VMware Costs To Skyrocket 1,050%: AT&T's Concerns Over Broadcom's Acquisition

Table of Contents

AT&T's Vocal Opposition and the 1,050% VMware Cost Projection

AT&T's public statement regarding the Broadcom-VMware merger paints a stark picture: a potential 1,050% surge in their VMware licensing costs. The telecommunications giant bases this projection on analyses of Broadcom’s past acquisition strategies and their projected pricing models for VMware's products. This substantial increase could severely impact AT&T's operational budget and force them to re-evaluate their IT infrastructure strategy. While a specific quote from AT&T isn't publicly available at this time, their filed concerns with regulatory bodies clearly express their deep apprehension about the cost implications.

- Specific examples of VMware products and services affected: The projected 1,050% increase isn't necessarily uniform across all VMware products. While specific details remain confidential, it's likely that high-usage enterprise solutions like vSphere, vSAN, and NSX will see the most significant price hikes.

- Breakdown of the 1,050% increase: The 1,050% figure represents AT&T's projection of their overall VMware cost increase based on their current usage. Whether this is an average across all products or weighted towards specific, high-volume licenses, remains unclear. Further investigation into AT&T's cost analysis is needed for a clearer picture.

- Legal challenges and regulatory hurdles: AT&T’s concerns extend beyond mere cost increases. They are likely to participate in, or even initiate, legal challenges and utilize regulatory avenues to challenge the acquisition if the cost projections prove accurate and negatively impact their business.

Broadcom's Response and the Justification for Price Increases

Broadcom, in response to AT&T's and other parties' concerns, has maintained that the acquisition will ultimately benefit VMware customers through increased innovation and investment. They argue that synergies between the two companies will lead to cost efficiencies that could offset any price increases. Broadcom points to its commitment to research and development as a justification for potential price adjustments, promising enhanced product features and improved performance. However, concrete reassurances about specific pricing strategies remain limited.

- Specific points from Broadcom’s statements: Broadcom’s official statements focus heavily on long-term benefits and innovation, but lack specifics regarding pricing structures post-acquisition. The company has refrained from directly addressing the 1,050% figure.

- Analysis of the credibility of Broadcom’s arguments: The credibility of Broadcom's arguments hinges on their ability to deliver on their promises of enhanced innovation and cost efficiencies. Past acquisitions by Broadcom offer mixed results in terms of subsequent pricing changes, making it difficult to definitively assess the veracity of their current claims.

- Comparison to pricing strategies in other similar acquisitions: Analyzing Broadcom's pricing strategies in previous acquisitions of comparable enterprise software companies is crucial for evaluating the likelihood of the projected VMware cost increase. This analysis could provide valuable insights into their post-merger pricing practices.

Impact on the Broader Tech Landscape and VMware Customers

The potential VMware cost increases, if realized, extend far beyond AT&T. Numerous businesses relying on VMware virtualization solutions face the prospect of substantial budget overruns. Reduced competition in the virtualization market following the acquisition also raises concerns about innovation and the development of alternative solutions.

- Potential impact on small and medium-sized businesses: Smaller companies with limited budgets may face the most significant challenges, potentially being forced to explore less-cost-effective alternatives or compromise on their IT infrastructure capabilities.

- Alternatives to VMware virtualization solutions: The acquisition could spur increased interest in alternative virtualization technologies, such as those offered by Microsoft, Citrix, or open-source solutions. This could potentially foster greater competition and innovation in the long run.

- Long-term implications for the cloud computing market: The merger’s effects on the cloud computing market are multifaceted, potentially influencing pricing strategies, competition, and overall cloud adoption rates. The increased VMware costs could push some businesses towards public cloud alternatives.

Antitrust Concerns and Regulatory Scrutiny

The Broadcom-VMware merger has attracted significant antitrust scrutiny from regulatory bodies like the FTC and the EU. Concerns revolve around reduced competition within the virtualization and networking markets, potentially leading to higher prices and less innovation for consumers. Ongoing investigations are examining whether the acquisition would create a monopoly or significantly lessen competition, and whether the merger is in the public interest.

- Specific antitrust concerns: Concerns primarily center around Broadcom's already substantial market share in networking and its potential dominance in the virtualization market post-acquisition.

- Potential outcomes of regulatory reviews: Possible outcomes range from unconditional approval to the imposition of conditions (like divestitures) or even a complete blocking of the merger.

