US-China Trade Optimism Triggers Gold Price Decline

Table of Contents

The Inverse Relationship Between Trade Optimism and Gold Prices

Gold's inherent value often stems from its perceived safety during times of economic uncertainty. Investors traditionally flock to gold as a safe haven asset during periods of market volatility, geopolitical instability, or heightened trade tensions. This is because gold is seen as a store of value that holds its worth even when other assets decline. However, when trade tensions ease, as we’ve recently seen with positive shifts in US-China relations, the demand for this safe haven diminishes.

Reduced trade war risks lead to increased investor confidence in global markets. This increased confidence translates into a shift away from safe-haven assets, such as gold, towards riskier investments offering potentially higher returns. This shift in investor sentiment directly impacts gold's price.

- Reduced trade war risks: The lessening threat of tariffs and trade disputes reduces market uncertainty.

- Increased investor confidence in global markets: Positive trade developments boost overall market sentiment, encouraging investment in equities and other growth-oriented assets.

- Shift from safe-haven assets (like gold) to riskier investments: Investors move their capital from gold to assets perceived as having greater potential for growth.

- Examples of previous trade agreements and their effects on gold prices: Historically, periods following major trade agreements have often seen a corresponding dip in gold prices, mirroring the current trend. For example, the initial signing of the first phase of the USMCA trade deal saw a slight decrease in gold prices.

Economic Growth Prospects and Gold's Diminished Appeal

Improved US-China trade relations significantly boost global economic growth predictions. When trade flows smoothly, businesses can operate more efficiently, leading to increased production and overall economic expansion. This positive economic outlook often leads to higher interest rates. Central banks tend to raise interest rates during periods of robust economic growth to manage inflation.

Higher interest rates make non-interest-bearing assets like gold less attractive. Because gold doesn't generate interest income, its appeal diminishes when investors can earn higher returns on interest-bearing assets such as bonds or savings accounts.

- Increased global investment opportunities: A healthier global economy creates more lucrative investment prospects beyond gold.

- Rising US dollar strength (often inverse to gold): A stronger US dollar typically puts downward pressure on gold prices, as gold is priced in US dollars.

- The impact of higher interest rates on bond yields versus gold returns: Higher bond yields offer a more competitive return compared to holding gold, thus reducing demand for the precious metal.

Market Sentiment and Speculative Trading in Gold

Positive news regarding US-China trade significantly impacts market sentiment, shifting it from apprehension to optimism. This positive sentiment influences speculative trading in gold. Traders, sensing reduced risk and anticipating higher returns in other markets, often reduce their gold holdings. This can involve short-selling, where traders borrow and sell gold, hoping to buy it back at a lower price later, thereby profiting from the price decline.

- Analysis of recent gold futures trading volume: A decrease in trading volume in gold futures contracts indicates reduced speculative activity.

- Impact of investor psychology and market speculation: Market sentiment, driven by news and speculation, plays a crucial role in gold price fluctuations.

- The influence of major gold market players: Large institutional investors and hedge funds can significantly impact gold prices through their buying and selling activities.

Conclusion: Understanding the Dynamics of Gold Prices in the Face of Improved US-China Trade

In summary, improved US-China trade relations lead to a decrease in risk aversion among investors, increased economic growth prospects, higher interest rates, and ultimately, a decline in gold prices. The inverse relationship between US-China trade optimism and gold price movements is undeniable. Understanding this dynamic is vital for investors navigating the complexities of the precious metals market.

Stay informed about shifts in US-China trade relations to better understand and predict future movements in gold prices. Monitoring these dynamics is key to making informed decisions regarding your investment strategy in the face of US-China trade optimism and its effect on gold price decline.

