Vodacom (VOD) Payout Surpasses Estimates On Improved Earnings Performance

Table of Contents

Strong Revenue Growth Fuels Higher Payout

Vodacom's impressive dividend payout is directly linked to its significant revenue growth. Several factors contributed to this surge in financial performance:

-

Increased Subscriber Base: Vodacom experienced substantial growth in its subscriber base across all segments – prepaid, postpaid, and enterprise. This expansion reflects the company's success in attracting new customers and retaining existing ones. The addition of [insert specific number] new subscribers represents a [insert percentage]% increase year-on-year.

-

Booming Data Consumption: The rise in smartphone penetration and the increasing adoption of digital services have fueled a dramatic increase in data consumption. Vodacom's robust network infrastructure has effectively capitalized on this trend, resulting in a [insert percentage]% growth in data revenue compared to the previous year.

-

Growth in Financial Technology (Fintech) Services: Vodacom's expansion into Fintech services, such as mobile money transfers and other financial solutions, has proven highly successful, contributing significantly to overall revenue growth. This segment saw a remarkable [insert percentage]% increase in revenue.

-

Successful Market Expansion: Strategic expansion into new markets and the introduction of innovative services have further bolstered Vodacom's revenue streams. This includes [mention specific examples of market expansions or new service offerings].

Improved Operational Efficiency Contributes to Profitability

Beyond strong revenue growth, Vodacom's improved profitability is also a result of enhanced operational efficiency. The company implemented several key strategies:

-

Cost Optimization: Rigorous cost-cutting measures and effective expense management have played a crucial role in boosting profit margins. Vodacom successfully reduced operational expenses by [insert percentage]%, showcasing its commitment to efficiency.

-

Network Optimization: Investments in network infrastructure and advanced technologies have led to increased efficiency in network operations and reduced maintenance costs.

-

Process Streamlining: Streamlined internal processes and the adoption of cutting-edge technologies have improved overall operational efficiency and reduced administrative overhead. This includes [mention specific examples of process improvements].

-

Profit Margin Improvement: The combined impact of these strategies resulted in a significant improvement in profit margins, contributing directly to the higher dividend payout.

Impact on Vodacom (VOD) Stock Performance

The exceeding dividend payout has had a positive impact on Vodacom's stock performance and investor sentiment.

-

Stock Price Increase: Following the announcement, Vodacom's share price experienced a [insert percentage]% increase, reflecting positive market reaction.

-

Positive Investor Sentiment: The exceeding dividend payout has boosted investor confidence in Vodacom's future performance, leading to a more positive market outlook.

-

Market Capitalization: The improved financial results have positively impacted Vodacom's market capitalization, strengthening its position in the telecommunications sector.

-

Analyst Upgrades: Several analysts have upgraded their ratings for Vodacom stock following the announcement of the strong financial results, further indicating positive investor sentiment.

Future Outlook for Vodacom (VOD)

Vodacom's future outlook remains positive, driven by several key factors:

-

Strategic Initiatives: The company plans to continue investing in network infrastructure, expanding its Fintech offerings, and exploring new growth opportunities in the African market.

-

Competitive Landscape: While the competitive landscape remains challenging, Vodacom's strong brand recognition, extensive network coverage, and innovative service offerings position it well for continued growth.

-

Risk Mitigation: Vodacom acknowledges potential risks, such as regulatory changes and economic fluctuations, but has implemented strategies to mitigate these challenges.

-

Long-Term Prospects: The company's long-term prospects are promising, given its strong market position, robust growth strategy, and commitment to operational excellence. Investors see a strong potential for continued growth and attractive dividend payouts.

Conclusion

Vodacom's exceeding dividend payout is a direct result of its improved earnings performance, driven by strong revenue growth and enhanced operational efficiency. This positive performance has significantly boosted investor sentiment and positively impacted the company's stock price. The future outlook for Vodacom (VOD) remains bright, promising continued growth and attractive returns for investors. Learn more about Vodacom's (VOD) impressive financial results and consider investing in this strong performer in the South African and wider African telecommunications sector. Stay informed about future Vodacom (VOD) dividend payouts and other key developments by regularly checking reputable financial news sources for updates and analysis.

