US Stock Market Surge: Tech Giants Power Gains, Tesla In The Lead

Table of Contents

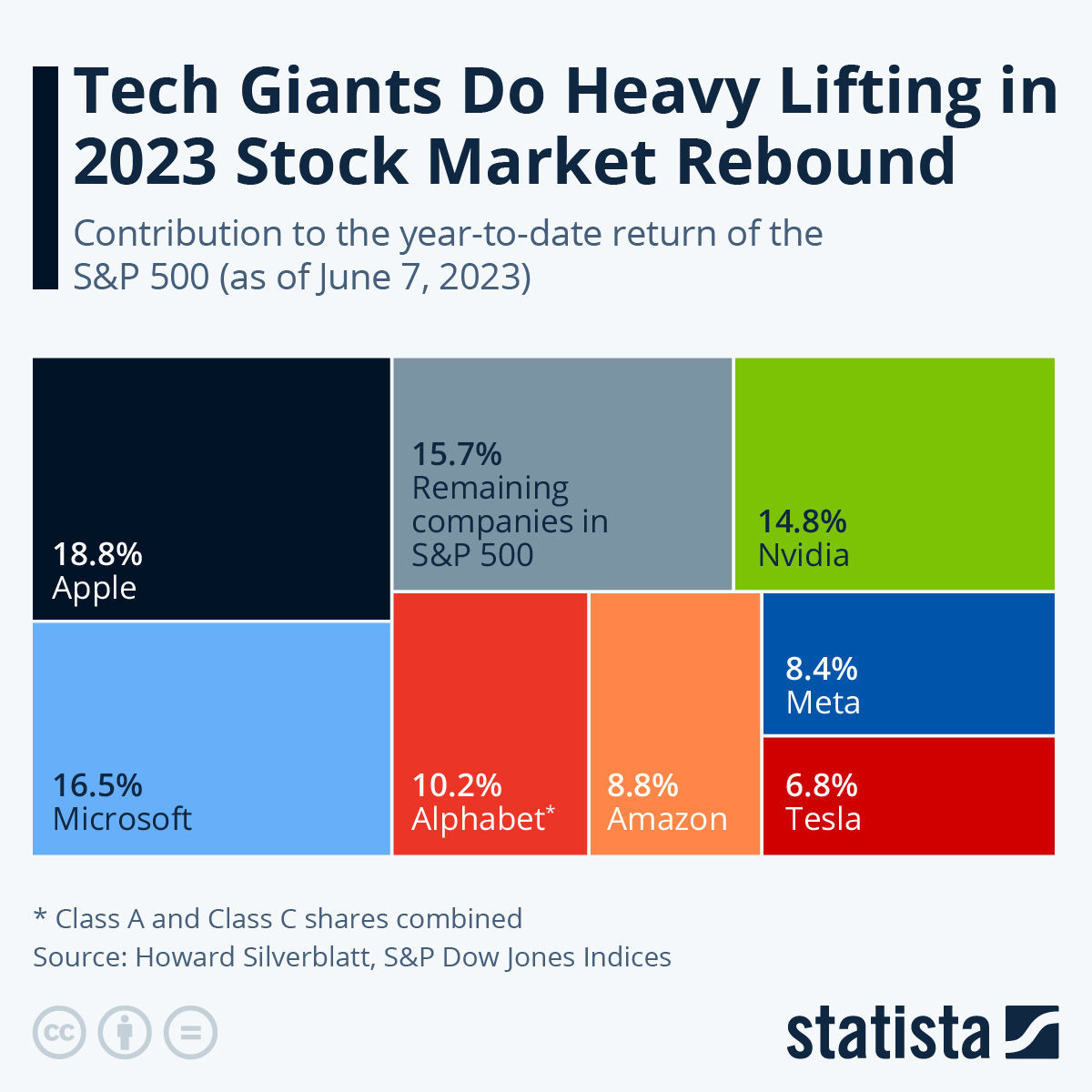

Tech Giants Fueling the Market Rally

The "Big Tech" companies—Apple, Microsoft, Google (Alphabet), Amazon, and Meta (formerly Facebook)—have played a pivotal role in this stock market rally. Their strong financial performance has significantly boosted overall market gains.

- Exceptional Financial Performance: These companies have consistently exceeded earnings expectations, demonstrating impressive revenue growth. For example, Apple's robust iPhone sales and expansion into services have driven significant gains, while Microsoft's cloud computing dominance continues to fuel its market capitalization.

- Innovation and Technological Advancements: New product launches and technological advancements have further propelled stock prices. The release of new iPhones, the expansion of Microsoft's Azure cloud platform, and Google's advancements in AI have all contributed to positive investor sentiment and increased "tech stock performance."

- Positive Investor Sentiment: Investors remain bullish on the long-term prospects of these tech giants, contributing to their high valuations. The belief in their continued innovation and market dominance fuels further investment and supports the ongoing market rally. This positive sentiment is reflected in the high "market capitalization" of these FAANG stocks.

Tesla's Exceptional Performance and its Influence

Tesla's remarkable stock price gains have been a major catalyst for the recent market surge. Its influence extends beyond the automotive sector, impacting broader market sentiment and investor confidence.

