Volatility Alert: Secure Your S&P 500 Portfolio With Downside Protection

Table of Contents

Understanding S&P 500 Volatility and its Impact

Market volatility, characterized by sharp price swings in the S&P 500, can significantly impact your investment portfolio. Understanding the causes and assessing your risk tolerance are crucial first steps in building a resilient investment strategy and securing your portfolio against losses.

Identifying Market Volatility Triggers

Several factors can trigger fluctuations in the S&P 500, impacting investor sentiment and portfolio value. These triggers often interact, creating complex market dynamics.

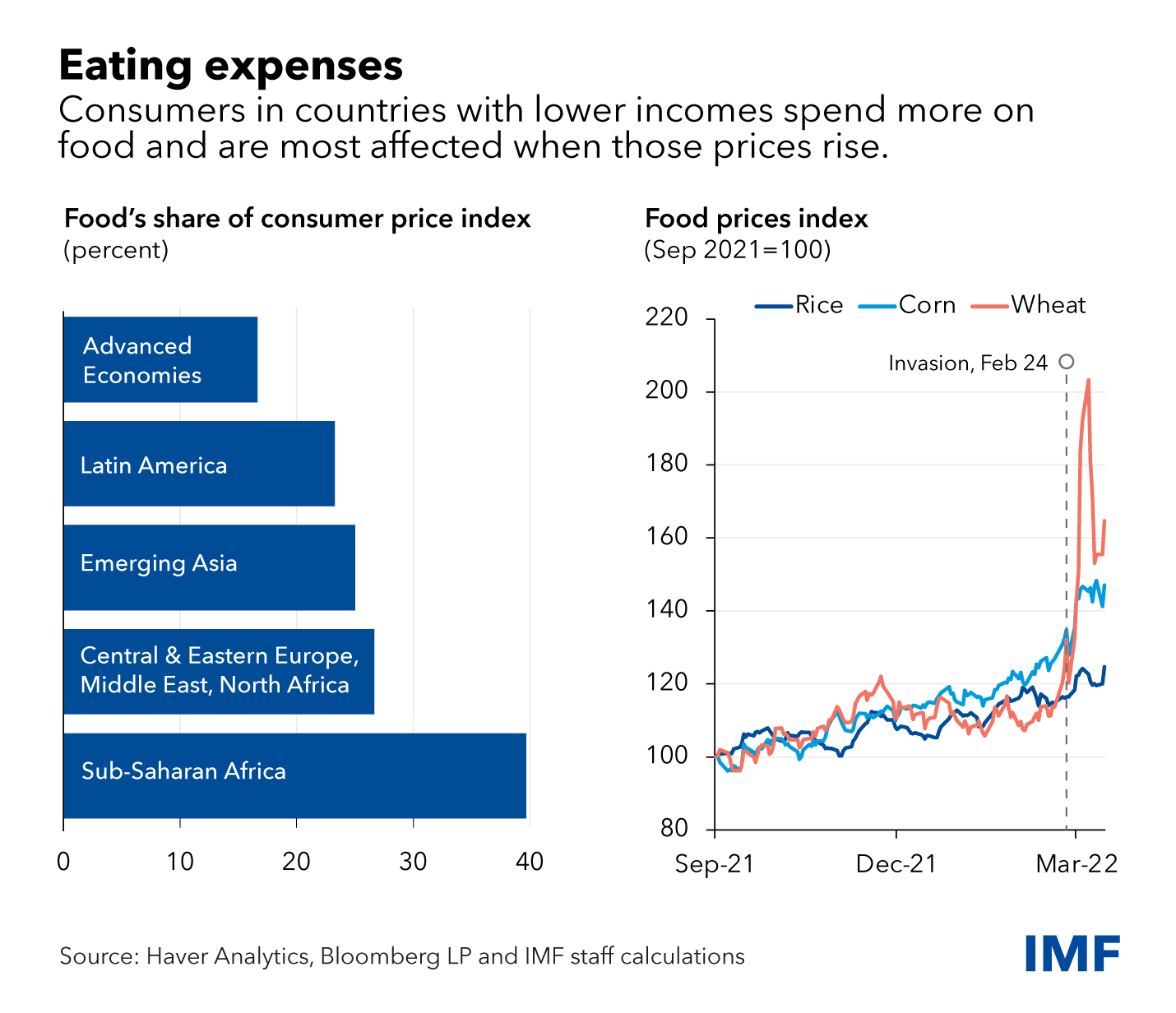

- Inflation concerns: High inflation erodes purchasing power and prompts central banks to raise interest rates, potentially slowing economic growth and impacting stock prices.

- Recessionary fears: Concerns about an impending recession can lead to decreased investor confidence and a sell-off in the stock market, including the S&P 500.

- Unexpected policy changes: Unexpected shifts in monetary or fiscal policy, such as surprise interest rate hikes or new regulations, can create market uncertainty and volatility.

- Geopolitical events: Global conflicts, political instability, and international tensions can significantly impact market sentiment and lead to sharp price movements in the S&P 500.

These triggers can dramatically affect investor confidence, leading to rapid buying or selling pressure, and subsequently influencing the overall market direction and the value of your S&P 500 holdings.

Assessing Your Risk Tolerance

