Weekly CAC 40 Performance: Slight Decline, Stable Trend (07/03/2025)

Table of Contents

The CAC 40, a benchmark index for the French stock market, holds significant weight for investors worldwide. Its performance reflects the health of the French economy and offers insights into broader European market trends. This week, ending July 3rd, 2025, witnessed a slight decline in the CAC 40's performance, yet the overall trend remains relatively stable. This article analyzes the CAC 40 performance, examining the weekly performance, sector-specific trends, external influences, and offering a cautious outlook for the coming week. We'll explore key factors contributing to this week's movement, providing you with crucial insights into this important market index.

H2: Overall Weekly Performance of the CAC 40

The CAC 40 experienced a slight dip this week, ending with a -0.45% decrease compared to the previous week's closing price. While this represents a minor setback, it's important to consider the context of the year-to-date performance, which shows a more positive trend of +6.2%. The index opened the week at 7,320 points and closed at 7,285, reaching a high of 7,345 and a low of 7,270 during the trading period. This relatively contained range suggests a market consolidating after recent gains. Several factors contributed to this slight decline, including mixed economic data released from the Eurozone and concerns regarding global inflation.

- Percentage change from the previous week's closing price: -0.45%

- Opening value for the week: 7,320 points

- Closing value for the week: 7,285 points

- Highest point reached during the week: 7,345 points

- Lowest point reached during the week: 7,270 points

H2: Sector-Specific Performance within the CAC 40

Analyzing sector-specific performance reveals a mixed bag. While the energy sector enjoyed a modest uptick (+1.2%) fueled by rising oil prices, the technology sector underperformed (-1.8%), largely impacted by profit-taking after recent strong growth. The financial sector showed resilience, with a marginal increase of 0.2%. This divergence highlights the importance of diversification within the CAC 40.

- Energy Sector Performance: +1.2% (driven by rising oil prices and increased demand)

- Technology Sector Performance: -1.8% (profit-taking and concerns about future growth)

- Financial Sector Performance: +0.2% (relatively stable performance amidst economic uncertainty)

- Luxury Goods Sector Performance: +0.8% (steady demand despite global economic headwinds)

H2: Influence of External Factors on CAC 40 Performance

Several external factors played a role in shaping the CAC 40's weekly performance. Geopolitical tensions in Eastern Europe added to market uncertainty, while the release of weaker-than-expected Eurozone manufacturing data dampened investor sentiment. The relatively stable performance of the US dollar also influenced the index. Interest rate decisions from the European Central Bank (ECB) were largely in line with expectations, preventing any significant market shock.

- Geopolitical tensions in Eastern Europe: Increased market volatility and risk aversion.

- Weaker-than-expected Eurozone manufacturing data: Negative impact on investor confidence.

- US Dollar stability: Limited impact on the CAC 40, given the Euro's relative stability.

- ECB interest rate decision: Largely in line with expectations, avoiding significant market disruption.

H2: Predictions and Outlook for the CAC 40

Predicting short-term market movements is inherently challenging, yet based on current trends and considering the ongoing factors, a cautious outlook for next week seems prudent. The CAC 40's performance will likely depend on further economic data releases, geopolitical developments, and the direction of global inflation. Potential catalysts for further growth could include positive earnings reports from major CAC 40 companies and renewed investor confidence. Conversely, negative surprises on the economic front or escalating geopolitical tensions could put downward pressure on the index.

- Short-term outlook for the CAC 40 (next week's expected performance): Slight sideways movement, with potential for modest gains or losses depending on incoming data and news.

- Potential risks: Escalation of geopolitical tensions, weaker-than-expected economic data, and increased inflationary pressures.

- Potential opportunities: Strong corporate earnings, easing inflationary concerns, and improved investor sentiment.

Conclusion: Summarizing the CAC 40's Weekly Performance and Future Outlook

This week's analysis of the CAC 40 performance shows a slight decline (-0.45%), yet the overall trend remains relatively stable. Sectoral performance varied considerably, with energy and luxury goods sectors outperforming while technology lagged. External factors, including geopolitical uncertainties and economic data, contributed to the week's market movements. Looking ahead, careful monitoring of economic indicators and global events will be crucial for assessing the CAC 40's future performance. Stay tuned for next week's analysis of CAC 40 performance to keep up-to-date on the French stock market's trends and to gain further insight into the intricacies of the CAC 40's performance.

Featured Posts

-

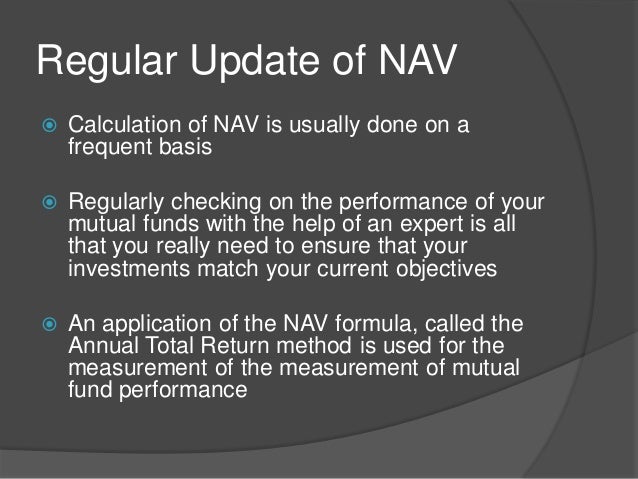

What Is Net Asset Value Nav A Focus On The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

What Is Net Asset Value Nav A Focus On The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Hawaii Keiki Artists Shine Memorial Day Lei Making Poster Competition

May 25, 2025

Hawaii Keiki Artists Shine Memorial Day Lei Making Poster Competition

May 25, 2025 -

Glastonbury 2025 Charli Xcx Neil Young And A Killer Lineup Is It The Best

May 25, 2025

Glastonbury 2025 Charli Xcx Neil Young And A Killer Lineup Is It The Best

May 25, 2025 -

18 Brazilian Nationals Face Charges In Massive Massachusetts Gun Trafficking Case

May 25, 2025

18 Brazilian Nationals Face Charges In Massive Massachusetts Gun Trafficking Case

May 25, 2025 -

Ferrari Hot Wheels New Releases Have Arrived Mamma Mia

May 25, 2025

Ferrari Hot Wheels New Releases Have Arrived Mamma Mia

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025