US Regulatory Shift Sends Bitcoin To New Record High

Table of Contents

The cryptocurrency market is experiencing a dramatic upheaval. A recent US regulatory shift has unexpectedly sent Bitcoin soaring to new record highs. This unprecedented jump is sparking intense debate and speculation within the financial world. This article will explore the key factors contributing to this remarkable price surge and analyze its potential implications. We'll examine the regulatory changes, market sentiment, and other contributing factors that have led to this significant milestone for Bitcoin.

The Regulatory Shift: A Catalyst for Bitcoin's Rise

A pivotal moment in Bitcoin's history occurred recently with [Specific Regulatory Change, e.g., the passing of the "Digital Asset Market Structure Act" or a significant court ruling clarifying Bitcoin's legal status]. This regulatory change has dramatically altered the landscape for cryptocurrency in the US.

-

Details of the regulatory change and its implications: [Provide detailed explanation of the specific regulatory change. For example, explain how the new bill clarifies the legal definition of cryptocurrencies, provides a regulatory framework for exchanges, or offers tax clarity for cryptocurrency transactions. Be precise and cite specific sections or clauses if possible]. This change removes previous ambiguity surrounding [mention specific area of ambiguity, e.g., taxation, securities classification], thereby increasing institutional confidence.

-

How this change affects the perception of Bitcoin's legitimacy and future in the US: The regulatory clarity provided by [Name of Act/Ruling] has significantly boosted Bitcoin's legitimacy in the eyes of institutional investors and the general public. This reduced uncertainty is crucial for encouraging wider adoption and investment.

-

Links to official sources (government websites, legal documents): [Insert links to official government websites, legal documents, and press releases related to the regulatory change. This adds credibility and strengthens your SEO].

Increased Institutional Investment Fueling Bitcoin's Growth

The recent Bitcoin price surge isn't solely driven by retail investors. Large institutional investors, including hedge funds and corporations, are increasingly allocating capital to Bitcoin. This significant influx of institutional money has provided a powerful tailwind to the price.

-

Examples of institutional investors showing increased interest in Bitcoin: [Mention specific examples of large financial institutions investing in Bitcoin. Cite reputable news sources to back up your claims. Examples include: "BlackRock's recent filing for a Bitcoin ETF," or "MicroStrategy's continued Bitcoin accumulation."]. These investments represent a significant vote of confidence in Bitcoin's long-term potential.

-

Analysis of why institutions are now investing more heavily: Several factors contribute to increased institutional interest. These include: the regulatory clarity mentioned above, Bitcoin's potential as a hedge against inflation, and the belief that Bitcoin represents a new asset class with growth potential.

-

Mention of any relevant news articles or reports: [Include links to relevant news articles and reports supporting your claims about institutional investment in Bitcoin. This will further strengthen your article’s credibility and SEO].

Market Sentiment and Public Perception: A Positive Feedback Loop

Positive news and media coverage have created a self-reinforcing positive feedback loop, further propelling Bitcoin's price increase. This positive sentiment is contagious and amplified through various channels.

-

Impact of positive media coverage on public perception: Favorable media portrayals of Bitcoin, focusing on its price appreciation and potential as a store of value, have contributed to a more positive public perception, driving retail investor interest.

-

Analysis of social media sentiment and its influence on trading activity: Social media platforms like Twitter and Reddit are buzzing with discussion around Bitcoin. The overwhelmingly positive sentiment on these platforms has a direct influence on trading activity and price fluctuations.

-

Mention of prominent figures endorsing Bitcoin: [Mention any prominent business leaders, celebrities, or financial experts who have recently endorsed Bitcoin. This adds social proof and boosts the article’s appeal]. Their endorsements add further weight to the positive market sentiment surrounding Bitcoin.

The Role of Macroeconomic Factors

Broader economic trends also play a role in Bitcoin's price movements. Concerns about inflation and potential recessions can influence investor decisions.

-

How inflation might drive investment in Bitcoin as a hedge against currency devaluation: As inflation erodes the purchasing power of fiat currencies, Bitcoin, with its limited supply, is seen by some as a potential hedge against inflation.

-

How economic uncertainty might lead investors to seek safer alternatives like Bitcoin: During periods of economic uncertainty, investors often seek alternative assets perceived as safer havens. Bitcoin, despite its volatility, is increasingly viewed as such an asset by a segment of investors.

-

Potential correlation between traditional market downturns and Bitcoin's price movements: While not always perfectly correlated, Bitcoin's price can sometimes move inversely to traditional markets. This "safe haven" perception can become stronger during periods of market turmoil.

Conclusion

The recent surge in Bitcoin's price is a complex event driven by a confluence of factors. A pivotal US regulatory shift, coupled with increased institutional investment and a wave of positive market sentiment, has created a perfect storm propelling Bitcoin to new record highs. While macroeconomic factors also play a role, the regulatory change appears to be the most significant catalyst.

Call to Action: Stay informed about the latest developments in the evolving regulatory landscape and the potential impact on Bitcoin’s future. Follow our blog for continuous updates on the latest news and analysis concerning the impact of US regulatory changes on Bitcoin and other cryptocurrencies. Understanding these shifts is crucial for navigating the exciting and dynamic world of Bitcoin investing.