Featured Posts

-

How To Watch Peppa Pig Online Free Streaming Guide

May 21, 2025

How To Watch Peppa Pig Online Free Streaming Guide

May 21, 2025 -

Us Navy Corruption Four Star Admiral Sentenced

May 21, 2025

Us Navy Corruption Four Star Admiral Sentenced

May 21, 2025 -

Premier League 2024 25 Champions Image Gallery

May 21, 2025

Premier League 2024 25 Champions Image Gallery

May 21, 2025 -

Britons Epic Australian Run Pain Flies And Controversy

May 21, 2025

Britons Epic Australian Run Pain Flies And Controversy

May 21, 2025 -

Peppa Pig Theme Park Opens In Texas A Family Fun Guide

May 21, 2025

Peppa Pig Theme Park Opens In Texas A Family Fun Guide

May 21, 2025

Latest Posts

-

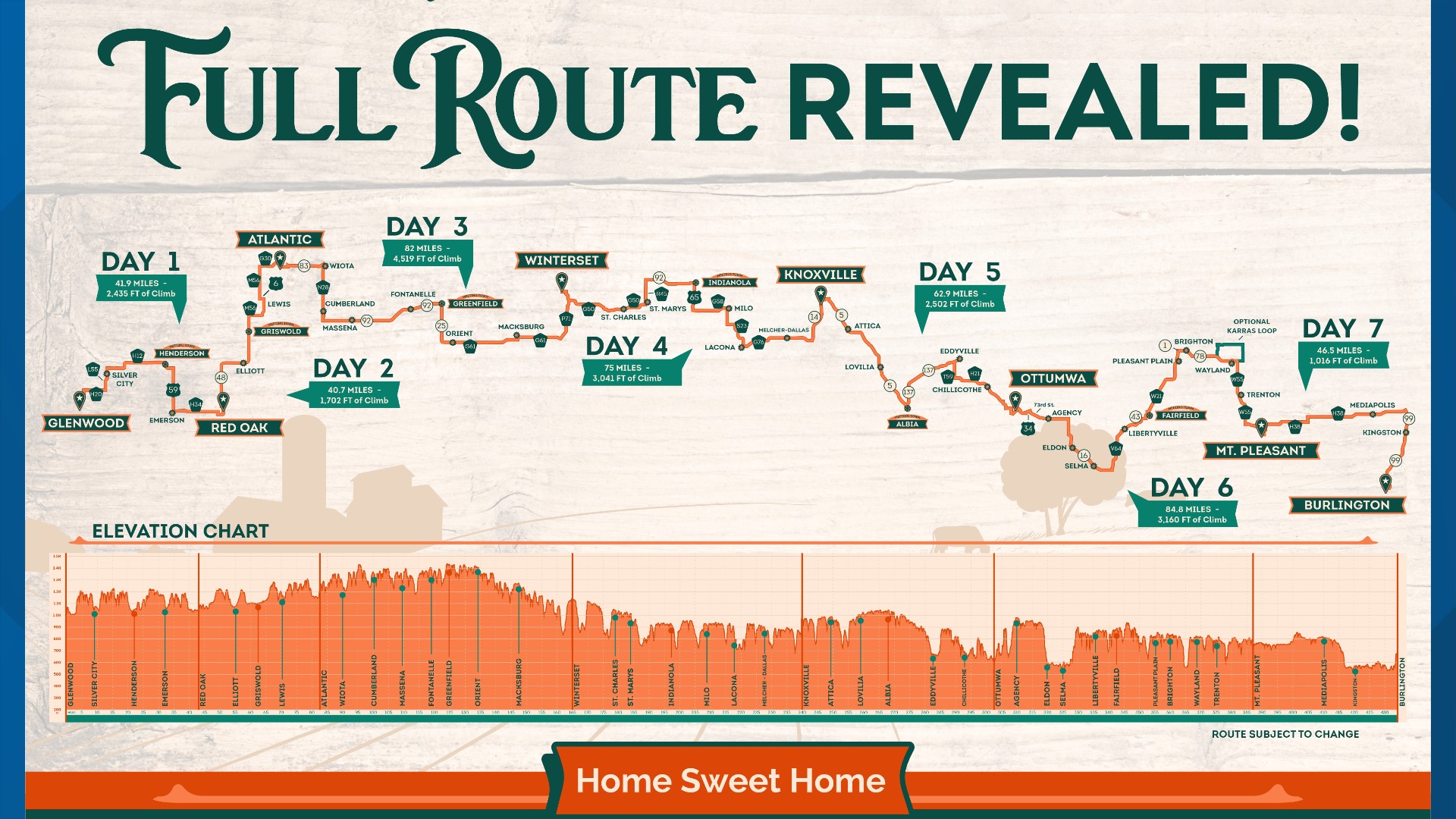

From Ragbrai To Daily Rides Scott Savilles Passion For Cycling

May 21, 2025

From Ragbrai To Daily Rides Scott Savilles Passion For Cycling

May 21, 2025 -

How To Dress For Breezy And Mild Weather

May 21, 2025

How To Dress For Breezy And Mild Weather

May 21, 2025 -

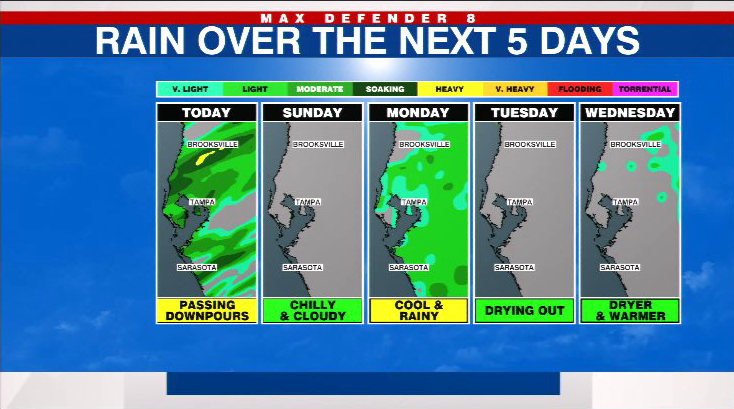

Increased Storm Chance Overnight Severe Weather Risk Monday

May 21, 2025

Increased Storm Chance Overnight Severe Weather Risk Monday

May 21, 2025 -

Enjoying Breezy And Mild Days Tips And Activities

May 21, 2025

Enjoying Breezy And Mild Days Tips And Activities

May 21, 2025 -

Monday Severe Weather Overnight Storm Potential And Impacts

May 21, 2025

Monday Severe Weather Overnight Storm Potential And Impacts

May 21, 2025