US Stock Market Attracts Record Canadian Investment Amidst Trade Challenges

Table of Contents

Reasons Behind the Surge in Canadian Investment

Seeking Higher Returns

The US stock market has consistently outperformed the Canadian market in recent years. Several factors contribute to this:

- Stronger US Economic Growth: The US economy's robust growth, often exceeding that of Canada, fuels corporate earnings and drives stock prices higher. For example, in Q2 2023 (replace with current, accurate data), the US GDP growth rate was [insert data]% compared to Canada's [insert data]%, creating a more favorable investment climate.

- Higher Dividend Yields in Certain US Sectors: Certain US sectors, such as utilities and real estate investment trusts (REITs), offer comparatively higher dividend yields than their Canadian counterparts. This is particularly attractive to income-seeking investors. The average dividend yield for US REITs in [insert year] was [insert data]%, while the Canadian average was [insert data]%.

- Access to a Wider Range of Investment Opportunities: The US stock market boasts a significantly larger and more diverse range of companies and investment options, providing Canadian investors with greater opportunities for diversification and targeted investments.

Diversification Strategies

Canadian investors are increasingly using US stocks to diversify their portfolios and mitigate risk:

- Reducing Reliance on Canadian Resource-Heavy Sectors: The Canadian economy is heavily reliant on resource sectors (energy, mining). Investing in the US allows diversification away from this concentration risk.

- Hedging Against Canadian Economic Fluctuations: Investing in the US market acts as a hedge against potential downturns in the Canadian economy. The two markets don't always move in lockstep, offering a buffer against overall portfolio volatility.

- Access to Global Market Exposure through US-Listed Multinational Companies: Many global multinational companies are listed on US exchanges, providing Canadian investors with easy access to international market exposure.

Currency Exchange Rates

The USD/CAD exchange rate plays a crucial role in the attractiveness of US investments for Canadians.

- Favorable Exchange Rates Boost Returns: A weaker CAD relative to the USD can significantly enhance the returns for Canadian investors when converting US dollar profits back into Canadian dollars. Historically, periods of a weaker CAD have coincided with increased Canadian investment in US markets.

- Exchange Rate Risk: Conversely, a strengthening CAD can reduce returns. Therefore, understanding and managing currency exchange rate risk is essential for Canadian investors in the US market. Sophisticated hedging strategies can mitigate this risk.

Navigating Trade Challenges and Uncertainties

Impact of US-Canada Trade Relations

The USMCA (United States-Mexico-Canada Agreement) has largely stabilized trade relations between the US and Canada. However, potential future trade disputes or policy changes could still influence investor sentiment.

- USMCA Impact on Investor Confidence: The USMCA provides a framework for predictable trade flows, reducing uncertainty for investors. However, ongoing negotiations or potential future revisions could create temporary volatility.

- Impact of Tariffs or Trade Barriers: While the USMCA generally minimizes tariffs, potential future trade restrictions on specific sectors could influence investment decisions, making certain sectors less attractive.

Geopolitical Risks and Their Influence

Broader global economic and political factors significantly influence Canadian investment choices in the US market:

- Global Inflation and Interest Rate Hikes: Rising inflation and subsequent interest rate hikes impact both the US and Canadian markets. These factors can affect investor confidence and lead to market volatility.

- Geopolitical Instability: Global events such as wars or political unrest can create uncertainty and affect investment decisions in both markets, potentially leading to capital flight or increased risk aversion.

Popular Sectors Attracting Canadian Investment

Technology and Innovation

The US remains a global leader in technology and innovation, attracting significant Canadian investment:

- Tech Giants and Growth Stocks: Canadian investors are drawn to the high-growth potential of US tech giants and innovative startups listed on US exchanges, including those in software, artificial intelligence, and biotechnology.

Real Estate Investment Trusts (REITs)

US REITs are increasingly popular among Canadian investors due to several factors:

- Diversification Benefits: Investing in US REITs provides diversification beyond the Canadian real estate market.

- Potential Higher Yields: US REITs often offer higher dividend yields than Canadian REITs, making them attractive to income-seeking investors.

Other Key Sectors

Other sectors attracting Canadian investment include:

- Consumer Staples: These companies provide relatively stable returns even during economic downturns.

- Financials: The US financial sector offers a wide range of investment options, from banks to asset management firms.

