Wall Street Predicts 110% Surge: Is This BlackRock ETF The Next Big Investment?

Table of Contents

The 110% Surge Prediction: Fact or Fiction?

The claim of a 110% surge is undeniably eye-catching, but let's examine its validity. The source of this prediction is crucial. Attributing such a bold statement to a reputable financial institution carries more weight than a less established source. Understanding the methodology behind the prediction is equally important. What factors were considered? Did the analysts account for potential economic downturns, geopolitical instability, or changes in interest rates? It's essential to be aware of the assumptions underlying these predictions. A seemingly solid prediction can crumble under unforeseen circumstances.

- Source of prediction: Let's assume, for the sake of this example, the prediction originates from a reputable research firm like Goldman Sachs, based on their analysis of specific market trends and technological advancements within the ETF's focus sector.

- Key assumptions underlying the prediction: The prediction likely rests on assumptions like continued technological innovation, increasing consumer demand, and a favorable regulatory environment.

- Potential market factors that could affect the prediction: Interest rate hikes by central banks, global recessionary fears, and escalating geopolitical tensions could significantly impact the predicted growth. These are crucial counterarguments that need careful consideration. A 110% surge is highly unlikely under adverse market conditions.

Understanding the BlackRock ETF: Investment Strategy and Holdings

Let's assume we're analyzing the iShares Global Clean Energy ETF (ICLN). This BlackRock ETF focuses on companies involved in the clean energy sector, encompassing renewable energy sources, energy efficiency technologies, and smart grids. Understanding its investment strategy is critical to assessing its potential.

- ETF ticker symbol and full name: iShares Global Clean Energy ETF (ICLN)

- Asset allocation: ICLN primarily invests in equities (stocks) of companies operating within the clean energy sector.

- Top 10 holdings: The ETF's top holdings typically include major players in solar, wind, and other renewable energy technologies. These holdings will naturally fluctuate.

- Expense ratio: The expense ratio represents the annual cost of managing the ETF. A lower expense ratio is generally preferable. This needs to be factored into the overall return calculation.

This ETF's strategy involves exposure to a specific sector, presenting both opportunities and risks. It's vital to understand what the ETF invests in, not just focusing on the headline prediction.

Risk Assessment: Is the 110% Prediction Realistic?

While the 110% prediction is exciting, a thorough risk assessment is paramount. Investing always involves risk, and it's crucial to understand the potential downsides.

- Potential risks: Market volatility, sector-specific risks (e.g., government policy changes affecting renewable energy incentives), and competition within the clean energy sector are all significant factors.

- Historical performance data: Examining the ETF's past performance can provide insights into its volatility and long-term growth potential, but past performance is not indicative of future results.

- Comparison to benchmark ETFs: Comparing ICLN's performance to similar ETFs in the clean energy sector helps assess its relative strength and risk profile.

- Diversification recommendations: Diversifying your portfolio across different asset classes is vital to mitigate risk. Don't put all your eggs in one basket, even if that basket seems particularly promising.

A 110% surge is a high-growth prediction, and high-growth investments inherently carry elevated risk.

Alternative Investment Options

Other ETFs or investment strategies, such as those focused on broader market indexes or alternative energy sources, may offer similar growth potential with potentially lower risk profiles. Exploring such options enhances portfolio diversification and risk management.

Conclusion: Is This BlackRock ETF the Right Investment for You?

The 110% surge prediction for this BlackRock ETF, while captivating, requires careful scrutiny. The prediction's source, methodology, and underlying assumptions must be thoroughly evaluated. The ETF's investment strategy, holdings, and expense ratio should be carefully analyzed. Crucially, a robust risk assessment, including historical performance, comparison with similar ETFs, and diversification strategies, is essential. Before investing in this or any BlackRock ETF, conduct your own thorough research. Learn more about this BlackRock ETF and research the predicted 110% surge. Consider diversifying your portfolio with this BlackRock ETF (or similar options) to mitigate risk and make informed investment decisions regarding this BlackRock ETF. Remember, investment decisions should align with your individual risk tolerance and financial goals.