Featured Posts

-

New Southwest Airlines Policy Limitations On Portable Chargers In Carry On

May 23, 2025

New Southwest Airlines Policy Limitations On Portable Chargers In Carry On

May 23, 2025 -

Joe Jonass Mature Response To A Couples Disagreement

May 23, 2025

Joe Jonass Mature Response To A Couples Disagreement

May 23, 2025 -

Wolffs Optimism A Strong F1 Season Start

May 23, 2025

Wolffs Optimism A Strong F1 Season Start

May 23, 2025 -

Big Rig Rock Report 3 12 Your Rock 101 Learning Resource

May 23, 2025

Big Rig Rock Report 3 12 Your Rock 101 Learning Resource

May 23, 2025 -

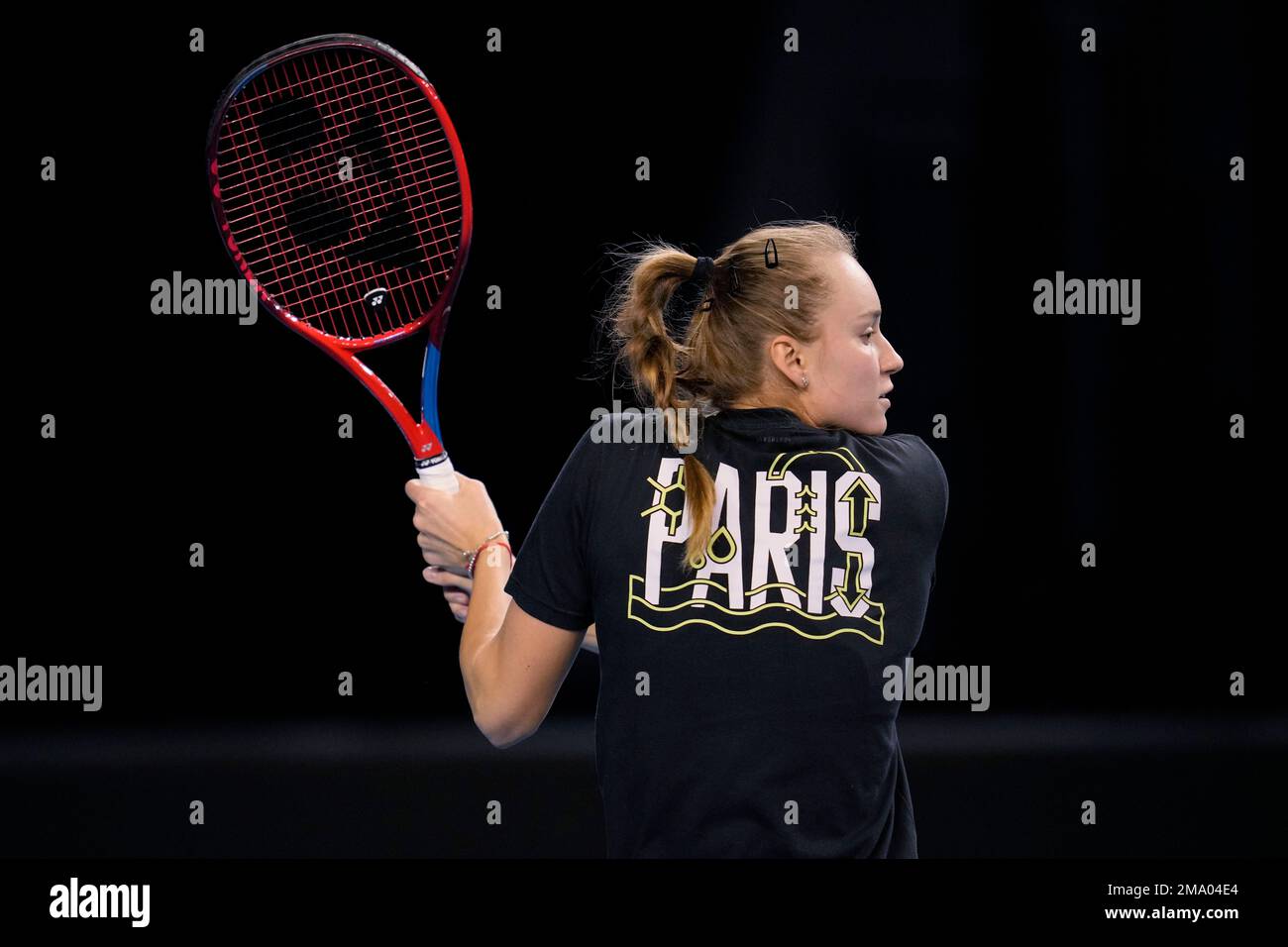

Rybakinas Power Propels Kazakhstan Into Billie Jean King Cup Finals

May 23, 2025

Rybakinas Power Propels Kazakhstan Into Billie Jean King Cup Finals

May 23, 2025

Latest Posts

-

The Story Behind A Couples Fight Over Joe Jonas

May 23, 2025

The Story Behind A Couples Fight Over Joe Jonas

May 23, 2025 -

Joe Jonas Defuses Couples Argument A Graceful Response

May 23, 2025

Joe Jonas Defuses Couples Argument A Graceful Response

May 23, 2025 -

Joe Jonass Mature Response To A Fans Marital Dispute

May 23, 2025

Joe Jonass Mature Response To A Fans Marital Dispute

May 23, 2025 -

Jonathan Groffs Just In Time Opening Lea Michele And Co Stars Celebrate

May 23, 2025

Jonathan Groffs Just In Time Opening Lea Michele And Co Stars Celebrate

May 23, 2025 -

Gideon Glick And Jonathan Groffs Etoile Reunion A Hilarious Spring Awakening Callback

May 23, 2025

Gideon Glick And Jonathan Groffs Etoile Reunion A Hilarious Spring Awakening Callback

May 23, 2025