US Tariffs Weigh On Copper: Tongling's Short-Term Forecast

Table of Contents

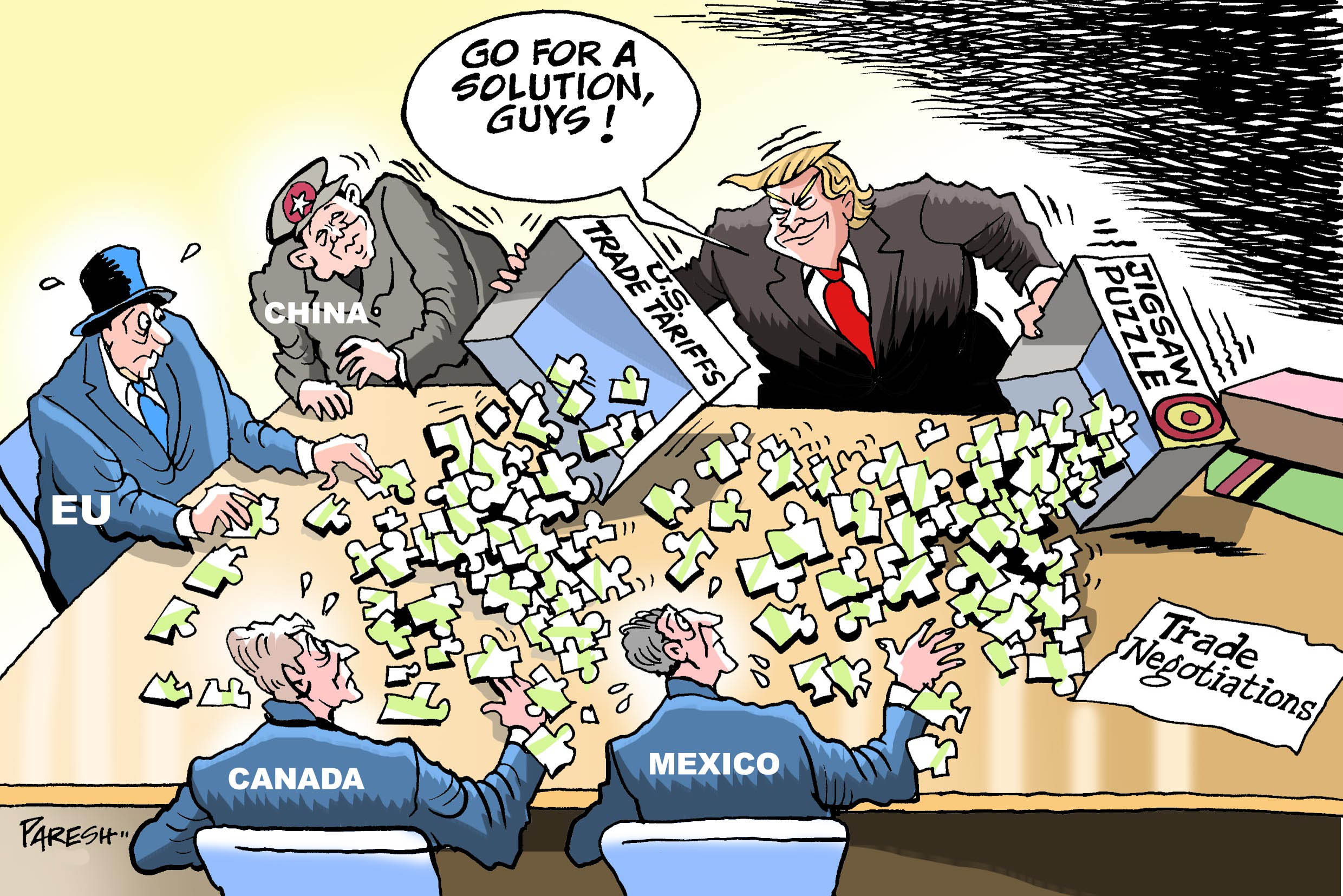

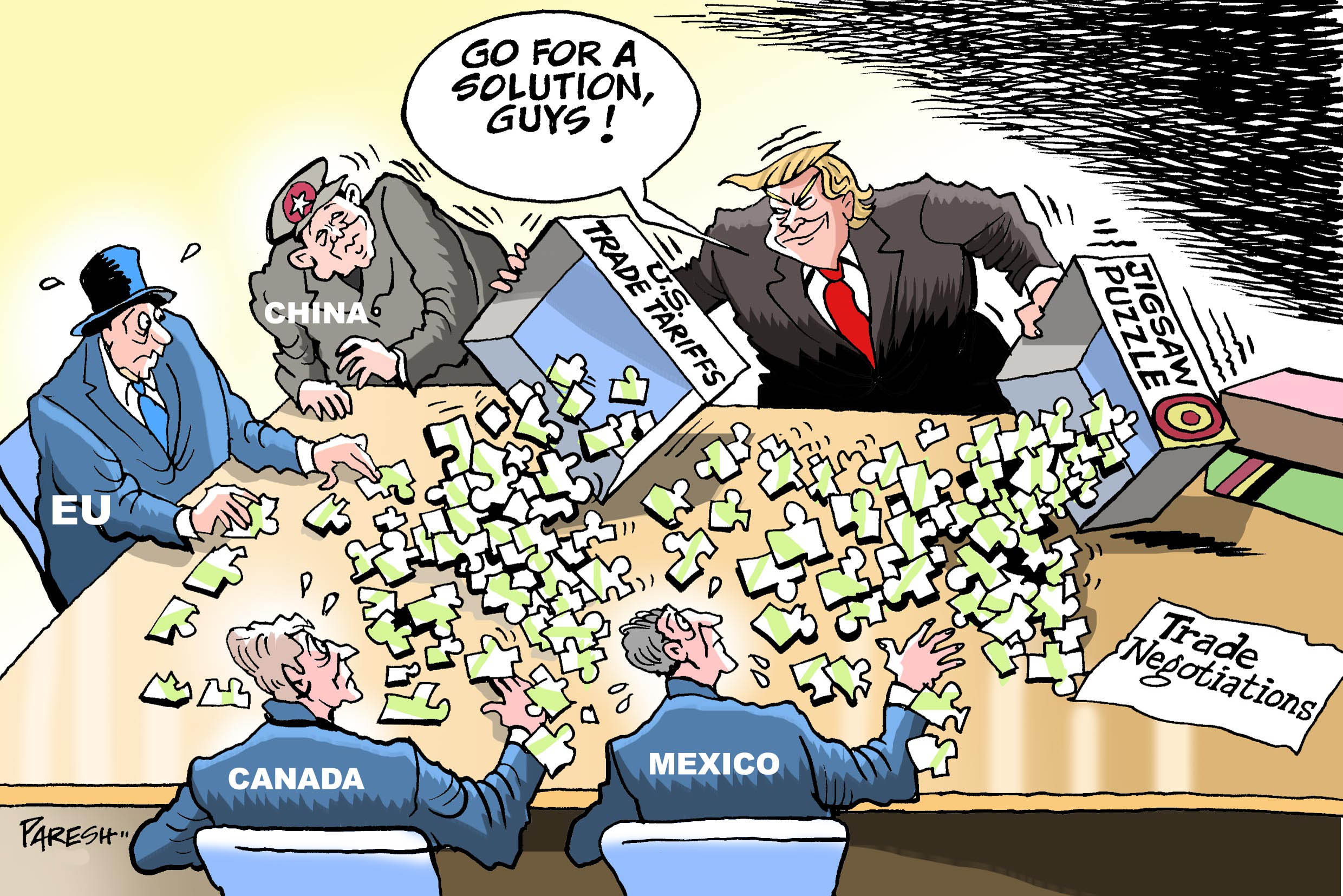

The Impact of US Tariffs on Global Copper Prices

US tariffs on imported goods, including copper, have had a profound impact on global copper prices. This impact stems from two primary channels: increased import costs and reduced demand from the US market.

Increased Import Costs

US tariffs directly increase the cost of copper imported from countries like China, a major copper producer. These tariffs act as an additional tax, raising the price of copper for US consumers and businesses.

- Specific Tariff Rates: The exact tariff rates vary depending on the type of copper product and the country of origin. However, even modest tariff increases can significantly impact global copper prices due to the sheer volume of copper traded internationally.

- Implementation Timeline: The implementation of these tariffs has been phased in over time, creating further uncertainty and volatility in the market. This staggered approach makes it difficult for companies like Tongling to accurately predict future costs and pricing strategies.

- Effect on Copper Product Categories: Tariffs disproportionately affect certain copper product categories, impacting downstream industries that rely heavily on those specific types of copper. For instance, tariffs on refined copper may impact the electronics industry more severely than those on raw copper. Data on price fluctuations since the implementation of the tariffs reveals a clear upward trend, increasing the overall cost of copper globally.

Reduced Demand from the US Market

Higher copper prices, resulting from the tariffs, lead to reduced demand from US-based manufacturers. This decreased demand contributes to a weakening of global copper consumption.

- Affected Industries: Industries such as construction, manufacturing, and electronics are particularly sensitive to copper price increases. Higher costs make projects less economically viable, leading to project delays or cancellations.

- Reduced Orders & Project Delays: Numerous reports highlight reduced orders for copper from US-based companies since the implementation of the tariffs. This reduction in demand further depresses prices, particularly for copper producers heavily reliant on the US market.