- Precedents set by previous antitrust cases: Previous antitrust cases involving large tech mergers offer valuable precedents and insights into the potential legal battles ahead and the likelihood of regulatory intervention.

Conclusion

AT&T's alarming projection of a 1,050% increase in VMware costs highlights the serious concerns surrounding the Broadcom acquisition. Broadcom's response, focusing on future innovation, needs more concrete evidence to offset the potential for significant price hikes. The impact on businesses, particularly smaller companies, is likely to be substantial. Regulatory scrutiny from antitrust authorities could play a critical role in determining the final outcome. The long-term implications for the virtualization and cloud computing markets remain uncertain.

Call to Action: Stay informed about the ongoing developments in the Broadcom-VMware acquisition. Monitor regulatory decisions closely and consider evaluating alternative virtualization solutions to mitigate the risk of substantial VMware cost increases. Actively research the impact of this acquisition on your specific VMware licensing costs and budget. The future of your VMware infrastructure may depend on it.

Featured Posts

-

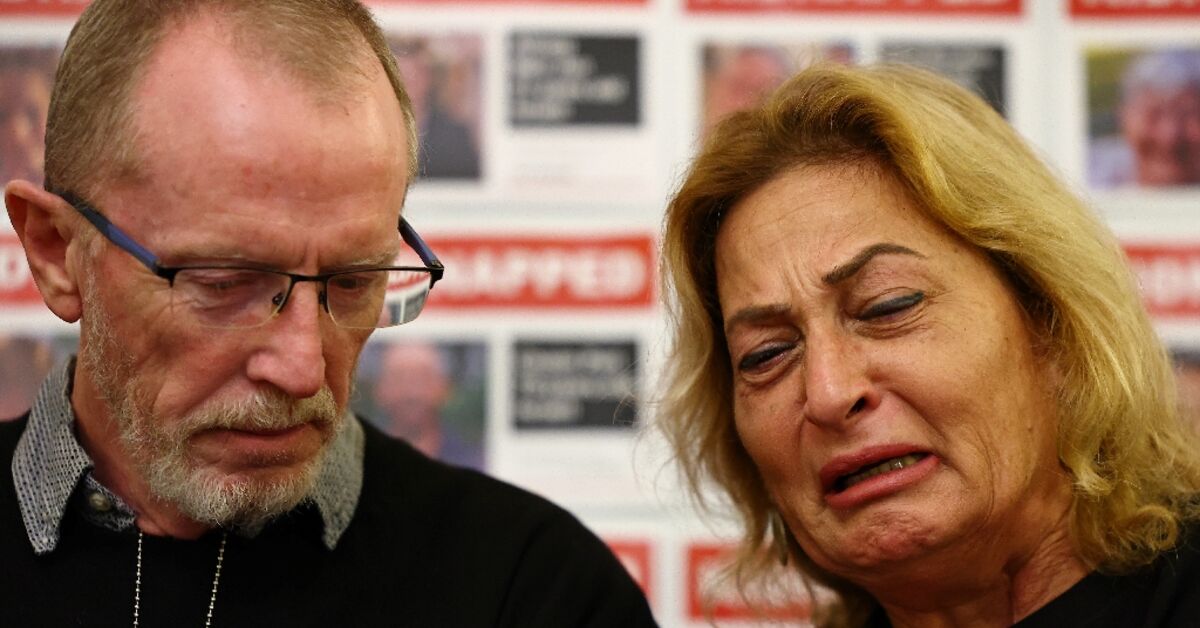

Families Of Gaza Hostages Face Lingering Nightmare

May 13, 2025

Families Of Gaza Hostages Face Lingering Nightmare

May 13, 2025 -

Ice Raid In Worcester Sparks Public Outrage And Confrontation

May 13, 2025

Ice Raid In Worcester Sparks Public Outrage And Confrontation

May 13, 2025 -

Urgent Search For Missing Elderly Hiker In Peninsula Hill Region

May 13, 2025

Urgent Search For Missing Elderly Hiker In Peninsula Hill Region

May 13, 2025 -

Discovering The Countrys Next Big Business Centers

May 13, 2025

Discovering The Countrys Next Big Business Centers

May 13, 2025 -

Ftcs Appeal Challenges Court Ruling On Microsoft Activision Merger

May 13, 2025

Ftcs Appeal Challenges Court Ruling On Microsoft Activision Merger

May 13, 2025