Warren Buffett's Apple Stock Sale: A Strategic Move And What It Means For Investors

Table of Contents

The recent sale of Apple stock by Warren Buffett's Berkshire Hathaway has sent ripples through the financial world. This strategic move, by one of the most respected investors of all time, raises crucial questions about the future of Apple, the shifting landscape of Berkshire Hathaway's portfolio, and what it all means for individual investors. This article delves into the details of the sale, analyzing the potential reasons behind Buffett's decision and its implications for the broader market.

The Scale of the Apple Stock Sale and its Timing

Keywords: Berkshire Hathaway, Apple stock holdings, stock reduction, quarterly reports, SEC filings.

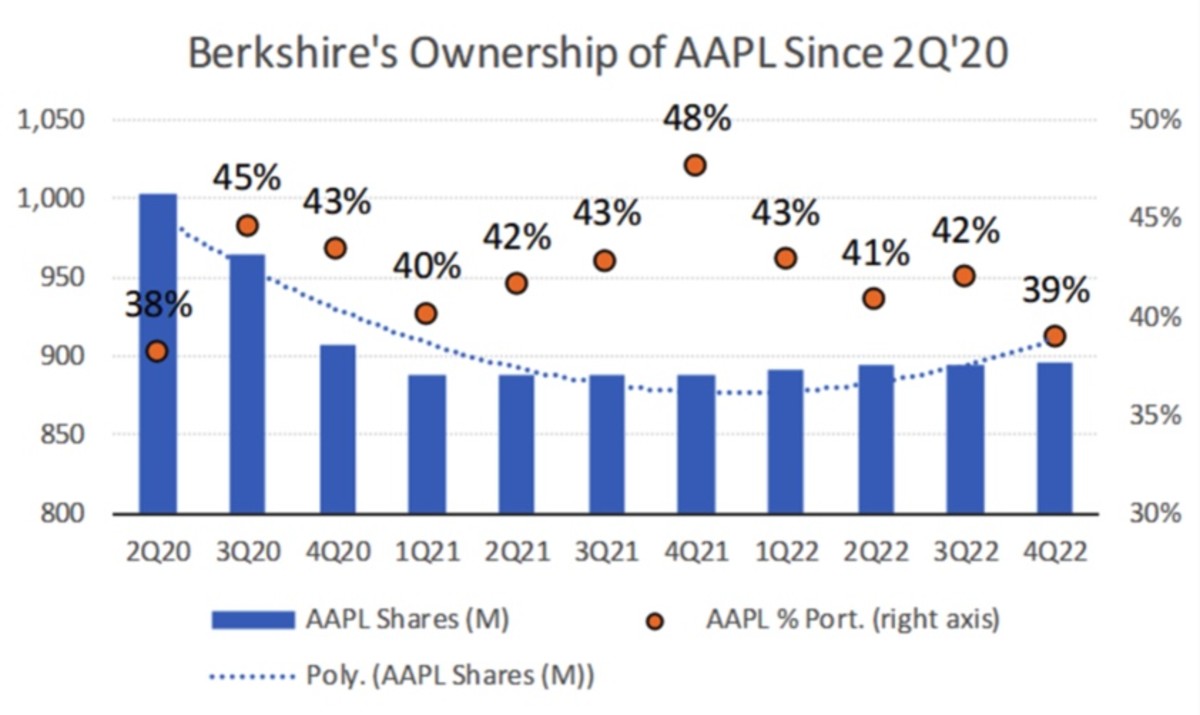

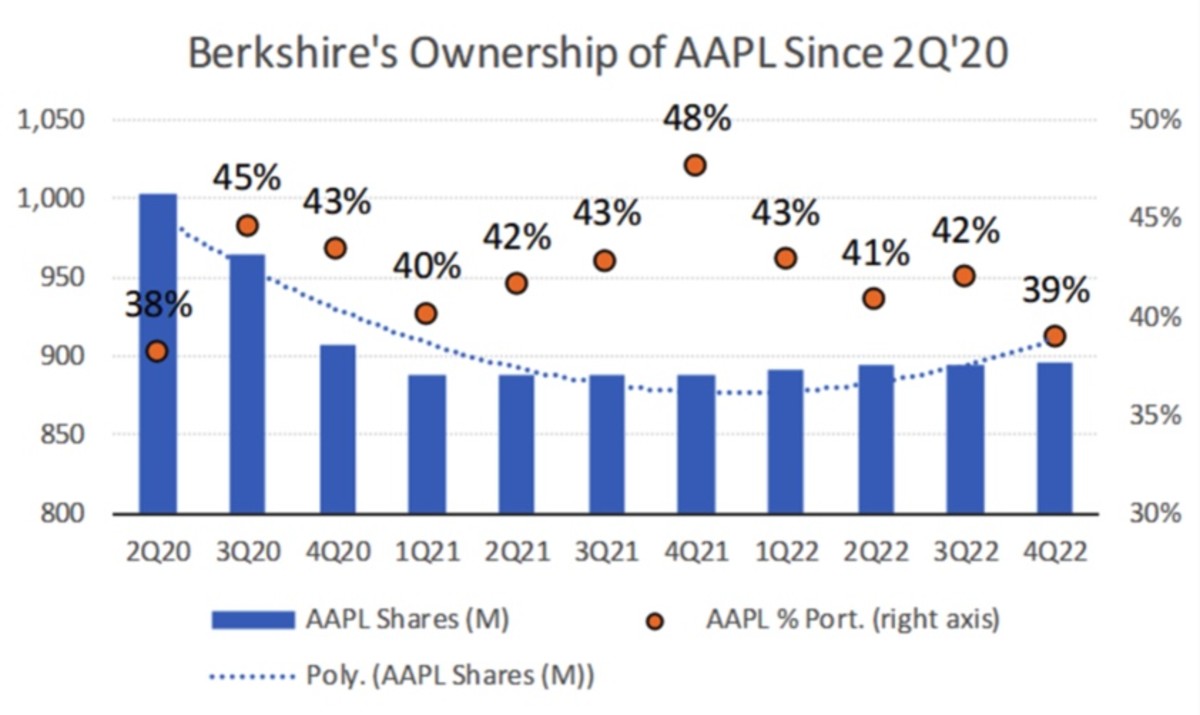

Berkshire Hathaway's reduction in Apple stock holdings wasn't a minor adjustment; it represented a significant shift in their investment strategy. While the precise amounts and timing vary across quarters, analyzing SEC filings reveals a substantial decrease in their Apple stock ownership. This wasn't a single, sudden event but rather a strategic reduction spread across several quarters.

- Percentage Reduction: Berkshire Hathaway reduced its Apple stock holdings by [Insert Percentage]% – a substantial decrease from their peak ownership.

- Value of Sold Shares: The overall value of the sold shares amounted to [Insert Dollar Amount], reflecting a significant capital outflow from this single holding.

- Timeframe: The sales occurred gradually over [Insert timeframe, e.g., the last three quarters], suggesting a planned and considered strategy rather than a panicked reaction.

- SEC Filings: For detailed information, refer to the official SEC filings available on the [Link to SEC Filings].

Potential Reasons Behind Buffett's Decision

Keywords: Investment strategy, portfolio diversification, market valuation, stock price, economic outlook, risk management.

While Buffett himself may not explicitly state his reasons, several plausible explanations exist for the Apple stock sale. His investment decisions are often guided by a long-term perspective, risk management, and a focus on value.

- Portfolio Diversification: A core tenet of Buffett's investment philosophy is diversification. Reducing Apple's weight in the portfolio mitigates concentration risk – if Apple experiences a significant downturn, the impact on Berkshire Hathaway's overall portfolio is lessened.

