Westpac (WBC): Shrinking Margins Lead To Lower Profitability

Table of Contents

Analyzing Westpac's (WBC) Shrinking Net Interest Margins

The decline in Westpac's profitability is largely attributed to a shrinking net interest margin (NIM). This key metric reflects the difference between the interest income a bank earns on loans and the interest it pays on deposits. A smaller NIM directly translates to lower profitability. Several factors contribute to this concerning trend.

Competition Intensifies in the Australian Banking Sector

The Australian banking sector is highly competitive. Westpac faces intense pressure from other major players like the Commonwealth Bank, ANZ, and NAB, as well as smaller, more agile competitors. This competitive landscape fuels an "interest rate war," pushing down both lending rates and deposit rates.

- Aggressive Lending: Banks are competing fiercely to attract borrowers, offering increasingly competitive loan rates, squeezing margins.

- Deposit Rate Pressure: Simultaneously, banks face pressure to offer attractive deposit rates to retain customers, further impacting profitability.

- Market Share Battles: The fight for market share is intense, leading banks to sacrifice some margin to gain customers. This is evident in the recent marketing campaigns focused on low-rate offerings.

For example, a recent comparison of home loan interest rates shows Westpac trailing behind some competitors, highlighting the pressure on its lending margins. This competitive pressure directly translates into a shrinking NIM for Westpac (WBC).

Regulatory Changes and Compliance Costs

Stringent regulatory changes in Australia significantly impact banking operations and profitability. Regulations such as responsible lending laws and AUSTRAC compliance requirements necessitate substantial investments in technology and personnel.

- Increased Operational Costs: Meeting regulatory standards requires significant investment in compliance systems, personnel training, and ongoing monitoring.

- AUSTRAC Compliance: The cost of adhering to AUSTRAC (Australian Transaction Reports and Analysis Centre) regulations for anti-money laundering and counter-terrorism financing is substantial.

- Fines and Penalties: Non-compliance can result in hefty fines and penalties, further impacting profitability. Past instances of regulatory breaches have added to Westpac's operational burden.

These increased operational and compliance costs directly reduce Westpac's profitability and contribute to the shrinking net interest margin.

Economic Headwinds and Macroeconomic Factors

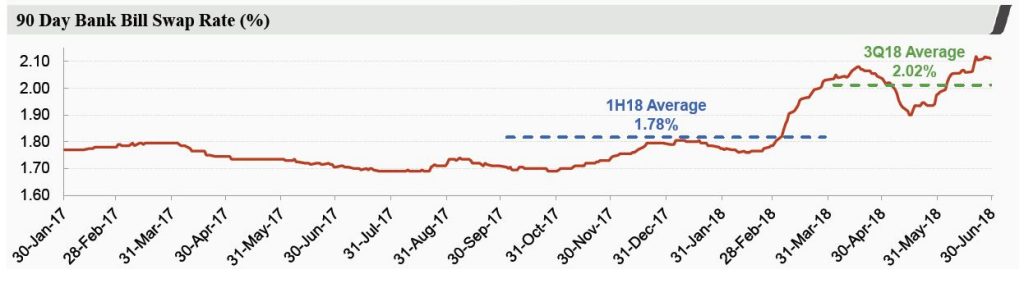

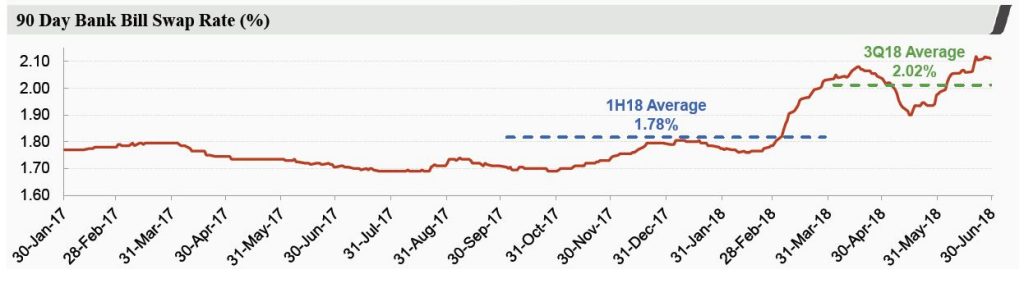

Macroeconomic conditions play a significant role in shaping a bank's profitability. Low interest rate environments, in particular, compress net interest margins.

- Low Interest Rate Environment: Extended periods of low interest rates reduce the spread between lending and deposit rates, directly impacting NIM.

