What We Learned About Treasuries On April 8th: Key Market Insights

Table of Contents

Yield Curve Shifts and Their Implications

The yield curve, a graphical representation of Treasury yields across different maturities, is a vital indicator of economic health and future interest rate expectations. On April 8th, the yield curve exhibited interesting shifts, providing valuable insights into investor sentiment and expectations.

Changes in Short-Term Treasury Yields

Short-term Treasury yields, such as the 2-year and 3-month yields, experienced a notable [insert specific data, e.g., increase/decrease of X%] on April 8th. This movement can be attributed to several factors:

- Fed Policy Expectations: Market participants may have adjusted their expectations regarding the Federal Reserve's future monetary policy decisions based on [mention specific news or rumors impacting Fed policy]. This could have led to increased or decreased demand for short-term Treasuries.

- Inflation Concerns: Concerns about rising inflation could have influenced short-term Treasury yields, as investors sought to protect their investments from the erosion of purchasing power. [Mention any specific inflation indicators that influenced the market on that day].

- Impact on Borrowing Costs: The shift in short-term Treasury yields directly impacts borrowing costs for businesses and consumers. Higher yields translate to higher interest rates on loans, potentially impacting economic activity.

Movement in Long-Term Treasury Yields

Long-term Treasury yields, such as the 10-year and 30-year yields, also showed [insert specific data, e.g., movement of Y%] on April 8th. This movement can be analyzed considering:

- Inflation Expectations: Long-term Treasury yields are highly sensitive to inflation expectations. If investors anticipate higher inflation in the future, they will demand higher yields to compensate for the risk of purchasing power erosion.

- Economic Growth Outlook: The outlook for future economic growth also plays a significant role in shaping long-term Treasury yields. Positive growth prospects typically lead to higher yields, as investors anticipate higher returns.

- Implications for Long-Term Investments: The movement in long-term Treasury yields has significant implications for long-term investors, impacting the attractiveness of fixed-income investments and potentially influencing overall investment strategies.

Impact of Economic Data Releases on Treasury Prices

Several significant economic data releases on April 8th had a noticeable impact on Treasury prices and yields.

Inflation Data and its Effect on Treasury Yields

[Mention the specific inflation data released, e.g., CPI, PPI]. The release of this data [describe the impact - e.g., exceeded/fell short of expectations]. This had a direct impact on Treasury yields due to the inverse relationship between bond prices and inflation:

- Inverse Relationship: When inflation rises, bond prices typically fall, and yields rise, as investors demand higher returns to compensate for the decreased purchasing power.

- Market Reaction: Market participants reacted to the [inflation data - e.g., higher-than-expected inflation] by [explain the market reaction, e.g., selling Treasury bonds, driving yields higher].

Other Economic Indicators and their Influence

Other economic indicators, such as [mention specific indicators, e.g., employment data, manufacturing PMI], also influenced Treasury prices on April 8th.

- Correlation Analysis: The correlation between these indicators and Treasury market movements needs further analysis to fully understand the combined effect on the market sentiment.

- Market Sentiment: The overall market sentiment, influenced by the collective interpretation of these economic data points, played a crucial role in shaping Treasury prices and yields on April 8th.

Trading Volume and Market Volatility

Analyzing the trading volume and volatility in the Treasury market on April 8th provides further insight into market dynamics.

Analysis of Increased or Decreased Trading Activity

The trading volume in the Treasury market on April 8th was [insert data, e.g., higher/lower than average]. This can be attributed to:

- Market Events: Significant news events or economic data releases can lead to increased trading activity as investors react to new information.

- Impact on Liquidity: Higher trading volume generally indicates greater market liquidity, facilitating smoother price discovery. Lower volume can lead to increased price volatility.

Market Volatility and its Causes

Treasury prices exhibited [insert data on volatility, e.g., higher/lower] volatility on April 8th. This volatility can be explained by:

- Unexpected News: Unexpected news or events, such as [mention any specific events], can trigger sharp price fluctuations.

- Changing Market Sentiment: Shifting investor sentiment, driven by economic data releases or geopolitical events, can lead to increased price volatility.

- Implications for Investors: High volatility presents both opportunities and risks for investors, requiring careful risk management strategies.

