What Makes A Crypto Exchange Compliant In India? A Simple Guide For 2025

Table of Contents

Understanding the Indian Regulatory Landscape for Crypto Exchanges in 2025

India's legal framework regarding cryptocurrencies is currently evolving, making it vital to stay informed. While there isn't a comprehensive, singular law governing crypto exchanges, various government bodies influence the regulatory environment. The Reserve Bank of India (RBI) plays a significant role, expressing concerns about financial stability and money laundering risks associated with cryptocurrencies. Other relevant bodies include the Ministry of Finance and the Securities and Exchange Board of India (SEBI).

The ongoing debate surrounding cryptocurrency regulation in India is shaping the future of the industry. There's potential for a comprehensive crypto bill in the near future, which could significantly impact the operational landscape for crypto exchanges. Global regulatory trends, particularly from developed markets, also influence India's approach.

- Ongoing debates: Discussions around the classification of cryptocurrencies (assets, securities, commodities) are ongoing.

- Potential for a comprehensive crypto bill: A unified legal framework could clarify licensing requirements, taxation, and consumer protection measures.

- Impact of global regulatory trends: The regulatory approaches taken by countries like the US, UK, and EU will likely influence India's future policies.

Key Compliance Requirements for Crypto Exchanges Operating in India

Operating a compliant crypto exchange in India requires meticulous attention to several key areas:

KYC/AML (Know Your Customer/Anti-Money Lauundering) Compliance

KYC/AML procedures are fundamental for preventing illicit activities like money laundering and terrorist financing. Indian regulations require crypto exchanges to implement robust KYC/AML processes, including:

- Customer due diligence: Verifying the identity of all users through thorough documentation checks.

- Transaction monitoring: Tracking transactions for suspicious activity and reporting potential violations.

- Data security and privacy: Protecting user data with strong security measures and adhering to data privacy regulations.

Technology plays a crucial role in enhancing KYC/AML processes. AI-powered solutions can automate identity verification and flag suspicious transactions more efficiently.

Taxation of Cryptocurrency Transactions

Understanding the tax implications of cryptocurrency transactions in India is vital for compliance. Currently, profits from cryptocurrency trading are taxed as capital gains. This means that profits are taxed at either short-term or long-term capital gains rates, depending on the holding period.

- Capital gains tax: Profits from crypto trading are subject to capital gains tax, with rates varying based on the holding period.

- Tax implications for staking and lending: The tax treatment of income generated through staking and lending activities is still evolving.

- GST implications: Goods and Services Tax (GST) may apply to certain crypto-related services.

Data Security and Privacy

Protecting user data is paramount for maintaining trust and complying with Indian data protection laws. Robust security measures, including data encryption and secure storage, are essential. Compliance with the upcoming Personal Data Protection Bill is also crucial.

- Data encryption and secure storage: Implementing encryption protocols to protect sensitive user information.

- Compliance with data protection regulations: Adhering to the stipulations outlined in the Personal Data Protection Bill.

- Incident response plan: Establishing a comprehensive plan for handling data breaches.

Reserve Bank of India (RBI) Guidelines and Compliance

The RBI's stance on cryptocurrencies significantly influences the regulatory environment for crypto exchanges. While the RBI hasn't issued specific regulations for crypto exchanges, its guidelines on maintaining financial stability and preventing money laundering impact their operations.

- RBI's concerns: The RBI's primary concerns are the potential risks to financial stability and the use of cryptocurrencies for illicit activities.

- Impact on bank relationships: RBI guidelines influence the ability of crypto exchanges to establish banking relationships.

- Compliance with directives: Staying informed about and complying with any RBI circulars or notifications related to cryptocurrencies is crucial.

Conclusion: Ensuring Crypto Exchange Compliance in India for a Secure Future

Maintaining crypto exchange compliance in India involves a multi-faceted approach encompassing KYC/AML, taxation, data security, and adherence to RBI guidelines. Staying compliant is not merely about avoiding penalties; it's about building trust, ensuring the long-term sustainability of your exchange, and protecting your users. The regulatory landscape is dynamic, requiring ongoing vigilance and adaptation. To ensure your crypto exchange is compliant in 2025 and beyond, stay updated on the latest regulatory developments and seek professional advice to achieve regulatory compliance and maintain crypto compliance. Don't hesitate to consult legal and financial experts to help you navigate this evolving space and ensure your crypto exchange operates within the bounds of Indian law.

