US Tariffs Influence Brookfield's Manufacturing Investment Decisions

Table of Contents

The Impact of Section 301 Tariffs on Brookfield's Investment Strategy

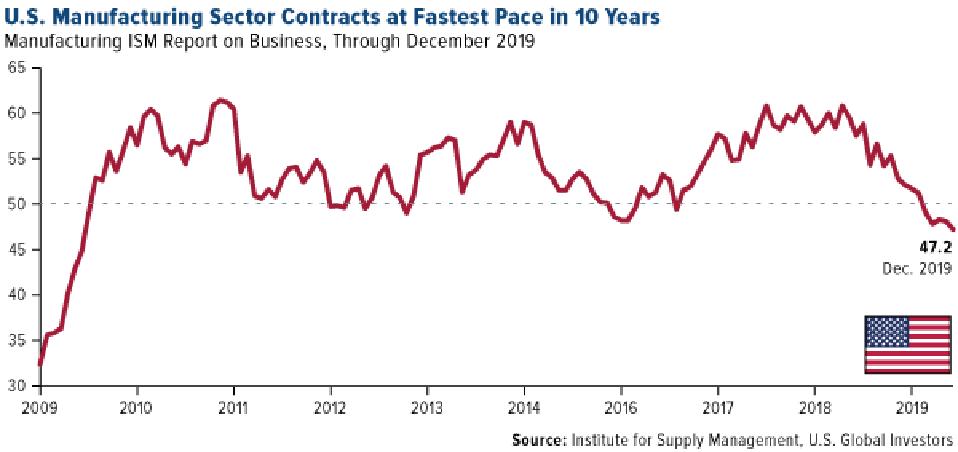

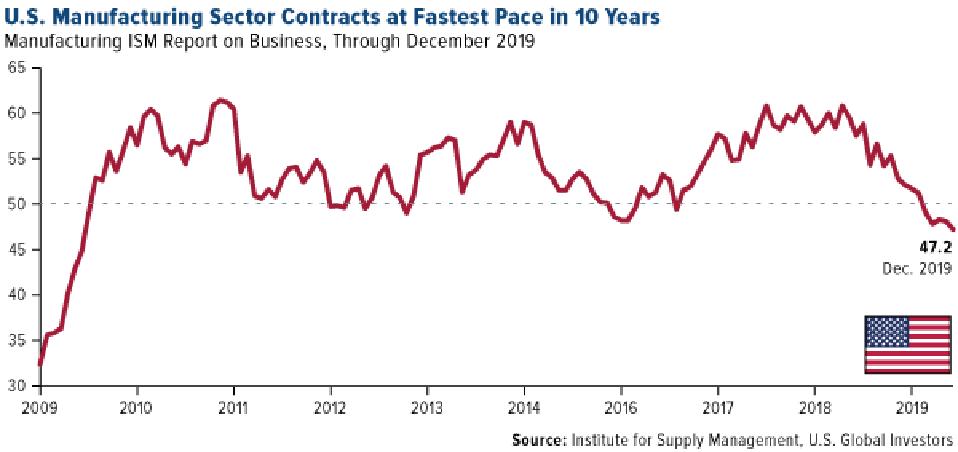

Section 301 tariffs, imposed by the US government, are a key factor affecting Brookfield's investment strategy in US manufacturing. These tariffs, designed to protect domestic industries from unfair foreign competition, place additional duties on imported goods. This has several significant consequences for Brookfield's investments:

-

Increased input costs for imported goods: Many US manufacturers rely on imported components and raw materials. Section 301 tariffs increase the cost of these inputs, directly impacting profitability. This makes US-based manufacturing less competitive compared to production in countries without these tariffs.

-

Potential for reduced profitability on US-manufactured goods using imported components: Even if the final product is manufactured in the US, reliance on imported parts increases the final cost, reducing the product's competitiveness in the global market. Brookfield needs to carefully consider this factor when evaluating potential investments.

-

Necessity for diversification of supply chains: To mitigate the risk associated with tariff increases, Brookfield is likely diversifying its supply chains. This involves sourcing components from multiple countries to reduce reliance on any single source potentially subject to tariffs.

-

Increased scrutiny of foreign sourcing and potential for reshoring initiatives: Brookfield is likely scrutinizing its sourcing strategies, assessing the costs and benefits of reshoring – bringing manufacturing operations back to the US – to avoid tariff impacts. This is a significant shift in global manufacturing strategies.

-

Analysis of tariff impact on specific industries Brookfield invests in (e.g., steel, aluminum): Industries like steel and aluminum, heavily impacted by Section 301 tariffs, require a nuanced investment approach from Brookfield. The company needs to analyze the long-term viability of investments in these sectors considering ongoing tariff uncertainties.