- Strong Vehicle Deliveries and Expanding Production: Tesla's consistently strong vehicle deliveries and its expansion of production capacity globally have significantly boosted investor confidence. The increasing demand for electric vehicles (EVs) fuels this growth.

- Elon Musk's Impact: Elon Musk's actions and announcements, while often controversial, have a significant impact on Tesla's stock price. His pronouncements on new technologies and future plans create volatility but also attract attention and investment, influencing the "EV sector" as a whole.

- Comparison to Other Automakers: Tesla's performance dwarfs that of traditional automakers, solidifying its position as a market leader in the "electric vehicle market." This performance contributes to the positive "Tesla growth" narrative and overall market sentiment.

Broader Economic Factors Contributing to the Surge

While the performance of individual companies is crucial, broader macroeconomic factors also contribute significantly to the positive market sentiment.

- Interest Rate Changes: Interest rate adjustments by the Federal Reserve influence borrowing costs and investor behavior. While rate hikes can initially dampen market enthusiasm, a perceived control over inflation can lead to renewed investor confidence and market gains.

- Inflation Rates and Investor Behavior: Inflation rates significantly impact investor behavior. Moderate inflation can be positive, but high inflation can erode investor confidence, leading to market volatility. Currently, the market seems to be responding positively to indications of controlled inflation.

- Economic Growth and Market Performance: Overall economic growth is strongly correlated with market performance. Strong economic indicators generally lead to a more positive market outlook and increased investor confidence.

- Geopolitical Events and Market Volatility: Geopolitical events can introduce uncertainty and volatility into the market. However, in the current climate, the market seems relatively resilient to many geopolitical headwinds.

Potential Risks and Future Outlook

Despite the current positive market trend, several risks could impact the continued upward trajectory of the US stock market.

- Market Correction: The potential for a market correction or downturn remains a significant risk. Periods of rapid growth are often followed by periods of consolidation or decline.

- Geopolitical Uncertainties: Ongoing geopolitical tensions and uncertainties could negatively affect investor sentiment and market stability.

- Inflationary Pressures: Persistent inflationary pressures could lead to further interest rate hikes, potentially dampening economic growth and negatively impacting stock valuations.

- Sectoral Competition: Increased competition within the tech and EV sectors could impact the performance of leading companies.

Conclusion: Navigating the US Stock Market Surge – What to Expect Next

The recent US stock market surge is primarily driven by the exceptional performance of tech giants and Tesla, alongside favorable macroeconomic factors. However, investors should remain aware of potential risks, including the possibility of a market correction and ongoing geopolitical uncertainties. To navigate these conditions, it's crucial to monitor market trends carefully, diversify investments, and consult with financial advisors before making any significant investment decisions. Understanding market risks is paramount to making "informed investment decisions" during this "US stock market surge." Remember to "monitor market trends" closely to make the best choices for your portfolio. Stay informed about the latest developments in the US stock market and make sound, informed investment decisions.

Featured Posts

-

Ray Epps V Fox News A Defamation Lawsuit Examining January 6th Narratives

Apr 29, 2025

Ray Epps V Fox News A Defamation Lawsuit Examining January 6th Narratives

Apr 29, 2025 -

Ferry And Boat Collision In Clearwater Florida Details On The Tragedy

Apr 29, 2025

Ferry And Boat Collision In Clearwater Florida Details On The Tragedy

Apr 29, 2025 -

Cassidy Hutchinson Jan 6 Hearing Testimony To Become Fall Memoir

Apr 29, 2025

Cassidy Hutchinson Jan 6 Hearing Testimony To Become Fall Memoir

Apr 29, 2025 -

Double Trouble In Hollywood Writers And Actors Strike Brings Industry To Standstill

Apr 29, 2025

Double Trouble In Hollywood Writers And Actors Strike Brings Industry To Standstill

Apr 29, 2025 -

50 000 Fine For Anthony Edwards Following Vulgar Exchange With Fan

Apr 29, 2025

50 000 Fine For Anthony Edwards Following Vulgar Exchange With Fan

Apr 29, 2025

Latest Posts

-

The Porsche Puzzle Why Australias Enthusiasm Lags Behind

Apr 29, 2025

The Porsche Puzzle Why Australias Enthusiasm Lags Behind

Apr 29, 2025 -

Dsv Leoben Neues Trainerteam Fuer Die Regionalliga Mitte

Apr 29, 2025

Dsv Leoben Neues Trainerteam Fuer Die Regionalliga Mitte

Apr 29, 2025 -

Is Australia Missing Out Exploring The Global Love For This Porsche

Apr 29, 2025

Is Australia Missing Out Exploring The Global Love For This Porsche

Apr 29, 2025 -

Missing Person British Paralympian Last Seen In Las Vegas Over A Week Ago

Apr 29, 2025

Missing Person British Paralympian Last Seen In Las Vegas Over A Week Ago

Apr 29, 2025 -

Seven Days Missing Las Vegas Police Investigate Paralympians Disappearance

Apr 29, 2025

Seven Days Missing Las Vegas Police Investigate Paralympians Disappearance

Apr 29, 2025