Warren Buffett's Leadership Lessons: Humility And Avoiding Mistakes

Table of Contents

The Power of Humility in Warren Buffett's Leadership Style

Warren Buffett's success isn't solely attributable to genius; it's significantly fueled by his remarkable humility. This humble leadership forms the bedrock of his approach.

Acknowledging Limitations and Seeking Expertise

Buffett readily admits when he doesn't know something. He understands the importance of teamwork and delegation, surrounding himself with a team of experts whose diverse skillsets complement his own. This isn't a sign of weakness, but a strength. It's a testament to his understanding of his own circle of competence.

- Examples: Buffett relies heavily on his trusted lieutenants at Berkshire Hathaway, acknowledging their expertise in areas where he lacks specific knowledge. He famously sought expert advice before making significant acquisitions.

- Instances of admitting mistakes: Buffett has publicly acknowledged past investment blunders, demonstrating a willingness to learn and adapt. This transparency builds trust and fosters a culture of continuous improvement within his organization.

- Emphasis on continuous learning: Buffett is a voracious reader and continuously seeks new knowledge, demonstrating his commitment to lifelong learning and his understanding that knowledge is power, particularly in the dynamic world of finance. This relentless pursuit of knowledge directly supports his continuous improvement efforts.

This emphasis on expert advice and open communication is key to his effective teamwork and strategic decision-making process.

Learning from Mistakes and Adapting Strategies

Buffett doesn't shy away from analyzing his past investment errors. He sees failure analysis as a crucial tool for refining future strategies. This proactive approach to adaptive leadership allows him to continuously learn and improve.

- Specific examples: While he rarely makes significant mistakes, examining his past investments, like his early involvement with Dexter Shoe Company, reveals his capacity to learn from setbacks and modify his approach. A detailed post-mortem analysis is always conducted.

- Approach to post-mortem analysis: Buffett meticulously dissects unsuccessful investments to identify underlying causes and prevent similar errors in the future. This rigorous process forms the basis of his risk mitigation strategies.

This consistent focus on refining his approach demonstrates his mastery of investment strategy through adaptation and learning from both successes and failures.

Warren Buffett's Proactive Approach to Avoiding Mistakes

Buffett’s extraordinary success is also a testament to his proactive approach to avoiding costly errors. This involves thorough planning and execution.

The Importance of Thorough Due Diligence

Buffett is renowned for his meticulous due diligence. Before making any significant investment decision, he conducts in-depth research and analysis.

- Detailed descriptions of his research process: Buffett spends countless hours understanding the fundamentals of a business, its management team, its competitive landscape, and its long-term prospects. He emphasizes understanding the business's "moat," or competitive advantage.

- The time he invests in understanding businesses: His commitment to long-term value creation means that he prioritizes thorough research above quick returns, thus establishing a robust basis for sound investment analysis.

- His focus on long-term value: Buffett's investment philosophy centers on identifying undervalued businesses with strong fundamentals and holding them for the long term, maximizing long-term investment returns.

This commitment to comprehensive thorough research is at the heart of his successful value investing strategy.

Understanding and Managing Risk

Buffett is famously risk-averse. He prefers predictable businesses with strong cash flows and a history of profitability. His approach to risk management involves carefully assessing potential downsides before committing to any investment.

- Examples of his risk-averse investment strategies: Buffett avoids speculative investments and focuses on businesses with a proven track record and strong balance sheets. He prefers understanding and controlling investment risk.

- His aversion to speculative investments: He consistently steers clear of high-risk, high-reward opportunities that lack a solid foundation of value and predictable future cash flows.

- His focus on understanding business fundamentals: Buffett emphasizes analyzing financial statements, management quality, and competitive dynamics to assess the inherent risks in each investment.

This conservative investing philosophy is a key factor contributing to his outstanding long-term performance and resilience in challenging economic times.

The Circle of Competence and Staying Within it

Buffett adheres to the principle of staying within his circle of competence. He focuses on areas where he possesses genuine expertise and avoids ventures outside his understanding.

- Real-world examples: Buffett’s success is largely built on his deep understanding of the insurance and consumer goods industries. He rarely ventures into technology or other areas where he lacks deep expertise.

- His advice on understanding one's limitations: Buffett repeatedly emphasizes the importance of knowing what you don't know, a key element in building one's investment expertise.

This focused investment strategy avoids spreading resources too thin and reduces the likelihood of costly mistakes.

Conclusion

Warren Buffett's remarkable success is a testament to the power of Warren Buffett's leadership lessons. His humility, proactive approach to error avoidance, and emphasis on meticulous due diligence, effective risk management, and staying within his circle of competence are invaluable lessons for leaders and investors alike. He consistently demonstrates the importance of understanding one’s limitations and learning from mistakes. By applying these principles to your leadership style, you can significantly enhance your effectiveness and reduce the risk of costly errors.

