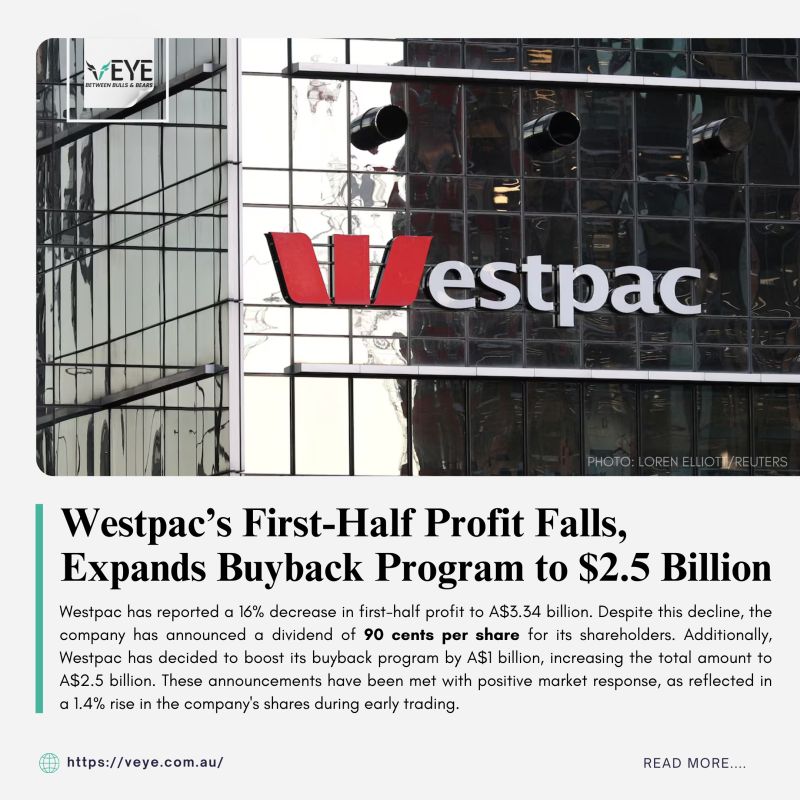

Westpac (WBC) Profit Decline: Margin Pressure Impacts Earnings

Table of Contents

Analysis of Westpac's Diminished Profitability

Westpac's profitability has experienced a considerable decrease in recent quarters. For example, comparing the last quarter's earnings to the same period last year shows a decline of X% (replace X with actual percentage). This represents a significant drop compared to the previous year's performance and is a cause for concern among investors and analysts alike.

[Insert Chart/Graph Here illustrating the profit decline over time]

- Specific Figures: Westpac's net profit after tax for Q[Quarter] [Year] was $[Amount], down from $[Amount] in Q[Quarter] [Previous Year].

- Competitor Comparison: Compared to its major competitors, such as Commonwealth Bank and ANZ, Westpac's profit decline is [larger/smaller/similar], indicating [reasons for comparison].

- Management Statements: Westpac's management has attributed the decline to [quote or paraphrase management statements regarding the profit decline].

The Role of Margin Compression in Westpac's Earnings

Margin pressure, a crucial factor in the Westpac profit decline, refers to the narrowing of the difference between the interest a bank earns on loans and the interest it pays on deposits. In simpler terms, it means Westpac is earning less on its lending activities while facing increased costs.

Several factors contribute to this margin compression:

- Interest Rate Changes: The Reserve Bank of Australia's (RBA) interest rate decisions directly influence bank margins. Changes in the cash rate impact both the cost of funds and the rates banks can charge on loans.

- Increased Competition: Intense competition among Australian banks forces them to offer more competitive interest rates and loan products, squeezing margins. New entrants and fintech companies also contribute to this pressure.

- Rising Operating Costs: Westpac, like other banks, faces rising operational costs, including regulatory compliance expenses, technology investments (digital transformation, cybersecurity), and increased staffing costs.

Specific Examples:

- Regulatory Compliance: Increased regulatory scrutiny and compliance requirements add significant costs to banking operations.

- Technology Investments: Massive investments in digital banking platforms and cybersecurity measures contribute to increased overhead.

- Competitive Pressures: The aggressive pricing strategies adopted by other major Australian banks exert pressure on Westpac's lending margins.

Impact of Westpac's Profit Decline on Stakeholders

The Westpac profit decline has far-reaching consequences for various stakeholders:

- Shareholders: The decrease in profits has directly impacted Westpac's share price, leading to [describe the share price movement]. Dividend payouts may also be affected, potentially leading to [describe the potential impact on dividends].