- Concerns about Apple's Future Growth: While Apple remains a dominant player, concerns about slowing growth in specific sectors (e.g., iPhone sales) or increased competition may have influenced Buffett's decision. Analyst reports suggesting a plateauing of Apple's growth trajectory might support this theory.

- Attractive Investment Opportunities Elsewhere: Buffett is always looking for undervalued assets. The sale of Apple stock could free up capital to invest in other sectors he deems more promising, offering potentially higher returns.

- Economic Outlook Concerns: A cautious outlook on the broader economic environment, potentially involving recessionary fears, could have prompted a strategic move towards a more conservative portfolio allocation.

The Impact on Apple Stock and the Broader Market

Keywords: Stock price volatility, market reaction, investor sentiment, stock performance, Apple valuation.

The sale of Apple stock by Berkshire Hathaway had a noticeable, though not catastrophic, impact on the market.

- Short-Term Market Reaction: The news initially caused some volatility in Apple's stock price, with a [Insert direction and percentage] change observed in the immediate aftermath of the announcement.

- Long-Term Implications: The long-term effects remain to be seen, but the sale could signal a shift in investor sentiment towards Apple, potentially leading to a more cautious valuation of the company.

- Ripple Effect on Tech Stocks: The decision might influence the valuation of other tech companies, depending on market interpretation of Buffett's actions.

- Changes in Investor Sentiment: The sale could foster a more cautious outlook among some investors regarding Apple's future growth potential, despite the company’s enduring market dominance.

Implications for Individual Investors

Keywords: Investment advice, portfolio management, risk tolerance, long-term investing, diversification strategy.

Warren Buffett's investment choices are not a blueprint for everyone. His actions, however, offer valuable insights into investment principles.

- Diversification is Key: The Apple stock sale underscores the importance of a well-diversified investment portfolio to mitigate risk. Don't put all your eggs in one basket.

- Assess Your Risk Tolerance: Consider your individual risk tolerance and investment goals before making any investment decisions. Buffett’s choices reflect his long-term strategy, which may not suit everyone's financial profile.

- Avoid Impulsive Decisions: Don't blindly follow Buffett's actions. Conduct thorough due diligence before making investment decisions based on news headlines.

- Due Diligence is Essential: Thorough research is paramount. Before investing in any stock, understand the company's financials, market position, and growth prospects.

Conclusion

Warren Buffett's reduction of Apple stock holdings highlights the dynamic nature of investment strategies, even for the most experienced investors. The sale reflects principles of portfolio diversification, risk management, and a continuous search for value. While the specific impact on Apple's stock price and the broader market is still unfolding, it serves as a reminder of the importance of adapting investment strategies to evolving economic conditions and market dynamics. Understanding Warren Buffett's investment decisions, and the nuances of Apple stock and other significant holdings, is crucial for navigating the complexities of the stock market. Learn more about creating a diversified investment strategy today!

Featured Posts

-

Rayadas Doblete De Burky Define La Victoria Del Partido

Apr 23, 2025

Rayadas Doblete De Burky Define La Victoria Del Partido

Apr 23, 2025 -

3 Mart 2024 Pazartesi Ankara Iftar Ve Sahur Vakitleri

Apr 23, 2025

3 Mart 2024 Pazartesi Ankara Iftar Ve Sahur Vakitleri

Apr 23, 2025 -

Aldhhb Alywm Asearh Balsaght Bed Alankhfad

Apr 23, 2025

Aldhhb Alywm Asearh Balsaght Bed Alankhfad

Apr 23, 2025 -

Ohio Train Disaster Long Term Presence Of Toxic Chemicals In Nearby Structures

Apr 23, 2025

Ohio Train Disaster Long Term Presence Of Toxic Chemicals In Nearby Structures

Apr 23, 2025 -

L Integrale De Good Morning Business Du Lundi 24 Fevrier 2024

Apr 23, 2025

L Integrale De Good Morning Business Du Lundi 24 Fevrier 2024

Apr 23, 2025