Conclusion

The Treasury market on April 8th showcased a complex interplay of factors impacting Treasury yields and prices. Shifts in the yield curve, influenced by Fed policy expectations and inflation concerns, were prominent. Economic data releases, particularly inflation data, played a crucial role in shaping market sentiment and driving price fluctuations. Trading volume and volatility reflected the dynamic nature of the market, highlighting the importance of staying informed about current events and economic indicators. Understanding these factors is essential for navigating the complexities of the Treasury market.

Stay updated on the latest developments in Treasuries by following reputable financial news sources and consulting with financial advisors to make informed investment decisions regarding Treasuries and Treasury bonds. Effectively navigating the Treasury market requires consistent monitoring and a deep understanding of the influencing factors.

Featured Posts

-

Perplexity Ceo The Fight For Ai Browser Dominance Against Google

Apr 29, 2025

Perplexity Ceo The Fight For Ai Browser Dominance Against Google

Apr 29, 2025 -

Willie Nelsons Annual 4th Of July Picnic Date Location And Tickets

Apr 29, 2025

Willie Nelsons Annual 4th Of July Picnic Date Location And Tickets

Apr 29, 2025 -

Mlb Scores Twins 6 Mets 3 Minnesota Takes Series Lead

Apr 29, 2025

Mlb Scores Twins 6 Mets 3 Minnesota Takes Series Lead

Apr 29, 2025 -

Modificari Fiscale 2025 Ce Ne Rezerva Noul An

Apr 29, 2025

Modificari Fiscale 2025 Ce Ne Rezerva Noul An

Apr 29, 2025 -

Convicted Cardinal Claims Entitlement To Papal Conclave Vote

Apr 29, 2025

Convicted Cardinal Claims Entitlement To Papal Conclave Vote

Apr 29, 2025

Latest Posts

-

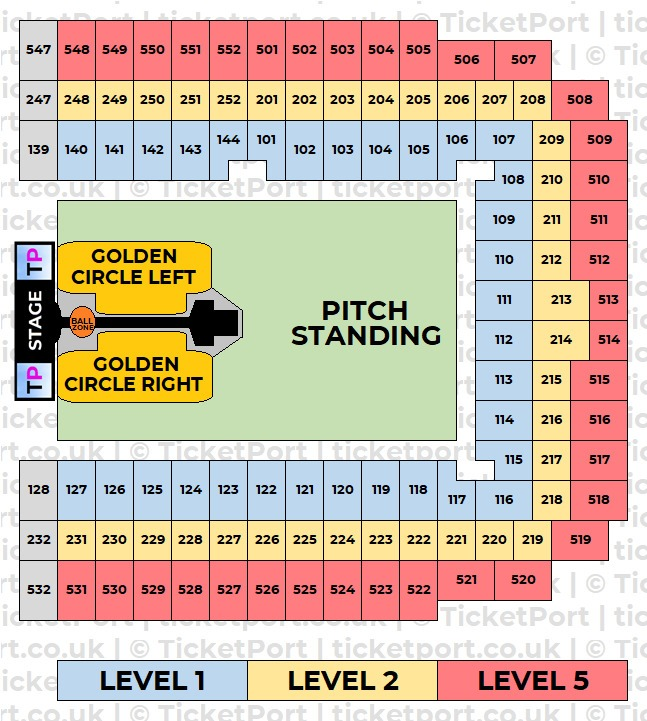

Capital Summertime Ball 2025 Tips For Getting Tickets

Apr 29, 2025

Capital Summertime Ball 2025 Tips For Getting Tickets

Apr 29, 2025 -

Secure Your Capital Summertime Ball 2025 Tickets A Buyers Guide

Apr 29, 2025

Secure Your Capital Summertime Ball 2025 Tickets A Buyers Guide

Apr 29, 2025 -

How To Buy Capital Summertime Ball 2025 Tickets Now

Apr 29, 2025

How To Buy Capital Summertime Ball 2025 Tickets Now

Apr 29, 2025 -

Your Guide To Buying Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Your Guide To Buying Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Capital Summertime Ball 2025 Ticket Information And Purchase Options

Apr 29, 2025

Capital Summertime Ball 2025 Ticket Information And Purchase Options

Apr 29, 2025