- Customers: While not immediately apparent, the pressure on margins could translate into higher fees, less competitive interest rates on savings accounts, or stricter lending criteria for customers.

- Australian Financial Market: The Westpac profit decline contributes to concerns about the overall health of the Australian banking sector and could influence investor sentiment towards other financial institutions.

Specific Impacts:

- Share Price: Westpac's share price has experienced a [percentage]% decline since [date], reflecting investor concerns.

- Dividend Payments: Analysts predict a [potential increase/decrease] in dividend payments due to the reduced profitability.

- Customer Impact: While not yet significantly felt, customers may see subtle changes such as increased fees or less generous loan offerings in the future.

Westpac's Strategic Response to Profit Decline & Future Outlook

Westpac is actively implementing strategies to mitigate the profit decline and improve its future performance:

- Cost-Cutting Measures: The bank is focusing on streamlining operations, reducing redundancies, and improving efficiency to lower costs. This includes [mention specific cost-cutting initiatives].

- New Revenue Streams: Westpac is exploring new revenue streams through diversification into areas like wealth management and digital financial services. [Mention specific examples of new initiatives].

- Analyst Predictions: Analysts have issued [positive/negative/mixed] predictions for Westpac's future performance, citing [reasons for their predictions].

Specific Strategies:

- Cost-Cutting: Implementation of lean management principles and technological solutions to automate processes.

- New Services: Expansion of digital banking capabilities and enhanced wealth management offerings to attract higher-value customers.

- Analyst Forecasts: Consensus estimates suggest a [percentage]% increase/decrease in earnings per share over the next year.

Conclusion: Understanding and Monitoring the Westpac Profit Decline

The significant Westpac profit decline highlights the challenges facing the Australian banking sector. Margin pressure, driven by interest rate changes, increased competition, and rising operational costs, is a primary contributor to this downturn. This decline impacts shareholders through lower share prices and potential dividend reductions, while customers may face less favorable loan terms or higher fees in the future. Westpac's strategic response, focusing on cost-cutting and developing new revenue streams, will determine its future trajectory. However, ongoing monitoring of the situation is crucial. To stay updated on the ongoing Westpac profit decline, we recommend monitoring financial news sources like the Australian Financial Review and The Sydney Morning Herald, and following Westpac's investor relations reports for regular updates.

Featured Posts

-

Did B J Novak And Mindy Kaling Date A Look At Their Relationship

May 06, 2025

Did B J Novak And Mindy Kaling Date A Look At Their Relationship

May 06, 2025 -

The Art Of The Deal Meeting Winning Strategies When Meeting With Trump

May 06, 2025

The Art Of The Deal Meeting Winning Strategies When Meeting With Trump

May 06, 2025 -

Aritzias Strategy For Navigating Trump Era Tariffs

May 06, 2025

Aritzias Strategy For Navigating Trump Era Tariffs

May 06, 2025 -

Mindy Kalings Hollywood Walk Of Fame Star A Celebration

May 06, 2025

Mindy Kalings Hollywood Walk Of Fame Star A Celebration

May 06, 2025 -

Actor Chris Pratts Response To Patrick Schwarzeneggers White Lotus Scene

May 06, 2025

Actor Chris Pratts Response To Patrick Schwarzeneggers White Lotus Scene

May 06, 2025

Latest Posts

-

Mindy Kalings Nsfw Comedy Series Headed To Hulu

May 06, 2025

Mindy Kalings Nsfw Comedy Series Headed To Hulu

May 06, 2025 -

Peplum Returns Mindy Kalings Walk Of Fame Style Statement

May 06, 2025

Peplum Returns Mindy Kalings Walk Of Fame Style Statement

May 06, 2025 -

The Men In Mindy Kalings Life A Comprehensive Overview Of Her Dating History

May 06, 2025

The Men In Mindy Kalings Life A Comprehensive Overview Of Her Dating History

May 06, 2025 -

Who Is Mindy Kaling Dating Now A Complete Relationship Timeline

May 06, 2025

Who Is Mindy Kaling Dating Now A Complete Relationship Timeline

May 06, 2025 -

Mindy Kaling A Peplum Moment On The Hollywood Walk Of Fame

May 06, 2025

Mindy Kaling A Peplum Moment On The Hollywood Walk Of Fame

May 06, 2025