Wall Street's 110% Prediction: Why Billionaires Are Investing In This BlackRock ETF

Table of Contents

Whispers on Wall Street suggest a specific BlackRock ETF holds the potential for a staggering 110% return, attracting significant investment from billionaires. This isn't just another market rumor; it's a compelling narrative fueled by analysts' projections and the strategic moves of high-net-worth individuals. This article delves into the reasons behind this optimistic 110% prediction for a specific BlackRock ETF (we'll refer to it as "the ETF" for simplicity, and will not name a specific ticker to avoid promoting any specific investment) and explores why billionaire investors are placing significant bets on its future performance. We'll examine the underlying assets, the inherent risks, and the role of BlackRock's expertise in this potentially lucrative investment opportunity.

The 110% Prediction: Deconstructing the Forecast

The 110% prediction for this BlackRock ETF stems from a confluence of factors analyzed by leading financial institutions. While specific details are often proprietary, the consensus points to a bullish outlook driven by several key economic indicators and market trends. For instance, robust growth projections in the technology and renewable energy sectors, two key areas of investment for the ETF, are major contributors to this optimistic forecast. Furthermore, a generally favorable regulatory environment and a projected increase in investor confidence are contributing factors.

Supporting this prediction are several economic models suggesting a period of sustained economic expansion. (Insert a hypothetical chart or graph here showing projected growth in relevant sectors). These models account for potential inflation and interest rate changes, yet still point towards strong performance.

Key assumptions underpinning the 110% prediction include:

- Strong economic growth in specific sectors: The ETF heavily invests in sectors expected to experience significant growth, such as technology, renewable energy, and certain emerging markets.

- Favorable regulatory environment: A stable and supportive regulatory landscape minimizes unforeseen disruptions and fosters investor confidence.

- Increased investor confidence: A positive market sentiment and increased investor appetite for risk contribute to higher valuations.

- Potential for disruptive technologies within the ETF's holdings: The ETF invests in companies at the forefront of innovation, poised to benefit from technological advancements.

Why Billionaires are Betting Big on This BlackRock ETF

Billionaires aren't blindly following the 110% prediction; their investment strategy is far more nuanced. This BlackRock ETF offers several key advantages aligning perfectly with their sophisticated portfolio management approaches.

The ETF provides significant diversification benefits, allowing billionaires to gain exposure to a basket of high-growth assets without over-concentrating their investments in any single sector or company. Moreover, the potential for high returns significantly surpasses those offered by more traditional investments such as bonds or low-growth stocks. This makes it an attractive proposition for investors seeking substantial capital appreciation.

Billionaire investment strategies often center around long-term growth and inflation hedging. This ETF ticks both boxes. Its focus on growth sectors positions it well for long-term capital appreciation, while its diverse holdings act as a hedge against inflationary pressures.

Key billionaire investment strategies linked to this ETF include:

- Long-term growth potential: The ETF targets companies with strong growth prospects, suitable for long-term investment horizons.

- Inflation hedging capabilities: The diversification across various asset classes helps mitigate the impact of inflation.

- Diversification within a broader portfolio: The ETF complements other investments, reducing overall portfolio risk.

- Exposure to high-growth sectors: The ETF provides targeted exposure to rapidly expanding sectors.

Understanding the Underlying Assets and Risks

This BlackRock ETF invests primarily in (insert specific asset classes here, e.g., a mix of large-cap US equities, international equities, and select bonds). Its investment strategy focuses on (explain the ETF's specific investment approach, e.g., growth investing, value investing). Understanding the underlying assets is crucial for any potential investor.

It's important to acknowledge the inherent risks associated with any investment, especially those with high growth potential. Market volatility is a constant factor, and this ETF is not immune to potential price fluctuations. Furthermore, interest rate changes and geopolitical events can significantly impact the ETF's performance. Remember, past performance is not indicative of future results.

Risks associated with investing in this BlackRock ETF include:

- Market risk: Overall market downturns can negatively affect the ETF's value.

- Interest rate risk: Changes in interest rates can impact the value of fixed-income holdings within the ETF.

- Inflation risk: Unexpected inflation can erode the purchasing power of returns.

- Geopolitical risk: Global events can create uncertainty and volatility in the markets.

BlackRock's Role and ETF Management

BlackRock's reputation as a leading global asset manager is a significant factor contributing to investor confidence in this ETF. Their extensive experience, vast resources, and robust research capabilities provide a strong foundation for effective ETF management. BlackRock employs experienced professionals who leverage sophisticated strategies and risk management techniques to maximize returns while mitigating potential losses.