- Economic Slowdowns: During economic slowdowns or recessions, consumer spending and borrowing decrease, affecting loan demand and reducing interest income.

- Inflation and Interest Rate Hikes: While rising interest rates can potentially improve NIMs in the long term, the immediate impact can be negative as it can lead to higher funding costs.

The current global economic uncertainty creates additional headwinds for Westpac, further complicating its efforts to improve its net interest margin.

The Impact of Shrinking Margins on Westpac's (WBC) Overall Profitability

The shrinking net interest margins have far-reaching consequences for Westpac's overall financial performance.

Reduced Return on Equity (ROE)

Net interest margin is a key component in calculating Return on Equity (ROE), a crucial measure of profitability. A shrinking NIM directly translates to a lower ROE.

- Direct Relationship: ROE reflects the return a company generates on shareholder investments. A reduced NIM directly impacts this return.

- Competitive Benchmarking: Westpac's ROE is often compared to its competitors. A lower ROE compared to peers signals a potential weakness.

- Impact on Shareholder Value: A lower ROE can negatively affect shareholder returns and investor confidence.

Earnings Per Share (EPS) Decline

Reduced profitability directly impacts earnings per share (EPS), a key indicator of a company's performance.

- Lower Profits, Lower EPS: As net profits decline due to shrinking margins, the EPS also decreases.

- Impact on Dividend Payouts: Lower EPS can lead to reduced dividend payouts to shareholders.

- Investor Sentiment: A declining EPS trend can negatively impact investor sentiment and share price.

Investor Sentiment and Share Price Volatility

Shrinking margins and declining profitability negatively impact investor sentiment and lead to share price volatility.

- Reduced Investor Confidence: Concerns about the bank's future profitability can erode investor confidence.

- Share Price Decline: Negative news about shrinking margins often results in a decline in the bank's share price.

- Analyst Ratings: Analyst downgrades often accompany declining profitability, further impacting investor perception.

Conclusion: Understanding Westpac (WBC) and its Shrinking Margins

Westpac's shrinking margins are a result of a confluence of factors: intense competition within the Australian banking sector, increased regulatory compliance costs, and challenging macroeconomic conditions. These factors have led to reduced ROE, declining EPS, and negative impacts on investor sentiment. To address these challenges, Westpac may need to explore strategies such as cost-cutting, diversification into new revenue streams, and potentially strategic acquisitions. Stay updated on Westpac’s (WBC) shrinking margins and monitor Westpac (WBC) profitability trends closely to understand the evolving dynamics of the Australian banking landscape. Further research into the long-term implications of shrinking margins on the Australian banking sector is crucial for investors and stakeholders alike.

Featured Posts

-

Celtics Vs 76ers Prediction Expert Picks And Best Bets February 20 2025

May 06, 2025

Celtics Vs 76ers Prediction Expert Picks And Best Bets February 20 2025

May 06, 2025 -

Are We In A Recession Stock Market Performance Suggests Otherwise

May 06, 2025

Are We In A Recession Stock Market Performance Suggests Otherwise

May 06, 2025 -

Data Breach Millions Stolen From Executive Office365 Accounts

May 06, 2025

Data Breach Millions Stolen From Executive Office365 Accounts

May 06, 2025 -

Australian Election Result Potential For Asset Market Surge

May 06, 2025

Australian Election Result Potential For Asset Market Surge

May 06, 2025 -

Analyzing The Impact Of Trumps Tariffs On Us Manufacturing

May 06, 2025

Analyzing The Impact Of Trumps Tariffs On Us Manufacturing

May 06, 2025

Latest Posts

-

April 4th Celtics Vs Suns Game Time Tv Channel And Streaming Guide

May 06, 2025

April 4th Celtics Vs Suns Game Time Tv Channel And Streaming Guide

May 06, 2025 -

Celtics Playoffs 2024 Eastern Conference Semifinals Start Time

May 06, 2025

Celtics Playoffs 2024 Eastern Conference Semifinals Start Time

May 06, 2025 -

When Do The Celtics Begin Their Eastern Conference Semifinals Play

May 06, 2025

When Do The Celtics Begin Their Eastern Conference Semifinals Play

May 06, 2025 -

Celtics Vs Heat Tip Off Time Tv Channel And Live Stream February 10th

May 06, 2025

Celtics Vs Heat Tip Off Time Tv Channel And Live Stream February 10th

May 06, 2025 -

Watch Celtics Vs Suns April 4th Game Time Tv And Streaming Options

May 06, 2025

Watch Celtics Vs Suns April 4th Game Time Tv And Streaming Options

May 06, 2025