Wall Street Bets: Is The Worst Of Trump's Trade War Over?

Table of Contents

Assessing the Economic Fallout of Trump's Trade War

The Trump administration's trade war, characterized by significant tariff increases on goods from China and other countries, left a considerable mark on the global and US economy.

The Initial Impact on Various Sectors

Several sectors felt the brunt of the trade war's initial impact. Agriculture, for example, suffered greatly due to retaliatory tariffs imposed by China on US soybeans and other agricultural products. The manufacturing sector also experienced significant challenges, facing increased costs for imported materials and reduced export opportunities. This resulted in job losses, a slowdown in economic growth, and increased inflation.

- GDP Growth: US GDP growth noticeably slowed in the period following the escalation of the trade war, falling from an average of X% in [period before tariffs] to Y% in [period after tariff increases]. (Replace X and Y with actual data)

- Affected Companies: Companies like [Example company 1 in agriculture] saw significant drops in profits due to reduced exports to China, while [Example company 2 in manufacturing] faced increased production costs due to tariffs on imported steel.

- Consumer Prices: Tariffs contributed to a rise in consumer prices for certain goods, impacting household budgets and reducing consumer spending.

The Role of the US-China Trade Relationship

The US-China trade relationship remains a focal point of global economic uncertainty. While some trade tensions have eased, several unresolved issues persist. The ongoing debate over intellectual property rights, technology transfer, and market access continues to cast a shadow over the future of bilateral trade.

- Unresolved Disputes: Key disputes, such as those related to [specific unresolved trade issue 1] and [specific unresolved trade issue 2], remain sources of potential future conflict.

- Tariff Levels: Although some tariffs have been reduced, significant tariffs remain in place on various goods, impacting trade flows and business decisions.

- Geopolitical Factors: The broader geopolitical landscape, including escalating tensions in other regions, adds further complexity to the US-China trade relationship.

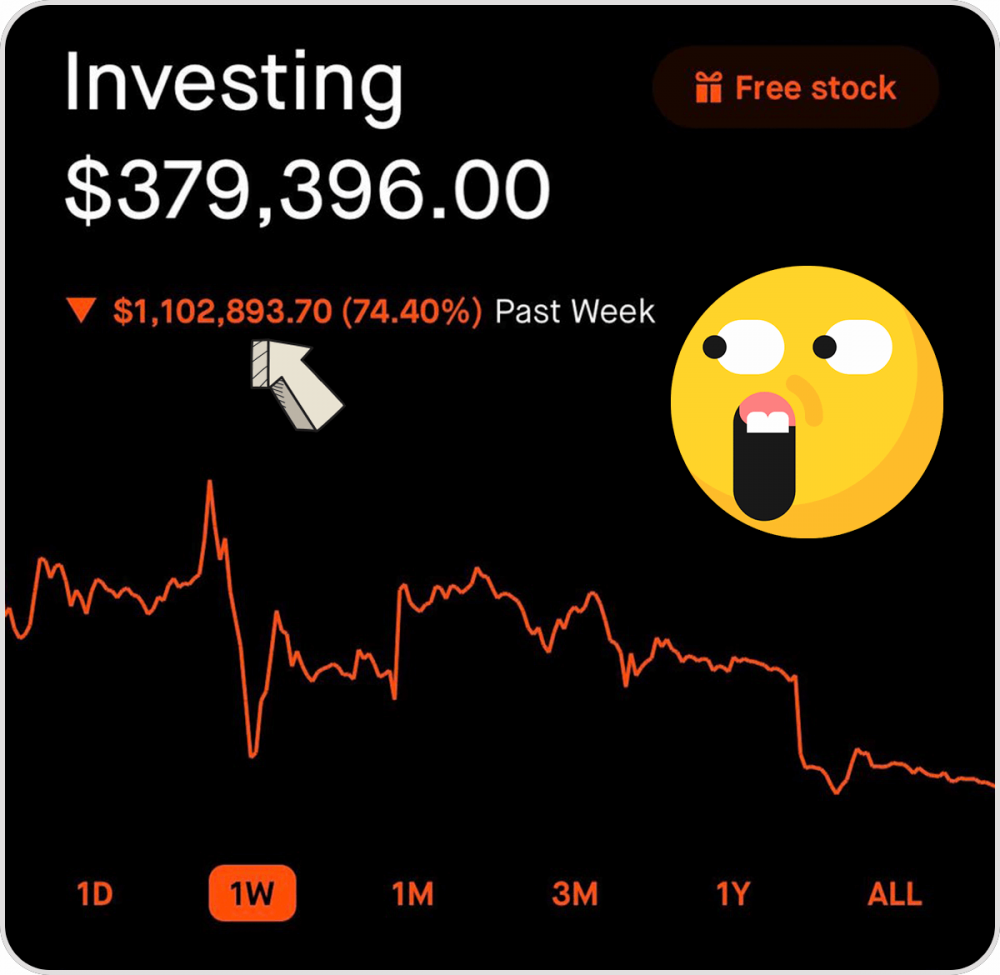

Wall Street Bets' Reaction to Trade War Uncertainty

Wall Street Bets, known for its active and often unpredictable trading behavior, didn't remain unaffected by the trade war.

How WSB Traders Reacted to Trade War News

WSB traders reacted to tariff announcements and subsequent market fluctuations with a mix of speculation, fear, and opportunism. The community's response was often amplified by social media sentiment, leading to both dramatic rallies and significant dips in certain stocks.