Featured Posts

-

Cardinals Opener Analyzing Jansens Performance And The Games Outcome

May 18, 2025

Cardinals Opener Analyzing Jansens Performance And The Games Outcome

May 18, 2025 -

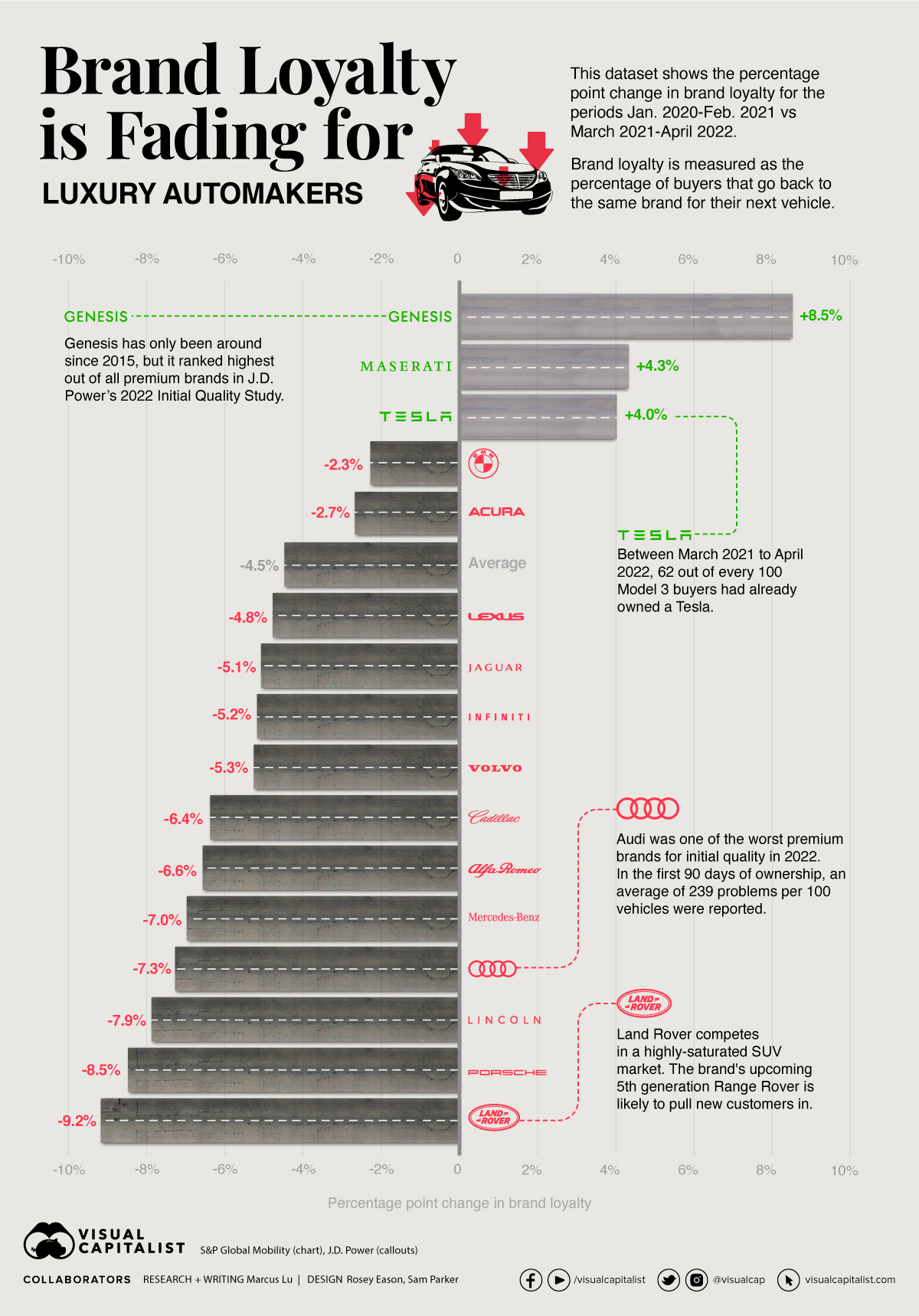

The China Factor Why Luxury Automakers Face Headwinds In The Chinese Market

May 18, 2025

The China Factor Why Luxury Automakers Face Headwinds In The Chinese Market

May 18, 2025 -

Kanye Wests Ex Julia Fox Accused Of Copying Bianca Censoris Style

May 18, 2025

Kanye Wests Ex Julia Fox Accused Of Copying Bianca Censoris Style

May 18, 2025 -

Trump Responds To Springsteens Treasonous Allegation

May 18, 2025

Trump Responds To Springsteens Treasonous Allegation

May 18, 2025 -

Top New Music Releases This Week Featuring Ezra Furman Billy Nomates And Damiano David

May 18, 2025

Top New Music Releases This Week Featuring Ezra Furman Billy Nomates And Damiano David

May 18, 2025

Latest Posts

-

Easy A On Bbc Three Hd Tv Guide And Listings

May 18, 2025

Easy A On Bbc Three Hd Tv Guide And Listings

May 18, 2025 -

Celebrity Only Fans Amanda Bynes Impact

May 18, 2025

Celebrity Only Fans Amanda Bynes Impact

May 18, 2025 -

Amanda Bynes Latest Only Fans Content An Analysis

May 18, 2025

Amanda Bynes Latest Only Fans Content An Analysis

May 18, 2025 -

Smart Mlb Dfs Picks May 8th Sleepers And Hitter To Sit

May 18, 2025

Smart Mlb Dfs Picks May 8th Sleepers And Hitter To Sit

May 18, 2025 -

Florida Space Coast Economic Development 800 000 Investment Announced

May 18, 2025

Florida Space Coast Economic Development 800 000 Investment Announced

May 18, 2025