Featured Posts

-

End Of Development For Ryujinx Switch Emulator Official Statement

May 15, 2025

End Of Development For Ryujinx Switch Emulator Official Statement

May 15, 2025 -

Padres Vs Pirates Prediction Picks And Odds For Todays Mlb Game

May 15, 2025

Padres Vs Pirates Prediction Picks And Odds For Todays Mlb Game

May 15, 2025 -

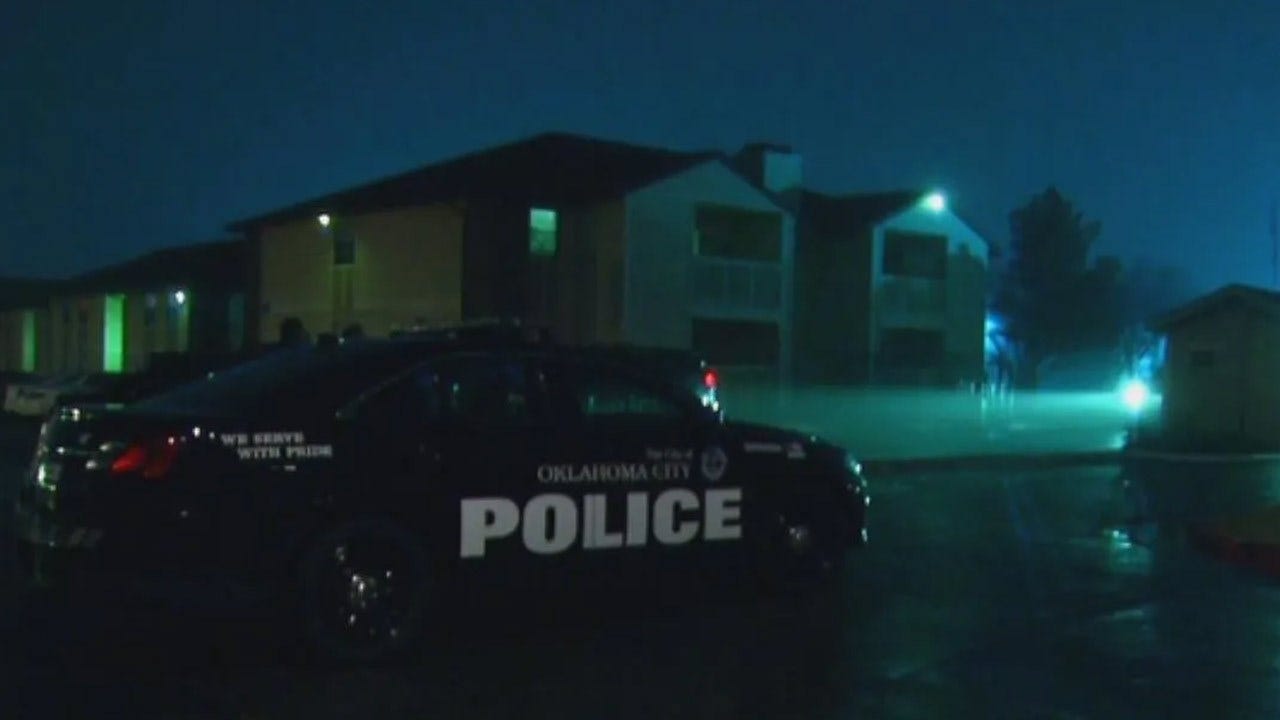

Ohio City Apartment Complex Shooting Police Seek Witnesses

May 15, 2025

Ohio City Apartment Complex Shooting Police Seek Witnesses

May 15, 2025 -

Presiden Prabowo Dan Dpr Sepakat Pembangunan Giant Sea Wall

May 15, 2025

Presiden Prabowo Dan Dpr Sepakat Pembangunan Giant Sea Wall

May 15, 2025 -

Limited Time Celtics Finals Gear Under 20

May 15, 2025

Limited Time Celtics Finals Gear Under 20

May 15, 2025