US Credit Downgrade: Analysis Of Dow Futures And Dollar Movement

Table of Contents

Immediate Impact on Dow Futures

The announcement of the US credit downgrade resulted in an immediate and sharp decline in Dow futures. Understanding this initial market reaction and the subsequent volatility is crucial for assessing the overall impact.

Initial Market Reaction

Following the downgrade announcement, Dow futures experienced a significant drop, reflecting a rapid erosion of investor confidence. For example, we saw a [Insert Percentage]% drop within the first [Insert Timeframe, e.g., hour, two hours] of the announcement, accompanied by a surge in trading volume, indicating heightened market activity.

- Psychological Impact: The downgrade triggered a wave of negative sentiment among investors. The perceived increased risk associated with US Treasury securities impacted confidence in the broader US economy and stock market.

- Algorithmic Trading: Algorithmic trading systems, designed to react instantly to market signals, likely amplified the initial price drop. These automated systems contributed to the speed and magnitude of the Dow futures decline.

- Sector-Specific Reactions: The impact wasn't uniform across all Dow components. Sectors heavily reliant on borrowing, such as real estate and technology, experienced more significant drops compared to others perceived as more resilient.

Volatility and Uncertainty

The period following the initial drop was characterized by heightened volatility in Dow futures trading. Uncertainty about the long-term economic consequences fueled significant price swings.

- Widening Bid-Ask Spreads: The difference between the buying and selling prices (bid-ask spread) widened significantly, reflecting the uncertainty and reluctance of market participants to engage in large trades.

- Increased Hedging Strategies: Investors resorted to hedging strategies, such as purchasing put options, to protect their portfolios from further losses resulting from increased market volatility stemming from the credit downgrade.

- Impact on Options Pricing: Implied volatility, a measure of expected future price fluctuations, surged dramatically in options markets, reflecting the increased uncertainty and risk perception.

Dollar Movement and the US Credit Downgrade

The US credit downgrade presented a complex scenario for the dollar, pitting safe-haven demand against reduced confidence in the US economy.

Safe-Haven Demand vs. Loss of Confidence

The dollar often acts as a safe-haven currency during times of global economic uncertainty. However, the credit downgrade simultaneously undermined confidence in the US economy's stability.

- Safe-Haven Effect: Some investors sought refuge in the dollar, anticipating further global market turmoil. This increased demand temporarily supported the dollar's value.

- Decreased Demand: Conversely, the downgrade also raised concerns about the long-term strength of the US economy, potentially reducing investor confidence and leading to some capital flight.

- Interest Rate Differentials: Interest rate differentials between the US and other major economies played a role. If US interest rates rise to compensate for increased risk, this could attract foreign investment and strengthen the dollar.

Impact on Foreign Exchange Markets

The downgrade's ripple effects were felt across foreign exchange markets, impacting the value of other major currencies against the dollar.

- Euro, Yen, and Pound Sterling: The performance of these currencies against the dollar varied depending on their own economic conditions and investor sentiment. [Insert data on currency performance post-downgrade].

- Correlation with Safe-Haven Currencies: The dollar's movement showed some correlation with other safe-haven currencies like the Japanese Yen and Swiss Franc, as investors sought refuge in perceived safer assets.

- Global Capital Flows: The downgrade triggered shifts in global capital flows, with some investors moving funds out of US assets into perceived safer havens elsewhere.

Long-Term Implications and Investment Strategies

The long-term consequences of the US credit downgrade are still unfolding, but potential impacts on the economy and appropriate investor strategies need careful consideration.

Potential Economic Consequences

The credit downgrade could trigger a series of negative economic repercussions, impacting various aspects of the US and global economies.

- Inflationary Pressures: Increased government borrowing costs could contribute to inflationary pressures, potentially eroding purchasing power.

- Recessionary Pressures: Reduced consumer and business confidence could dampen economic activity, increasing the risk of a recession.

- Government Borrowing Costs: The downgrade will likely increase the cost of borrowing for the US government, potentially impacting future government spending and economic stimulus initiatives.

Strategies for Navigating Market Volatility

Investors need to adapt their strategies to mitigate the risks associated with the increased market volatility stemming from the credit downgrade.

- Diversification: Diversifying investment portfolios across different asset classes (stocks, bonds, real estate, etc.) can help reduce the impact of market downturns.

- Hedging Strategies: Employing hedging strategies, like options contracts, can offer some protection against further losses in a volatile market environment.

- Risk Assessment and Due Diligence: Thoroughly assess the risks associated with each investment and conduct comprehensive due diligence before making investment decisions.