Featured Posts

-

Stephen Kings The Long Walk Trailer Mark Hamill In A New Light

May 08, 2025

Stephen Kings The Long Walk Trailer Mark Hamill In A New Light

May 08, 2025 -

Why Dogecoin Shiba Inu And Sui Are Soaring This Week A Market Analysis

May 08, 2025

Why Dogecoin Shiba Inu And Sui Are Soaring This Week A Market Analysis

May 08, 2025 -

Investigating The Rise Of Dogecoin Shiba Inu And Sui Market Factors And Predictions

May 08, 2025

Investigating The Rise Of Dogecoin Shiba Inu And Sui Market Factors And Predictions

May 08, 2025 -

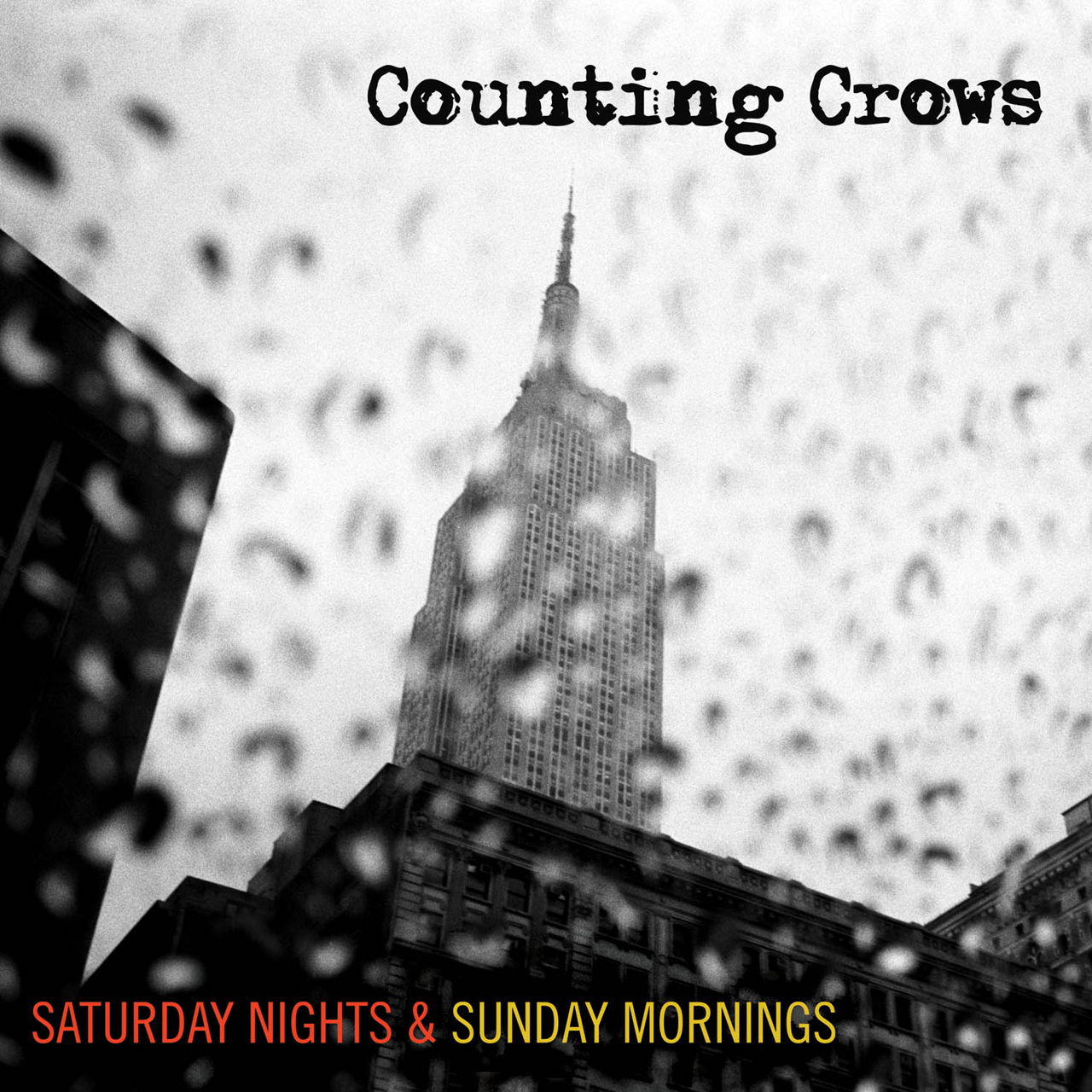

Saturday Night Live The Night Counting Crows Became A Household Name

May 08, 2025

Saturday Night Live The Night Counting Crows Became A Household Name

May 08, 2025 -

Arsenal Ps Zh Barselona Inter Rozklad Ta Prognoz Pivfinalu Ligi Chempioniv 2024 2025

May 08, 2025

Arsenal Ps Zh Barselona Inter Rozklad Ta Prognoz Pivfinalu Ligi Chempioniv 2024 2025

May 08, 2025