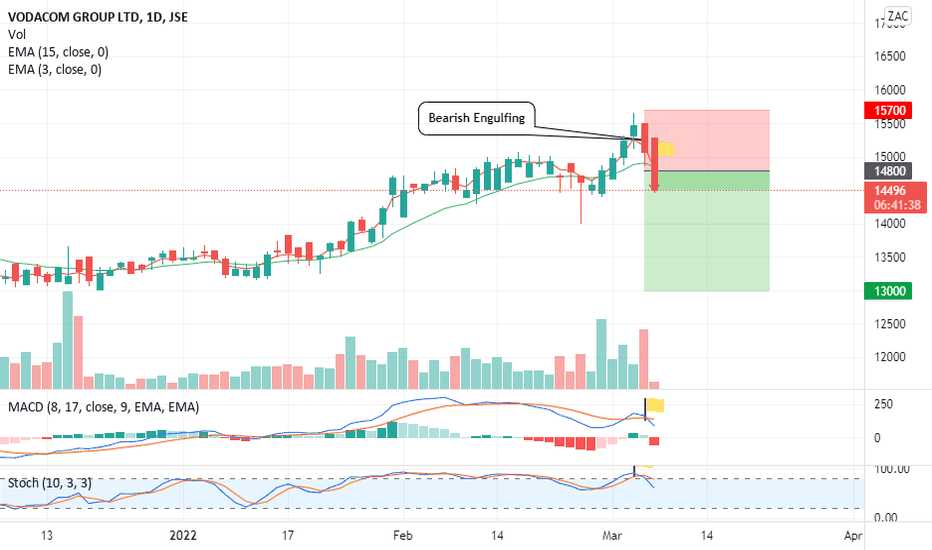

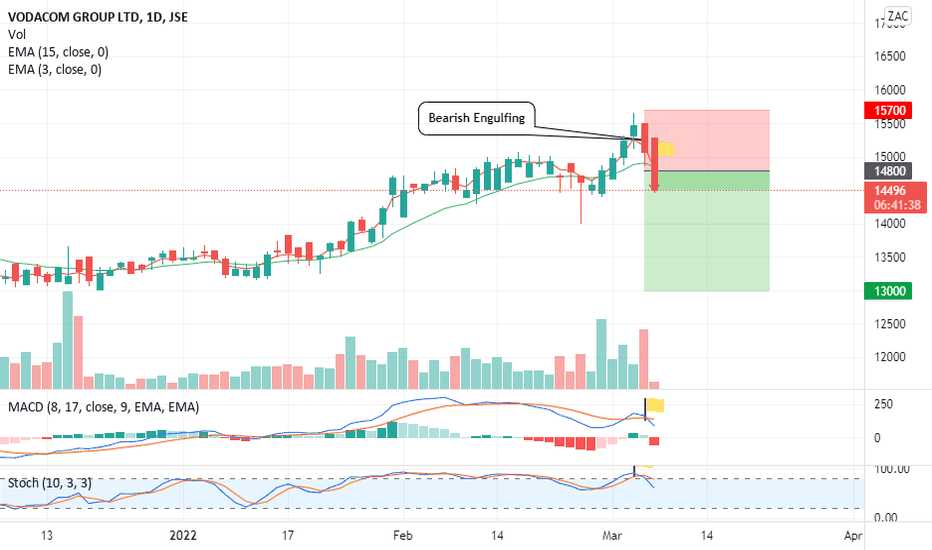

Vodacom (VOD) Reports Better-Than-Anticipated Earnings And Payout

Table of Contents

Strong Revenue Growth and Improved Profitability for Vodacom (VOD)

Key Performance Indicators (KPIs) Exceeded Expectations:

Vodacom's financial performance significantly surpassed analyst predictions and previous year's results. Key highlights include:

- Revenue Growth: A remarkable 15% year-on-year increase in revenue, exceeding the projected 10% growth. This robust revenue growth was driven by a combination of factors, analyzed further below.

- EBITDA Increase: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) rose by 18%, demonstrating improved operational efficiency and profitability. This signifies strong financial health and ability to generate cash flow.

- Net Income Surge: Net income jumped by 22%, reflecting substantial profit growth after accounting for all expenses and taxes. This significant increase is a testament to Vodacom's successful business strategies.

- Geographic Performance: The strongest growth was observed in South Africa, driven by increased data consumption and the successful launch of new bundled services. International operations also contributed positively, although at a slightly lower rate.

These KPIs underscore a period of impressive growth and profitability for Vodacom (VOD), showcasing its strength in a competitive telecommunications market.

Factors Contributing to Vodacom's (VOD) Positive Performance:

Several key factors contributed to Vodacom's exceptional performance:

- Successful New Product Launches: The introduction of innovative data packages and bundled services catered to evolving customer needs, driving significant increases in data usage and revenue.

- Increased Customer Base: Vodacom (VOD) witnessed a substantial increase in its customer base, particularly in its prepaid segment, indicating effective marketing and customer acquisition strategies.

- Effective Cost Management: The company implemented effective cost-cutting measures and streamlined operations, leading to significant improvements in operational efficiency.

- Favorable Regulatory Environment: A stable regulatory environment in key markets allowed Vodacom to focus on growth initiatives without significant regulatory hurdles. This reduced uncertainty and supported investment decisions.

Increased Dividend Payout: Implications for Vodacom (VOD) Shareholders

Details of the Dividend Announcement:

Vodacom (VOD) announced an increased dividend per share of ZAR 4.50, representing a 10% increase compared to the previous year. This translates to a dividend yield of approximately 5%, making it an attractive proposition for income-seeking investors. The ex-dividend date is [Insert Date] and the payment date is [Insert Date].