Before implementing any downside protection strategy, it's vital to honestly assess your risk tolerance. This involves understanding your comfort level with market fluctuations and how much potential loss you can endure without compromising your financial goals.

- Investment timeline: Longer-term investors generally have a higher risk tolerance as they have more time to recover from potential market downturns.

- Financial goals: Your financial goals (e.g., retirement, education) will influence your risk tolerance. More aggressive goals may justify accepting higher risk.

- Overall risk appetite: Consider your personality and comfort level with market fluctuations. Are you a conservative, moderate, or aggressive investor?

Understanding your risk tolerance allows you to select appropriate investment strategies and downside protection mechanisms that align with your individual circumstances.

Strategies for Downside Protection of Your S&P 500 Holdings

Protecting your S&P 500 investments requires a multi-faceted approach that combines diversification, hedging techniques, and risk management tools.

Diversification: Spreading Your Risk

Diversification is a fundamental principle of risk management. Don't put all your eggs in one basket! By diversifying your investments beyond the S&P 500, you can significantly reduce your overall portfolio volatility.

- Bonds: Bonds offer lower returns than stocks but are generally less volatile, acting as a ballast in your portfolio.

- Real estate: Real estate investments can provide diversification and potentially hedge against inflation.

- International stocks: Investing in international markets reduces your dependence on the US economy and can offer different growth opportunities.

