US Credit Rating Downgrade Impacts Dow Futures And Dollar

Table of Contents

Understanding the US Credit Rating Downgrade

The Role of Credit Rating Agencies

Credit rating agencies like Moody's, S&P Global Ratings, and Fitch play a crucial role in assessing the creditworthiness of sovereign nations and corporations. Their methodologies involve analyzing various economic and financial factors to assign ratings, reflecting the likelihood of debt repayment. A downgrade signifies a decreased confidence in a country's ability to meet its debt obligations.

- Rating Levels: Ratings typically range from AAA (highest) to D (default). A downgrade from, for instance, AAA to AA+ signals increased risk.

- Meaning of a Downgrade: A downgrade reflects concerns about the country's fiscal health, potentially stemming from factors like rising national debt, unsustainable budget deficits, and political instability.

- Potential Consequences: Downgrades can lead to higher borrowing costs for the government, increased market volatility, and a weakened currency. The US credit rating downgrade is particularly significant due to the dollar's role as a global reserve currency.

The factors leading to this specific downgrade include:

- Increasing National Debt: The US national debt has reached unprecedented levels, raising concerns about long-term fiscal sustainability.

- Political Gridlock: Frequent political gridlock has hampered efforts to address the nation's fiscal challenges, further eroding investor confidence.

- Erosion of Institutional Capacity: Concerns regarding the effectiveness and predictability of US governance have also played a role.

Immediate Market Reactions

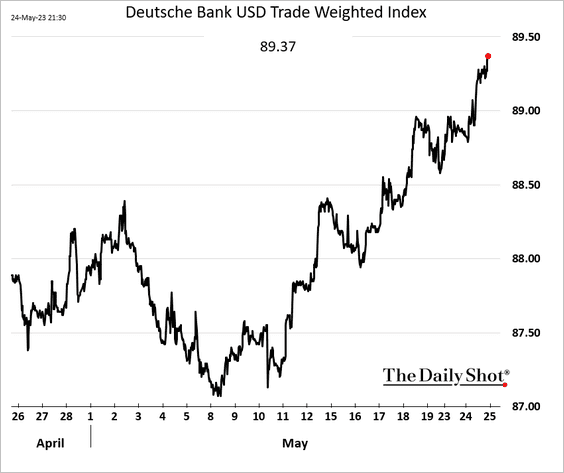

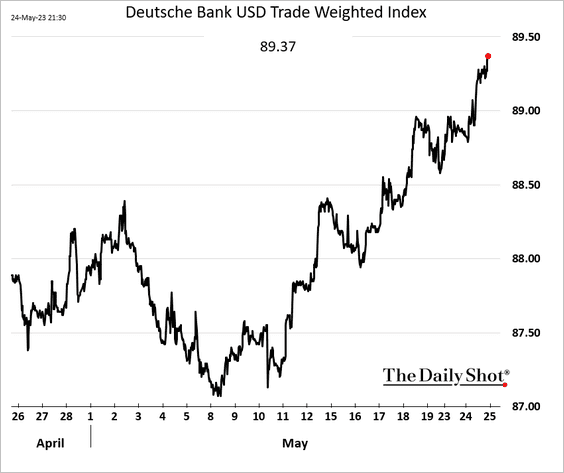

The announcement of the US credit rating downgrade triggered immediate and significant market reactions. Dow futures experienced a sharp drop, reflecting a flight to safety as investors sought less risky assets. The US dollar also weakened against other major currencies.

- Charts and Graphs: (Insert relevant charts and graphs illustrating the market's response to the downgrade, showing the price movements of Dow futures and the US dollar against other major currencies. Include data on trading volume to emphasize the market reaction.)

- Flight to Safety: Investors moved their capital into perceived safe-haven assets, such as US Treasury bonds (initially), gold, and other less volatile investments.

Impact on Dow Futures

Short-Term Volatility

The downgrade fueled significant short-term volatility in Dow futures contracts. Investor uncertainty and risk aversion led to increased price swings.

- Investor Confidence: The downgrade severely impacted investor confidence, leading to a sell-off in equities and increased hedging activity.

- Trading Strategies: Many investors adjusted their trading strategies, employing hedging mechanisms to mitigate potential losses. This included options trading and short-selling.