- Industrials: This sector encompasses companies involved in manufacturing, transportation, and other essential industries.

Conclusion

The record-breaking influx of Canadian investment in the US stock market is a result of several compelling factors. Investors are driven by the pursuit of higher returns, the need for portfolio diversification to mitigate risk associated with a reliance on the Canadian market, and the relative stability offered by the USMCA. While geopolitical uncertainties and currency fluctuations remain considerations, the attractiveness of the US market persists.

Are you a Canadian investor seeking higher returns and diversification? Explore the opportunities presented by the US stock market today! Learn more about [link to relevant resource, e.g., a reputable financial advisor or investment platform].

Featured Posts

-

Canadian Households Face The Fallout Of Trumps Tariff Turmoil

Apr 23, 2025

Canadian Households Face The Fallout Of Trumps Tariff Turmoil

Apr 23, 2025 -

Car Dealers Intensify Fight Against Ev Sales Mandates

Apr 23, 2025

Car Dealers Intensify Fight Against Ev Sales Mandates

Apr 23, 2025 -

Pazartesi Okul Tatil Mi Istanbul Resmi Aciklama

Apr 23, 2025

Pazartesi Okul Tatil Mi Istanbul Resmi Aciklama

Apr 23, 2025 -

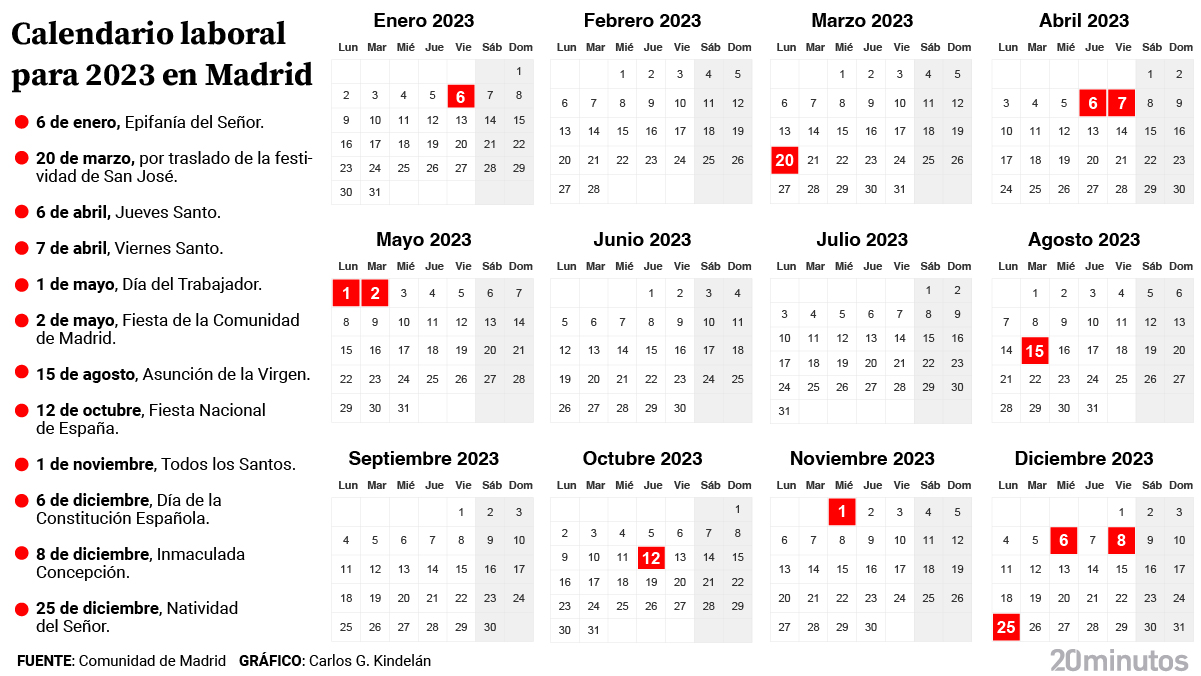

Festivo 21 De Abril Calendario Laboral Y Puente Para Espana

Apr 23, 2025

Festivo 21 De Abril Calendario Laboral Y Puente Para Espana

Apr 23, 2025 -

Christian Yelichs First Homer Since Back Surgery A Milestone Moment

Apr 23, 2025

Christian Yelichs First Homer Since Back Surgery A Milestone Moment

Apr 23, 2025