Wall Street's Resurgence: A Turnaround For Bullish Investors

Table of Contents

Economic Indicators Pointing Towards a Bull Market

Several key economic indicators suggest a sustained period of growth, fueling Wall Street's resurgence. Let's examine some of the most significant factors:

Inflation Cooling and Interest Rate Hikes Slowing Down

Easing inflationary pressures are a major driver of market optimism. The inflation rate, which soared to multi-decade highs in 2022, is now showing signs of cooling. The Federal Reserve's (Fed) monetary policy, including interest rate hikes, aimed at curbing inflation, is beginning to show results. While interest rate hikes impact borrowing costs, their slowing down indicates a stabilizing economic environment. This improved market stability is reflected in decreased volatility and increased investor confidence.

- Data Point: The Consumer Price Index (CPI) has shown a consistent decline in recent months, indicating that inflationary pressures are easing.

- Impact: Reduced inflation allows the Fed to potentially pause or slow the pace of interest rate hikes, bolstering investor confidence and reducing the risk of a sharp economic downturn.

- Keywords: inflation rate, interest rate hikes, monetary policy, market stability, CPI, Federal Reserve

Strong Corporate Earnings and Profitability

Robust corporate earnings reports are another significant indicator of a healthy market. Many companies are exceeding expectations, demonstrating strong profitability and driving stock market performance. This positive trend is particularly noticeable in specific sectors such as technology, energy, and healthcare, which are experiencing robust sector growth.

- Example: Strong performance in the tech sector, driven by AI advancements and cloud computing, has significantly boosted overall market sentiment.

- Impact: High corporate earnings indicate a strong economy and increased investor returns, contributing to the ongoing Wall Street resurgence.

- Keywords: corporate earnings, profitability, stock market performance, sector growth, earnings reports

Increased Consumer Spending and Economic Growth

Increased consumer spending is a vital sign of a thriving economy. Positive consumer confidence and rising disposable incomes are fueling increased demand for goods and services, leading to significant GDP growth. Consumer confidence indices are showing improvements, suggesting a more optimistic outlook among consumers.

- Data Point: Recent reports show an increase in retail sales and consumer spending across various sectors.

- Impact: Strong consumer spending translates to increased revenue for businesses, supporting economic growth and reinforcing the bull market narrative.

- Keywords: consumer spending, economic growth, consumer confidence, GDP growth, retail sales

Strategies for Bullish Investors in the Resurgent Market

The resurgence of Wall Street presents excellent opportunities for investors, but a strategic approach is essential. Here are key strategies to consider:

Identifying Growth Stocks and Emerging Markets

Identifying growth stocks and emerging markets is crucial for maximizing returns in a bull market. Thorough research, focusing on companies with strong fundamentals and growth potential, is key. Emerging markets often offer higher growth potential, but also come with increased risk.

- Strategy: Analyze industry trends, technological advancements, and competitive landscapes to identify promising growth stocks. Diversify across sectors and geographies to mitigate risk.

- Keywords: growth stocks, emerging markets, stock picking, investment strategy, fundamental analysis

Diversification and Risk Management in a Bull Market

Even in a bull market, diversification and risk management are paramount. Don't put all your eggs in one basket. Diversify your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate potential losses.

- Strategy: Implement a well-defined asset allocation strategy based on your risk tolerance and investment goals.

- Keywords: portfolio diversification, risk management, investment portfolio, asset allocation, risk tolerance

Long-Term Investment Strategies vs. Short-Term Gains

While the allure of short-term gains is tempting, a long-term investment strategy is often more rewarding in a bull market. Short-term trading exposes you to greater volatility and risk. A buy-and-hold strategy, focusing on long-term growth, can yield significant returns over time.

- Strategy: Invest in companies with solid fundamentals and a proven track record, aiming for long-term growth rather than quick profits.

- Keywords: long-term investment, short-term trading, investment horizon, buy and hold strategy, long-term growth

Potential Risks and Challenges in the Resurgent Market

While Wall Street's resurgence offers significant opportunities, it's crucial to acknowledge potential risks and challenges:

Geopolitical Uncertainty and Global Economic Risks

Geopolitical instability and global economic uncertainties can significantly impact market performance. Events such as international conflicts or unexpected economic downturns in major economies can create market volatility.

- Impact: These events can trigger market corrections or even a broader economic downturn, impacting investor confidence.

- Keywords: geopolitical risk, global economy, market volatility, economic uncertainty, international conflict

Inflationary Pressures and Interest Rate Volatility

While inflation is currently cooling, the risk of unexpected spikes remains. Interest rate volatility, resulting from the Fed's actions, can also influence market sentiment.

- Impact: Sudden increases in inflation or interest rates can lead to market corrections and reduce investor confidence.

- Keywords: inflation risk, interest rate volatility, market correction, economic downturn, monetary policy

Overvaluation and Market Bubbles

In a bull market, some sectors or assets might become overvalued, creating the risk of market bubbles. Identifying these bubbles and avoiding overexposure is crucial.

- Impact: Market bubbles can burst, leading to significant losses for investors who are heavily invested in overvalued assets.

