Walleye Cuts Credit: A Commodities Team's Focus On Core Groups

Table of Contents

Understanding the Challenges of Commodities Credit Risk

Assessing creditworthiness in the commodities market presents unique challenges far beyond those in traditional financial markets. The inherent volatility makes accurate risk assessment crucial. Consider these key obstacles:

- High volatility of commodity prices: Global events, weather patterns, and geopolitical instability constantly impact prices, making accurate forecasting challenging. This commodity price volatility necessitates robust risk models that account for these fluctuations.

- Complex supply chains: Commodities often travel through intricate global networks, increasing the complexity of tracing origin, ownership, and potential disruptions. Effective credit risk management in commodities requires a deep understanding of these supply chain dynamics.

- Geopolitical risks: Political instability, trade wars, and sanctions significantly influence commodity markets, adding a layer of unpredictable risk. Understanding these geopolitical risks is vital for any commodity credit analysis.

- Counterparty risks: Dealing with numerous counterparties across various jurisdictions increases the risk of default or payment failures. Thorough counterparty risk assessment is essential.

- Regulatory changes: Frequent alterations in regulations and compliance standards further complicate the credit risk landscape, requiring continuous monitoring and adaptation.

These challenges highlight the need for specialized expertise and sophisticated analytical tools to effectively manage credit risk within the commodities sector. The recent disruptions in the global grain supply chain due to the war in Ukraine, for instance, serve as a stark reminder of the unpredictable nature of commodity markets and the importance of proactive risk management.

The "Walleye Cuts" Strategy: Focusing on Core Commodity Groups

The "Walleye Cuts" strategy represents a paradigm shift in commodity credit risk management. It advocates for concentrating resources on a smaller number of strategically chosen core commodity groups. This focused approach offers several key advantages:

- Reduced complexity: By narrowing the focus, analysts can delve deeper into the intricacies of fewer, better-understood markets. This reduces the overall complexity of the risk assessment process.

- Improved risk assessment: Deep expertise within specific core groups (e.g., energy, agriculture, base metals) enables more accurate risk profiling and prediction.

- Efficient resource allocation: Concentrating efforts on fewer groups allows for optimal allocation of human and financial resources, maximizing efficiency and minimizing operational costs.

Identifying core groups involves a rigorous process, using criteria such as market size, trading volume, strategic importance, and the firm's existing expertise. Data sources range from publicly available market data and financial statements to proprietary intelligence and industry reports. Sophisticated analytical techniques, including predictive modeling and machine learning, are often employed to refine the selection process and optimize the commodity portfolio.

Enhanced Due Diligence and Risk Assessment for Core Groups

Focusing on core commodity groups allows for significantly enhanced due diligence and risk assessment:

- Detailed credit analysis: More time can be dedicated to thorough credit analysis of individual counterparties within the selected groups. This includes detailed financial statement analysis, credit scoring models, and qualitative assessments.

- Enhanced monitoring of key indicators: Continuous monitoring of key indicators such as price movements, production levels, and counterparty financial health provides early warning signals of potential problems.

- Stress testing and scenario planning: Sophisticated simulations, incorporating various stress scenarios, allow for a more realistic assessment of potential losses under different market conditions.

The implementation of advanced analytical techniques, such as machine learning and predictive analytics, plays a crucial role. These tools enable the development of more accurate credit scoring models and improve the prediction of defaults. However, it's critical to combine quantitative data with qualitative factors, such as management quality and geopolitical risks, to achieve a holistic view.

Improved Resource Allocation and Operational Efficiency

The "Walleye Cuts" strategy leads to significant improvements in resource allocation and operational efficiency:

- Reduced operational costs: By streamlining the analytical process and focusing on fewer groups, firms can reduce overall operational costs associated with credit risk management.

- Improved decision-making speed: Deeper expertise and readily available data lead to faster and more informed credit decisions.

- Enhanced team collaboration: Concentrating efforts enables better coordination and collaboration among team members, improving communication and knowledge sharing.

- More accurate risk forecasting: A more focused approach allows for more accurate risk forecasting, leading to better risk mitigation strategies.

By concentrating resources, the firm can achieve economies of scale, freeing up resources for other crucial activities and ultimately leading to substantial cost reduction strategies.

Conclusion

The "Walleye Cuts" approach to commodities credit risk management offers a compelling solution to the challenges posed by the volatile and complex nature of the commodities market. By focusing on core commodity groups, firms can significantly improve the accuracy of their credit assessments, enhance their risk mitigation capabilities, and achieve greater operational efficiency. The benefits extend from reduced operational costs to faster, more informed decision-making and enhanced team collaboration. Implement a "Walleye Cuts" strategy for improved commodities credit risk management today! Optimize your commodities credit risk management with a focused approach to core groups.

Featured Posts

-

Dodgers Defeat Cubs 3 0 Yamamotos 6 Inning Masterpiece And Edmans 3 Run Homer

May 13, 2025

Dodgers Defeat Cubs 3 0 Yamamotos 6 Inning Masterpiece And Edmans 3 Run Homer

May 13, 2025 -

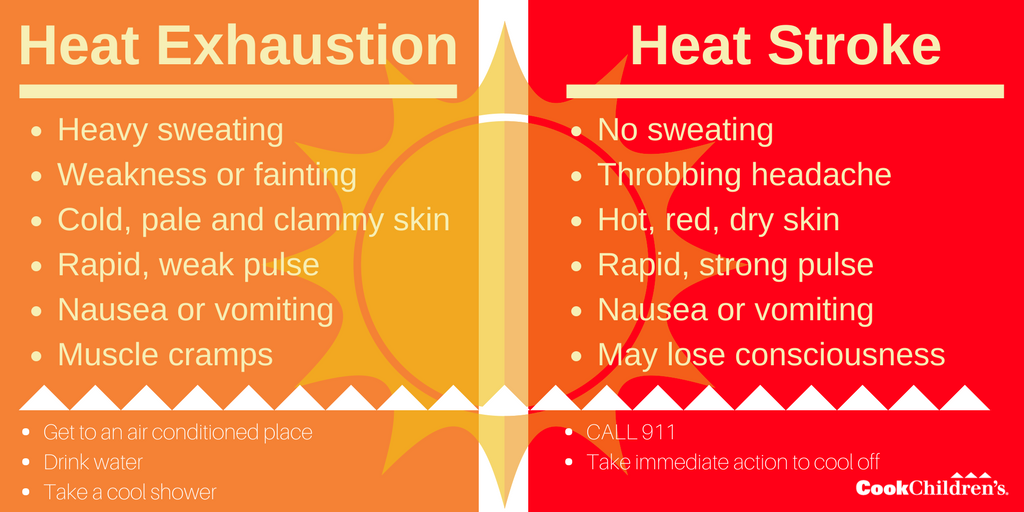

Ghaziabads Heat Advisory Safety Guidelines For Outdoor Workers In Noida

May 13, 2025

Ghaziabads Heat Advisory Safety Guidelines For Outdoor Workers In Noida

May 13, 2025 -

Selective Justice Examining Britain And Australias Stance On Myanmars Military And Opposition

May 13, 2025

Selective Justice Examining Britain And Australias Stance On Myanmars Military And Opposition

May 13, 2025 -

Watch Texas Rangers Vs Boston Red Sox Free Mlb Live Stream

May 13, 2025

Watch Texas Rangers Vs Boston Red Sox Free Mlb Live Stream

May 13, 2025 -

Ostapenko Upsets Sabalenka In Stuttgart Final

May 13, 2025

Ostapenko Upsets Sabalenka In Stuttgart Final

May 13, 2025