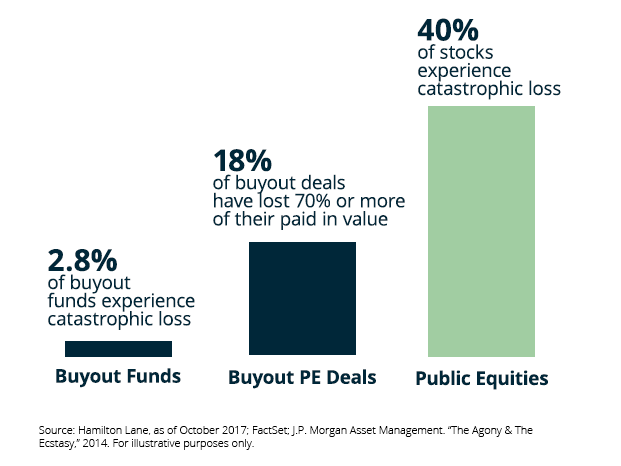

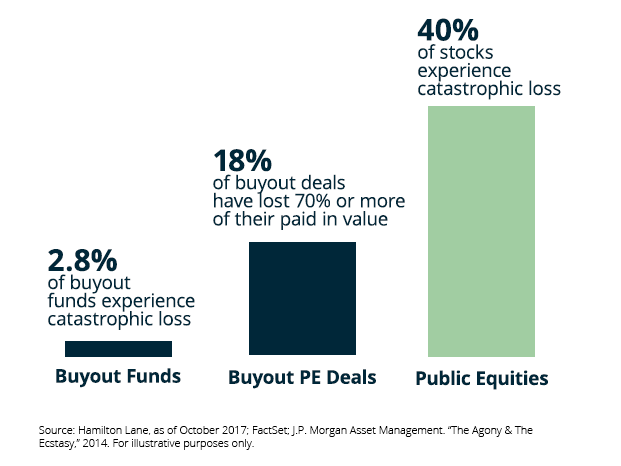

- Alternative investments: Consider alternative asset classes like commodities, private equity, or hedge funds to further diversify your portfolio.

Diversification across different asset classes helps to reduce the impact of any single asset's poor performance on your overall portfolio.

Hedging Techniques: Mitigating Potential Losses

Hedging strategies aim to offset potential losses in your S&P 500 investments. While they don't guarantee profits, they can cushion the blow during market downturns.

- Options strategies (puts, protective puts): Buying put options provides the right, but not the obligation, to sell your S&P 500 holdings at a predetermined price, limiting potential downside.

- Inverse ETFs: These exchange-traded funds (ETFs) profit when the underlying market (like the S&P 500) declines, providing a hedge against market drops.

- Gold as a safe haven asset: Gold is often considered a safe haven asset, meaning its value tends to increase during times of market uncertainty. Including gold in your portfolio can offer some downside protection.

Remember, hedging techniques come with their own risks and costs. Carefully consider the associated risks before implementing these strategies.

Stop-Loss Orders: Automatic Protection

Stop-loss orders are instructions to your broker to sell your S&P 500 holdings automatically when the price falls to a predetermined level. This limits your potential losses, but it doesn't eliminate them entirely.

- How stop-loss orders work: You set a price trigger, and when the market price reaches that level, your order is automatically executed.

- Setting appropriate stop-loss levels: Choosing the right level requires careful consideration of your risk tolerance and the stock's volatility.

- Advantages and disadvantages: Stop-loss orders offer automatic protection but carry the risk of being "stopped out" during temporary market dips, potentially missing out on subsequent price recovery.

Building a Resilient S&P 500 Portfolio

Building a resilient portfolio requires proactive management and a long-term perspective.

Rebalancing Your Portfolio

Regularly reviewing and adjusting your asset allocation is crucial to maintaining your target asset allocation and managing risk.

- Importance of rebalancing: Rebalancing involves selling some assets that have performed well and buying assets that have underperformed, bringing your portfolio back to its target allocation.

- Managing risk and capitalizing on opportunities: Rebalancing helps to lock in profits from winners and reinvest in potential opportunities in underperforming sectors.

Dollar-Cost Averaging (DCA): Consistent Investing

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of the market price.

- How DCA works: It reduces the impact of market timing by averaging your purchase price over time.

- Reducing the impact of market timing: DCA helps avoid buying high and selling low, a common mistake among investors who try to time the market.

Long-Term Investment Strategy: Patience and Discipline

Maintaining a long-term perspective is paramount when investing in the S&P 500.

- Avoiding emotional decision-making: Market volatility can trigger emotional responses, leading to impulsive buy or sell decisions. Avoid this by sticking to your investment plan.

- Staying invested through market cycles: Remember that short-term volatility doesn't negate the long-term growth potential of the S&P 500.

Conclusion

Market volatility is an inherent risk when investing in the S&P 500. However, by understanding the factors driving these fluctuations and implementing appropriate downside protection strategies, you can significantly reduce risk and enhance the resilience of your portfolio. Diversification, hedging, stop-loss orders, rebalancing, and dollar-cost averaging are crucial tools for navigating market uncertainty and securing your long-term financial goals. Don't wait for the next market downturn; take proactive steps to secure your S&P 500 portfolio with effective downside protection today.