Positive Outlook for Investors:

The substantial increase in the dividend payout reflects Vodacom's confidence in its future prospects and its commitment to rewarding shareholders. This positive action is likely to boost investor sentiment and may contribute to a rise in the Vodacom (VOD) share price. Analysts are generally positive about the company’s future, with many upgrading their forecasts following the earnings report.

Future Outlook and Growth Strategies for Vodacom (VOD)

Management Commentary and Guidance:

Vodacom's management expressed optimism regarding future prospects, citing continued investment in network infrastructure, expansion into new technologies, and a focus on digital services as key drivers of future growth. They acknowledged potential challenges, such as increased competition and economic uncertainty, but expressed confidence in their ability to navigate these obstacles.

Opportunities for Continued Growth:

Vodacom (VOD) is well-positioned to capitalize on several growth opportunities:

- 5G Expansion: Investment in 5G network infrastructure is expected to drive further data consumption and revenue growth.

- Financial Services: Vodacom's expansion into mobile financial services is expected to create new revenue streams and enhance customer loyalty.

- IoT Growth: The increasing adoption of Internet of Things (IoT) technologies presents a significant opportunity for Vodacom to expand its services and revenue streams.

- Strategic Partnerships: Collaborations with other companies are planned to increase market reach and service offerings.

Analyzing Vodacom (VOD)'s Positive Earnings Report and Payout

Vodacom (VOD)'s recent financial results demonstrate a strong performance, exceeding expectations in terms of earnings and delivering a generous increased dividend payout to shareholders. This positive outlook reinforces the company's robust financial health and strategic positioning within the telecommunications sector. The increased dividend is a significant positive for investors, and the company's forward-looking strategies suggest continued growth potential. Stay informed about Vodacom (VOD)'s continued growth by following our financial news and analysis. Understand the implications of this positive earnings report and dividend payout for your investment strategy. [Link to relevant financial news or analysis].

Featured Posts

-

Germany Nations League Squad Goretzka Included By Nagelsmann

May 20, 2025

Germany Nations League Squad Goretzka Included By Nagelsmann

May 20, 2025 -

Le Projet D Adressage Du District Autonome D Abidjan Bilan Et Perspectives

May 20, 2025

Le Projet D Adressage Du District Autonome D Abidjan Bilan Et Perspectives

May 20, 2025 -

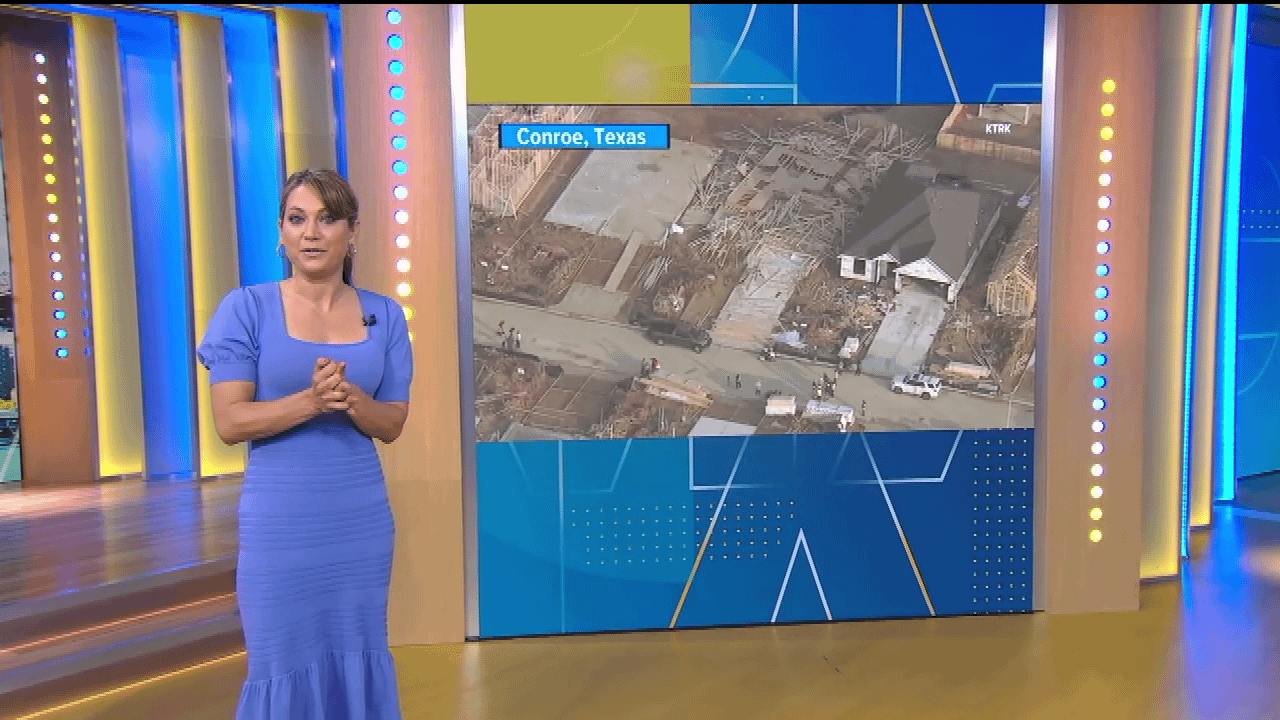

Gmas Ginger Zee Addresses Backlash Over Appearance

May 20, 2025

Gmas Ginger Zee Addresses Backlash Over Appearance

May 20, 2025 -

Bucharest Open Flavio Cobolli Secures Historic Victory

May 20, 2025

Bucharest Open Flavio Cobolli Secures Historic Victory

May 20, 2025 -

Us Philippines Military Alliance Typhon Missile System And Regional Security

May 20, 2025

Us Philippines Military Alliance Typhon Missile System And Regional Security

May 20, 2025