BlackRock’s advantages include:

- Strong track record: BlackRock has a proven history of successful ETF management.

- Experienced management team: The ETF is managed by a team of highly skilled investment professionals.

- Economies of scale: BlackRock's size allows for cost efficiencies passed on to investors.

- Robust research capabilities: Extensive research supports investment decisions and risk management.

Conclusion: Should You Invest in This Promising BlackRock ETF?

This article explored the compelling 110% prediction for a specific BlackRock ETF and the reasons why billionaires are showing significant interest. While the potential for high returns is undeniably attractive, it's crucial to remember the inherent risks involved. Market volatility, interest rate fluctuations, and geopolitical uncertainties can all impact the ETF's performance.

Before making any investment decision, it's vital to conduct thorough research, carefully consider your risk tolerance, and ideally consult with a qualified financial advisor. This will help determine whether this particular BlackRock ETF aligns with your individual investment goals and financial situation.

Learn more about this potentially lucrative BlackRock ETF and explore if it aligns with your investment goals. Don't miss out on the opportunity to understand why billionaires are investing in this high-growth BlackRock ETF. (Insert link to relevant resources here)

Featured Posts

-

Wynne Evans Illness A Look At His Recovery And Possible Stage Return

May 09, 2025

Wynne Evans Illness A Look At His Recovery And Possible Stage Return

May 09, 2025 -

Stricter Uk Visa Rules Addressing Work And Student Visa Abuse

May 09, 2025

Stricter Uk Visa Rules Addressing Work And Student Visa Abuse

May 09, 2025 -

Increased Scrutiny For Nigerian Visa Applicants In The Uk

May 09, 2025

Increased Scrutiny For Nigerian Visa Applicants In The Uk

May 09, 2025 -

Iditarod 2024 Following Seven Rookie Teams To Nome

May 09, 2025

Iditarod 2024 Following Seven Rookie Teams To Nome

May 09, 2025 -

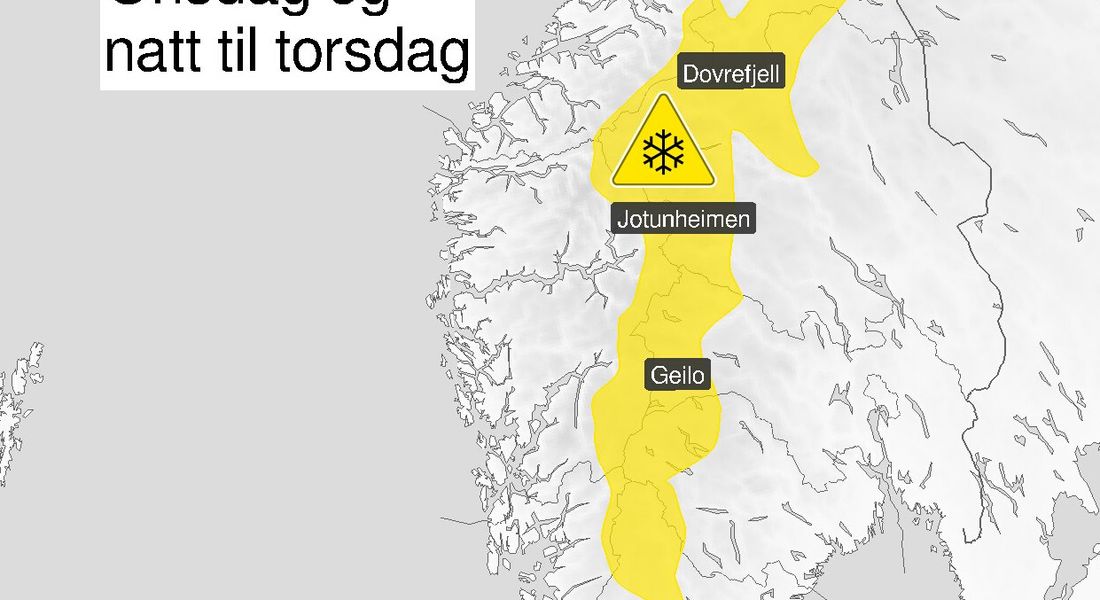

Sno Og Vanskelige Kjoreforhold Viktig Informasjon For Sor Noreg

May 09, 2025

Sno Og Vanskelige Kjoreforhold Viktig Informasjon For Sor Noreg

May 09, 2025