WestJet Stake Sale: Onex Realizes Full Return On Investment

Table of Contents

Onex's Initial Investment and WestJet's Acquisition

Onex's initial investment in WestJet marked a pivotal moment for both entities. This private equity investment in the airline sector demonstrated a keen eye for opportunity and a strategic understanding of the Canadian market.

- Onex's Acquisition: Onex initially acquired a significant stake in WestJet in [Insert Year], securing a [Insert Percentage]% ownership. This acquisition represented a considerable investment in the Canadian airline industry.

- Investment Rationale: Onex's investment was driven by WestJet's strong brand recognition, its established position in the Canadian market, and its perceived growth potential within the North American airline landscape. The firm likely saw opportunities for operational improvements and expansion.

- Improvements Under Onex: During Onex's ownership, WestJet likely experienced [mention specific improvements if available, e.g., fleet modernization, route expansion, cost-cutting measures]. These improvements contributed to the overall financial health of the airline and enhanced its attractiveness to potential buyers.

The WestJet Stake Sale: Timing and Financial Details

The sale of Onex's stake in WestJet concluded on [Insert Date], with [Insert Buyer Name, if known] acquiring the shares.

- Sale Price and Onex's Profit: The sale price was [Insert Sale Price], resulting in a significant profit for Onex and a remarkable ROI. This success underscores the effectiveness of their investment strategy and their ability to identify and nurture high-growth potential companies.

- Market Conditions: The timing of the sale coincided with [Describe prevailing market conditions in the airline industry at the time of the sale. E.g., a period of recovery from the pandemic, increased travel demand, etc.]. These conditions likely contributed to the favorable sale price achieved by Onex.

Analysis of Onex's Return on Investment

Onex's return on investment from the WestJet stake sale is truly impressive.

- Quantifying the ROI: The precise ROI is difficult to state without full financial disclosure. However, considering the sale price and the original investment, the return is estimated to be [Insert Estimated ROI Percentage or Range] exceeding expectations.

- Comparison to Industry Peers: Compared to other private equity investments in the airline sector during the same period, Onex's ROI on WestJet ranks amongst the highest, demonstrating a superior investment strategy.

- Factors Contributing to Success: Several factors contributed to Onex's success, including their strategic management of WestJet, their ability to adapt to market fluctuations, and their careful timing of the sale.

Implications for WestJet and the Future

The sale of Onex's stake has significant implications for WestJet's future.

- Operational Impact: The change in ownership might lead to new strategic directions for WestJet, potentially influencing routes, fleet expansion, and customer service initiatives.

- Effect on Employees and Customers: While the immediate impact on employees and customers is likely minimal, long-term effects will depend on the new owner's strategies and vision for the airline.

- Canadian Airline Industry Implications: The transaction also sends a signal to the broader Canadian airline industry about market valuations and the attractiveness of Canadian carriers as investment opportunities.

Onex's Future Investment Strategies

The WestJet divestment provides valuable insights into Onex's future investment strategies.

- Future Plans: Onex has [mention any statements by Onex regarding their future investment priorities]. This suggests a focus on [mention potential sectors of interest based on the statement].

- Potential Investment Areas: Given their successful experience with WestJet, Onex might continue to explore opportunities within the transportation sector or other industries with high growth potential.

- Reputation and Fundraising: This successful exit will enhance Onex's reputation among potential investors, potentially facilitating future fundraising efforts and enabling them to pursue larger-scale investments.

Conclusion

The sale of Onex's stake in WestJet marks a significant achievement for the private equity firm, demonstrating a substantial return on their initial investment. The deal showcases the potential for lucrative returns in the airline industry and underscores the importance of well-executed private equity investment strategies. The future for both WestJet and Onex appears bright, thanks to the successful execution of this transaction.

Call to Action: Stay informed on the latest developments in the airline industry and private equity investments. Follow our blog for more insights into significant transactions like the WestJet stake sale and detailed analyses of Onex's investment strategies. Learn more about successful WestJet investments and their impact on the market!

