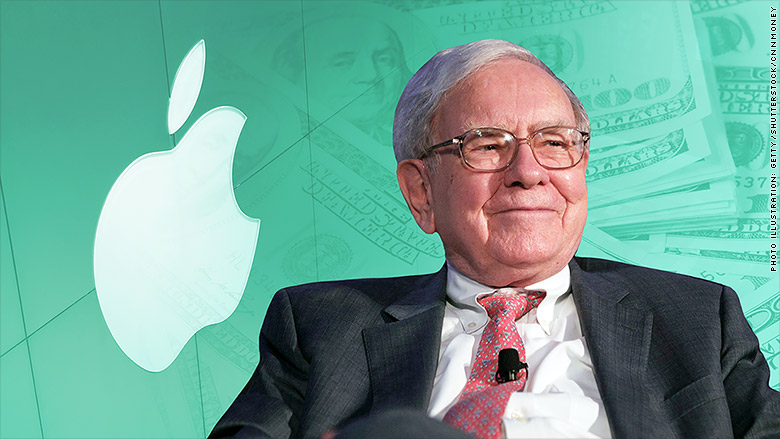

Warren Buffett And Apple: A Case Study In Long-Term Investment Success

Table of Contents

The Genesis of the Warren Buffett Apple Investment

Berkshire Hathaway's foray into Apple wasn't a sudden decision. It was a gradual process, starting with smaller purchases in 2016, which slowly grew into a massive stake. Initially, the Warren Buffett Apple investment raised eyebrows within the investing community. Buffett's traditional value investing approach, focusing on undervalued, established companies with robust balance sheets, seemed at odds with Apple, a tech company known for its innovative products and fluctuating stock prices.

However, several factors swayed Buffett. He recognized Apple's incredibly strong brand loyalty, the seamless integration of its products within a powerful ecosystem, and the enormous potential of its services division. This combination, combined with Apple's growing profitability, convinced him of its long-term potential.

- Initial purchase date and amount: While the exact dates and amounts of early purchases are not publicly available, it is known that Berkshire Hathaway significantly increased its holdings throughout 2016 and beyond.

- Initial market reaction: The initial market reaction was mixed. Some analysts questioned the investment, seeing it as a departure from Buffett’s usual strategy. However, this skepticism soon faded as Apple's performance continued to grow.

- Key differentiators of Apple that attracted Buffett: Buffett saw Apple's immense brand loyalty, its robust and expanding ecosystem (iPhones, iPads, Macs, Apple Watch, etc.), and the sticky nature of its services (Apple Music, iCloud, App Store) as key differentiators setting it apart from other tech companies.

Apple's Business Model and its Appeal to Buffett's Value Investing Principles

Apple's business model perfectly aligns with Buffett's value investing principles. The company possesses a powerful "moat," a competitive advantage that protects it from rivals. This moat is multifaceted:

- Explanation of Apple's moat: The network effect – the value of the Apple ecosystem increases as more users join – coupled with unparalleled brand recognition and ecosystem lock-in, creates a significant barrier to entry for competitors.

- Analysis of Apple's pricing power and profitability: Apple commands premium prices for its products due to the high demand and brand loyalty. This translates into exceptional profitability margins.

- Discussion of Apple's recurring revenue streams (services): Apple's services division, generating recurring revenue from subscriptions and app sales, provides a stable and predictable income stream, further enhancing its long-term value.

This strong business model, characterized by high profitability, brand loyalty, and recurring revenue streams, perfectly embodies the kind of long-term value Buffett seeks in his investments.

The Long-Term Returns and the Power of Patience

The Warren Buffett Apple investment has yielded spectacular returns for Berkshire Hathaway. The initial investment has grown significantly, demonstrating the power of patience and a long-term investment horizon.

- Percentage return on investment: While the precise percentage return varies depending on the purchase dates and the specific timing of calculations, the overall return on Berkshire Hathaway's Apple investment has been extraordinarily high, exceeding many of their other investments.

- Comparison to other Berkshire Hathaway investments: While many of Buffett’s investments have been successful, the Apple investment stands out for its sheer scale and rapid growth in a relatively short period.

- The impact of dividend reinvestment: Though Apple doesn't currently pay dividends, the capital appreciation alone has been substantial enough to generate incredible wealth.

Lessons Learned from the Warren Buffett Apple Investment

The Warren Buffett Apple investment offers invaluable lessons for individual investors:

- Importance of fundamental analysis: Thoroughly research a company's fundamentals—its business model, financial health, and competitive landscape—before investing.

- The value of long-term perspective: Patience is crucial for long-term investment success. Don't be swayed by short-term market fluctuations.

- Risk management strategies: While the Apple investment has been exceptionally successful, remember that all investments carry risk. Diversify your portfolio and invest only what you can afford to lose.

Conclusion

The Warren Buffett Apple investment stands as a testament to the power of long-term vision, the importance of understanding a company's fundamental strength, and the patience required to ride out market volatility. The significant financial returns achieved highlight the potential rewards of identifying and investing in truly exceptional businesses. Understanding Warren Buffett’s investment strategy, particularly his successful long-term Apple investments, provides valuable insights for all investors. Learning from Buffett's Apple investment emphasizes the need for rigorous due diligence and a long-term perspective.

To further your understanding of value investing and successful long-term investment strategies, explore additional resources on Warren Buffett's investment philosophy and the fundamentals of successful long-term investing. Learn from Buffett’s Apple investment and craft your own path to financial success.

Featured Posts

-

Australian Dollar Vs New Zealand Dollar Options Market Signals A Shift

May 06, 2025

Australian Dollar Vs New Zealand Dollar Options Market Signals A Shift

May 06, 2025 -

Shotgun Cop Man A Weird And Wild Platformer Experience

May 06, 2025

Shotgun Cop Man A Weird And Wild Platformer Experience

May 06, 2025 -

Patrick Schwarzeneggers Classic Bronco Effortless Cool In La

May 06, 2025

Patrick Schwarzeneggers Classic Bronco Effortless Cool In La

May 06, 2025 -

Inchvo E Natanyahvo N Aliyevi Hamar Baryekhvosvo Tyvo N Anvo M Trampi Mvot

May 06, 2025

Inchvo E Natanyahvo N Aliyevi Hamar Baryekhvosvo Tyvo N Anvo M Trampi Mvot

May 06, 2025 -

Gigabyte Aorus Master 16 Review Powerful Graphics But Loud Fans

May 06, 2025

Gigabyte Aorus Master 16 Review Powerful Graphics But Loud Fans

May 06, 2025

Latest Posts

-

Life After Lockup Watch Gypsy Roses Story Full Episodes Streaming

May 06, 2025

Life After Lockup Watch Gypsy Roses Story Full Episodes Streaming

May 06, 2025 -

Gypsy Rose Blanchards 25 Pound Weight Loss Journey After Pregnancy

May 06, 2025

Gypsy Rose Blanchards 25 Pound Weight Loss Journey After Pregnancy

May 06, 2025 -

Is Gypsy Rose Blanchard Ready For Marriage With Ken Urker An Analysis

May 06, 2025

Is Gypsy Rose Blanchard Ready For Marriage With Ken Urker An Analysis

May 06, 2025 -

Gypsy Rose Life After Lockup Full Episodes And Where To Watch

May 06, 2025

Gypsy Rose Life After Lockup Full Episodes And Where To Watch

May 06, 2025 -

Gypsy Rose Blanchard Shows Off 25 Pound Weight Loss Following Babys Birth

May 06, 2025

Gypsy Rose Blanchard Shows Off 25 Pound Weight Loss Following Babys Birth

May 06, 2025