- Meme Stock Rallies: Some meme stocks experienced significant price increases during periods of trade war uncertainty, as traders speculated on their potential to benefit from or resist the negative impact of tariffs. (e.g., [example of a meme stock affected])

- Investment Strategy Shifts: WSB traders appeared to shift their investment strategies based on perceived winners and losers in the trade war, often moving towards sectors seen as less exposed to trade tensions.

- Social Media Sentiment: The rapid dissemination of information and opinions on social media platforms like Reddit played a crucial role in shaping WSB's collective reaction to trade war events.

The Influence of WSB on Broader Market Sentiment

The question of whether WSB's activity significantly impacted broader market sentiment is complex. While WSB's influence on individual stocks can be substantial, its impact on overall market trends remains debatable.

- Potential for Influence: The concentrated activity of WSB traders, particularly on specific stocks, can lead to short-term price fluctuations and influence other investors.

- Correlation with Market Movements: Studies on the correlation between WSB activity and broader market indicators are ongoing, and the results remain inconclusive.

- Limitations of Influence: WSB, despite its considerable online presence, represents only a small fraction of the overall market, limiting its ability to unilaterally dictate major market movements.

Is the Worst Over? Analyzing Current Trade Dynamics

Determining whether the worst of the trade war is over requires careful examination of current trade dynamics and economic indicators.

Current Trade Agreements and Policies

The current administration has taken some steps towards easing trade tensions, including [mention specific trade deals or policy changes]. However, the underlying issues that fueled the trade war remain.

- Impact of Trade Deals: New or revised trade agreements have had varying impacts on different sectors, with some experiencing benefits while others continue to face challenges.

- Political Climate: The current political climate significantly influences the trajectory of future trade negotiations. [mention specific political factors].

- Potential Escalations: The risk of future escalations remains, depending on the actions of both the US and other trading partners.

Economic Indicators and Future Predictions

Key economic indicators offer a mixed picture. While [mention positive indicators], concerns remain about [mention negative indicators].

- Economic Data: Current economic data suggests [cite specific data, e.g., inflation rates, unemployment figures].

- Future Forecasts: Experts offer varying forecasts for future economic growth, with some predicting a continued recovery while others warn of potential challenges from lingering trade uncertainties.

- Risks and Opportunities: The current market environment presents both significant risks and opportunities for investors. Careful analysis of trade dynamics and economic indicators is crucial for informed decision-making.

Conclusion: The Future of Wall Street Bets in a Post (or Continuing) Trade War World

Trump's trade war had a significant and lasting impact on the US economy, affecting various sectors and influencing investor behavior. Wall Street Bets, while not solely responsible for market movements, played a role in amplifying market reactions to trade war news. Whether the worst is truly over remains unclear. Significant challenges persist in the US-China trade relationship and other trade disputes. Ongoing trade tensions continue to create uncertainty in the market.

Key Takeaways: The lingering effects of the trade war continue to shape market sentiment and investor behavior. While some tensions have eased, significant uncertainties remain. Wall Street Bets' activity, while impactful on specific stocks, has limited influence on overall market trends.

Call to Action: Stay informed about current trade developments and their impact on market trends. Follow reputable news sources and conduct your own research to understand the evolving dynamics of the post-trade war economy and its effect on Wall Street Bets and your investment strategies. Understanding the lingering shadow of Trump's trade war is crucial for navigating the complexities of the current market.

Featured Posts

-

Ftc Challenges Microsofts Activision Acquisition The Future Of Gaming

May 29, 2025

Ftc Challenges Microsofts Activision Acquisition The Future Of Gaming

May 29, 2025 -

Antqal Jwnathan Tah Ila Bayrn Mywnkh Tfasyl Jdydt

May 29, 2025

Antqal Jwnathan Tah Ila Bayrn Mywnkh Tfasyl Jdydt

May 29, 2025 -

Bring Her Back A24 Horror Movie Receives Rave Reviews And High Rotten Tomatoes Score

May 29, 2025

Bring Her Back A24 Horror Movie Receives Rave Reviews And High Rotten Tomatoes Score

May 29, 2025 -

De Rol Van Steden Met Een Oorlogsverleden Een Oxfam Novib Perspectief

May 29, 2025

De Rol Van Steden Met Een Oorlogsverleden Een Oxfam Novib Perspectief

May 29, 2025 -

Teddy Swims 2025 Saturday In The Park Headliner

May 29, 2025

Teddy Swims 2025 Saturday In The Park Headliner

May 29, 2025

Latest Posts

-

Katastrophenschutz Am Bodensee Uebungsszenario In Hard Simuliert Ernstfall

May 31, 2025

Katastrophenschutz Am Bodensee Uebungsszenario In Hard Simuliert Ernstfall

May 31, 2025 -

Bodensee Katastrophenuebung Einsatzkraefte Trainieren In Hard Fuer Den Ernstfall

May 31, 2025

Bodensee Katastrophenuebung Einsatzkraefte Trainieren In Hard Fuer Den Ernstfall

May 31, 2025 -

Womans Basement Holds A Puzzling Surprise For Plumber

May 31, 2025

Womans Basement Holds A Puzzling Surprise For Plumber

May 31, 2025 -

Constance Lloyd Wilde Paying The Price For Oscars Genius

May 31, 2025

Constance Lloyd Wilde Paying The Price For Oscars Genius

May 31, 2025 -

Katastrophenfall Am Bodensee Grossuebung Der Einsatzkraefte In Hard

May 31, 2025

Katastrophenfall Am Bodensee Grossuebung Der Einsatzkraefte In Hard

May 31, 2025