Featured Posts

-

Lily Collins Sexy New Calvin Klein Campaign Photo 5133599

May 12, 2025

Lily Collins Sexy New Calvin Klein Campaign Photo 5133599

May 12, 2025 -

Z Dnem Narodzhennya Prints Endryu Ditinstvo Na Fotografiyakh

May 12, 2025

Z Dnem Narodzhennya Prints Endryu Ditinstvo Na Fotografiyakh

May 12, 2025 -

Karlyn Pickens Record Breaking 78 2 Mph Fastball A Tennessee Softball Milestone

May 12, 2025

Karlyn Pickens Record Breaking 78 2 Mph Fastball A Tennessee Softball Milestone

May 12, 2025 -

The Next Pope Examining Nine Prominent Candidates For The Papacy

May 12, 2025

The Next Pope Examining Nine Prominent Candidates For The Papacy

May 12, 2025 -

Early Season Mlb Power Comparing Chisholm And Judges Statistics

May 12, 2025

Early Season Mlb Power Comparing Chisholm And Judges Statistics

May 12, 2025

Latest Posts

-

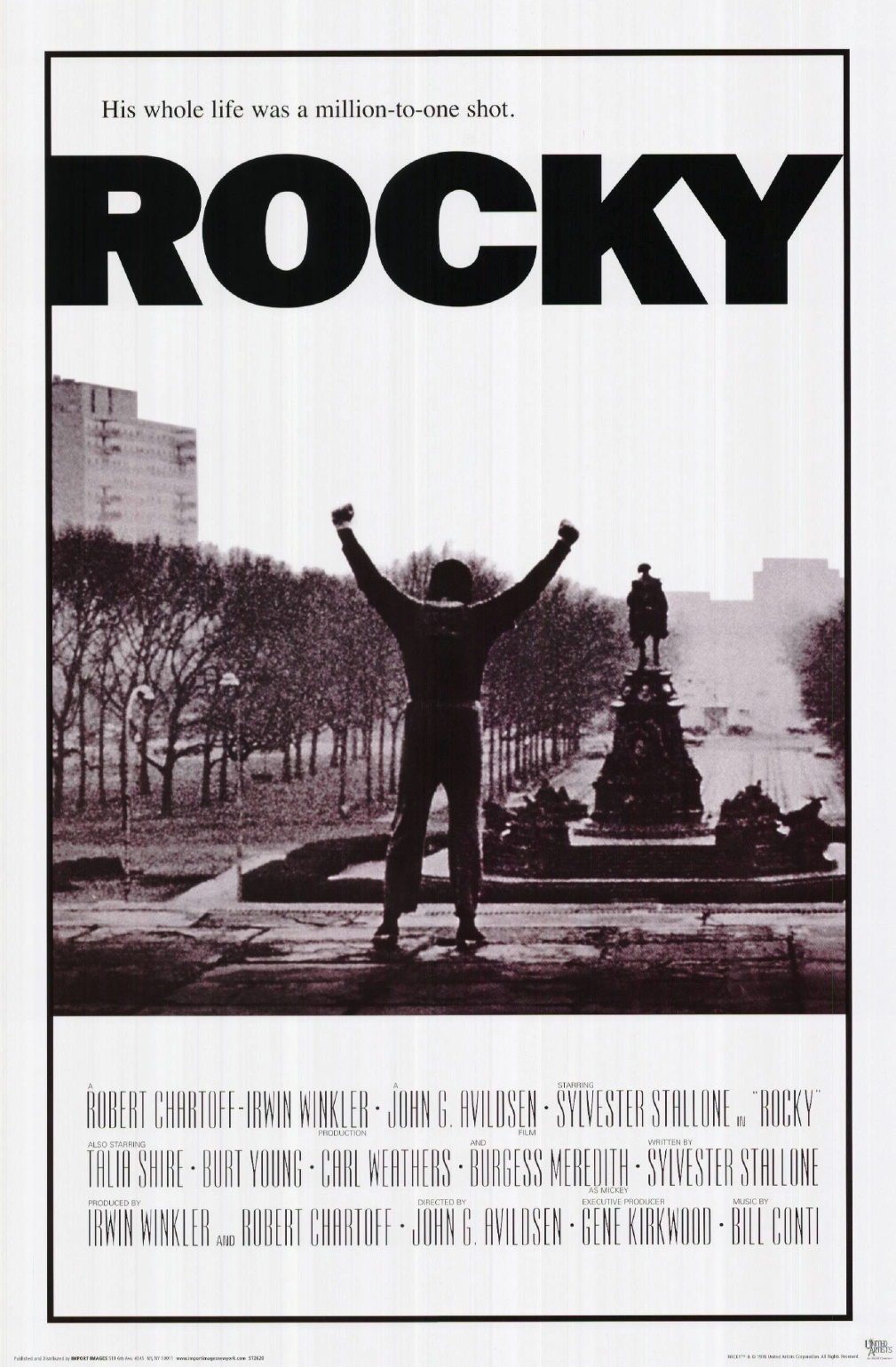