Learn from Warren Buffett's leadership lessons and cultivate humility in your approach to leadership and investment. Master the art of avoiding mistakes by incorporating Warren Buffett's strategies into your leadership style. By embracing his principles of thorough research, conservative risk assessment, and continuous learning, you can pave the way for lasting success. [Link to a resource on Warren Buffett or leadership development]

Featured Posts

-

Understanding Cobra Kais Connections To The Karate Kid Films

May 07, 2025

Understanding Cobra Kais Connections To The Karate Kid Films

May 07, 2025 -

Isabela Merced 10 Filmes Para Conhecer A Dina De The Last Of Us

May 07, 2025

Isabela Merced 10 Filmes Para Conhecer A Dina De The Last Of Us

May 07, 2025 -

Cavs 10 Day Contract G League Player Joins The Roster

May 07, 2025

Cavs 10 Day Contract G League Player Joins The Roster

May 07, 2025 -

Atfaqyt Shhn Jdydt Laram Trbt Alsyn Almghrb Walbrazyl Bkht Shhn Bhry

May 07, 2025

Atfaqyt Shhn Jdydt Laram Trbt Alsyn Almghrb Walbrazyl Bkht Shhn Bhry

May 07, 2025 -

Nhl A Svetovy Pohar 2028 Vplyv Ruska Na Slovensku Ucast

May 07, 2025

Nhl A Svetovy Pohar 2028 Vplyv Ruska Na Slovensku Ucast

May 07, 2025

Latest Posts

-

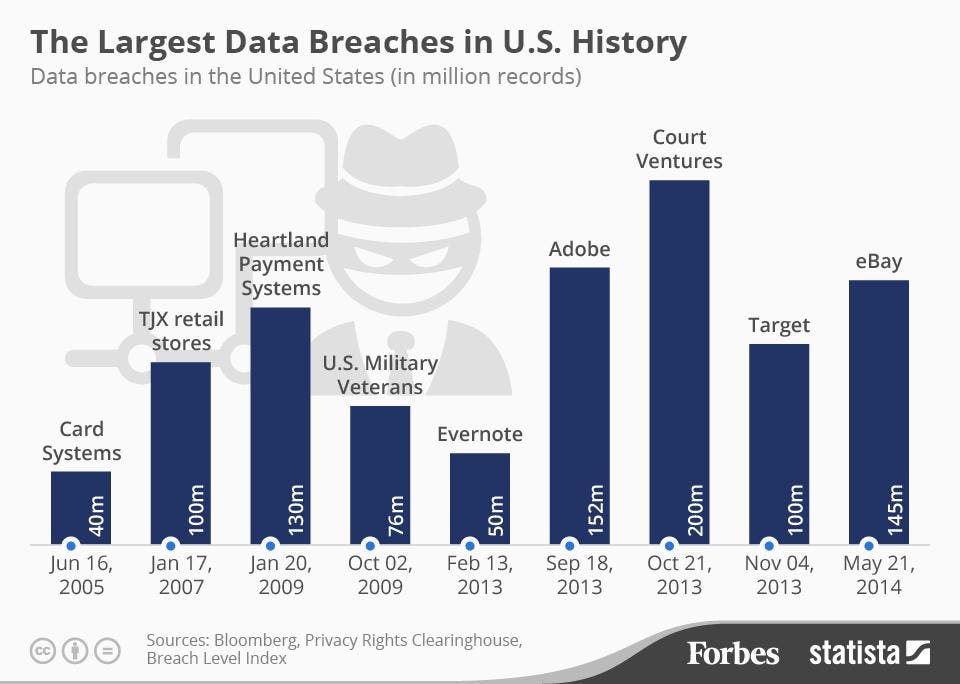

Federal Investigation Office365 Data Breaches Yield Millions For Hacker

May 08, 2025

Federal Investigation Office365 Data Breaches Yield Millions For Hacker

May 08, 2025 -

Exec Office365 Breaches Net Millions For Crook Fbi Says

May 08, 2025

Exec Office365 Breaches Net Millions For Crook Fbi Says

May 08, 2025 -

Impact Of Lingering Toxic Chemicals From Ohio Train Derailment On Buildings

May 08, 2025

Impact Of Lingering Toxic Chemicals From Ohio Train Derailment On Buildings

May 08, 2025 -

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 08, 2025

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 08, 2025 -

From Scatological Documents To Profound Podcasts The Power Of Ai Summarization

May 08, 2025

From Scatological Documents To Profound Podcasts The Power Of Ai Summarization

May 08, 2025