Long-Term Implications for Dow Jones Industrial Average

The long-term effects on the Dow Jones Industrial Average remain uncertain. However, several potential scenarios exist:

- Changes in Investment Strategies: Investors may shift their portfolios away from US equities, potentially leading to a prolonged period of depressed valuations.

- Potential for Recession: The downgrade could exacerbate existing economic headwinds, potentially increasing the likelihood of a recession.

- Impact on Corporate Earnings: Higher borrowing costs and reduced consumer confidence could negatively impact corporate earnings, leading to further downward pressure on the Dow.

Impact on the US Dollar

Dollar's Safe-Haven Status Challenged?

The US dollar has traditionally been considered a safe-haven asset during times of global uncertainty. However, this downgrade has challenged this status.

- Potential for Capital Flight: Investors might diversify away from dollar-denominated assets, leading to capital flight and weakening the currency.

- Impact on Interest Rates: The downgrade could lead to higher interest rates as the US government faces increased borrowing costs.

- Dollar's Role in Global Trade: The dollar's dominance in international trade could be impacted, leading to shifts in global currency dynamics.

International Implications

The ripple effect of the US credit rating downgrade extends beyond US borders, impacting global currency markets and international trade.

- Impacts on Other Major Currencies: The weaker dollar could strengthen other major currencies, altering global exchange rates.

- Potential for Trade Disputes: Economic uncertainty caused by the downgrade could exacerbate existing trade tensions and potentially lead to new disputes.

Conclusion

This article has explored the significant consequences of the recent US credit rating downgrade on Dow futures and the US dollar. The immediate market reactions demonstrated considerable volatility, and the long-term impacts remain uncertain, demanding close monitoring of economic indicators and investor behavior. The downgrade highlights underlying economic challenges and underscores the necessity for proactive fiscal and monetary policies. The interconnectedness of global markets means that this event's impact will be felt far beyond US borders.

Call to Action: Stay informed about the evolving situation surrounding the US credit rating downgrade and its persistent impact on Dow futures and the US dollar. Regularly review market updates and consult with financial advisors to make informed investment decisions. Understanding the implications of this significant event is crucial for effectively navigating the complexities of the current financial landscape. Monitoring the US credit rating and its effect on the global economy requires vigilance and proactive investment strategies.

Featured Posts

-

Le Theatre Tivoli De Clisson Un Tresor Architectural Restaure Grace Au Loto Du Patrimoine 2025

May 21, 2025

Le Theatre Tivoli De Clisson Un Tresor Architectural Restaure Grace Au Loto Du Patrimoine 2025

May 21, 2025 -

Henriksen The Mainz Manager Charting A Path After Klopp And Tuchel

May 21, 2025

Henriksen The Mainz Manager Charting A Path After Klopp And Tuchel

May 21, 2025 -

D Wave Quantum Qbts Stock Crash Reasons Behind The Monday Decline

May 21, 2025

D Wave Quantum Qbts Stock Crash Reasons Behind The Monday Decline

May 21, 2025 -

D Wave Quantum Inc Qbts Deciphering Mondays Stock Market Plunge

May 21, 2025

D Wave Quantum Inc Qbts Deciphering Mondays Stock Market Plunge

May 21, 2025 -

Abn Amro Waarschuwt Te Grote Afhankelijkheid Van Goedkope Arbeidsmigranten In De Voedingsindustrie

May 21, 2025

Abn Amro Waarschuwt Te Grote Afhankelijkheid Van Goedkope Arbeidsmigranten In De Voedingsindustrie

May 21, 2025

Latest Posts

-

Benjamin Kaellman Potentiaalia Taeynnae Huuhkajissa

May 21, 2025

Benjamin Kaellman Potentiaalia Taeynnae Huuhkajissa

May 21, 2025 -

Rtl Group On Track For Streaming Profitability A Deep Dive

May 21, 2025

Rtl Group On Track For Streaming Profitability A Deep Dive

May 21, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Kasvu

May 21, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Kasvu

May 21, 2025 -

Kaellmanin Maalivire Huuhkajien Apuna Mitae Odottaa

May 21, 2025

Kaellmanin Maalivire Huuhkajien Apuna Mitae Odottaa

May 21, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Kehitys

May 21, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Kehitys

May 21, 2025