Conclusion

The US credit downgrade has undeniably introduced significant uncertainty into financial markets, impacting Dow futures and the dollar's value. While the dollar may initially benefit from safe-haven demand, the long-term economic consequences and the dollar's trajectory remain uncertain. Investors must carefully assess the potential economic repercussions and adopt robust risk management strategies. Understanding the complexities of the US credit downgrade and its effects on Dow futures and dollar movement is crucial for navigating this period of volatility. Continue your research on the implications of the US credit downgrade and its effects on Dow futures and dollar movement to make informed investment decisions.

Featured Posts

-

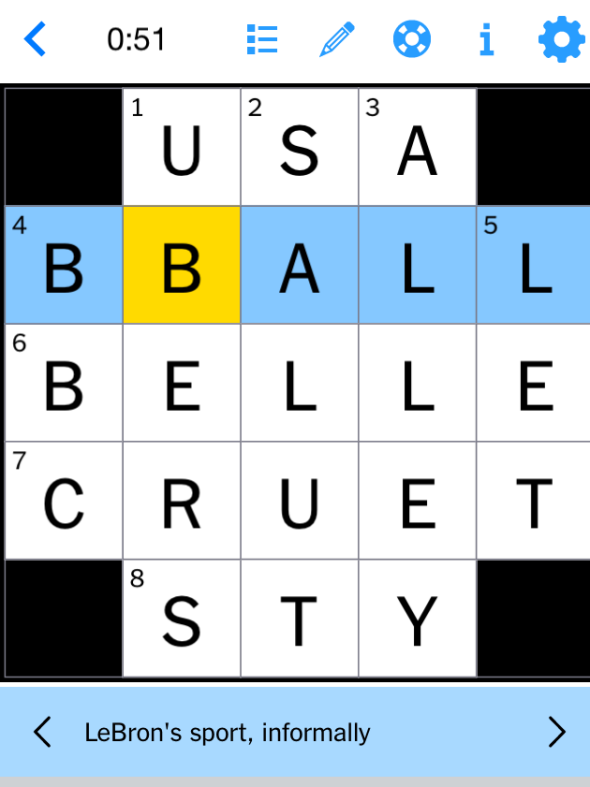

Complete Guide Nyt Mini Crossword Answers For March 26 2025

May 21, 2025

Complete Guide Nyt Mini Crossword Answers For March 26 2025

May 21, 2025 -

Huizenprijzen Nederland Discussie Geen Stijl En Abn Amro

May 21, 2025

Huizenprijzen Nederland Discussie Geen Stijl En Abn Amro

May 21, 2025 -

Javier Baez Un Analisis De Su Salud Y Su Futuro En El Beisbol

May 21, 2025

Javier Baez Un Analisis De Su Salud Y Su Futuro En El Beisbol

May 21, 2025 -

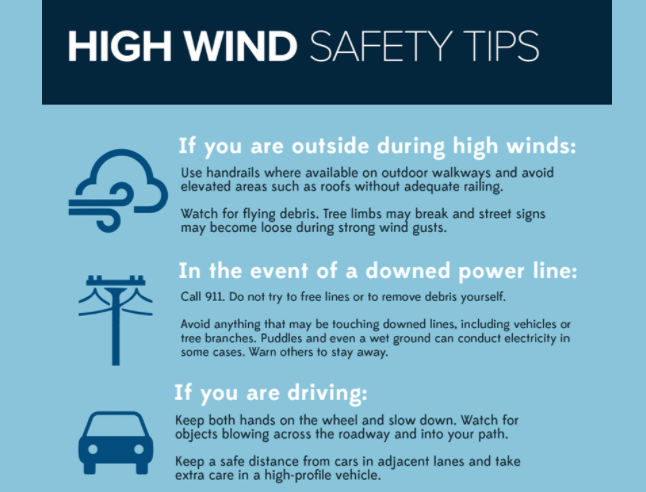

High Wind Safety Actions To Take During Fast Moving Storms

May 21, 2025

High Wind Safety Actions To Take During Fast Moving Storms

May 21, 2025 -

Abn Amro Rentedaling En De Impact Op Huizenprijzen

May 21, 2025

Abn Amro Rentedaling En De Impact Op Huizenprijzen

May 21, 2025

Latest Posts

-

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 21, 2025

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 21, 2025 -

Rtl Groups Streaming Strategy Profitability Projections And Key Milestones

May 21, 2025

Rtl Groups Streaming Strategy Profitability Projections And Key Milestones

May 21, 2025 -

Benjamin Kaellman Potentiaalia Taeynnae Huuhkajissa

May 21, 2025

Benjamin Kaellman Potentiaalia Taeynnae Huuhkajissa

May 21, 2025 -

Rtl Group On Track For Streaming Profitability A Deep Dive

May 21, 2025

Rtl Group On Track For Streaming Profitability A Deep Dive

May 21, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Kasvu

May 21, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Kasvu

May 21, 2025