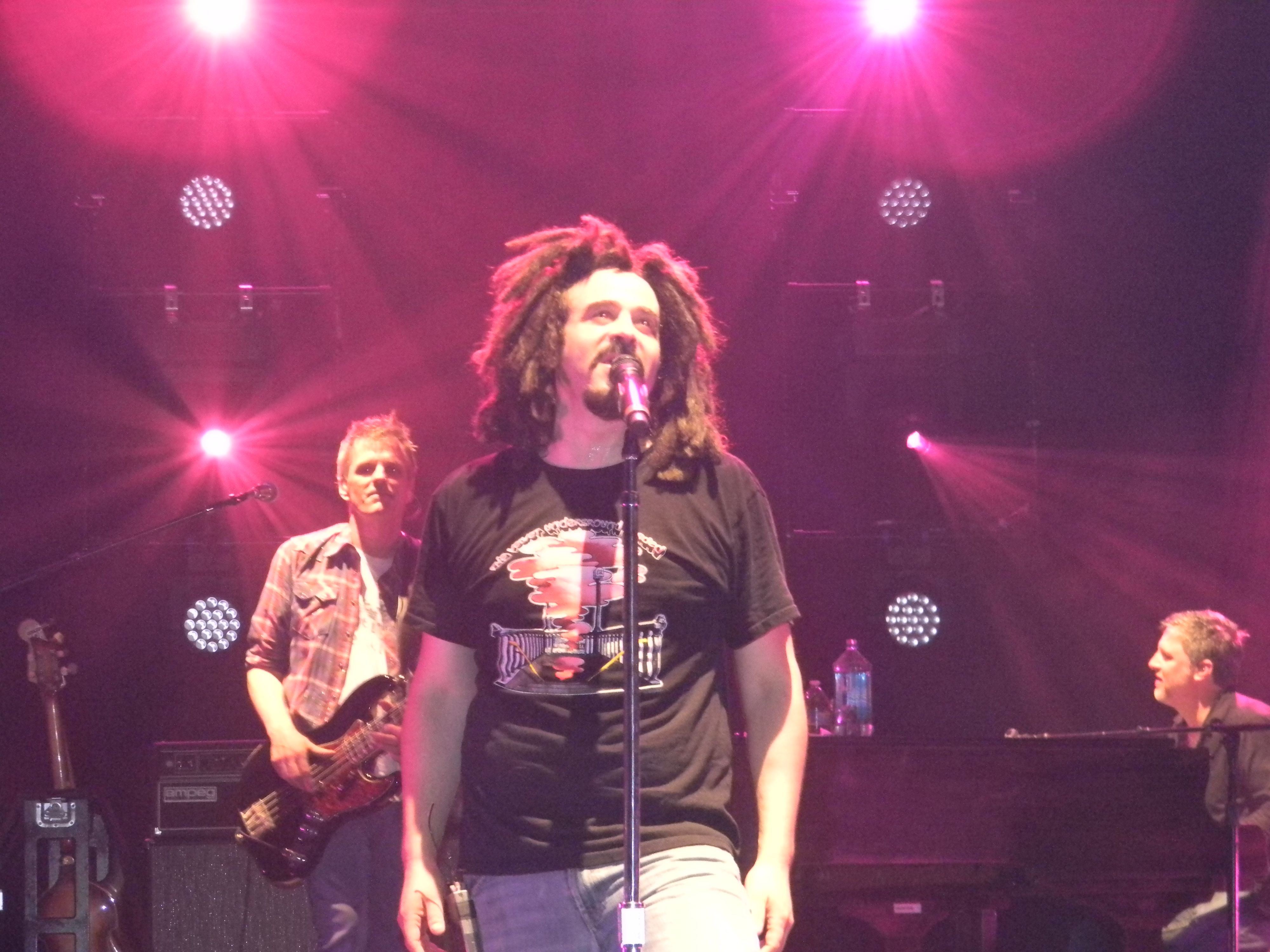

The Impact Of Saturday Night Live On Counting Crows Popularity

May 08, 2025

The Impact Of Saturday Night Live On Counting Crows Popularity

May 08, 2025 -

Cryptocurrency Market Outlook Bitcoin Gains Momentum Amidst Trade Negotiations

May 08, 2025

Cryptocurrency Market Outlook Bitcoin Gains Momentum Amidst Trade Negotiations

May 08, 2025 -

Play Station Podcast 512 True Blue A Full Breakdown

May 08, 2025

Play Station Podcast 512 True Blue A Full Breakdown

May 08, 2025 -

Ftc Appeals Activision Blizzard Acquisition Decision Whats Next

May 08, 2025

Ftc Appeals Activision Blizzard Acquisition Decision Whats Next

May 08, 2025