Weak Q1 Figures Cause 6% Fall In Kering Share Price

Table of Contents

Disappointing Q1 Performance Across Key Brands

Kering's Q1 2024 results revealed underwhelming performance across its key brands, significantly impacting the Kering share price. The underperformance wasn't isolated to a single brand but rather represented a broader trend affecting luxury retail sales. Let's examine the specific challenges:

-

Gucci: Gucci, Kering's flagship brand, experienced slower-than-expected growth, particularly in crucial markets like China and Europe. While exact figures are pending official reports, preliminary indications suggest a sales decline of approximately 5% compared to Q1 2023. This underperformance is attributed to weakening consumer demand in these key regions, potentially due to decreased consumer confidence and economic uncertainty.

-

Yves Saint Laurent (YSL): YSL also underperformed, with lower-than-anticipated handbag sales contributing significantly to the overall shortfall. Reports suggest a smaller percentage decline compared to Gucci, but still below internal projections and market expectations. This could indicate a need for renewed marketing strategies or adjustments to product offerings.

-

Bottega Veneta: Bottega Veneta continues to face challenges in its ongoing brand revitalization efforts. While the brand has shown attempts to rejuvenate its image, these efforts haven't yet translated into substantial revenue growth in Q1. The brand needs to find a more effective strategy to regain its position in the luxury market.

-

Other Brands: While the impact on other brands within the Kering portfolio remains relatively less pronounced in the initial reports, the collective underperformance significantly contributed to the overall negative sentiment impacting the Kering stock price.

Impact of Macroeconomic Factors on Luxury Spending

The disappointing Q1 results for Kering are not entirely isolated incidents. The luxury goods market is sensitive to macroeconomic trends, and several factors contributed to the downturn.

-

Inflation and Interest Rates: Rising inflation and interest rates have significantly impacted consumer confidence and discretionary spending globally. Luxury goods, being a non-essential category, are particularly vulnerable to such economic headwinds. High inflation erodes purchasing power, while higher interest rates increase borrowing costs and generally dampen consumer sentiment.

-

Economic Uncertainty and Geopolitical Risks: The ongoing global economic uncertainty, exacerbated by geopolitical instability and the lingering effects of the pandemic, has further dampened luxury consumer spending. Supply chain disruptions continue to pose challenges for many luxury brands, increasing costs and potentially affecting product availability.

-

Data and Statistics: Reports from leading economic institutions indicate a decline in consumer confidence indices, directly correlating with a slowdown in luxury purchases. These trends strongly suggest the current economic climate is negatively affecting the luxury goods sector, impacting Kering's performance and subsequently the Kering share price.

Investor Reaction and Market Outlook

The release of Kering’s weak Q1 figures immediately triggered a negative reaction in the market, resulting in a 6% drop in the Kering stock price. Investor sentiment has turned cautious, reflecting concerns about the company's ability to navigate the challenging macroeconomic landscape.

-

Analyst Commentary: Financial analysts have expressed concerns about the ongoing challenges facing Kering's key brands and the broader luxury market. Some analysts have downgraded their price targets for Kering stock, indicating a more pessimistic outlook for the short term. Several financial news outlets reported on the downturn, with several analysts suggesting the need for a substantial shift in strategy for a recovery.

-

Future Outlook: The outlook for Kering's stock performance remains uncertain. The company's ability to effectively address the challenges outlined above, including strengthening brand performance, adapting to changing consumer preferences, and effectively managing macroeconomic headwinds, will be crucial in determining its future trajectory. The market will be closely watching Kering's Q2 results and subsequent performance for any signs of recovery.

Conclusion

The significant 6% fall in Kering's share price following its disappointing Q1 figures underscores the volatility and sensitivity of the luxury goods market to macroeconomic factors. The weak performance across key brands like Gucci, YSL, and Bottega Veneta, coupled with the impact of inflation, economic uncertainty, and geopolitical risks, has created a challenging environment for the company. The negative investor sentiment and analyst commentary further highlight the severity of the situation. To make informed decisions about investments in Kering stock or the luxury goods sector, it is crucial to monitor Kering's Q2 and future financial updates, market analyses, and the company's strategic responses to these challenges. Understanding the factors influencing the Kering share price is key to navigating the volatility of this market.

Featured Posts

-

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025 -

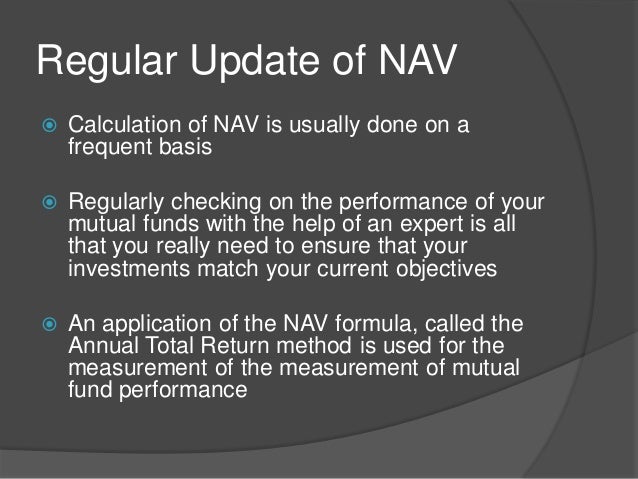

What Is Net Asset Value Nav A Focus On The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

What Is Net Asset Value Nav A Focus On The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

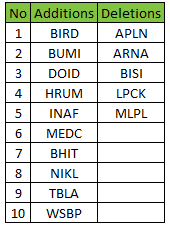

Apakah Mtel And Mbma Layak Dibeli Setelah Masuk Indeks Msci Small Cap

May 25, 2025

Apakah Mtel And Mbma Layak Dibeli Setelah Masuk Indeks Msci Small Cap

May 25, 2025 -

Porsche 911 Konfiguracio 80 Millio Forint Extrak

May 25, 2025

Porsche 911 Konfiguracio 80 Millio Forint Extrak

May 25, 2025 -

Ferrari Chief Slams Lewis Hamiltons Unfair Comments

May 25, 2025

Ferrari Chief Slams Lewis Hamiltons Unfair Comments

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025