- Keywords: market valuation, stock market bubble, market correction, investment risk, overvalued assets

Conclusion: Capitalizing on Wall Street's Resurgence

Wall Street's resurgence is driven by several key factors: cooling inflation, strong corporate earnings, and increased consumer spending. However, potential risks such as geopolitical uncertainty and inflation remain. Bullish investors can capitalize on this market upswing by employing effective strategies such as identifying growth stocks, diversifying portfolios, and adopting a long-term investment horizon. Remember to conduct thorough research, consider your risk tolerance, and, if needed, seek professional financial advice. By understanding the opportunities and risks associated with Wall Street's resurgence, you can position yourself for success. Start researching and developing your investment strategy today to benefit from Wall Street's resurgence and navigate this dynamic market effectively.

Featured Posts

-

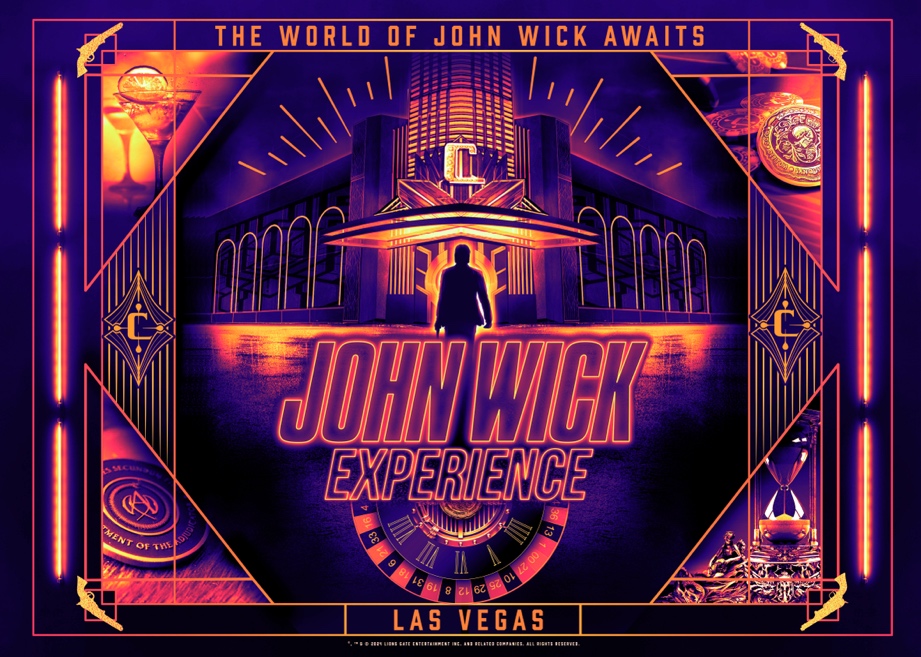

Las Vegas John Wick Experience Embrace Your Inner Baba Yaga

May 11, 2025

Las Vegas John Wick Experience Embrace Your Inner Baba Yaga

May 11, 2025 -

Nintendos Action Leads To Ryujinx Emulator Development Cessation

May 11, 2025

Nintendos Action Leads To Ryujinx Emulator Development Cessation

May 11, 2025 -

Mls

May 11, 2025

Mls

May 11, 2025 -

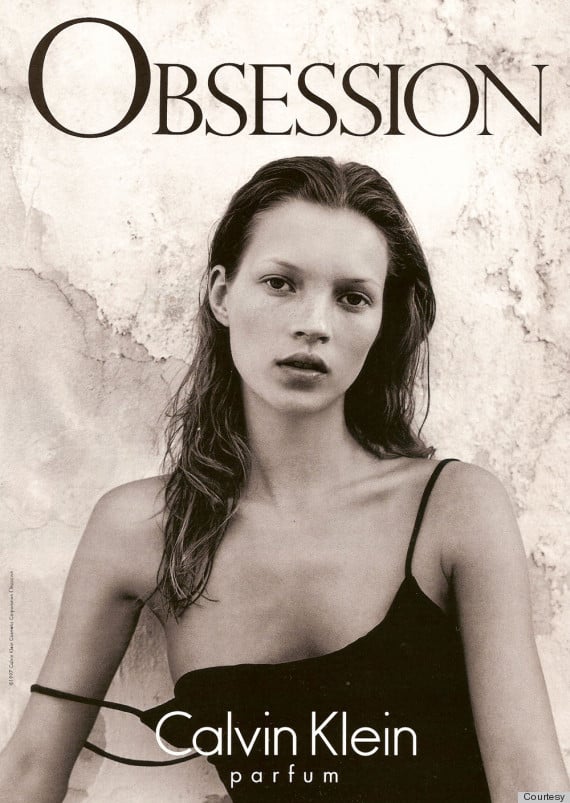

Lily Collins Stars In Sexy Calvin Klein Campaign See The Photos

May 11, 2025

Lily Collins Stars In Sexy Calvin Klein Campaign See The Photos

May 11, 2025 -

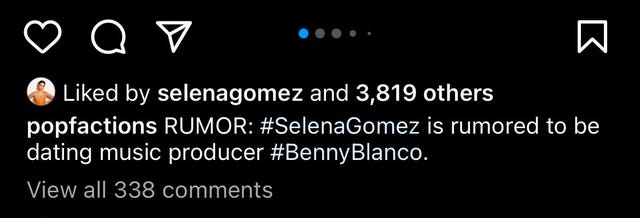

Selena Gomez Responds To Cheating Rumors Involving Benny Blanco

May 11, 2025

Selena Gomez Responds To Cheating Rumors Involving Benny Blanco

May 11, 2025