Brookfield's Risk Assessment and Mitigation Strategies in Response to US Tariffs

Brookfield employs robust risk assessment and mitigation strategies to navigate the complexities of US tariffs. Their approach involves:

-

Due diligence processes involving tariff impact assessments: Before making any investment, Brookfield conducts thorough due diligence, including detailed assessments of the potential impact of existing and future tariffs on the targeted company and its supply chain.

-

Scenario planning and risk modelling to forecast potential losses: Brookfield uses sophisticated models to forecast potential financial losses under various tariff scenarios, allowing for better decision-making and risk management.

-

Strategies for negotiating with suppliers to mitigate tariff impacts: Brookfield likely engages in negotiations with its suppliers to explore options for cost reduction and shared responsibility for tariff burdens.

-

Exploring alternative sourcing options (domestic or other countries): Brookfield is likely actively seeking alternative sourcing options, both domestically within the US and internationally in countries with favorable trade relations.

-

Investment in automation and technology to reduce reliance on imported components: Investing in automation and advanced technologies can help reduce reliance on imported components, mitigating the impact of tariffs and improving efficiency.

The Influence of US Tariffs on Brookfield's Long-Term Manufacturing Investment Plans

US tariffs significantly shape Brookfield's long-term vision for manufacturing investments:

-

Shifting investment priorities towards sectors less affected by tariffs: Brookfield is likely prioritizing investments in sectors less exposed to tariffs, ensuring a more stable and predictable return on investment.

-

Increased focus on domestic manufacturing and job creation in the US: To mitigate tariff risks, Brookfield may be increasing its focus on domestic manufacturing, contributing to job creation in the US.

-

Potential for increased investment in technology and automation to offset tariff costs: Investments in technology and automation can help offset increased input costs caused by tariffs, improving productivity and reducing reliance on imported components.

-

Long-term implications for US manufacturing competitiveness and employment: Brookfield's decisions contribute to the broader debate on US manufacturing competitiveness and employment in a globalized, tariff-affected market.

-

Discussion on Brookfield's lobbying efforts and advocacy regarding tariff policy: Brookfield may engage in lobbying efforts to advocate for policies that promote fair trade and reduce the negative impacts of tariffs on the manufacturing sector.

Case Study: A Specific Brookfield Manufacturing Investment Decision Influenced by US Tariffs (Optional)

(This section would require specific information on a Brookfield investment decision directly influenced by tariffs. An example might involve a decision to invest in a US-based manufacturer of solar panels, a sector benefiting from tariffs on imported panels, rather than a similar manufacturer overseas.)

Conclusion

US tariffs have profoundly influenced Brookfield's manufacturing investment decisions, forcing the company to adopt sophisticated risk management strategies, diversify its supply chains, and reassess its long-term investment plans. The impact of these tariffs continues to shape the landscape of US manufacturing and global investment strategies. To stay informed about the evolving impact of US tariffs on global investment decisions, and specifically how they affect Brookfield's strategic direction, continue to follow our updates on [link to relevant page/blog]. Understanding the influence of US tariffs is crucial for navigating the complexities of the global manufacturing industry and making sound investment choices.

Featured Posts

-

Remembering Poppy Atkinson A Joint Tribute From Manchester United And Bayern Munich

May 02, 2025

Remembering Poppy Atkinson A Joint Tribute From Manchester United And Bayern Munich

May 02, 2025 -

Remembering A Dallas Icon Passing At 100

May 02, 2025

Remembering A Dallas Icon Passing At 100

May 02, 2025 -

Lotto Jackpot Saturday April 12th Winning Numbers

May 02, 2025

Lotto Jackpot Saturday April 12th Winning Numbers

May 02, 2025 -

Daisy May Cooper And Charlie Coopers New Bbc Show After Celeb Traitors

May 02, 2025

Daisy May Cooper And Charlie Coopers New Bbc Show After Celeb Traitors

May 02, 2025 -

Six Nations France Sends Ireland A Message With Italy Victory

May 02, 2025

Six Nations France Sends Ireland A Message With Italy Victory

May 02, 2025

Latest Posts

-

Aleksandr Lakazet 157 Gola Vv Frantsiya Nov Rekord

May 03, 2025

Aleksandr Lakazet 157 Gola Vv Frantsiya Nov Rekord

May 03, 2025 -

Will Boris Johnson Ride To The Rescue Of The Conservative Party

May 03, 2025

Will Boris Johnson Ride To The Rescue Of The Conservative Party

May 03, 2025 -

Alan Roden Examining His Style And Themes In The Spectators Writings

May 03, 2025

Alan Roden Examining His Style And Themes In The Spectators Writings

May 03, 2025 -

Could Boris Johnsons Comeback Save The Tories

May 03, 2025

Could Boris Johnsons Comeback Save The Tories

May 03, 2025 -

Alan Rodens Contributions To The Spectator A Critical Analysis

May 03, 2025

Alan Rodens Contributions To The Spectator A Critical Analysis

May 03, 2025