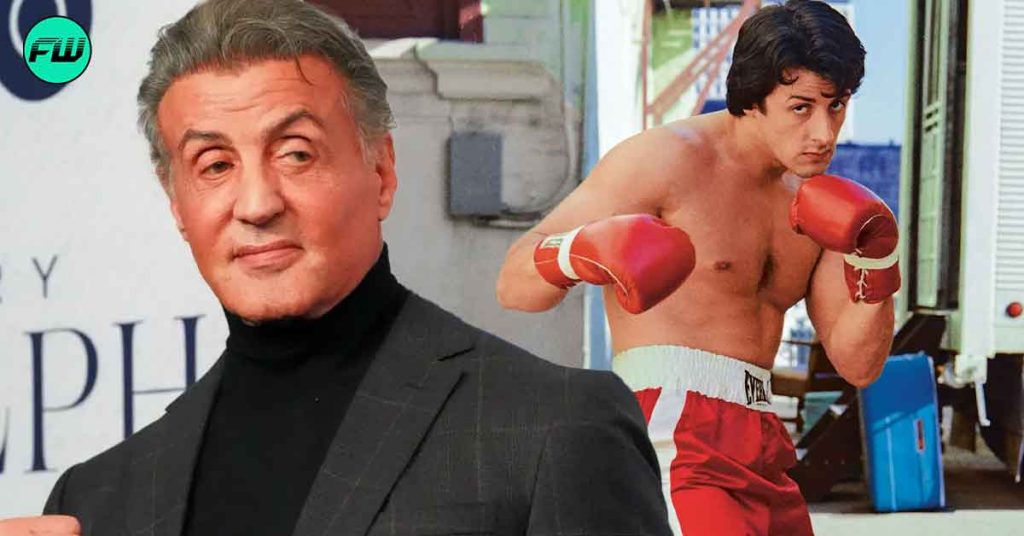

The Most Emotional Rocky Film Stallones Choice And Why It Matters

May 12, 2025

The Most Emotional Rocky Film Stallones Choice And Why It Matters

May 12, 2025 -

Which Rocky Movie Touches Stallone The Most His Emotional Favorite Revealed

May 12, 2025

Which Rocky Movie Touches Stallone The Most His Emotional Favorite Revealed

May 12, 2025 -

Rocky Franchise Stallone Reveals His Most Emotional Favorite

May 12, 2025

Rocky Franchise Stallone Reveals His Most Emotional Favorite

May 12, 2025 -

Stallones Pick The Most Emotionally Powerful Rocky Film

May 12, 2025

Stallones Pick The Most Emotionally Powerful Rocky Film

May 12, 2025 -

One And Done Sylvester Stallones Single Non Acting Directing Venture

May 12, 2025

One And Done Sylvester Stallones Single Non Acting Directing Venture

May 12, 2025