Featured Posts

-

Papal Funeral Seating Challenges And Considerations

Apr 30, 2025

Papal Funeral Seating Challenges And Considerations

Apr 30, 2025 -

Navigating Geopolitical Uncertainty The Case Of Nvidia

Apr 30, 2025

Navigating Geopolitical Uncertainty The Case Of Nvidia

Apr 30, 2025 -

Aktualno Prof Iva Khristova Za Gripniya Sezon

Apr 30, 2025

Aktualno Prof Iva Khristova Za Gripniya Sezon

Apr 30, 2025 -

Rising Global Military Expenditure The Impact Of The Ukraine Conflict

Apr 30, 2025

Rising Global Military Expenditure The Impact Of The Ukraine Conflict

Apr 30, 2025 -

Finansoviyat Uspekh Na Turneto Na Bionse Fakti I Tsifri

Apr 30, 2025

Finansoviyat Uspekh Na Turneto Na Bionse Fakti I Tsifri

Apr 30, 2025

Latest Posts

-

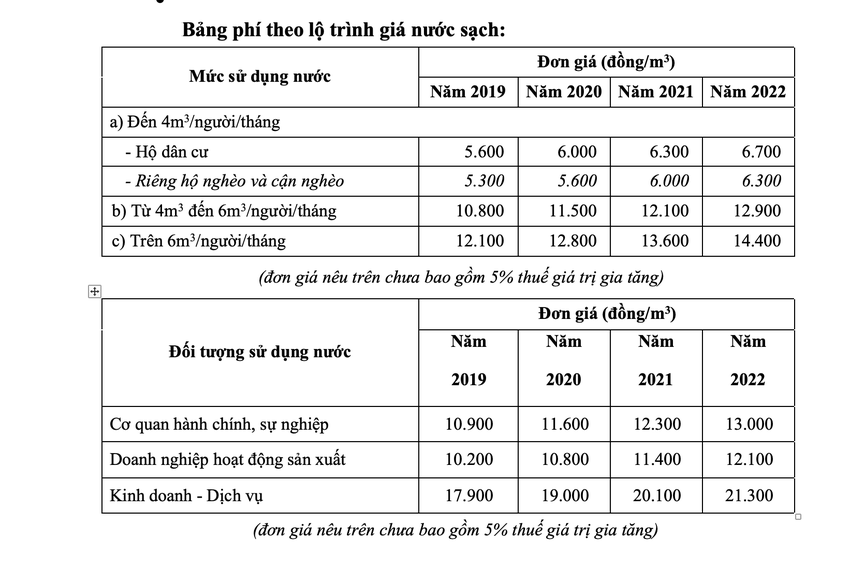

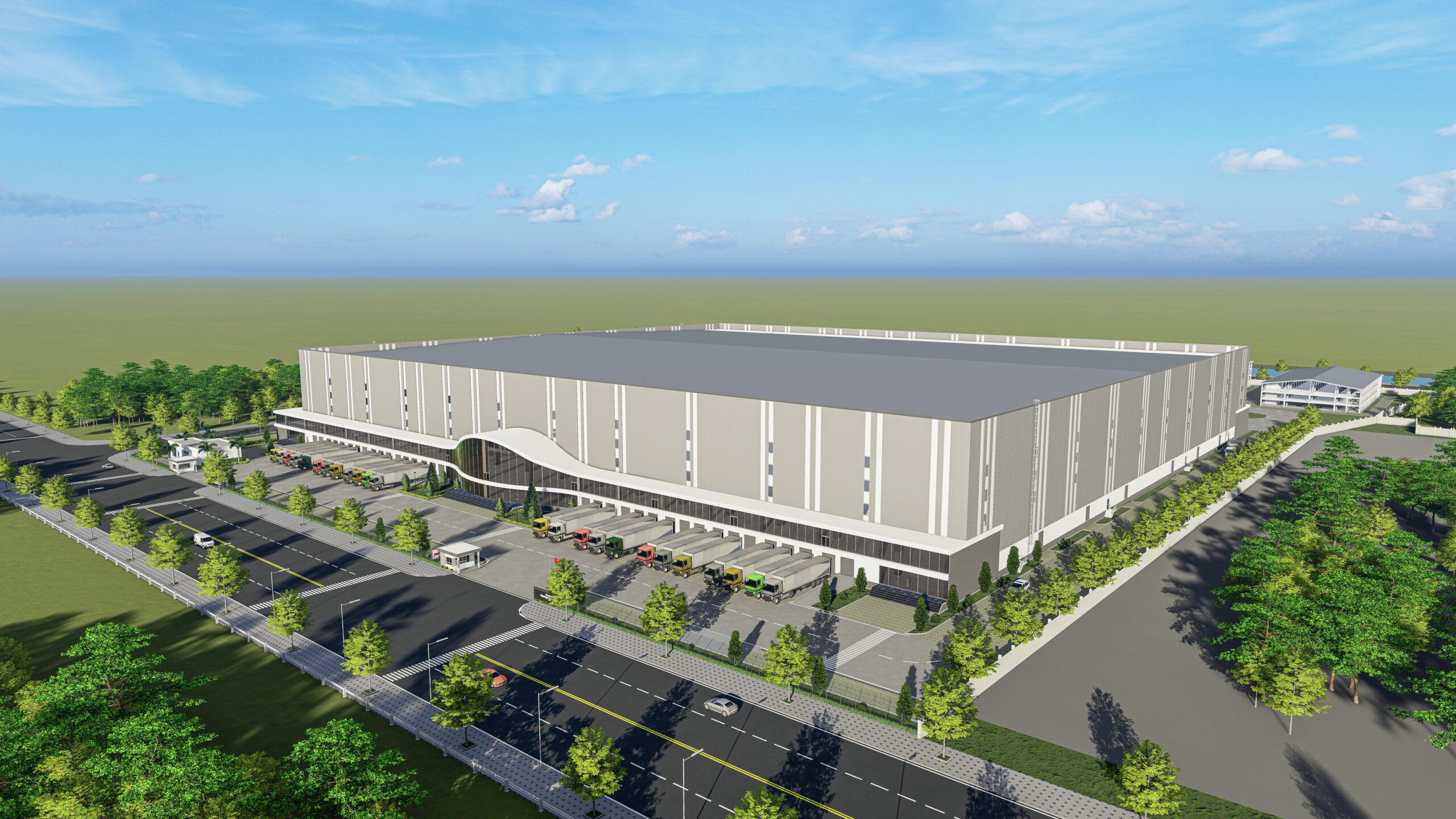

Du An Cap Nuoc Gia Dinh Tam Hop Chien Thang Thuyet Phuc Truoc 6 Doi Thu

Apr 30, 2025

Du An Cap Nuoc Gia Dinh Tam Hop Chien Thang Thuyet Phuc Truoc 6 Doi Thu

Apr 30, 2025 -

The Most Popular Cruise Lines In The Us A 2024 Overview

Apr 30, 2025

The Most Popular Cruise Lines In The Us A 2024 Overview

Apr 30, 2025 -

Ipo

Apr 30, 2025

Ipo

Apr 30, 2025 -

Thang Dam Tam Hop Vuot 6 Doi Thu Trung Thau Du An Cap Nuoc Gia Dinh

Apr 30, 2025

Thang Dam Tam Hop Vuot 6 Doi Thu Trung Thau Du An Cap Nuoc Gia Dinh

Apr 30, 2025 -

Choosing The Right Us Cruise Line For Your Next Vacation

Apr 30, 2025

Choosing The Right Us Cruise Line For Your Next Vacation

Apr 30, 2025