- US Copper Import Volumes: Data comparing US copper import volumes before and after tariff implementation shows a notable decrease, confirming the negative impact of these policies on US demand and global copper consumption.

Tongling Nonferrous Metals' Exposure to US Tariffs

Tongling Nonferrous Metals, a significant global copper producer, is significantly exposed to the effects of US tariffs due to its export dependence and price sensitivity.

Export Dependence

Tongling's revenue is heavily reliant on exporting copper to the US market. A substantial portion of its total exports is destined for the US.

- Proportion of Exports to the US: Precise figures on the exact percentage of Tongling's exports to the US are not consistently publicly available. However, industry reports suggest a significant reliance on the US market.

- Specific Copper Products Exported: Tongling exports a range of copper products, including refined copper, copper cathodes, and copper alloys. The US market's demand for these products directly influences Tongling's profitability.

Price Sensitivity

Tongling's profitability is highly sensitive to fluctuations in global copper prices. The US tariffs exacerbate this sensitivity, as any decrease in US demand impacts prices and, consequently, Tongling's bottom line.

- Cost Structure & Price Shock Absorption: Tongling’s ability to absorb price shocks depends on its cost structure and efficiency. However, sustained lower prices due to reduced US demand put significant pressure on profit margins.

- Hedging Strategies: To mitigate price risk, Tongling likely employs hedging strategies, such as futures contracts. However, the sudden and significant impact of US tariffs can make these strategies less effective in completely shielding the company from losses.

Alternative Markets

To mitigate the impact of reduced US demand, Tongling is likely exploring and developing alternative export markets.

- Key Alternative Markets: Tongling may be focusing on markets in Asia, Europe, and other regions with growing demand for copper.

- Potential for Growth: The success of diversifying into these alternative markets depends on the competitiveness of Tongling's pricing and the strength of demand in these regions.

Short-Term Forecast for Tongling Nonferrous Metals

Based on the ongoing impact of US tariffs and various mitigating factors, a short-term forecast for Tongling Nonferrous Metals can be cautiously offered.

Revenue Projections

Given the reduced US demand and increased competition, Tongling's short-term revenue is projected to experience a downturn.

- Data Points Supporting Projections: These projections are based on analysis of current copper prices, anticipated US demand, and Tongling's historical sales data.

- Potential Scenarios Based on Tariff Outcomes: Different scenarios are possible depending on any future changes or adjustments to US tariff policies.

Profitability Outlook

The short-term outlook for Tongling's profitability is negatively impacted due to the projected revenue decline and the high sensitivity to copper price fluctuations.

- Potential Risks & Opportunities: Risks include further price decreases and reduced demand. Opportunities lie in successful diversification into new markets and cost-cutting measures.

Stock Market Implications

The short-term forecast suggests a potential negative impact on Tongling's stock price, reflecting the uncertainty and challenges posed by the US tariffs.

- Insights Based on Financial Modeling & Market Trends: Financial modeling incorporating the revenue and profitability projections will indicate a possible decline in stock value. Market trends also suggest investor caution towards companies heavily exposed to US tariffs.

Conclusion

US tariffs on copper have significantly impacted global prices and presented considerable challenges for major copper producers like Tongling Nonferrous Metals. Decreased US demand and increased import costs create a challenging short-term outlook for Tongling. The company's success will depend on its ability to diversify its export markets and effectively manage its cost structure. To fully grasp the long-term effects, it’s crucial to continue monitoring the situation and the evolving impact of US tariffs on copper prices and companies like Tongling Nonferrous Metals. Further research into Tongling's financial reports and continuous monitoring of global copper price movements are recommended.

Featured Posts

-

24 Subat Pazartesi Izmir De Okullar Kapali Mi Kar Tatilinin Son Durumu

Apr 23, 2025

24 Subat Pazartesi Izmir De Okullar Kapali Mi Kar Tatilinin Son Durumu

Apr 23, 2025 -

9 7 Victory For Brewers Against Cubs High Winds Impact Game

Apr 23, 2025

9 7 Victory For Brewers Against Cubs High Winds Impact Game

Apr 23, 2025 -

Resume De Good Morning Business Du Lundi 24 Fevrier

Apr 23, 2025

Resume De Good Morning Business Du Lundi 24 Fevrier

Apr 23, 2025 -

Son Dakika Erzurum Okullari Tatil Mi Degil Mi 24 Subat Pazartesi Guencel Durum

Apr 23, 2025

Son Dakika Erzurum Okullari Tatil Mi Degil Mi 24 Subat Pazartesi Guencel Durum

Apr 23, 2025 -

Explore Pentrich Brewing The Factory Taproom And Brewery Tour

Apr 23, 2025

Explore Pentrich Brewing The Factory Taproom And Brewery Tour

Apr 23, 2025